65 Hudson's Bay Leases: Market Interest And Potential

Table of Contents

Prime Location and High-Demand Retail Spaces

The strategic locations of these 65 Hudson's Bay leases are a key factor driving their appeal. Many are situated in high-traffic areas within major city centers and thriving shopping malls, ensuring excellent visibility and accessibility. These aren't just any retail spaces; we're talking prime real estate with significant foot traffic and proximity to complementary businesses that create a synergistic retail environment. The leases encompass a range of retail spaces, from large-format department store locations to smaller, more flexible units, catering to a variety of potential tenants.

- High foot traffic areas: Locations often boast exceptionally high pedestrian and vehicular traffic, maximizing exposure to potential customers.

- Accessibility and visibility: Prominent locations ensure easy access for customers and high visibility for businesses operating within these spaces.

- Proximity to complementary businesses: Many leases are situated near other retailers and businesses, creating a vibrant and attractive shopping destination.

- Strong consumer base: The locations are typically situated in areas with a strong and affluent consumer base, guaranteeing a steady stream of potential customers.

Investment Opportunities and Return on Investment (ROI)

Investing in 65 Hudson's Bay Leases offers significant potential returns. Several factors contribute to a strong ROI, including favorable lease terms, competitive rental rates, and the potential for tenant appreciation. Investors can pursue various strategies, such as direct ownership or forming partnerships to share the investment and risk. However, potential challenges exist, including market fluctuations and the need for thorough due diligence.

- Lease term analysis: Carefully examine lease durations to understand long-term stability and potential for rental increases.

- Rental yield projections: Conduct thorough research to estimate potential rental income and project future yields.

- Tenant creditworthiness assessment: Thoroughly vet potential tenants to ensure financial stability and mitigate risk.

- Risk mitigation strategies: Develop a comprehensive risk management plan to address potential challenges and protect investments.

Market Trends and Future Outlook for Hudson's Bay Leases

The retail landscape is constantly evolving, influenced by factors like the rise of e-commerce and shifting consumer preferences. These trends will impact the value and demand for Hudson's Bay leases. While e-commerce poses a challenge, the strategic locations of these properties and potential for redevelopment offer resilience. A positive economic outlook further enhances the long-term prospects of these leases. Adaptability and innovative strategies will be key to maximizing their potential.

- E-commerce impact analysis: Understand how online shopping trends affect physical retail spaces and adapt strategies accordingly.

- Retail sector forecast: Stay informed about broader retail market trends to make informed investment decisions.

- Potential for redevelopment and repurposing: Explore the possibility of repurposing spaces to meet changing market demands.

- Long-term market value prediction: Conduct comprehensive market research to forecast the long-term value of these leases.

Analyzing Tenant Profiles and Lease Agreements

The success of any investment in Hudson's Bay leases hinges on the quality of tenants. Attracting financially stable tenants with strong brand reputations is crucial. Careful analysis of lease agreements is also vital. Understanding lease terms, renewal options, and the responsibilities of both landlords and tenants is essential.

- Tenant background checks: Perform thorough due diligence to assess the financial health and reputation of potential tenants.

- Lease agreement review: Engage legal professionals to thoroughly review lease agreements and negotiate favorable terms.

- Understanding lease terms and conditions: Ensure a clear grasp of all lease terms, including rent, duration, renewal options, and responsibilities.

- Negotiating favorable lease terms: Seek expert advice to ensure you negotiate the best possible terms for your investment.

Conclusion: Capitalizing on the Potential of 65 Hudson's Bay Leases

The 65 Hudson's Bay leases represent a compelling investment opportunity in prime retail real estate. Their strategic locations, potential for strong ROI, and opportunities for redevelopment make them attractive. However, thorough due diligence, including careful tenant selection and lease agreement review, is paramount. Seeking professional advice from real estate experts and legal counsel is strongly recommended before making any investment decisions. Explore the exciting potential of 65 Hudson's Bay Leases and similar opportunities in the retail real estate market by contacting experienced professionals today. Don't miss out on the chance to capitalize on this lucrative segment of the commercial real estate market – take action and explore the investment potential of Hudson's Bay leases now.

