Trump's Legacy: A Herculean Task For The Next Fed Chair

Table of Contents

The Trump presidency saw a significant shift in economic policy, characterized by deregulation, substantial fiscal stimulus, and protectionist trade measures. These actions, while aiming for rapid economic growth, have left the next Fed Chair with a multifaceted inheritance demanding careful management. This article will analyze the key economic trends and policies of the Trump era and their implications for the future of monetary policy.

Navigating the Inflationary Landscape Inherited from the Trump Era

The Trump administration's economic policies significantly contributed to the current inflationary environment. Understanding these contributing factors is crucial for the next Fed Chair to effectively implement monetary policy tools to control inflation.

The Impact of Fiscal Stimulus and Tax Cuts

The substantial fiscal stimulus packages and sweeping tax cuts enacted during the Trump presidency injected massive amounts of money into the economy. This influx of capital, while intended to boost economic growth, fueled inflationary pressures.

- Increased consumer spending: Tax cuts led to increased disposable income, boosting consumer demand and driving up prices.

- Business investment: Corporate tax cuts spurred investment, further contributing to inflationary pressures as businesses competed for resources.

- Government spending: Increased government spending on infrastructure and other initiatives added to the overall demand in the economy.

These policies created long-term challenges for controlling inflation, requiring the next Fed Chair to carefully manage monetary policy to avoid overheating the economy.

Managing the Supply Chain Disruptions

The Trump administration's trade policies, including tariffs and trade wars, significantly disrupted global supply chains. These disruptions, exacerbated by the COVID-19 pandemic, contributed to shortages, increased production costs, and elevated inflation.

- Trade wars with China: Tariffs imposed on Chinese goods led to increased costs for businesses and consumers.

- Disrupted global trade: Protectionist measures hampered the free flow of goods and services, creating bottlenecks and shortages.

- Increased transportation costs: Supply chain disruptions increased shipping costs, adding to the inflationary pressures.

Addressing these lingering supply chain issues will be critical for the next Fed Chair in navigating the inflationary landscape and fostering sustainable economic growth.

Addressing the Debt Burden Left by Trump's Policies

The Trump administration's policies resulted in a substantial increase in the national debt, presenting a major challenge for the next Fed Chair. Managing this debt while maintaining economic stability will require skillful fiscal and monetary policy coordination.

The Growing National Debt

The combination of tax cuts and increased government spending under the Trump administration led to a significant expansion of the national debt. This expanding debt poses risks to long-term economic stability.

- Increased interest payments: A larger national debt translates to higher interest payments, reducing the government's capacity for other spending.

- Reduced fiscal flexibility: A larger debt burden limits the government's ability to respond to future economic crises or invest in essential public services.

- Potential for debt crisis: Uncontrolled debt growth increases the risk of a debt crisis, potentially leading to economic instability.

Interest Rate Hikes and Their Impact

Rising interest rates, a tool often used to control inflation, pose a further challenge. Higher interest rates increase the cost of servicing the national debt, requiring a delicate balancing act between inflation control and debt management.

- Increased borrowing costs: Higher interest rates make it more expensive for the government to borrow money, increasing the cost of debt servicing.

- Potential for slowing economic growth: Aggressive interest rate hikes can slow economic growth, potentially leading to job losses and a recession.

- Trade-off between inflation and growth: The Fed Chair must carefully navigate the trade-off between controlling inflation and managing the risks associated with higher interest rates and their impact on economic growth.

Uncertainty and Geopolitical Risks in the Post-Trump Era

The Trump administration's unpredictable approach to foreign policy and international trade created significant uncertainty in the global economy, a legacy that continues to impact the current economic climate.

The Impact of Trade Wars and Protectionism

Trump's protectionist trade policies created significant uncertainty for businesses and investors, impacting global trade and international relations. The long-term effects of these policies are still unfolding, requiring careful management by the next Fed Chair.

- Retaliatory tariffs: Trump's tariffs prompted retaliatory measures from other countries, disrupting trade flows and harming businesses.

- Weakened international cooperation: The administration's approach strained relationships with key trading partners, undermining international cooperation on economic issues.

- Increased trade barriers: The legacy of protectionist policies continues to create challenges for businesses engaged in international trade.

Unpredictability and Market Volatility

The volatility and uncertainty that characterized the Trump presidency continue to impact market sentiment and economic forecasts. This makes accurate economic forecasting challenging and necessitates a flexible and adaptive approach by the next Fed Chair.

- Unpredictable policy shifts: Frequent changes in policy created uncertainty for businesses and investors.

- Increased market swings: Policy shifts and geopolitical events led to significant fluctuations in financial markets.

- Difficulty in forecasting: The unpredictable nature of the Trump era makes accurate economic forecasting incredibly difficult.

Conclusion

The next Federal Reserve Chair inherits a Herculean task: managing the complex economic legacy of the Trump administration. Navigating the inflationary landscape, addressing the burgeoning national debt, and dealing with lingering geopolitical risks require exceptional skill and strategic decision-making. Understanding Trump's legacy on the economy is crucial to understanding the immense task facing the next Fed Chair. Learn more about the complexities of navigating this challenging economic landscape.

