Broadcom's VMware Deal: An Extreme Price Hike Concerns AT&T

Table of Contents

The Deal's Impact on VMware Pricing

The primary concern stemming from the Broadcom VMware acquisition centers around the potential for significant price increases for VMware's virtualization software. Broadcom, known for its aggressive cost-cutting strategies, could implement substantial price hikes to boost profitability. This could have far-reaching consequences, impacting not only AT&T but also countless other businesses reliant on VMware technologies.

- Increased prices for VMware's virtualization software: Expect to see increases across the board, impacting everything from vSphere licensing to cloud management solutions.

- Potential reduction in research and development for VMware products: Prioritizing cost-cutting over innovation could lead to slower product development and fewer feature updates.

- Concerns about reduced customer support and responsiveness: Cost-cutting measures might translate to reduced customer support staff and longer response times for technical issues.

- Impact on VMware's competitive landscape: Increased pricing could make VMware less competitive, potentially driving customers to explore alternative virtualization solutions.

AT&T's Dependence on VMware and Potential Financial Strain

AT&T heavily relies on VMware technologies for its vast network infrastructure. The company uses VMware's virtualization platform for various critical operations, including server consolidation, cloud management, and network virtualization. Therefore, any substantial increase in VMware licensing fees will directly translate to increased operating costs for AT&T.

- Specific VMware products used by AT&T: This likely includes vSphere, vSAN, NSX, and potentially cloud-based VMware solutions.

- Estimated cost increases for AT&T: While precise figures are unavailable, the potential cost increase could run into millions, even billions, of dollars annually depending on the magnitude of the price hikes.

- Potential alternatives to VMware's products: AT&T might explore alternatives like Microsoft Azure Stack HCI, Red Hat Virtualization, or other open-source virtualization solutions to mitigate the impact of higher VMware costs.

- AT&T's potential lobbying efforts or legal challenges: AT&T may engage in lobbying efforts to influence the regulatory review process or even consider legal challenges if it deems the price increases unfair or anti-competitive.

Regulatory Scrutiny and Antitrust Concerns

The Broadcom-VMware merger is currently under intense regulatory scrutiny from various antitrust authorities globally. Concerns exist about the potential for Broadcom to leverage its newly acquired power to stifle competition and raise prices across the virtualization market. The outcome of these investigations will significantly influence VMware's pricing strategy and ultimately impact AT&T.

- Key regulatory bodies involved in the review process: This includes the U.S. Federal Trade Commission (FTC), the Department of Justice (DOJ), and similar regulatory bodies in other countries.

- Potential antitrust concerns raised by competitors and consumer groups: Competitors are likely to raise concerns about reduced competition and potential monopolistic practices, while consumer groups will focus on the impact on pricing.

- Possible outcomes of the regulatory review: Possible outcomes range from full approval with no conditions to approval with stipulations, or even outright rejection of the merger.

- Impact of any imposed conditions on VMware's pricing strategy: Any imposed conditions, such as restrictions on pricing or conduct, could potentially mitigate the anticipated price hikes.

Conclusion

The Broadcom VMware acquisition presents significant challenges, particularly concerning potential price increases for VMware products. AT&T, a heavy user of VMware technology, stands to experience a substantial financial strain if these concerns materialize. The ongoing regulatory review will play a crucial role in determining the final outcome. It's imperative to stay informed about the ongoing developments in the Broadcom VMware acquisition and its potential effects on telecommunications pricing. Continue following this issue to understand the implications of the Broadcom VMware deal for businesses relying on VMware technology.