Featured Posts

-

The Bold And The Beautiful April 3rd Episode Recap Liams Health Crisis

Apr 24, 2025

The Bold And The Beautiful April 3rd Episode Recap Liams Health Crisis

Apr 24, 2025 -

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025 -

Us Stock Futures Surge Trumps Powell Comments Boost Markets

Apr 24, 2025

Us Stock Futures Surge Trumps Powell Comments Boost Markets

Apr 24, 2025 -

How Effective Middle Management Drives Organizational Performance And Employee Satisfaction

Apr 24, 2025

How Effective Middle Management Drives Organizational Performance And Employee Satisfaction

Apr 24, 2025 -

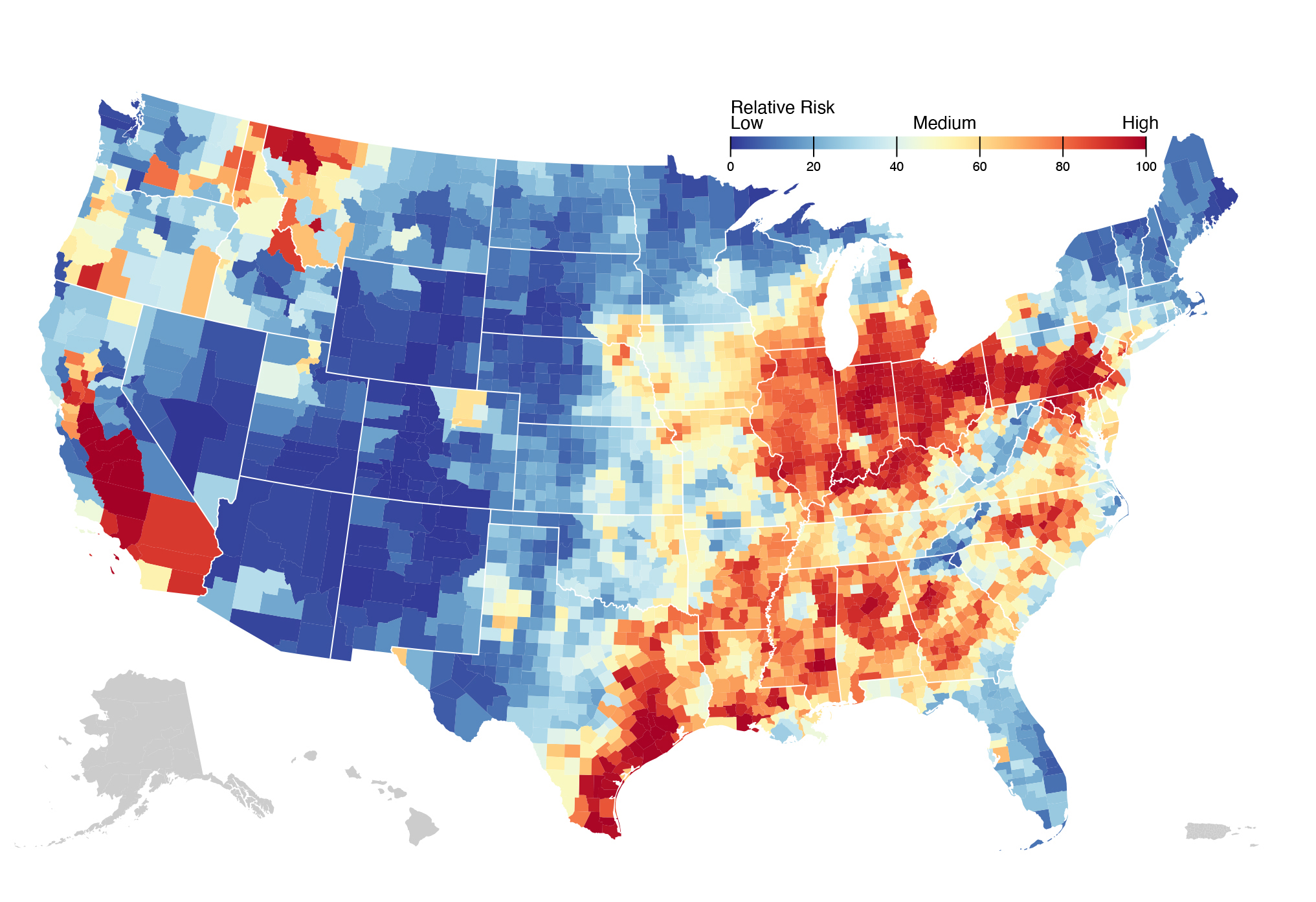

The Countrys New Business Hot Spots A Geographic Analysis

Apr 24, 2025

The Countrys New Business Hot Spots A Geographic Analysis

Apr 24, 2025