Featured Posts

-

Nfl Draft 2024 First Round Kicks Off In Green Bay

Apr 26, 2025

Nfl Draft 2024 First Round Kicks Off In Green Bay

Apr 26, 2025 -

Open Ai Facing Ftc Probe Concerns Over Chat Gpts Data Practices

Apr 26, 2025

Open Ai Facing Ftc Probe Concerns Over Chat Gpts Data Practices

Apr 26, 2025 -

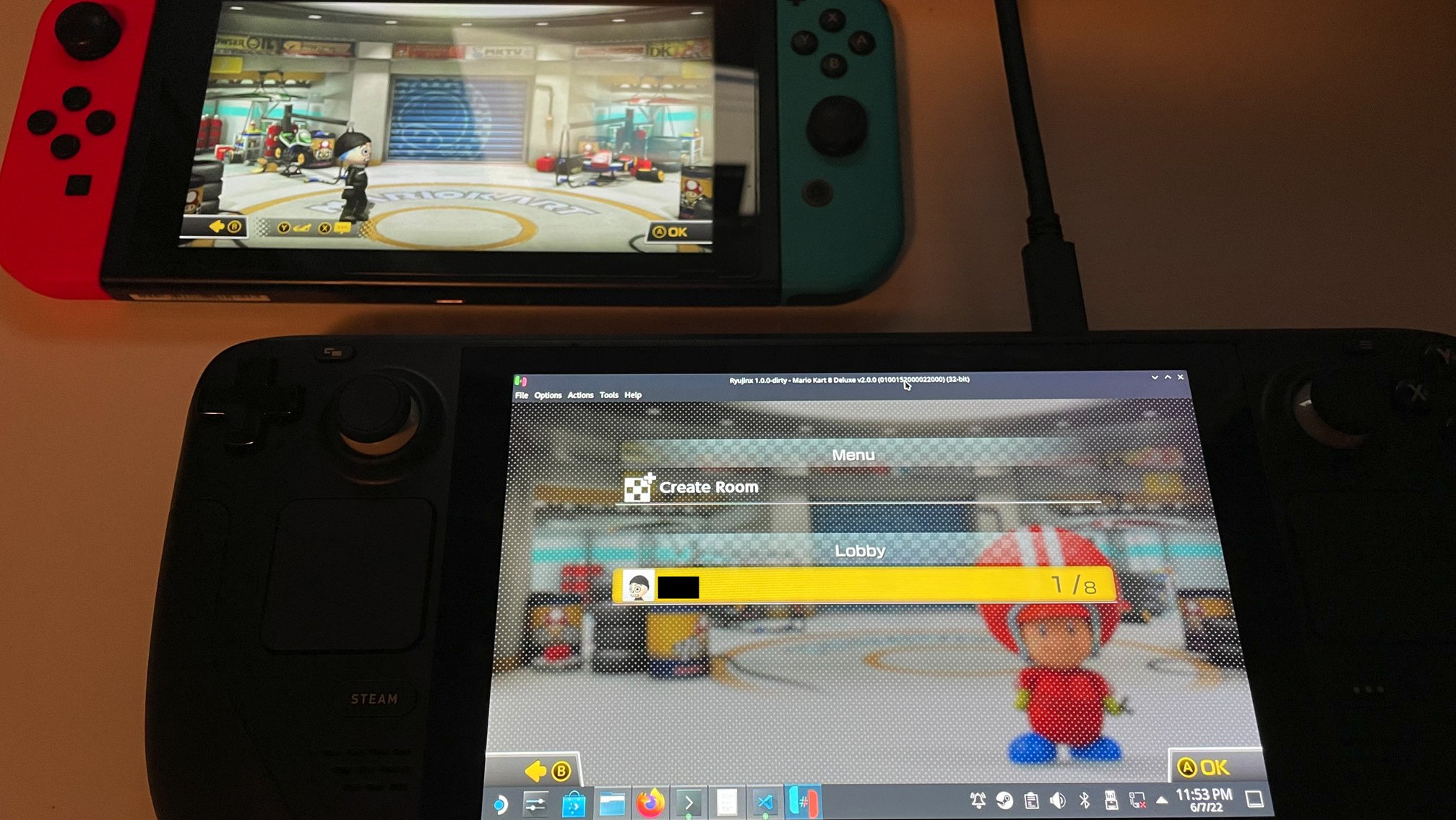

Ryujinx Emulator Project Ends After Alleged Nintendo Intervention

Apr 26, 2025

Ryujinx Emulator Project Ends After Alleged Nintendo Intervention

Apr 26, 2025 -

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 26, 2025

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 26, 2025 -

The 2700 Mile Divide How A Rural School Experienced Trumps First 100 Days

Apr 26, 2025

The 2700 Mile Divide How A Rural School Experienced Trumps First 100 Days

Apr 26, 2025