Bank Of Canada Interest Rate Pause: Expert Analysis From FP Video

Table of Contents

Reasons Behind the Bank of Canada's Interest Rate Pause

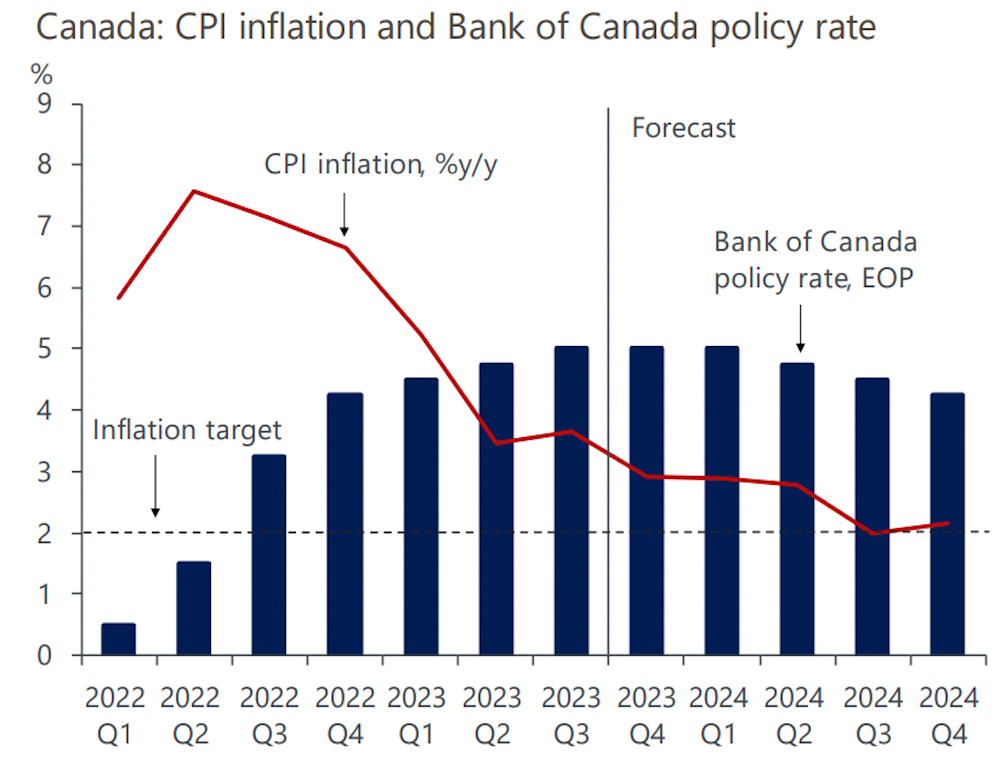

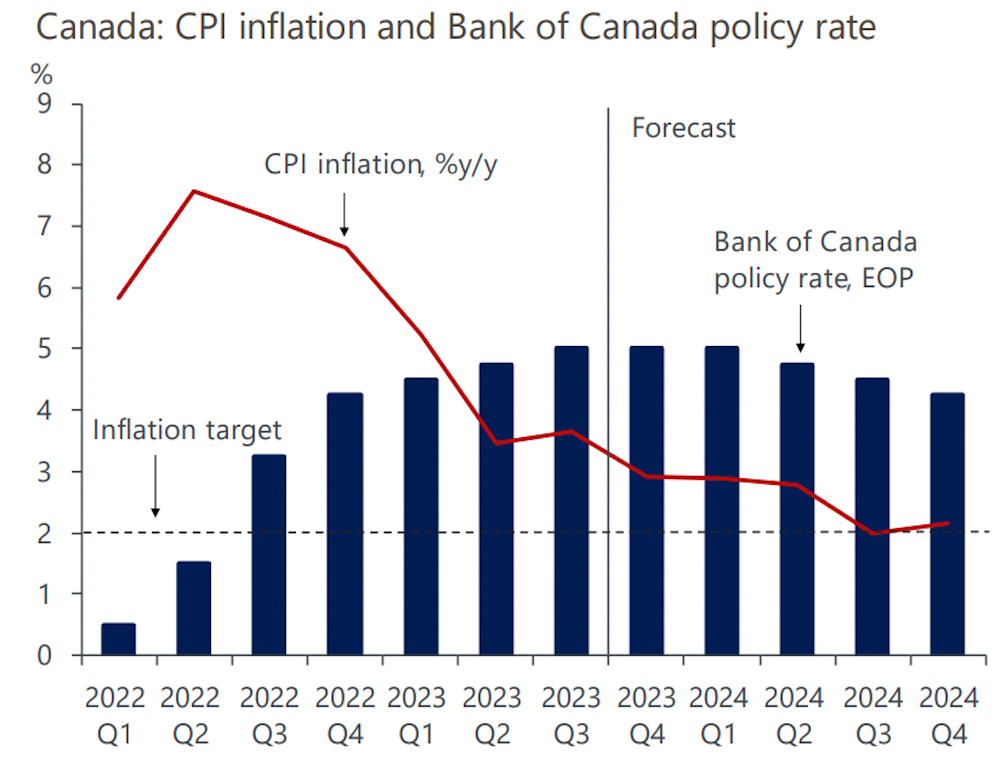

The Bank of Canada's decision to pause interest rate increases is a complex one, influenced by a multitude of intertwined economic factors. The current economic climate presents a delicate balancing act for policymakers.

