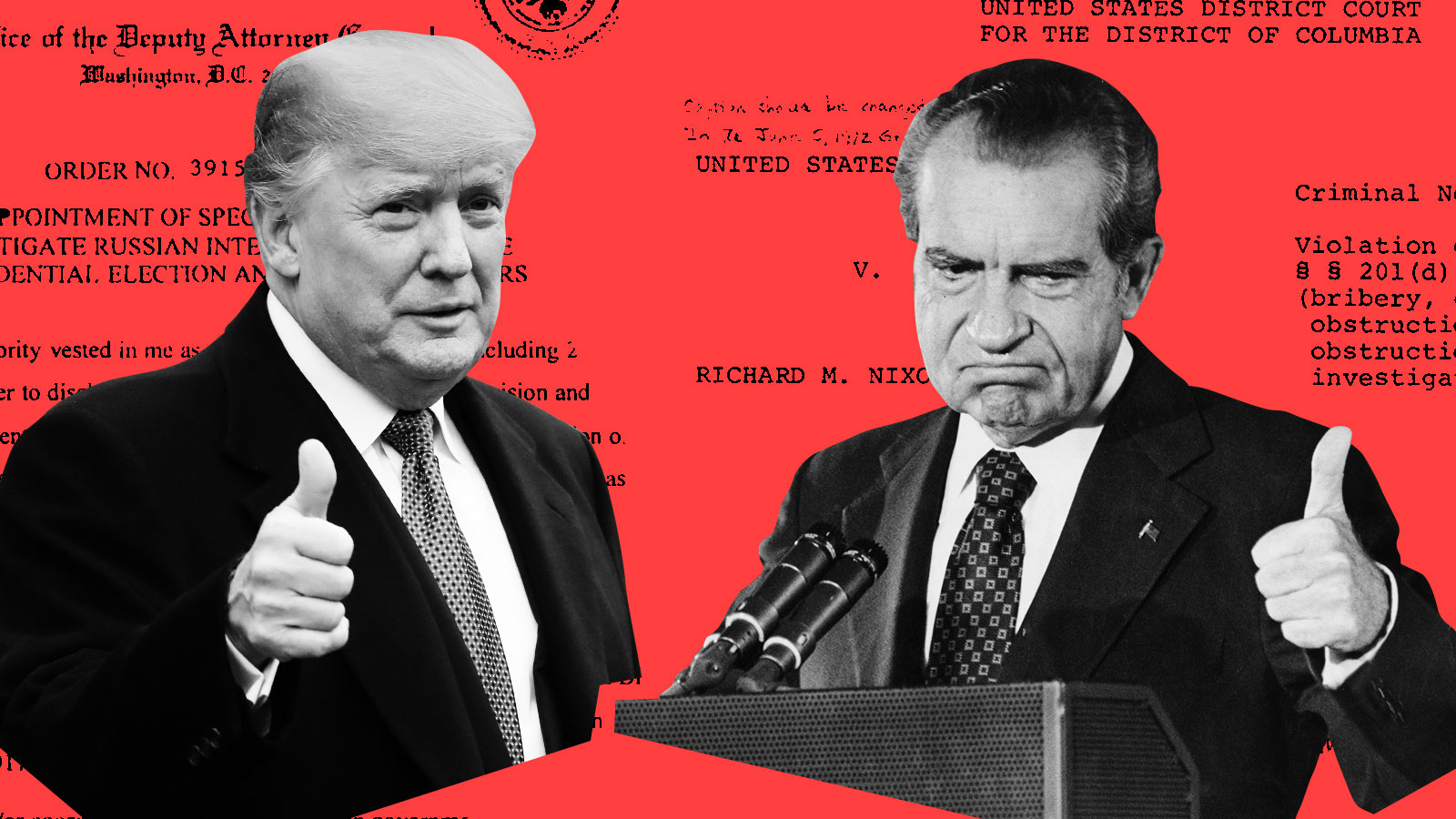

U.S. Dollar Performance: A Historical Comparison To The Nixon Era

Table of Contents

The Nixon Shock and the End of Bretton Woods (1971)

The Bretton Woods system, established after World War II, pegged the value of most currencies to the U.S. dollar, which in turn was convertible to gold at a fixed rate ($35 per ounce). This system provided relative stability but faced increasing pressure in the late 1960s due to the rising cost of the Vietnam War and expanding U.S. trade deficits. The U.S. was printing more dollars than it had gold reserves to back, leading to a loss of confidence in the dollar's value.

In August 1971, President Richard Nixon announced a series of drastic economic measures, now known as the "Nixon Shock," effectively ending the Bretton Woods system. This had an immediate and profound impact on U.S. dollar performance.

- Closing of the gold window: Nixon unilaterally ended the convertibility of the dollar to gold, severing the link between the dollar and a physical commodity.

- Floating exchange rates: This move allowed the value of the dollar to fluctuate freely against other currencies, based on supply and demand in the foreign exchange market. This ushered in an era of increased volatility in the U.S. dollar performance.

- Impact on international trade and investment: The shift to floating rates led to uncertainty and adjustment periods in international trade and investment flows. Businesses and investors had to adapt to a more unpredictable currency environment.

