AI Boom Propels SK Hynix Past Samsung In DRAM Sales

Table of Contents

The Surge in AI Demand Fuels DRAM Sales Growth

The rise of artificial intelligence is inextricably linked to the soaring demand for DRAM chips. AI, encompassing machine learning and deep learning algorithms, requires immense computational power and massive datasets. This translates into a voracious appetite for high-bandwidth memory (HBM) and other types of DRAM, driving unprecedented sales growth.

- Increased server demand for AI data centers: The backbone of AI operations relies on powerful servers housed in massive data centers. These servers require vast amounts of DRAM to handle the complex computations and data processing involved in AI applications.

- Growing need for high-performance computing (HPC) solutions for AI development: Developing and training sophisticated AI models requires immense processing power. HPC systems, heavily reliant on high-capacity DRAM, are crucial for this process.

- Expansion of the AI chip market driving DRAM requirements: The development of specialized AI chips, like GPUs and TPUs, further fuels the demand for DRAM. These chips often require large amounts of high-bandwidth memory to function effectively.

- Specific examples of AI applications contributing to DRAM demand: The increasing prevalence of generative AI models (like those powering image generation and large language models), autonomous driving systems, and other advanced AI applications all contribute to the growing need for DRAM. The more sophisticated the AI, the more DRAM it requires.

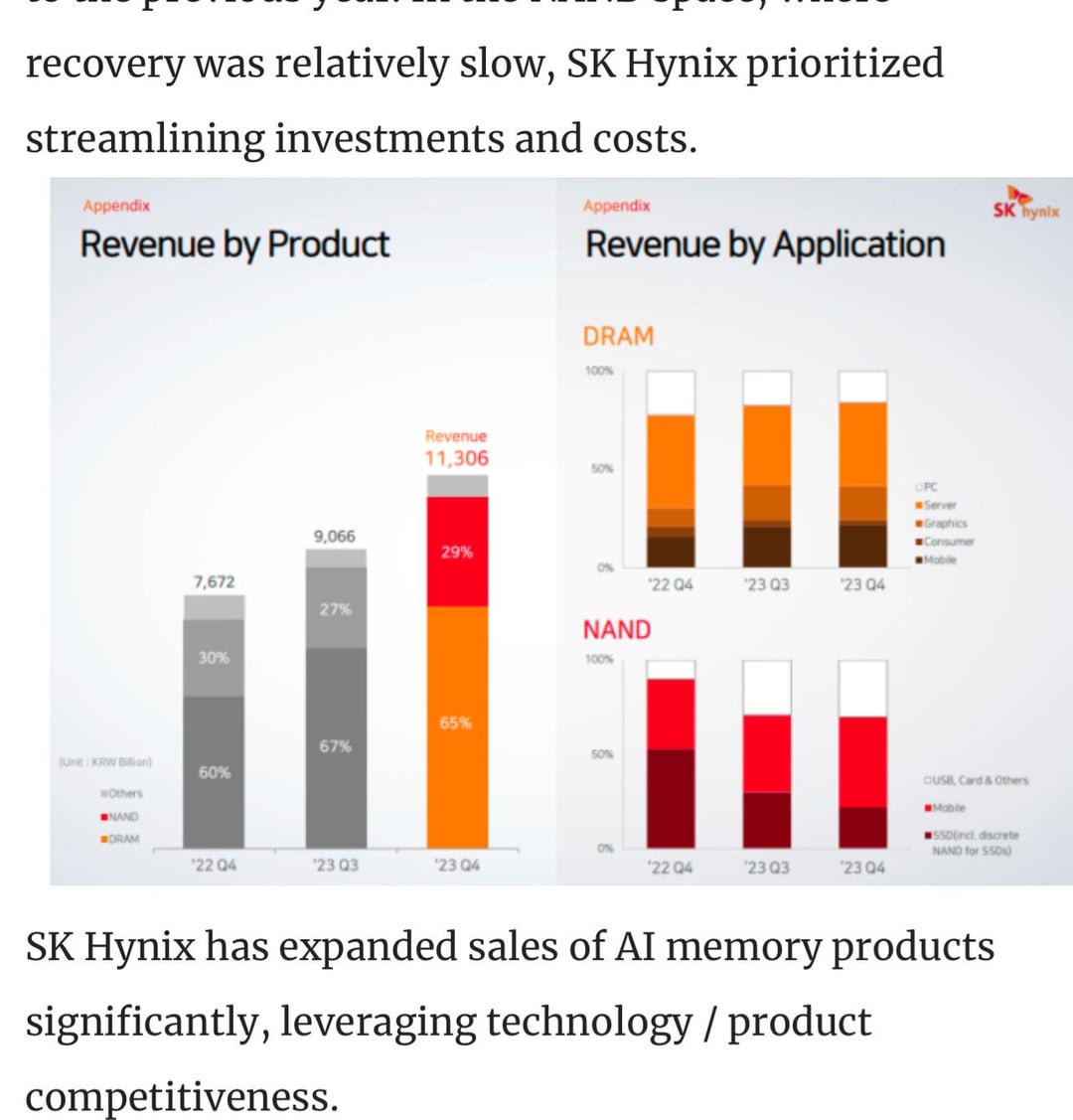

SK Hynix's Strategic Advantage in the AI-Driven Market

SK Hynix's success in surpassing Samsung isn't accidental. It’s the result of strategic investments and forward-thinking initiatives specifically tailored to the burgeoning AI market. Their focus on advanced DRAM technologies has proven exceptionally effective.

