Bundestag Elections And The Dax: Analyzing The Correlation

Table of Contents

Historical Performance of the DAX Around Bundestag Elections

Pre-Election Volatility

The months leading up to Bundestag elections often witness increased volatility in the DAX. This heightened uncertainty stems from several factors, including pre-election polling data, the policy platforms of competing parties, and the inherent unpredictability of election outcomes. The closer the election, the more pronounced this volatility tends to be. Investors react to shifting poll numbers and the potential implications of different governing coalitions.

- 2017 Bundestag Election: The lead-up to the 2017 election saw a period of moderate volatility as the outcome remained uncertain until the final days of the campaign. Concerns regarding the potential strength of the AfD (Alternative for Germany) party contributed to market nervousness.

- 2021 Bundestag Election: Similar to 2017, the 2021 election cycle saw increased volatility, driven by uncertainty regarding the formation of a new coalition government following a fragmented election result. The prolonged coalition negotiations added to market uncertainty.

[Insert chart/graph visualizing DAX volatility in the months leading up to the 2017 and 2021 elections]

Post-Election Market Reactions

The DAX's response to election results is often immediate, though the magnitude and direction of the reaction vary depending on several factors. A decisive victory for a party with a clear mandate often leads to a positive market response, reflecting investor confidence in the government's ability to implement its policies. However, close elections leading to protracted coalition negotiations, or the formation of unstable coalitions, may result in continued uncertainty and market volatility.

- 2013 Bundestag Election: The clear victory of Angela Merkel's CDU/CSU led to a relatively positive market response, reflecting investor confidence in her leadership and continued economic stability.

- 2017 Bundestag Election: The formation of a "grand coalition" between the CDU/CSU and the SPD (Social Democratic Party) initially stabilized the market, though the prolonged negotiations caused some uncertainty.

[Insert chart/graph visualizing DAX performance in the weeks and months following the 2013 and 2017 elections]

Factors Influencing the DAX's Response to Bundestag Elections

Policy Expectations and Uncertainty

Investor sentiment is heavily influenced by the policy platforms of the competing parties. Potential changes in fiscal policy, tax rates, environmental regulations, and social welfare programs can significantly affect specific sectors of the German economy. For example, changes to automotive regulations or incentives for renewable energy can have a considerable impact on related companies listed on the DAX.

- Automotive Industry: Policies related to emission standards and the transition to electric vehicles have a direct impact on the performance of automotive giants listed on the DAX.

- Renewable Energy Sector: Government support for renewable energy sources directly influences the performance of companies in this sector.

Coalition Government Formation and Stability

The formation of a stable coalition government is crucial for investor confidence. Protracted negotiations or the formation of a minority government can lead to uncertainty and market volatility. The stability and predictability of the governing coalition directly impact investor confidence in the long-term economic outlook.

- Coalition Negotiations: Lengthy coalition talks can create uncertainty and negatively impact investor confidence, leading to increased volatility in the DAX.

- Minority Governments: Minority governments often lack the stability to implement ambitious policy agendas, creating uncertainty for investors.

Global Economic Context

The global economic climate plays a significant role in influencing the DAX's response to Bundestag elections. Global economic downturns, trade wars, or geopolitical instability can overshadow domestic political events, impacting investor sentiment regardless of election outcomes. The German economy is highly integrated into the global economy, making it vulnerable to international shocks.

- Global Trade Wars: Trade disputes can negatively impact the German export sector, influencing the DAX's performance irrespective of the election results.

- Global Recessions: A global economic downturn will likely outweigh the impact of any domestic political changes on the DAX.

Conclusion

Historically, Bundestag elections have demonstrably influenced the DAX, primarily through the impact of policy uncertainty, coalition stability, and the global economic context. Pre-election volatility often increases as investors react to shifting poll numbers and differing party platforms. Post-election market reactions depend heavily on the clarity of the election results and the speed and stability of coalition formation. Understanding the correlation between Bundestag elections and the DAX is crucial for informed investment strategies.

Call to Action: Stay informed about upcoming Bundestag elections and their potential market effects. Monitor the DAX closely in the lead-up to and following the next Bundestag election to understand the impact of political developments on your investments. Utilize reputable financial news sources and market analysis tools to track market performance and political news effectively.

