BofA Says: Don't Worry About Stretched Stock Market Valuations

Table of Contents

BofA's Rationale Behind Downplaying Valuation Concerns

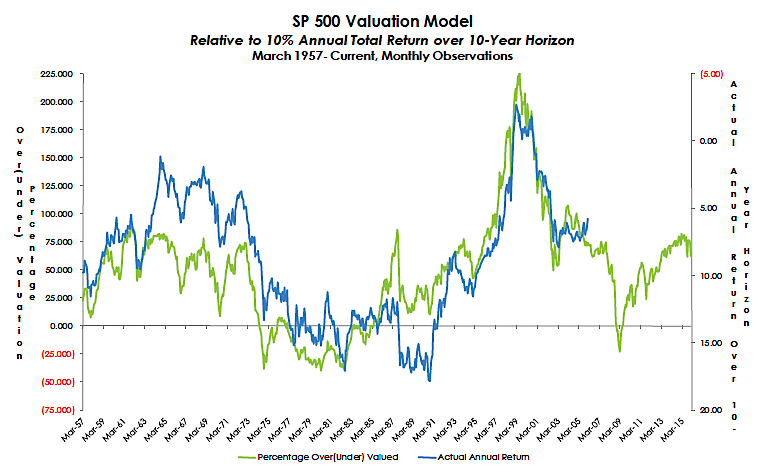

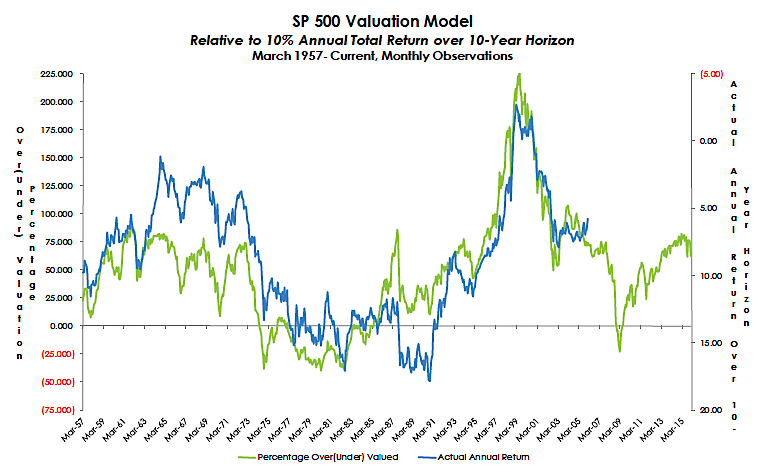

BofA's relatively optimistic outlook on current stretched valuations rests on several key pillars. They argue that a simple focus on price-to-earnings ratios alone misses the bigger picture.

The Importance of Interest Rates

BofA's analysis emphasizes the crucial role of low interest rates in justifying higher stock market valuations.

- Lower interest rates decrease the discount rate used in valuation models. This means that future earnings are worth more in present value terms. A lower discount rate directly impacts how we assess the value of future cash flows generated by companies.

- Lower interest rates make borrowing cheaper for companies. This allows for increased investment and, potentially, faster earnings growth. This increased potential for growth offsets the seemingly high valuations.

- BofA's report (mention specific report if available, e.g., "BofA's Global Research report dated October 26, 2023") highlights that historically low interest rates significantly alter the calculation of intrinsic value, making current valuations appear less extreme when viewed within this broader economic context.

Focus on Earnings Growth

BofA isn't ignoring the high valuations; instead, they're emphasizing the importance of strong corporate earnings growth as a counterbalance.

- Robust growth in key sectors: BofA points to sectors like technology and healthcare as exhibiting strong earnings growth, justifying their relatively higher valuations. The ongoing technological advancements and increased demand in these sectors fuel this growth.

- Innovation drives earnings: BofA highlights the role of innovation and technological advancements in driving earnings growth beyond what traditional valuation models might predict. Companies leveraging cutting-edge technologies often command higher valuations due to their growth potential.

