Ackman's Trade War Prediction: US Vs. China

Table of Contents

Ackman's Stance on the US-China Trade War

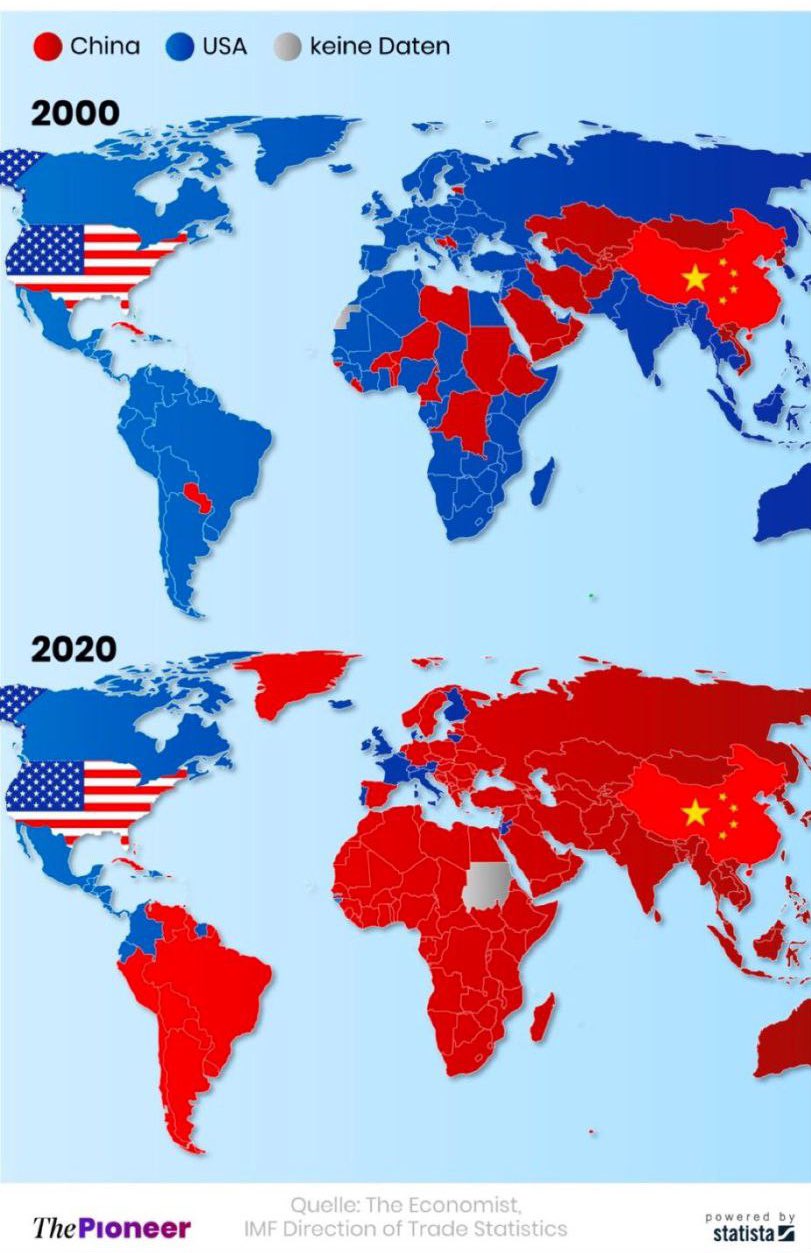

Bill Ackman, known for his insightful (and sometimes controversial) investment strategies, has expressed significant concerns about the escalating tensions between the US and China. While the specifics of his predictions evolve, his general stance leans towards a pessimistic outlook on the long-term outcome of the trade relationship. He doesn't necessarily predict an immediate, full-blown trade war, but rather a prolonged period of heightened tensions, economic decoupling, and increased geopolitical risk. This perspective is often supported by his investment decisions and public statements.

- Key Aspects of Ackman's Prediction:

- Focus on Technological Decoupling: Ackman highlights the growing divergence in technological standards and supply chains between the US and China as a major concern, predicting increased friction and potential disruptions.

- Impact on Specific Industries: He points to the technology sector, particularly semiconductors and AI, as being particularly vulnerable to the fallout from escalating trade tensions. Manufacturing and supply chain sectors are also highly susceptible to disruption.

- Assessment of Government Policies: Ackman emphasizes the influence of government policies, including tariffs and export controls, as key drivers of the ongoing trade conflict and its potential for escalation. He considers the potential for further restrictions and retaliatory measures as significant risks.

Analyzing the Underlying Factors of Ackman's Prediction

Ackman's prediction isn't made in a vacuum. Several significant geopolitical and economic factors underpin his perspective.

