Where To Invest: Mapping The Country's Top Business Growth Areas

Table of Contents

Analyzing Key Economic Indicators for Investment Decisions

Before diving into specific locations, analyzing macroeconomic indicators is vital for identifying regions poised for substantial growth. These economic indicators provide a clear picture of a region's financial health and future potential. Focusing on regions showing strength across multiple indicators will significantly reduce investment risk.

Key Metrics to Consider:

- GDP Growth Rate: Focus on regions exhibiting consistent GDP growth exceeding national averages. A consistently high GDP growth rate signifies a thriving economy capable of generating substantial returns on investment.

- Unemployment Rate: Analyze unemployment rates to identify areas with a strong and growing workforce. Low unemployment indicates a healthy labor market, attracting businesses and fueling economic expansion. A shrinking unemployment rate is a powerful indicator of future growth.

- Inflation Levels: Consider regions with low and stable inflation. High inflation erodes purchasing power and can negatively impact investment returns. Stable inflation signifies a balanced economy.

- Consumer Spending Patterns: Observe consumer spending trends. High and consistent consumer spending demonstrates a healthy economy with strong purchasing power.

- Business Confidence Indexes: Look for areas with high business confidence and positive future projections. High business confidence suggests a positive outlook and increased investment activity.

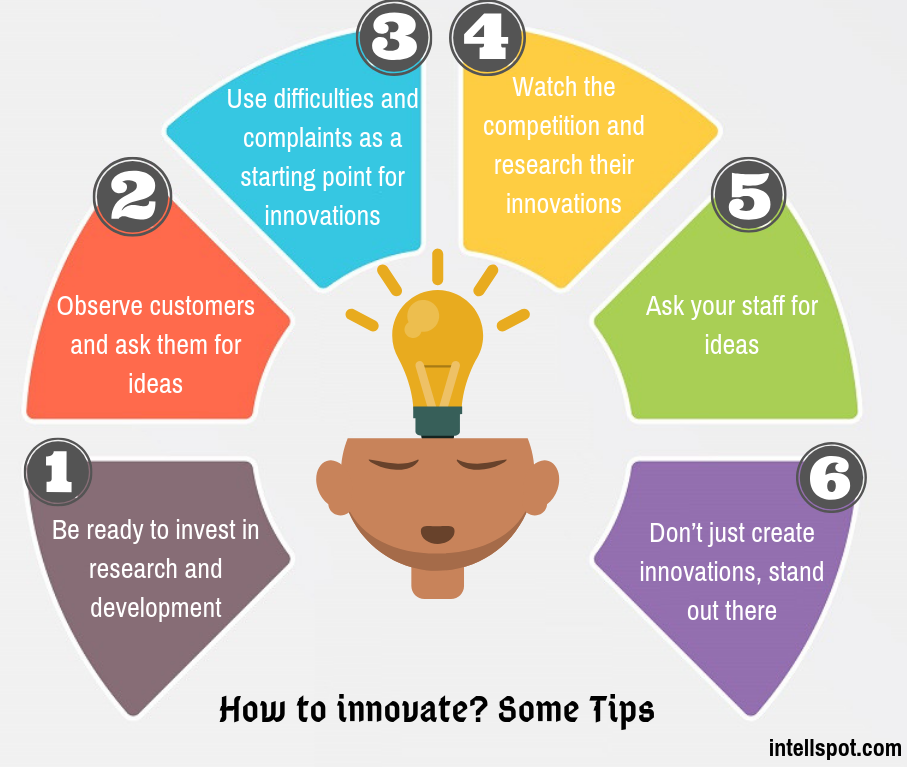

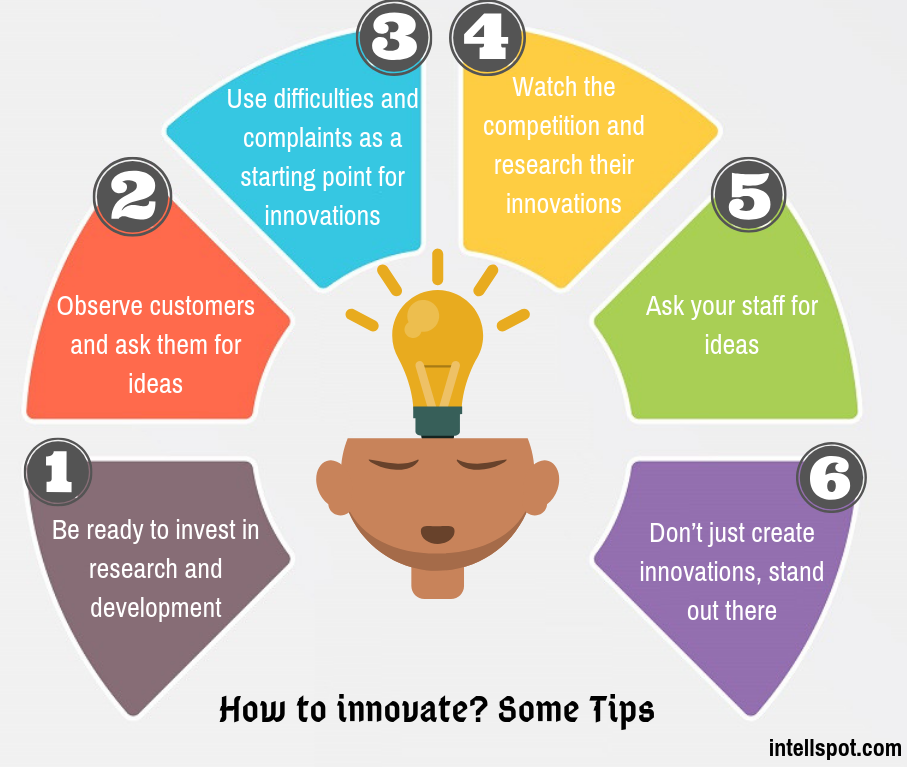

Identifying Emerging Industries and Technological Hubs

Investing in burgeoning sectors is a powerful strategy for maximizing returns. Emerging industries like renewable energy, biotechnology, artificial intelligence, and sustainable technologies are rapidly expanding, attracting significant investment and generating substantial job growth. These industries often cluster in specific geographic locations, creating thriving technological hubs and innovation clusters.

Strategic Focus:

- Research regions attracting significant investment in emerging technologies: Many governments actively promote specific industries, making these areas attractive for investment.

- Identify areas with strong support for startups and entrepreneurship: A thriving startup ecosystem signals a dynamic and innovative environment, breeding future growth.

- Analyze government initiatives and incentives supporting specific industries: Tax breaks, grants, and subsidies can significantly enhance the profitability of investments in certain sectors.

- Consider the presence of universities and research institutions driving innovation: Proximity to leading research institutions fuels innovation and attracts high-skilled talent.

Evaluating Infrastructure and Real Estate Opportunities

Robust infrastructure is essential for attracting businesses and driving economic growth. Investing in real estate in areas with planned infrastructure improvements offers significant potential for appreciation. Transportation infrastructure (roads, railways, airports), reliable utilities, and access to amenities are critical factors influencing property values and rental yields.

Real Estate Investment Considerations:

- Analyze planned infrastructure projects: New transportation links, improved utilities, and expanded communication networks can dramatically increase property values. Identify areas slated for such improvements.

- Research the local real estate market: Analyze rental yields and property prices to determine the potential for capital appreciation and consistent income generation. Consider both residential and commercial real estate opportunities.

- Consider areas with good access to amenities: Proximity to schools, hospitals, recreational facilities, and other essential services enhances the desirability and value of properties.

- Assess the potential for commercial real estate development: High-growth areas often experience increased demand for commercial space, leading to strong rental income and property appreciation.

Assessing Regulatory Environment and Government Incentives

A business-friendly regulatory environment is paramount for attracting investment and fostering economic growth. Regions with streamlined regulatory processes, attractive tax breaks, and supportive government policies offer a more stable and profitable investment climate. Understanding the local and national regulatory landscape is crucial for successful investment.

Important Factors:

- Research local and national government policies affecting businesses: Analyze tax regulations, labor laws, and other relevant policies to assess their impact on investment opportunities.

- Identify areas offering tax incentives or grants for specific industries: Government incentives can significantly reduce investment costs and enhance profitability.

- Assess the ease of doing business: Regions with simplified regulatory processes and efficient bureaucratic systems are more attractive to businesses.

- Consider areas with strong government support for business development: Active government support for business growth signifies a commitment to economic prosperity.

Conclusion

Selecting where to invest requires thorough research and a strategic approach. By carefully analyzing key economic indicators, identifying emerging industries, evaluating infrastructure, and assessing the regulatory environment, you can significantly improve your chances of success. Investing in areas with strong economic fundamentals, robust infrastructure, and supportive government policies offers the highest potential for significant returns. Start your journey to discover the best places to invest and unlock significant returns in the country's top business growth areas. Begin your research today and develop a well-informed investment strategy tailored to your risk tolerance and financial objectives.

Featured Posts

-

The Zuckerberg Trump Dynamic Implications For Social Media And Beyond

Apr 26, 2025

The Zuckerberg Trump Dynamic Implications For Social Media And Beyond

Apr 26, 2025 -

Russias Disinformation Campaign False Greenland News Fuels Denmark Us Rift

Apr 26, 2025

Russias Disinformation Campaign False Greenland News Fuels Denmark Us Rift

Apr 26, 2025 -

Worlds Fourth Largest Economy Californias Economic Powerhouse Status

Apr 26, 2025

Worlds Fourth Largest Economy Californias Economic Powerhouse Status

Apr 26, 2025 -

Ai Driven Podcast Creation Transforming Repetitive Data Into Compelling Audio

Apr 26, 2025

Ai Driven Podcast Creation Transforming Repetitive Data Into Compelling Audio

Apr 26, 2025 -

The American Battleground Taking On The Worlds Wealthiest

Apr 26, 2025

The American Battleground Taking On The Worlds Wealthiest

Apr 26, 2025