- Inflationary pressures following the shock: The devaluation of the dollar and the subsequent increase in the money supply contributed to significant inflationary pressures in the U.S. economy throughout the 1970s.

U.S. Dollar Performance in the 1970s

The 1970s witnessed a turbulent period for the U.S. dollar. Its value fluctuated significantly throughout the decade, influenced by various domestic and global factors.

The oil crisis of 1973, triggered by the Yom Kippur War, drastically increased oil prices, impacting inflation globally and weakening the dollar's purchasing power. Stagflation – a combination of high inflation and slow economic growth – further complicated the economic landscape and put downward pressure on the U.S. dollar performance.

- Periods of dollar strength and weakness: The dollar experienced periods of both significant strength and weakness, influenced by factors like interest rate differentials, investor sentiment, and global economic events.

- Impact of global economic events on the dollar: The interconnectedness of global markets became increasingly evident, with events such as the oil crisis significantly impacting the value of the dollar.

- Role of monetary policy in managing the dollar's value: The Federal Reserve (the central bank of the United States) attempted to manage the dollar's value through monetary policy tools like interest rate adjustments, but the effectiveness of these policies was limited amidst the unpredictable economic conditions.

- Comparison to current inflation rates and their impact on the dollar: While inflation was rampant in the 1970s, current inflation, although a concern, is generally lower than the hyperinflation experienced during that decade. The impact on the U.S. dollar performance is therefore different, though the underlying mechanisms remain similar.

Comparing Then and Now: Key Similarities and Differences in U.S. Dollar Performance

Comparing the U.S. dollar performance during the Nixon era and the present reveals both striking similarities and significant differences.

Similarities: Both periods witnessed inflationary pressures, albeit at different scales. Both eras also saw significant geopolitical events impacting global markets and influencing the dollar's value.

Differences: Globalization is far more advanced now than in the 1970s. The interconnected nature of today's financial markets amplifies the impact of any economic event on the U.S. dollar performance. Technological advancements, particularly in financial technology, have also created new dynamics in currency trading and investment.

- Inflationary pressures – then vs. now: While both periods experienced inflation, the scale and duration differed significantly. The stagflation of the 1970s was more persistent and severe.

- Global economic interdependence – then vs. now: The level of global interconnectedness is exponentially greater today, making the U.S. dollar more susceptible to international economic fluctuations.

- The role of central bank policies (Federal Reserve) – then vs. now: The Federal Reserve's tools and understanding of monetary policy have evolved significantly since the 1970s, enabling more sophisticated responses to economic challenges.

- Geopolitical influences on the U.S. dollar – then vs. now: Geopolitical events continue to impact the dollar but the nature of these influences has changed given the changing global power dynamic.

Predicting Future U.S. Dollar Performance

Predicting the future of the U.S. dollar is inherently complex, but analyzing current economic indicators offers valuable insights.

Current factors influencing the dollar's value include interest rate hikes by the Federal Reserve, the pace of global economic growth, and evolving geopolitical risks.

- Interest rate hikes and their effect on the dollar: Higher interest rates generally attract foreign investment, increasing demand for the dollar and strengthening its value.

- Global economic growth and its correlation with the dollar: Strong global growth tends to support the dollar, while weakening global economies often put downward pressure on its value.

- Potential geopolitical risks affecting the dollar's value: Political instability and international conflicts can significantly impact investor confidence and the U.S. dollar performance.

- Long-term outlook for the U.S. dollar's strength: The long-term outlook depends on a multitude of intertwined factors; however, continued economic strength in the U.S., alongside a stable geopolitical landscape, generally favors a strong U.S. dollar.

Conclusion

Comparing the U.S. dollar performance during the Nixon era and today reveals a complex interplay of economic and geopolitical factors that influence its value. While the challenges of inflation and global interdependence persist, the tools and understanding of economic management have evolved. Understanding historical context is crucial for predicting future trends. Monitoring key economic indicators and global events remains essential for navigating the complexities of U.S. dollar performance.

Call to Action: Stay informed about the ever-evolving landscape of U.S. dollar performance by continuing to research economic indicators and global events impacting its value. Understanding U.S. dollar performance is key to navigating the complexities of the global financial market.

Featured Posts

-

January 6th Hearing Witness Cassidy Hutchinson To Publish Memoir

Apr 28, 2025

January 6th Hearing Witness Cassidy Hutchinson To Publish Memoir

Apr 28, 2025 -

Nba Analyst Jj Redick Comments On Richard Jefferson Leaving Espn

Apr 28, 2025

Nba Analyst Jj Redick Comments On Richard Jefferson Leaving Espn

Apr 28, 2025 -

2000 Yankees Diary Posadas Homer Silences The Royals Surge

Apr 28, 2025

2000 Yankees Diary Posadas Homer Silences The Royals Surge

Apr 28, 2025 -

World Leaders Attend Pope Francis Funeral Mass

Apr 28, 2025

World Leaders Attend Pope Francis Funeral Mass

Apr 28, 2025 -

T Mobiles 16 Million Data Breach Fine Three Years Of Violations

Apr 28, 2025

T Mobiles 16 Million Data Breach Fine Three Years Of Violations

Apr 28, 2025