- Investments in HBM technology and its variations: Recognizing the crucial role of HBM in AI applications, SK Hynix heavily invested in research and development, leading to significant advancements in HBM2E and the upcoming HBM3.

- Focus on high-capacity and high-speed DRAM modules: SK Hynix has prioritized the development of DRAM modules with superior capacity and speed, directly addressing the needs of AI data centers and HPC systems.

- Strategic collaborations with AI companies: By partnering with key players in the AI sector, SK Hynix has secured crucial supply chains and gained valuable insights into future technological needs.

- Aggressive expansion of manufacturing capacity: SK Hynix has proactively increased its manufacturing capabilities to meet the rapidly growing demand for DRAM chips driven by the AI boom.

Samsung's Position and Future Strategies in the DRAM Market

Samsung, despite its recent setback, remains a dominant player in the DRAM market. While SK Hynix currently leads in sales, Samsung is undoubtedly working on counter-strategies to regain its position.

- Samsung's current market share and projections: Although currently second, Samsung still holds a substantial market share and is likely to leverage its existing infrastructure and brand recognition.

- Samsung's R&D efforts in DRAM and related technologies: Samsung's extensive R&D capabilities are expected to result in innovations that could challenge SK Hynix’s current lead. They are likely focusing on next-generation DRAM technologies and potentially exploring alternative memory solutions.

- Possible strategic partnerships and acquisitions: To bolster its position, Samsung could pursue strategic partnerships or acquisitions to expand its reach and technology portfolio.

- Focus on different market segments (e.g., mobile, consumer electronics): While the AI sector is crucial, Samsung might also focus on maintaining its dominance in other segments like mobile and consumer electronics, where DRAM demand remains strong.

Market Predictions and Long-Term Implications for DRAM Suppliers

The future of the DRAM market looks bright, largely fueled by continued growth in the AI sector. However, challenges and opportunities abound for manufacturers like SK Hynix and Samsung.

- Forecasted growth in the AI sector and its influence on DRAM demand: Analysts predict continued, robust growth in the AI sector, resulting in sustained demand for high-performance DRAM.

- Potential impact of technological advancements (e.g., new memory technologies): Emerging memory technologies could disrupt the market, presenting both opportunities and threats to established players.

- Challenges for DRAM manufacturers (e.g., supply chain disruptions, price fluctuations): Manufacturers face ongoing challenges related to supply chain stability and price volatility, which directly impact profitability.

- Opportunities for consolidation and strategic alliances in the industry: The industry may witness further consolidation, with mergers and acquisitions becoming more common to achieve economies of scale and technological synergies.

Conclusion: The Future of DRAM Sales in the AI Era

The recent shift in DRAM market share, with SK Hynix surpassing Samsung, is a clear indication of the transformative power of the AI boom. The high demand for high-performance memory chips, driven by the rapid expansion of AI applications, is reshaping the competitive landscape. While SK Hynix currently holds the advantage, Samsung's resilience and innovation ensure a continued, intense competition. Stay tuned for updates on the DRAM market, follow the AI boom's impact on DRAM sales, and learn more about the competition between SK Hynix and Samsung in the DRAM market – the future of memory is being written now.