While inflation remains a concern, recent data suggests a potential easing of inflationary pressures. Employment figures, although still robust, show signs of cooling, suggesting the previous rate hikes are beginning to have their intended effect. This is further complicated by the lagged effect of previous interest rate increases, meaning the full impact of those hikes is yet to be fully felt. The Bank is clearly weighing the risk of pushing the economy into a recession against the need to continue combating inflation.

The Bank's official statement highlighted several key points:

- Easing inflation pressure: While still above the target, inflation appears to be slowing down.

- Concerns about economic slowdown: The Bank acknowledges the risk of a significant economic slowdown.

- Assessment of the lagged effects of previous rate hikes: The full impact of previous rate increases is yet to be felt.

- Potential for a recession: The Bank is carefully considering the risk of triggering a recession with further rate hikes.

Expert Opinions from the FP Video

The FP video featured several prominent economists offering their perspectives on the Bank of Canada's interest rate pause. These experts provided valuable insights into the rationale behind the decision and its potential ramifications.

- Expert 1's view on the pause: [Insert Expert 1's name and credentials] argued that the pause is a necessary strategic move to assess the impact of past increases and avoid pushing the economy into a recession. They highlighted the importance of monitoring key economic indicators closely.

- Expert 2's analysis of future rate movements: [Insert Expert 2's name and credentials] suggested that while a pause is warranted now, further rate hikes are likely if inflation proves stubborn. They emphasized the need for the Bank to remain data-driven in its decision-making.

- Expert 3's perspective on the impact on the Canadian economy: [Insert Expert 3's name and credentials] focused on the potential effects of the pause on different sectors of the economy, emphasizing both the positive aspects (e.g., relief for borrowers) and the potential negative consequences (e.g., continued inflationary pressure).

Potential Impacts of the Bank of Canada Interest Rate Pause

The Bank of Canada interest rate pause will likely have far-reaching consequences across the Canadian economy, both in the short term and the long term.

The pause will directly influence borrowing costs, potentially offering some relief to consumers and businesses burdened by high interest rates. This could stimulate consumer spending, but it also carries the risk of reigniting inflationary pressures. The housing market, highly sensitive to interest rate changes, is expected to experience a period of uncertainty, with potential impacts on both prices and sales volume. Finally, the Canadian dollar's value is also likely to be affected by this decision, influenced by global market reactions and investor sentiment. Here's a breakdown:

- Effect on mortgage rates: A pause in rate hikes could temporarily stabilize or even slightly reduce mortgage rates.

- Influence on consumer confidence: The pause may boost consumer confidence, leading to increased spending.

- Impact on the housing market (prices, sales): The impact is uncertain, potentially leading to stabilization or even a slight rebound in prices.

- Potential changes to the Canadian dollar's value: The Canadian dollar’s value may strengthen or weaken depending on global market reactions.

What to Expect Next from the Bank of Canada

Predicting the Bank of Canada's next move is challenging, but several factors will heavily influence their future decisions. The Bank will closely monitor key economic indicators to gauge the effectiveness of the pause and assess the overall economic outlook. A resumption of rate hikes remains a possibility if inflation persists or if economic growth proves unexpectedly strong. Conversely, the Bank might extend the pause if economic indicators suggest a weakening economy or if inflation continues to cool significantly.

- Prediction of next rate decision timing: The next rate announcement is likely to be [Insert predicted date].

- Key economic indicators to watch (e.g., CPI, GDP growth): The Bank will scrutinize inflation data (CPI), GDP growth, and unemployment figures.

- Potential scenarios for future interest rate changes: Further hikes, continued pause, or even potential rate cuts are all possibilities.

Conclusion: Understanding the Bank of Canada Interest Rate Pause

The Bank of Canada's decision to pause interest rate increases is a significant development with potential far-reaching consequences for the Canadian economy. Understanding the reasons behind this pause, the expert opinions surrounding it, and its potential impacts is crucial for individuals, businesses, and policymakers alike. This article, drawing on analysis from a Financial Post video, has provided a comprehensive overview of the key considerations. To gain a deeper understanding of the Bank of Canada's interest rate policy and Canada's interest rate outlook, we strongly encourage you to watch the full FP video [Insert Video Link Here]. Staying informed about the Bank of Canada's decisions is essential for navigating the evolving economic landscape.

Featured Posts

-

Federal Investigation Millions Stolen Via Executive Office365 Compromise

Apr 22, 2025

Federal Investigation Millions Stolen Via Executive Office365 Compromise

Apr 22, 2025 -

Ryujinx Emulator Development Halted Nintendo Contact Confirmed

Apr 22, 2025

Ryujinx Emulator Development Halted Nintendo Contact Confirmed

Apr 22, 2025 -

Ukraine War Renewed Fighting After Russias Ceasefire Ends

Apr 22, 2025

Ukraine War Renewed Fighting After Russias Ceasefire Ends

Apr 22, 2025 -

Pope Francis His Life His Legacy And A Church Transformed

Apr 22, 2025

Pope Francis His Life His Legacy And A Church Transformed

Apr 22, 2025 -

Death Of Pope Francis At 88 A World Mourns

Apr 22, 2025

Death Of Pope Francis At 88 A World Mourns

Apr 22, 2025