UTAC Chip Tester: Chinese Buyout Firm Explores Sale

Table of Contents

The UTAC Chip Tester and its Market Significance

UTAC chip testers are indispensable in modern semiconductor manufacturing. As automated test equipment (ATE), they play a vital role in ensuring the quality and reliability of integrated circuits (ICs). These sophisticated machines rigorously test chips for defects, ensuring high yields and preventing costly product recalls. Their importance extends beyond simple quality control; UTAC testers contribute directly to yield improvement, a key metric for profitability in the semiconductor industry.

- Function: UTAC chip testers perform a variety of tests, including functional tests, parametric tests, and diagnostic tests, identifying and characterizing any flaws in the chips.

- Target Market: Semiconductor manufacturers of all sizes, from large multinational corporations to smaller fabless companies, rely on high-quality chip testing solutions like those offered by UTAC. Research institutions and universities also utilize such equipment for research and development purposes.

- Key Features & Benefits: UTAC testers are often praised for their speed, accuracy, and flexibility, adapting to the ever-evolving demands of modern chip designs. Their advanced algorithms and automated processes ensure efficiency and minimize human error, delivering significant cost savings and improved throughput. The specific advantages compared to competitors often include superior throughput, advanced diagnostic capabilities, and easier integration into existing production lines.

The Chinese Buyout Firm and its Interests

While the specific Chinese buyout firm involved remains undisclosed (for confidentiality reasons), its likely motivations for exploring a sale are multifaceted. Such firms often seek significant financial returns on their investments, but strategic considerations also play a significant role. Acquisition of a company like UTAC could provide access to critical technologies and intellectual property, strengthening their position in the rapidly growing semiconductor market.

- Potential Motives: The buyout firm might be looking to divest from less profitable assets to focus on core competencies. Alternatively, they might seek a strategic exit, realizing a strong return on their initial investment.

- Investment Portfolio: The firm's existing portfolio will provide clues about their industry focus and future strategic direction. A strong presence in technology-related acquisitions would suggest a targeted approach to capturing market share in the semiconductor testing sector.

- Track Record: Examining the firm’s past mergers and acquisitions (M&A) activity in the semiconductor industry would reveal their experience and approach to integrating acquired companies. This would provide insights into the likely fate of UTAC under new ownership.

Geopolitical and Regulatory Implications of the Sale

The potential sale of UTAC chip testers to a Chinese firm has ignited concerns about national security and data privacy. The technology embedded within these testers is highly sensitive, potentially containing valuable intellectual property related to advanced semiconductor manufacturing processes. This raises concerns about the potential for technology transfer and the safeguarding of sensitive information.

- National Security Concerns: Governments in many countries are scrutinizing foreign investment in sensitive technological sectors, especially those with national security implications. The review process will involve careful examination of the transaction's potential impact on domestic industries and critical infrastructure.

- Regulatory Landscape: Regulatory bodies worldwide will likely conduct thorough investigations, applying relevant regulations regarding foreign investment review, data security, and trade restrictions. The transaction's success hinges on navigating complex international regulatory hurdles.

- Impact on Trade and Supply Chains: The sale could have broader implications for international trade relations and supply chain stability. Concerns about technological dependence and potential disruptions to the global semiconductor supply chain are likely to influence regulatory decisions.

Potential Buyers and Future of UTAC Chip Testers

While the Chinese buyout firm is currently exploring a sale, a multitude of potential buyers exist. Both domestic (within the same country as UTAC) and international companies with a vested interest in semiconductor testing technology could be interested in acquiring UTAC.

- Potential Acquirers: Competitors in the ATE market, larger semiconductor manufacturers seeking to vertically integrate their operations, and private equity firms specializing in technology acquisitions are all plausible buyers.

- Impact on UTAC’s Future: The new owner’s strategic direction will significantly impact UTAC’s future development, its capacity for innovation, and its market position relative to competitors.

- Broader Industry Implications: The sale will influence the overall semiconductor testing landscape, potentially leading to industry consolidation, increased competition, or technological shifts, all impacting the price and availability of semiconductor test equipment.

Conclusion: The Uncertain Future of the UTAC Chip Tester Sale – What's Next?

The proposed sale of UTAC chip testers is a complex issue with far-reaching implications. The potential acquisition by a Chinese firm raises questions about national security, regulatory compliance, and the future competitiveness of the semiconductor testing industry. The outcome will significantly affect the global semiconductor landscape and international trade relations. The next steps involve navigating rigorous regulatory reviews and assessing the various bids from potential buyers. The future of UTAC and the broader semiconductor testing sector hinges on this crucial decision. Stay informed about the developments surrounding the UTAC chip tester sale and its impact on the semiconductor industry. Follow us for the latest updates!