Featured Posts

-

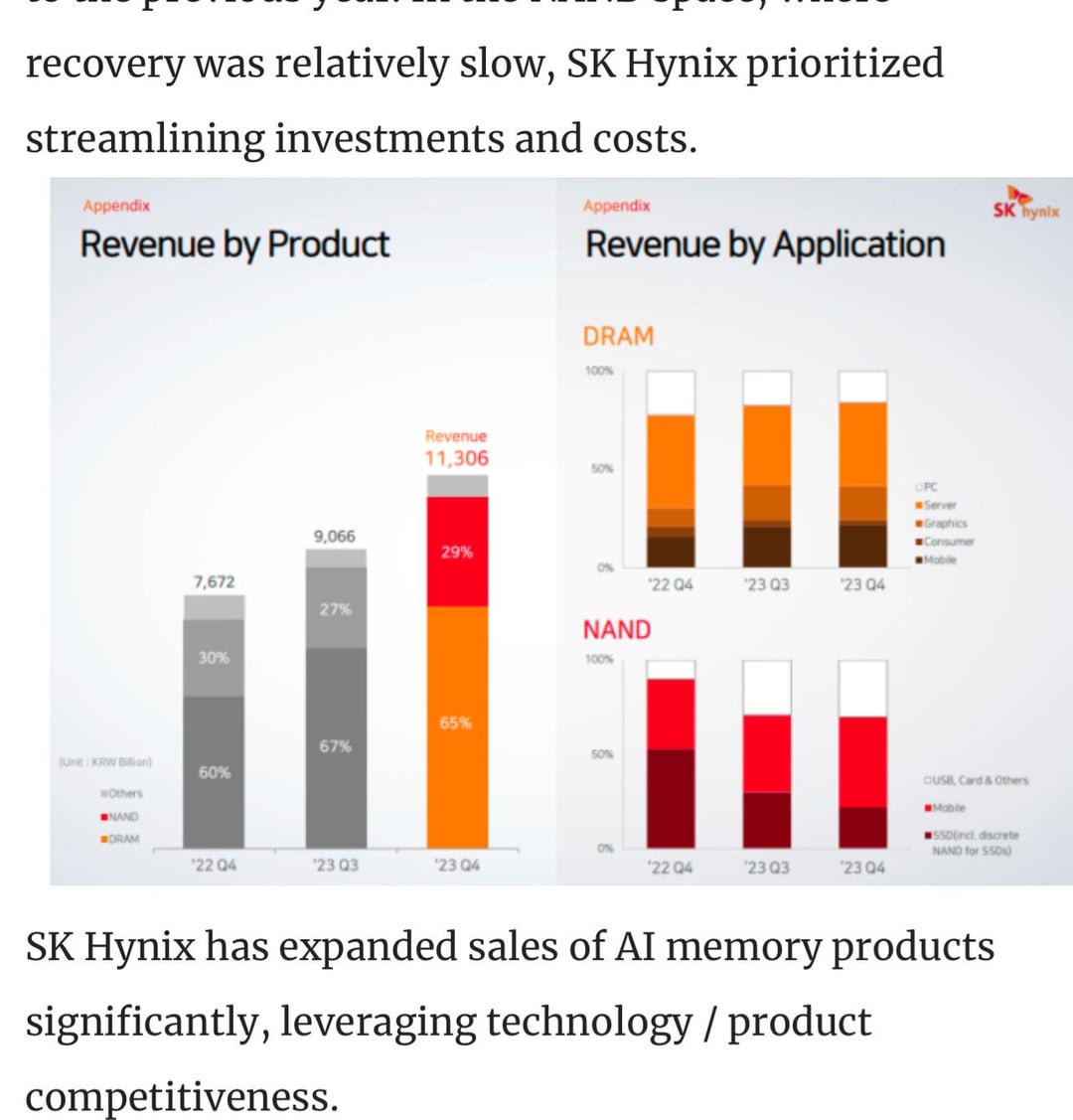

The Impact Of Us Tariffs Chinas Lpg Imports From The Middle East

Apr 24, 2025

The Impact Of Us Tariffs Chinas Lpg Imports From The Middle East

Apr 24, 2025 -

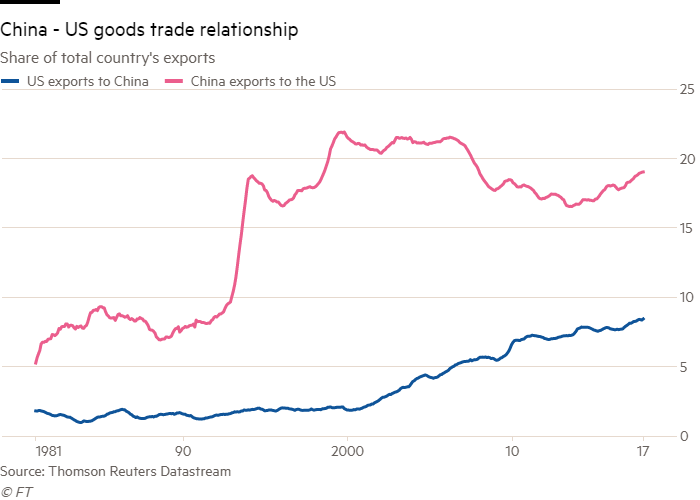

Teslas Optimus Robot Navigating The Challenges Of Rare Earth Supply

Apr 24, 2025

Teslas Optimus Robot Navigating The Challenges Of Rare Earth Supply

Apr 24, 2025 -

April 23rd Stock Market Summary Dow S And P 500 And Nasdaq Performance

Apr 24, 2025

April 23rd Stock Market Summary Dow S And P 500 And Nasdaq Performance

Apr 24, 2025 -

Canadas Economic Vision Prioritizing Fiscal Responsibility

Apr 24, 2025

Canadas Economic Vision Prioritizing Fiscal Responsibility

Apr 24, 2025 -

Celebrities Home Losses In The La Palisades Fires Comprehensive Report

Apr 24, 2025

Celebrities Home Losses In The La Palisades Fires Comprehensive Report

Apr 24, 2025