Featured Posts

-

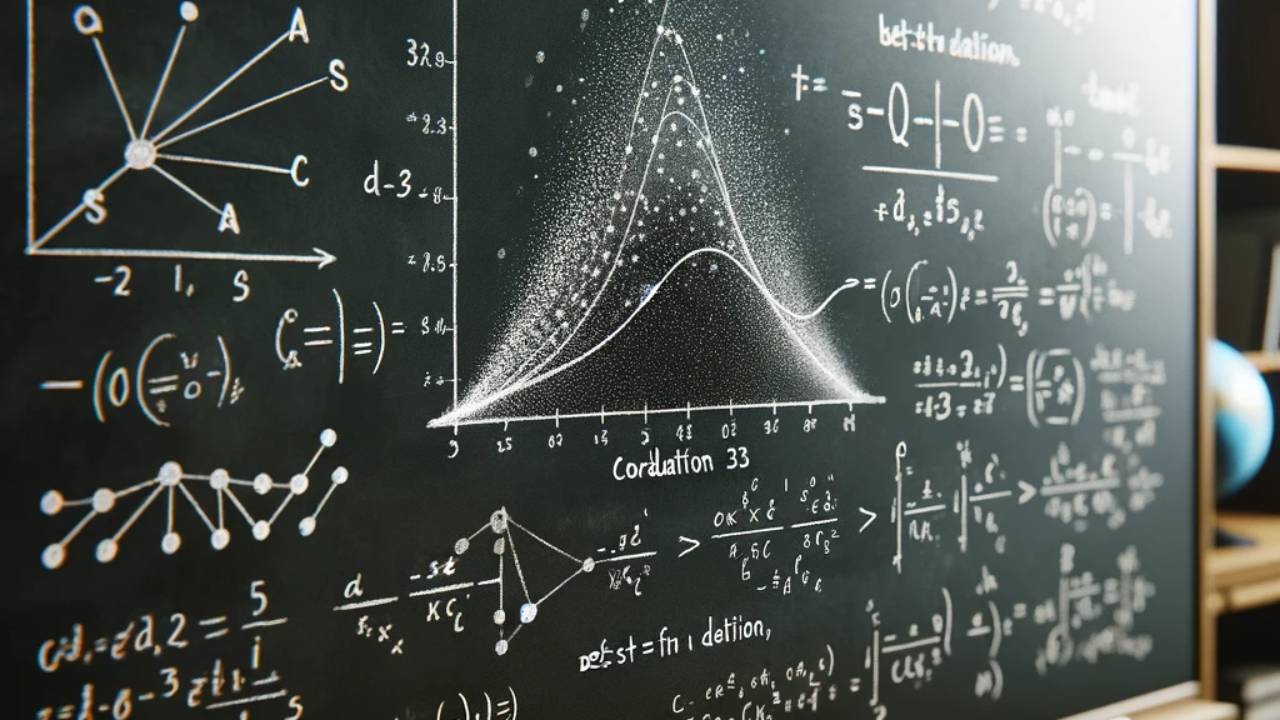

Canadians Ev Interest Dips For Third Consecutive Year

Apr 27, 2025

Canadians Ev Interest Dips For Third Consecutive Year

Apr 27, 2025 -

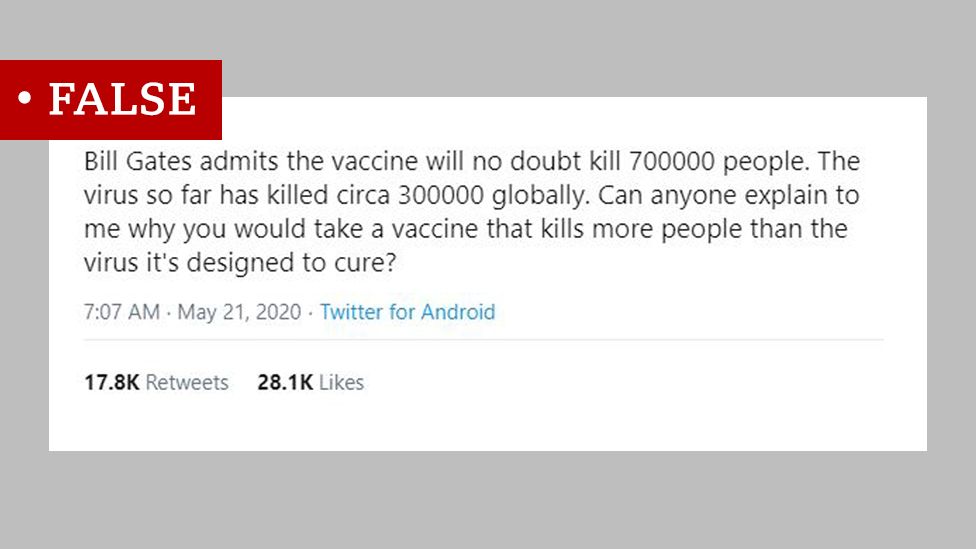

Controversial Hhs Decision Anti Vaccine Expert To Examine Debunked Autism Vaccine Claims

Apr 27, 2025

Controversial Hhs Decision Anti Vaccine Expert To Examine Debunked Autism Vaccine Claims

Apr 27, 2025 -

Cybercriminal Made Millions Targeting Executive Office365 Accounts Fbi Investigation

Apr 27, 2025

Cybercriminal Made Millions Targeting Executive Office365 Accounts Fbi Investigation

Apr 27, 2025 -

The Psychology Behind Ariana Grandes Hair And Tattoo Choices A Look At Professional Help

Apr 27, 2025

The Psychology Behind Ariana Grandes Hair And Tattoo Choices A Look At Professional Help

Apr 27, 2025 -

David Geier Vaccine Skeptic Joins Hhs To Analyze Vaccine Studies

Apr 27, 2025

David Geier Vaccine Skeptic Joins Hhs To Analyze Vaccine Studies

Apr 27, 2025