Featured Posts

-

Zuckerbergs New Chapter Navigating The Trump Presidency

Apr 24, 2025

Zuckerbergs New Chapter Navigating The Trump Presidency

Apr 24, 2025 -

Eu Aims To Phase Out Russian Gas Via Spot Market Intervention

Apr 24, 2025

Eu Aims To Phase Out Russian Gas Via Spot Market Intervention

Apr 24, 2025 -

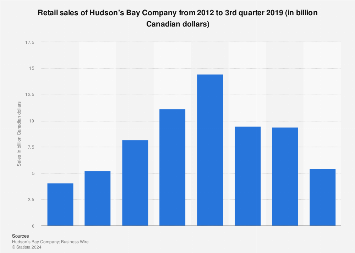

Significant Interest In 65 Hudsons Bay Retail Leases

Apr 24, 2025

Significant Interest In 65 Hudsons Bay Retail Leases

Apr 24, 2025 -

Decoding Indias Market Surge Factors Behind Niftys Rally

Apr 24, 2025

Decoding Indias Market Surge Factors Behind Niftys Rally

Apr 24, 2025 -

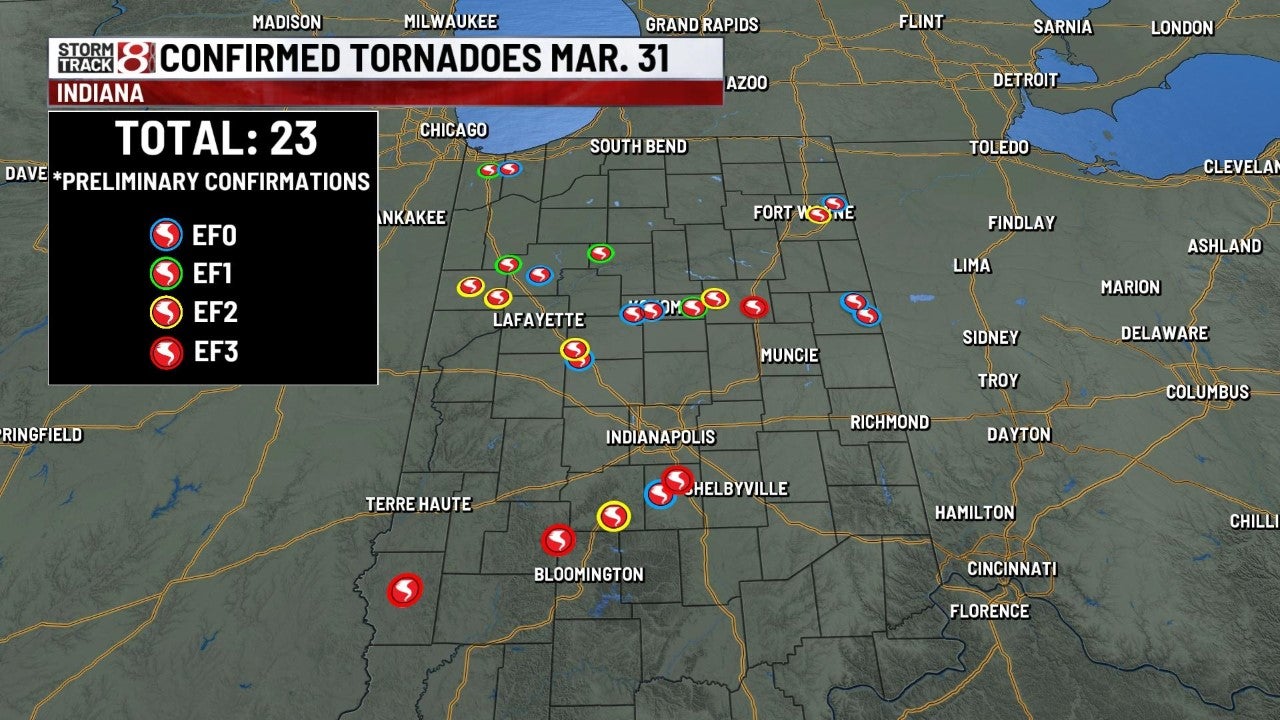

Reduced Funding Increased Danger How Trumps Cuts Impact Tornado Season

Apr 24, 2025

Reduced Funding Increased Danger How Trumps Cuts Impact Tornado Season

Apr 24, 2025