- Examples of high-growth companies: (Insert examples of specific companies mentioned in the BofA report that demonstrate strong earnings growth).

Long-Term Perspective

BofA strongly advocates for a long-term investment strategy.

- Short-term market fluctuations are normal: The bank cautions against reacting to short-term market volatility. High valuations don't automatically equate to an impending crash.

- Potential for long-term gains: Even with current high valuations, BofA suggests the potential for significant long-term gains remains, particularly for investors in well-selected companies with strong fundamentals.

- Diversification mitigates risk: A diversified investment portfolio across various sectors and asset classes is crucial to manage the risks associated with high valuations.

Addressing Potential Risks and Counterarguments

While BofA offers a reassuring message, they also acknowledge the inherent risks of investing in a market with stretched valuations.

Acknowledging Valuation Risks

BofA doesn't dismiss the possibility of a market correction.

- Market corrections are a normal part of market cycles: The bank acknowledges that high valuations do increase the likelihood of a market correction or downturn at some point.

- Rising interest rates impact valuations: A shift towards higher interest rates could negatively impact valuations by increasing the discount rate and making future earnings less valuable in present terms.

BofA's Risk Mitigation Strategies

BofA offers several strategies to help investors mitigate these risks:

- Diversification: Investing across various sectors and asset classes reduces exposure to any single sector's performance.

- Value investing: Focusing on undervalued companies with strong fundamentals can potentially offer better risk-adjusted returns.

- Sector-specific strategies: BofA likely suggests specific sectors or investment approaches based on their analysis – referencing these specific recommendations from their report would be beneficial here.

Key Sectors BofA Recommends

BofA's recommendations are not a blanket endorsement of the entire market; they highlight specific sectors showing strong potential.

High-Growth Sectors

BofA's analysis likely identifies high-growth sectors where the premium valuations are, according to their research, justified by strong fundamentals.

- Technology: (Explain BofA's reasoning for recommending the technology sector).

- Healthcare: (Explain BofA's reasoning for recommending the healthcare sector).

- (Other sectors): (Add other sectors BofA highlights and provide reasoning).

Value Investing Opportunities

Despite the overall market's high valuations, BofA likely identifies specific opportunities in undervalued sectors or individual companies.

- (Example sectors/companies): (Provide examples of undervalued sectors or companies and the reasons BofA cites for their potential).

Conclusion: Don't Panic – Navigating Stretched Stock Market Valuations with BofA's Insights

BofA's analysis suggests that while stretched stock market valuations present inherent risks, a long-term perspective coupled with a focus on strong earnings growth and diversification can help investors navigate these challenges. The bank acknowledges the potential for corrections but emphasizes the importance of considering interest rates and long-term growth prospects. While BofA's insights are valuable, remember to conduct your own thorough research before making any investment decisions. Understanding BofA's perspective on stretched stock market valuations can help you make informed investment decisions. Learn more and develop a robust investment strategy today!

Featured Posts

-

Open Ai Simplifies Voice Assistant Development 2024 Event Highlights

Apr 22, 2025

Open Ai Simplifies Voice Assistant Development 2024 Event Highlights

Apr 22, 2025 -

Judge Rules Against Section 230 Protection For Banned Chemicals On E Bay

Apr 22, 2025

Judge Rules Against Section 230 Protection For Banned Chemicals On E Bay

Apr 22, 2025 -

The Hollywood Strike What It Means For The Film Industry

Apr 22, 2025

The Hollywood Strike What It Means For The Film Industry

Apr 22, 2025 -

Rapid Police Response Insufficient Fsu Security Breach Exacerbates Student Anxiety

Apr 22, 2025

Rapid Police Response Insufficient Fsu Security Breach Exacerbates Student Anxiety

Apr 22, 2025 -

Debate Ensues Fsus Plan To Resume Classes Following Campus Tragedy

Apr 22, 2025

Debate Ensues Fsus Plan To Resume Classes Following Campus Tragedy

Apr 22, 2025