$417.5 Million Deal: Alcon Completes Village Roadshow Acquisition

Table of Contents

Alcon's Strategic Expansion Beyond Eye Care

Alcon's acquisition of Village Roadshow represents a bold strategic move beyond its traditional focus on eye care. This diversification into the entertainment sector signifies a long-term investment strategy with potentially significant returns.

Diversification into Entertainment

Alcon's motivation likely stems from several factors:

- Cross-promotional opportunities: The potential for synergistic marketing campaigns between Alcon's eye care products and Village Roadshow's film and television properties is considerable. Imagine product placement in movies or targeted advertising during film releases.

- Expanding brand reach: The acquisition significantly expands Alcon's brand reach into a new consumer demographic, broadening its market appeal beyond its existing customer base.

- Access to new consumer demographics: Village Roadshow's extensive network provides Alcon access to new, potentially lucrative, consumer markets.

- Long-term investment strategy: This acquisition is not a short-term play but a calculated investment in a growing entertainment sector, promising long-term growth and diversification.

Financial Implications and Investment Strategy

The $417.5 million investment represents a significant financial commitment for Alcon. The deal's success hinges on several factors:

- Stock market reactions: Initial market reactions to the news were largely positive, indicating investor confidence in Alcon's strategic vision. However, continued monitoring of stock performance is crucial.

- Investor sentiment: Investor sentiment towards the merger will play a key role in determining the long-term success of the acquisition. Positive sentiment will boost investment and growth.

- Analysis of the deal's profitability and return on investment: A thorough analysis of the deal's financial projections and return on investment (ROI) will be crucial in assessing its success in the coming years. This will involve careful tracking of revenue streams and cost management.

Village Roadshow's Future Under Alcon Ownership

The acquisition marks a new chapter for Village Roadshow, with significant implications for its leadership, production strategies, and overall future.

Changes in Leadership and Management

While details remain limited, it's likely that the acquisition will lead to some restructuring within Village Roadshow. Potential changes include:

- New CEO: The appointment of a new CEO, potentially from Alcon, is a strong possibility, signaling a shift in strategic direction.

- Changes in board members: We can anticipate changes in the composition of the board of directors, reflecting Alcon's increased influence.

- Potential restructuring of departments: Streamlining operations and potentially merging departments to eliminate redundancies and increase efficiency is a likely outcome.

Impact on Film Production and Distribution

Alcon's acquisition could significantly influence Village Roadshow's future film production and distribution strategies. Potential changes include:

- Potential for increased investment in filmmaking: Alcon's financial resources could lead to increased investment in higher-budget productions and potentially more diverse film projects.

- Expansion into new markets: Alcon's global presence could facilitate Village Roadshow's expansion into new international markets.

- Changes in content strategy: There could be a shift in the types of films and television shows produced, reflecting Alcon's overall strategic vision.

Industry Reactions and Market Analysis

The Alcon-Village Roadshow merger has sparked considerable debate and analysis within the eye care and entertainment industries.

Expert Opinions and Analyst Predictions

Early reactions from industry experts and financial analysts have been mixed, with some expressing optimism and others caution.

- Quotes from industry analysts: Analysts are closely watching the integration process and predicting the long-term success of the merger.

- Predictions on stock price: Stock price predictions vary widely, reflecting the uncertainty surrounding the merger's long-term impact.

- Discussion of potential challenges and opportunities: Analysts highlight both the potential challenges of integrating two vastly different businesses and the numerous opportunities for synergistic growth.

Competitive Landscape and Market Share

The acquisition will undoubtedly reshape the competitive landscape in both the eye care and entertainment sectors.

- Comparison to other major players in the industry: The merger enhances Alcon's competitive position, potentially challenging some of the larger players in the entertainment industry.

- Discussion of market dominance: Alcon's acquisition of Village Roadshow could lead to increased market share and potential dominance in specific niches.

- Potential for future acquisitions: The successful integration of Village Roadshow could pave the way for further acquisitions by Alcon in the entertainment or related sectors.

Conclusion

The $417.5 million Alcon-Village Roadshow acquisition marks a significant milestone, bringing together two seemingly disparate industries in a strategic move that could reshape both sectors. The long-term success of this merger hinges on successful integration, strategic synergy, and effective management of the combined entity. While challenges remain, the potential for growth and innovation is undeniable. Learn more about the Alcon acquisition and stay updated on the Village Roadshow future; follow the impact of this $417.5 million deal for further insights.

Featured Posts

-

Zuckerbergs Meta And The Trump Era Challenges And Opportunities

Apr 24, 2025

Zuckerbergs Meta And The Trump Era Challenges And Opportunities

Apr 24, 2025 -

417 5 Million Deal Alcon Completes Village Roadshow Acquisition

Apr 24, 2025

417 5 Million Deal Alcon Completes Village Roadshow Acquisition

Apr 24, 2025 -

Chat Gpt And Open Ai The Ftc Investigation Explained

Apr 24, 2025

Chat Gpt And Open Ai The Ftc Investigation Explained

Apr 24, 2025 -

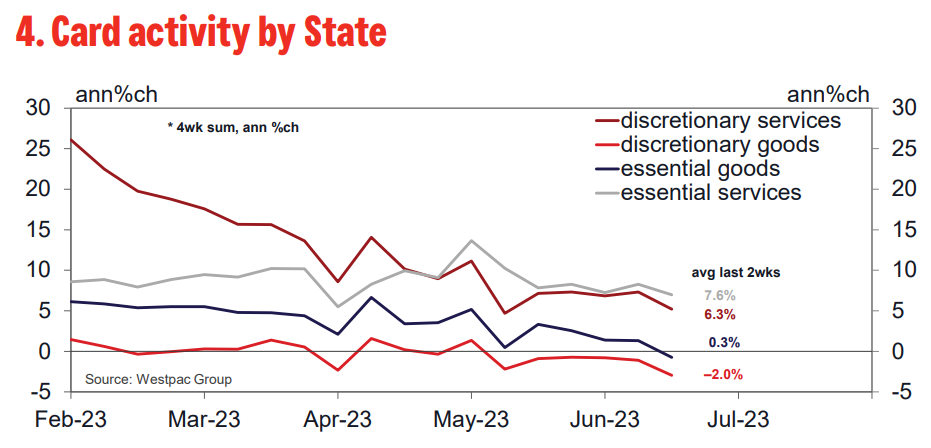

Are Credit Card Companies Prepared For The Consumer Spending Slowdown

Apr 24, 2025

Are Credit Card Companies Prepared For The Consumer Spending Slowdown

Apr 24, 2025 -

Liberal Policies Explained A Review By William Watson

Apr 24, 2025

Liberal Policies Explained A Review By William Watson

Apr 24, 2025