BofA's Take: Why Current Stock Market Valuations Shouldn't Worry You

Table of Contents

Interest Rate Environment and its Impact on Valuations

The current interest rate environment plays a significant role in shaping stock market valuations. Understanding this relationship is crucial to interpreting BofA's optimistic outlook.

The Role of Lower Rates

Historically, lower interest rates have supported higher stock market valuations, even with similar earnings. This is because interest rates directly impact present value calculations.

- Inverse Relationship: Interest rates and present value have an inverse relationship. Lower discount rates (interest rates) inflate the present value of future earnings, leading to higher valuations. A lower discount rate means future cash flows are worth more today.

- Present Value Calculation: The present value of a future cash flow is calculated by discounting it back to today's value using a discount rate (often related to prevailing interest rates). Lower rates lead to higher present values.

- BofA's Perspective: (Note: This section requires specific data from BofA reports. Replace the bracketed information with actual data and citations.) [Insert specific data from BofA reports illustrating the impact of lower interest rates on valuation multiples. For example, "BofA's research indicates that a 1% decrease in interest rates historically correlates with a [X]% increase in the S&P 500's P/E ratio."]

Inflation's Influence

Inflation significantly impacts stock market valuations. While high inflation can initially put pressure on valuations, BofA's analysis considers its long-term effects.

- Inflation Expectations: Market participants factor inflation expectations into their valuations. Higher expected inflation typically leads to higher discount rates, potentially lowering valuations. However, companies can often pass increased costs to consumers, mitigating the impact.

- BofA's Inflation Forecast: (Note: This section requires specific data from BofA reports. Replace the bracketed information with actual data and citations.) [Insert BofA's predictions for inflation and their reasoning. For example, "BofA projects inflation to average [X]% over the next [Y] years, which, coupled with [Z] factors, suggests a [positive/negative/neutral] impact on valuations."]

- Real Returns: Investors focus on real returns (returns adjusted for inflation). Even if nominal returns are high during inflationary periods, real returns might be lower if inflation significantly erodes the value of investment gains. BofA's assessment likely considers this crucial aspect.

Strong Corporate Earnings and Future Growth Prospects

BofA's positive outlook on stock market valuations isn't solely based on interest rates; it's also rooted in strong corporate earnings and promising future growth.

Resilient Corporate Performance

BofA's analysis highlights the resilience of corporate earnings and profitability despite economic headwinds.

- Strong Performing Sectors: [Insert examples of sectors with strong earnings performance according to BofA’s analysis, e.g., "BofA points to the robust performance in the technology and healthcare sectors as key drivers of overall earnings growth."]

- Earnings Growth Data: [Insert data from BofA reports to support claims of robust earnings growth. E.g., "BofA's data shows an [X]% increase in S&P 500 earnings per share over the past year."]

- Future Earnings Forecast: [Insert BofA's forecast for future earnings growth. E.g., "BofA forecasts continued earnings growth of [Y]% annually for the next [Z] years."]

Growth Opportunities in Key Sectors

BofA identifies several sectors poised for significant growth, bolstering their confidence in the market's long-term prospects.

- High-Growth Sectors: [Mention specific sectors and the reasons behind BofA's positive outlook. E.g., "BofA highlights the technology sector's potential driven by AI advancements and the healthcare sector's growth potential fueled by an aging population."]

- Growth Drivers: [Explain the factors contributing to the growth potential. E.g., "BofA's analysis suggests that innovation in renewable energy and the increasing demand for cybersecurity solutions will fuel substantial growth in these areas."]

- BofA's Rationale: [Explain BofA's justification for its bullish outlook on these sectors.]