-

Geopolitical Factors: The increasing rivalry between the US and China extends beyond trade, encompassing ideological differences, technological competition, and geopolitical influence. This broader context fuels Ackman’s concern about a prolonged period of strained relations.

-

Economic Factors:

- Supply Chain Disruptions: The existing and potential future disruptions to global supply chains due to trade restrictions and geopolitical instability are significant factors in Ackman’s analysis.

- Inflationary Pressures: Trade wars can contribute to inflationary pressures, as tariffs increase the cost of imported goods. Ackman likely considers this a key risk factor.

- Debt Levels: High levels of debt in both the US and China add another layer of complexity, increasing the potential for economic instability.

-

Key Factors Driving Ackman's Prediction:

- Technological Decoupling: The push for technological independence by both nations leads to increased competition and potential conflict.

- Tariffs and Trade Restrictions: Existing and potential future tariffs and trade restrictions exacerbate tensions and create uncertainty.

- Global Economic Uncertainty: The overall global economic climate, already vulnerable to various risks, is further destabilized by the US-China trade tensions.

- Potential for Escalation: The risk of further escalation, potentially extending beyond trade into other areas of conflict, is a central concern in Ackman’s view.

Investment Implications of Ackman's Trade War Prediction

Ackman's prediction holds significant implications for investors. Interpreting his view requires a careful assessment of potential risks and opportunities.

-

Investment Opportunities and Risks:

- Risks: Increased market volatility, potential for portfolio losses in sectors heavily reliant on trade with China, and disruption to supply chains are key risks investors need to consider.

- Opportunities: Opportunities may arise in sectors less dependent on trade with China, such as domestic manufacturing or companies developing alternative supply chains.

-

Investment Strategies:

- Hedging Strategies: Investors may utilize hedging strategies to protect against potential losses resulting from trade war-related volatility.

- Sector-Specific Opportunities: Focusing on sectors less susceptible to trade tensions can offer potential gains.

- Diversification: Diversifying investments across asset classes and geographies remains a crucial risk management strategy.

Counterarguments and Alternative Perspectives

While Ackman's perspective is influential, it's crucial to consider alternative viewpoints. Some analysts argue that the US and China are too economically intertwined for a complete decoupling, suggesting a potential for increased cooperation in the long term. Others believe that the impact of trade tensions will be less severe than Ackman predicts.

- Alternative Perspectives:

- Less Severe Trade War Outcome: Some analysts believe that both countries have too much to lose from a full-scale trade war, predicting eventual de-escalation and compromise.

- Potential for Cooperation: Despite heightened tensions, opportunities for cooperation on shared global challenges remain, potentially leading to a less confrontational relationship.

- Influence of Other Global Economic Factors: The overall global economic climate and the actions of other major economies can also influence the US-China trade relationship, potentially mitigating some of the negative impacts.

Conclusion: Navigating Ackman's Trade War Prediction: US vs. China

Bill Ackman's prediction regarding the US-China trade war highlights the significant risks and uncertainties facing global investors. His emphasis on technological decoupling, supply chain vulnerabilities, and geopolitical tensions provides a valuable, albeit pessimistic, perspective. However, it’s essential to consider counterarguments and alternative forecasts to develop a well-informed investment strategy. Understanding the nuances of this complex relationship is crucial for navigating the potential economic fallout. Conduct further research on the topic, stay informed about developments in the US-China trade relationship, and develop informed investment strategies based on your risk tolerance and Ackman's prediction, alongside other expert opinions. Careful risk management and diversification are paramount in managing the uncertainty surrounding Ackman's prediction and the ongoing US-China trade war.

Featured Posts

-

Cdcs New Vaccine Study Hire A Discredited Misinformation Agent

Apr 27, 2025

Cdcs New Vaccine Study Hire A Discredited Misinformation Agent

Apr 27, 2025 -

Ecbs Simkus Trade Headwinds May Trigger Two Additional Interest Rate Reductions

Apr 27, 2025

Ecbs Simkus Trade Headwinds May Trigger Two Additional Interest Rate Reductions

Apr 27, 2025 -

Public Health Concerns Anti Vaxxer Leading Autism Study

Apr 27, 2025

Public Health Concerns Anti Vaxxer Leading Autism Study

Apr 27, 2025 -

Trumps Trade Pressure Carneys Message To Canadian Voters

Apr 27, 2025

Trumps Trade Pressure Carneys Message To Canadian Voters

Apr 27, 2025 -

The Night Robert Pattinson Fell Asleep With Knives A Chilling Account

Apr 27, 2025

The Night Robert Pattinson Fell Asleep With Knives A Chilling Account

Apr 27, 2025