US Stock Futures Surge: Trump's Powell Comments Boost Markets

Table of Contents

Trump's Comments and Their Market Impact

President Trump's recent comments regarding Jerome Powell and the Federal Reserve's interest rate policy sent shockwaves through the financial markets. His statements, perceived by many as pressure on the Fed to lower rates, ignited a rapid and significant increase in US stock futures. The market's immediate reaction was palpable.

- Specific quote from Trump's statement: (Insert a direct quote from a reliable news source here. Example: "The Fed should be cutting rates, and cutting them fast.")

- Quantifiable market reaction: Dow Jones Industrial Average futures jumped over 200 points within minutes of the statement, while S&P 500 futures saw a similar surge, gaining over 25 points. Nasdaq futures also experienced a significant boost. Specific sectors like technology and financials showed disproportionately large gains.

- Psychological impact: Trump's words significantly impacted market sentiment, boosting investor optimism and risk appetite. Investors, anticipating a potential shift in monetary policy, reacted positively, leading to the sharp increase in futures contracts.

Analyzing the Federal Reserve's Role

The Federal Reserve currently maintains a cautious stance on interest rates, balancing concerns about inflation and economic growth. Trump's comments directly challenge this approach, expressing a desire for lower rates to stimulate the economy. This pressure on the Fed raises concerns about the independence of the central bank and the potential for politically motivated decisions rather than those based purely on economic data.

- Current Fed Funds rate: (Insert the current Fed Funds rate here.)

- Summary of recent Fed statements or actions: (Summarize the Fed's recent statements and actions regarding monetary policy.)

- Potential long-term effects of political interference: Continued political pressure on the Fed could undermine its credibility and effectiveness, leading to unpredictable market behavior and potentially higher inflation in the long run.

Implications for Investors

The dramatic US Stock Futures Surge presents both opportunities and risks for investors. The short-term impact is clear – significant gains for those holding long positions. However, the long-term implications are less certain.

- Advice for long-term investors: Maintain a diversified portfolio, avoid panic selling, and stick to your long-term investment strategy. The surge might be temporary, and a correction is always possible.

- Advice for short-term investors: Exercise extreme caution and manage risk effectively. Day traders should be prepared for increased market volatility and potential losses if the market reverses.

- Potential risks: Market volatility is expected to remain high in the short-term. Investors should closely monitor economic indicators and news related to the Fed's response to Trump's comments.

Related News and Future Outlook

Several factors beyond Trump's comments might have contributed to the market surge, including positive economic data releases or global market trends. However, Trump's statements clearly acted as a catalyst.

- Relevant economic indicators: (Mention any relevant economic indicators released recently that might have influenced market sentiment.)

- Quotes from financial analysts or experts: (Include quotes from financial analysts or experts offering their insights on the market's future trajectory.)

- Predictions for short-term and long-term market trends: (Summarize expert predictions, emphasizing the uncertainty and potential for volatility.) Some analysts predict continued growth fueled by lower interest rates, while others warn of a potential correction if the market overreacts.

Conclusion: Understanding the US Stock Futures Surge

The dramatic surge in US stock futures today underscores the significant impact that political statements can have on market sentiment. President Trump's comments regarding Jerome Powell and the Federal Reserve played a key role in this rapid market movement, boosting investor optimism and leading to significant gains. The implications for investors are complex, requiring a cautious approach and careful consideration of both the short-term and long-term risks and opportunities. To make informed investment decisions, stay informed about the latest developments regarding US stock market trends, future market predictions, and stock market analysis. Continuously monitor the situation and adapt your strategies accordingly. Don't hesitate to seek professional advice when navigating this volatile market environment.