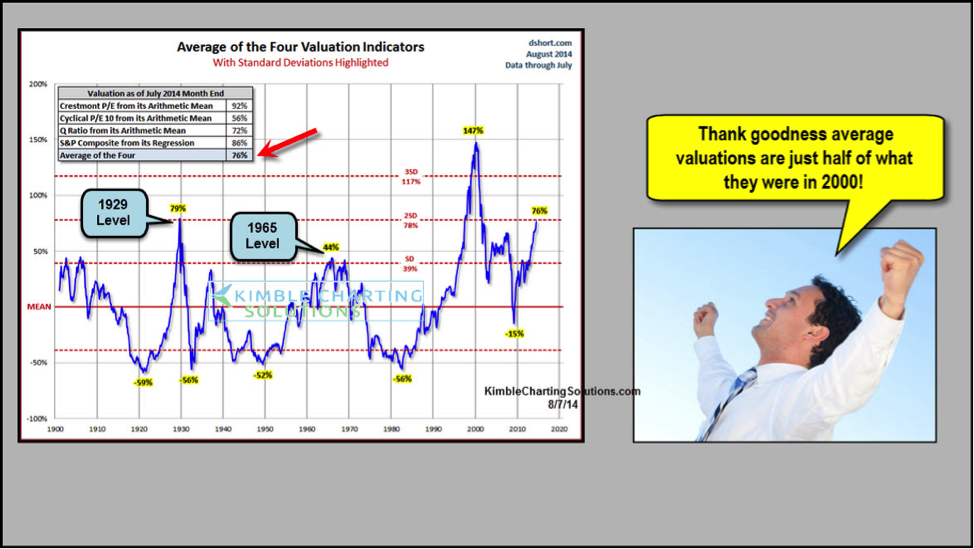

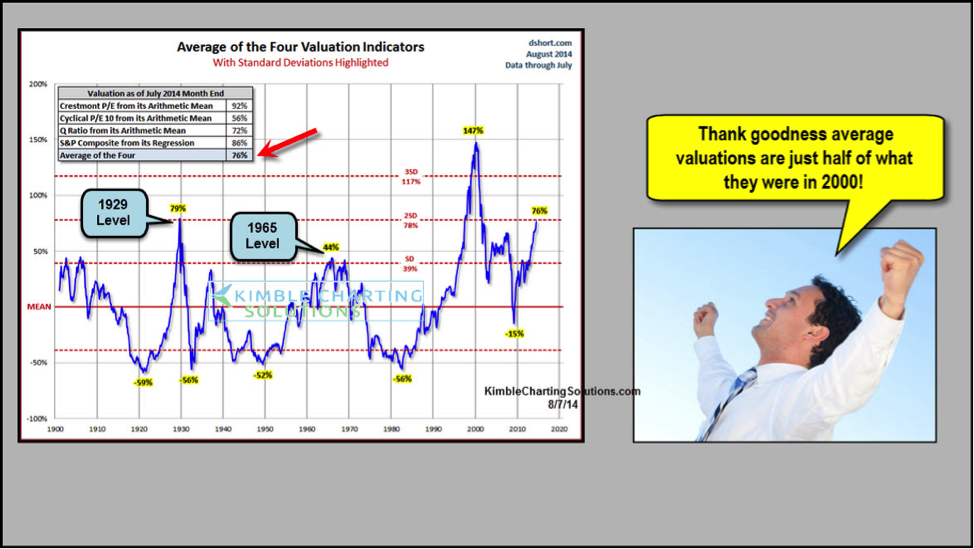

Addressing the "Overvalued" Narrative

Many argue that the market is overvalued. BofA addresses this concern by utilizing a more comprehensive valuation approach.

Alternative Valuation Metrics

BofA doesn't solely rely on the price-to-earnings (P/E) ratio. They employ a range of metrics to provide a more balanced perspective.

- Price-to-Sales (P/S) Ratio: [Explain how BofA uses P/S ratio and provide relevant data.]

- Price-to-Book (P/B) Ratio: [Explain how BofA uses P/B ratio and provide relevant data.]

- Other Metrics: [Mention any other valuation metrics used by BofA and their significance.]

Long-Term Growth Potential vs. Short-Term Volatility

BofA emphasizes the importance of considering long-term growth potential when assessing valuations, rather than focusing solely on short-term market fluctuations.

- Long-Term Investment Strategy: [Highlight BofA's advocacy for long-term investing.]

- Short-Term Volatility: [Explain how BofA accounts for and dismisses short-term market noise in its valuation analysis.]

- Risk Tolerance: [Mention the importance of aligning investment strategies with individual risk tolerance levels.]

Conclusion

BofA's analysis suggests that while current stock market valuations might appear high based on traditional metrics, a more comprehensive assessment considering interest rates, robust corporate earnings, and long-term growth prospects offers a balanced perspective. Don't let short-term market fluctuations based on perceived high stock market valuations deter you from a well-informed investment strategy. Explore BofA's research and resources for a deeper dive into their insights on stock market valuations. Contact a financial advisor to discuss your individual portfolio and how to navigate the current market effectively. Understanding stock market valuations is key to successful investing.

Featured Posts

-

Elon Musk Doge And The Epa A Tesla And Space X Regulatory Battle

Apr 24, 2025

Elon Musk Doge And The Epa A Tesla And Space X Regulatory Battle

Apr 24, 2025 -

Cybercriminal Accused Of Multi Million Dollar Office365 Executive Account Breach

Apr 24, 2025

Cybercriminal Accused Of Multi Million Dollar Office365 Executive Account Breach

Apr 24, 2025 -

The Bold And The Beautiful April 16 Recap Hopes Worry Over Liam And Bridgets Shocking Find

Apr 24, 2025

The Bold And The Beautiful April 16 Recap Hopes Worry Over Liam And Bridgets Shocking Find

Apr 24, 2025 -

Navigating The Chinese Market The Case Of Bmw And Porsche

Apr 24, 2025

Navigating The Chinese Market The Case Of Bmw And Porsche

Apr 24, 2025 -

Court Challenges Slow Trumps Immigration Enforcement Efforts

Apr 24, 2025

Court Challenges Slow Trumps Immigration Enforcement Efforts

Apr 24, 2025