Analyzing The Bank Of Canada's Pause: Key Takeaways From FP Video's Expert Interviews

Table of Contents

Inflationary Pressures and the Pause Decision

The Bank of Canada's pause comes amidst a complex inflationary environment. While inflation has begun to cool from its peak, it remains stubbornly above the Bank's 2% target. Understanding the current state of inflation is crucial to interpreting the pause decision.

- Analysis of recent inflation data (CPI, etc.): Recent CPI figures show a gradual decline in inflation, but core inflation (which excludes volatile items like food and energy) remains elevated. This suggests underlying inflationary pressures persist.

- Discussion of the Bank's inflation target: The Bank of Canada aims to maintain price stability through its inflation target. The current deviation from this target necessitates careful monitoring and strategic policy adjustments.

- Expert opinions on whether the pause is a sufficient response to inflation: FP's interviews revealed a range of opinions. Some economists believe the pause is a necessary strategic move to assess the impact of previous rate hikes, while others argue that it risks allowing inflation to become entrenched.

- Mention of potential future rate hikes based on upcoming economic indicators: The Bank of Canada has clearly stated that the pause is conditional. Future rate hikes remain a possibility, contingent upon upcoming economic data, particularly inflation figures and GDP growth. The Bank will closely monitor key economic indicators to guide future monetary policy decisions. This data-driven approach emphasizes the dynamic nature of the Bank of Canada's strategy in managing inflation.

Economic Growth and the Impact of the Pause

The Canadian economy's current state significantly influences the Bank of Canada's decision-making process. The pause in rate hikes aims to strike a balance between controlling inflation and supporting economic growth.

- Analysis of GDP growth and forecasts: GDP growth forecasts for Canada remain mixed, reflecting uncertainty about the global economic outlook and the impact of interest rate increases. Some forecasters predict a slowdown, while others believe the economy can withstand the current monetary policy stance.

- Impact on consumer spending and business investment: The pause might offer some relief to consumers struggling with high interest rates, potentially boosting consumer spending. Businesses may also see increased investment opportunities with a pause in further rate hikes.

- Potential risks to economic growth due to the pause: The risk of allowing inflation to become entrenched is a significant concern if the pause proves insufficient to curb rising prices. This could lead to more aggressive interest rate hikes in the future, potentially harming economic growth.

- Expert opinions on the long-term economic outlook: FP's expert interviews highlight varying perspectives on the long-term economic outlook. Some experts express optimism, citing resilience in the Canadian economy, while others caution against complacency and highlight potential risks to long-term growth.

Housing Market and the Pause's Implications

The Canadian housing market is highly sensitive to interest rate changes. The Bank of Canada's pause will have a significant impact on this already volatile sector.

- Impact on mortgage rates: The pause is expected to stabilize, or even slightly reduce, mortgage rates, offering some respite to potential homebuyers. However, rates remain significantly higher than pre-pandemic levels.

- Potential effects on home prices and sales: While a pause might offer some support to the housing market by slightly increasing affordability, other factors, such as limited supply, continue to influence home prices and sales. The overall impact remains uncertain.

- Discussion of the housing market's vulnerability: The housing market's vulnerability to interest rate changes is well-documented. A sudden shift in monetary policy could have significant consequences for home prices and consumer debt.

- Expert predictions on future trends in the housing sector: FP's interviews showcased differing expert predictions for the Canadian housing market, ranging from a period of stabilization to further price adjustments, depending on various economic indicators and market conditions.

Expert Opinions and Divergent Views on the Bank of Canada's Pause

The FP video interviews captured a spectrum of expert opinions on the Bank of Canada's pause. This diversity of views reflects the complexity of the economic landscape.

- Highlight differing perspectives on the effectiveness of the pause: Some experts believe the pause is a necessary step to assess the cumulative effects of prior rate hikes, while others fear it might allow inflation to linger.

- Summarize arguments for and against the pause: Arguments in favor emphasize the need to avoid unnecessarily harming economic growth, while counterarguments highlight the risks of underestimating inflation’s persistence.

- Mention any dissenting opinions or concerns raised by experts: Some experts expressed concern about the potential for a resurgence of inflation, emphasizing the need for vigilance and a willingness to adjust policy if necessary.

- Include quotes from the interviews to add credibility and engagement: "[Insert relevant quotes from FP's interviews here, properly attributed]."

Conclusion

The Bank of Canada's decision to pause interest rate increases is a significant event with far-reaching implications for the Canadian economy. FP Video's expert interviews offer a multifaceted perspective on this complex issue, highlighting the ongoing debate surrounding inflation, economic growth, and the housing market. While the pause may provide some short-term relief, the ultimate success of this strategy will depend on several factors, including future economic data and the Bank's ability to navigate the delicate balance between inflation control and economic stability. To stay informed on the evolving situation and gain further insights into the Bank of Canada's strategy, continue to follow the latest analysis on the Bank of Canada's pause and related economic news.

Featured Posts

-

The Conclave And The Future Pope Francis Lasting Influence

Apr 22, 2025

The Conclave And The Future Pope Francis Lasting Influence

Apr 22, 2025 -

Why Middle Managers Are Essential For Company Success

Apr 22, 2025

Why Middle Managers Are Essential For Company Success

Apr 22, 2025 -

The Selection Of A New Pope A Look Inside Papal Conclaves

Apr 22, 2025

The Selection Of A New Pope A Look Inside Papal Conclaves

Apr 22, 2025 -

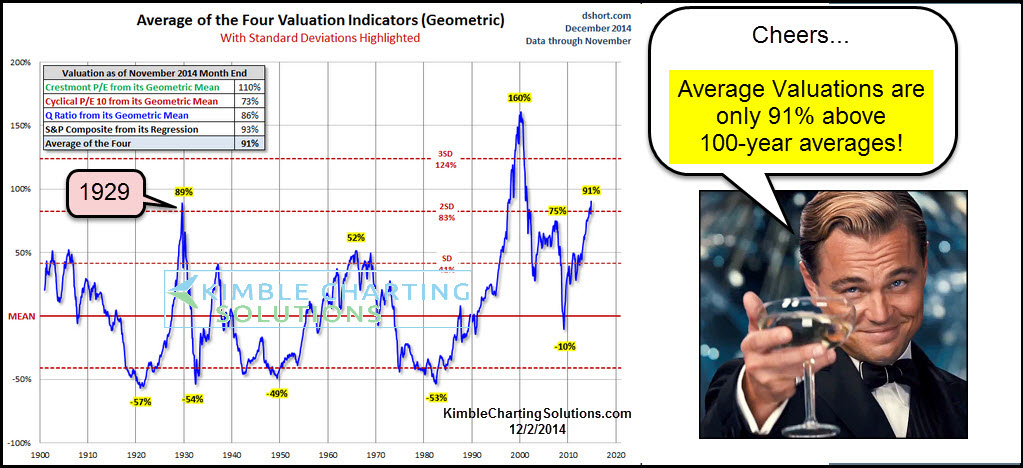

Investor Concerns About High Stock Valuations Bof As Response

Apr 22, 2025

Investor Concerns About High Stock Valuations Bof As Response

Apr 22, 2025 -

Us Pushes For Peace As Russia Unleashes Deadly Air Strikes On Ukraine

Apr 22, 2025

Us Pushes For Peace As Russia Unleashes Deadly Air Strikes On Ukraine

Apr 22, 2025