Featured Posts

-

Dollar Advances Trumps Cooling Rhetoric Boosts Usd Value

Apr 24, 2025

Dollar Advances Trumps Cooling Rhetoric Boosts Usd Value

Apr 24, 2025 -

Google Fis 35 Unlimited Plan A Detailed Review

Apr 24, 2025

Google Fis 35 Unlimited Plan A Detailed Review

Apr 24, 2025 -

Canadian Conservatives Detail Plan For Tax Cuts And Deficit Reduction

Apr 24, 2025

Canadian Conservatives Detail Plan For Tax Cuts And Deficit Reduction

Apr 24, 2025 -

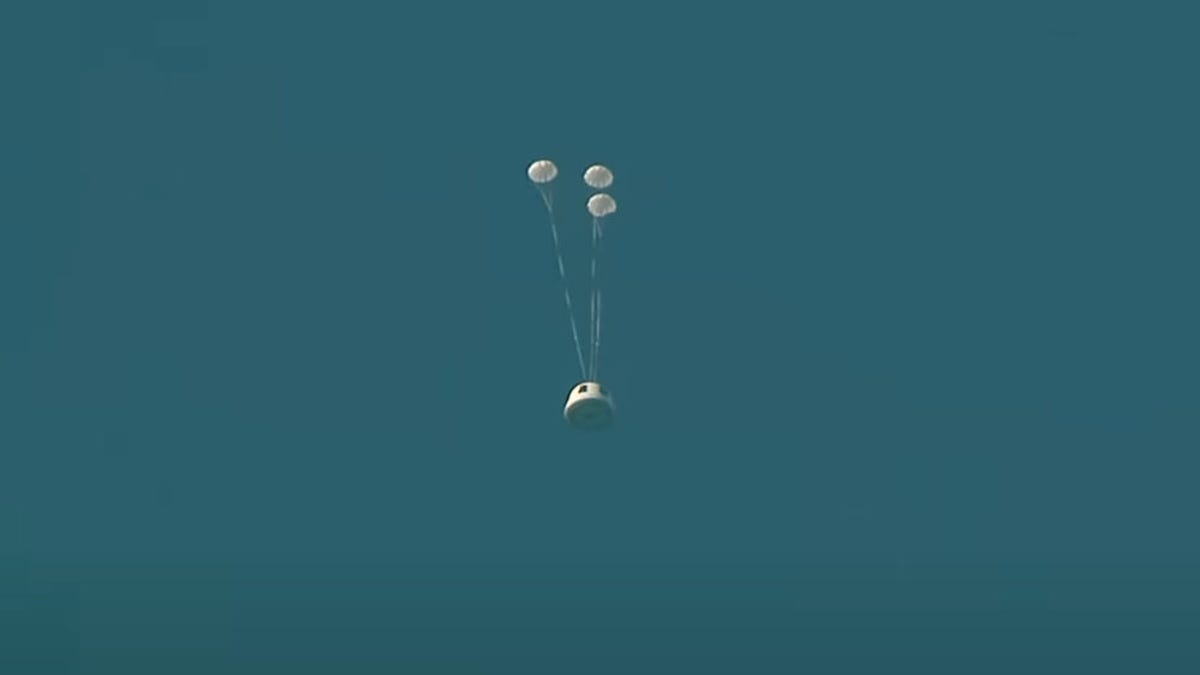

Subystem Failure Grounds Blue Origin Rocket Launch

Apr 24, 2025

Subystem Failure Grounds Blue Origin Rocket Launch

Apr 24, 2025 -

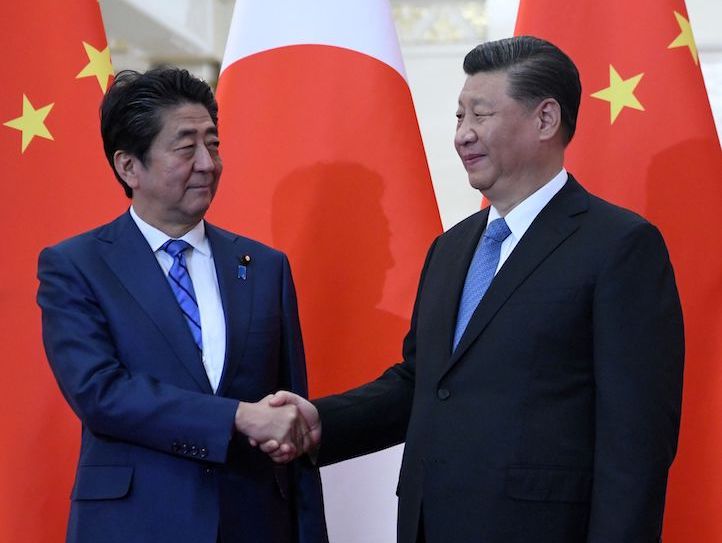

Navigating The Chinese Market The Case Of Bmw And Porsche

Apr 24, 2025

Navigating The Chinese Market The Case Of Bmw And Porsche

Apr 24, 2025