Featured Posts

-

Get Professional Help Ariana Grandes Transformation And Its Implications

Apr 27, 2025

Get Professional Help Ariana Grandes Transformation And Its Implications

Apr 27, 2025 -

Further Ecb Rate Cuts On The Horizon Simkus Highlights Trade Risks

Apr 27, 2025

Further Ecb Rate Cuts On The Horizon Simkus Highlights Trade Risks

Apr 27, 2025 -

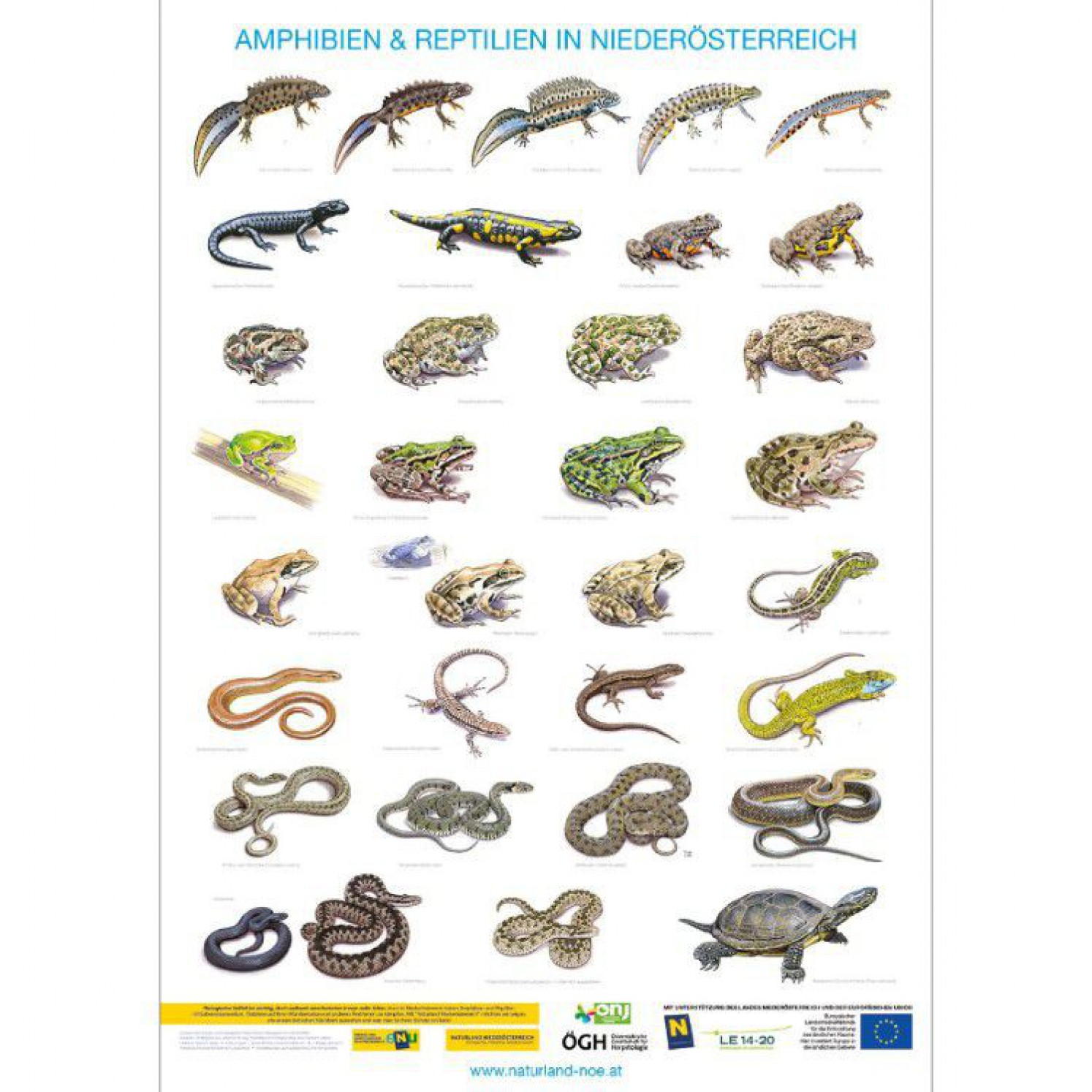

Amphibien Und Reptilien In Thueringen Der Vollstaendige Atlas

Apr 27, 2025

Amphibien Und Reptilien In Thueringen Der Vollstaendige Atlas

Apr 27, 2025 -

The Crucial Role Of Middle Managers In Business And Employee Development

Apr 27, 2025

The Crucial Role Of Middle Managers In Business And Employee Development

Apr 27, 2025 -

Werner Herzogs Next Film Bucking Fastard Casts Real Life Sisters

Apr 27, 2025

Werner Herzogs Next Film Bucking Fastard Casts Real Life Sisters

Apr 27, 2025