Cantor's $3 Billion Crypto SPAC Deal: Tether And SoftBank Involvement

Table of Contents

Cantor Fitzgerald's Strategic Move into Crypto

Understanding SPACs and their role in the Crypto Market

SPACs, or Special Purpose Acquisition Companies, are shell corporations listed on a stock exchange with the sole purpose of merging with a private company, typically taking it public. This process offers a quicker and potentially less burdensome alternative to a traditional initial public offering (IPO). SPACs have gained immense popularity in the crypto space, providing a streamlined pathway for innovative crypto companies to access capital and achieve a public listing. Successful examples include (insert examples of successful crypto SPACs here, e.g., "the merger of [Company A] and [SPAC B]").

- Definition of SPAC: A publicly traded company with no business operations, formed to raise capital for acquiring a private company.

- Advantages for Crypto Companies: Faster access to capital, reduced regulatory hurdles compared to a traditional IPO, increased visibility and legitimacy.

- Risks Involved: Dilution of existing shareholder equity, potential for conflicts of interest, and dependence on the SPAC’s management team.

- Recent Trends: A surge in crypto SPACs in recent years, reflecting increasing institutional interest in the cryptocurrency market.

Cantor Fitzgerald's Background and its Acquisition Strategy

Cantor Fitzgerald, a well-established global financial services firm with a strong history in trading, investment banking, and capital markets, has demonstrated a strategic shift towards the burgeoning cryptocurrency industry with this significant investment. Their rationale likely stems from a belief in the long-term potential of cryptocurrencies and blockchain technology. This move positions them at the forefront of this disruptive financial revolution.

- Cantor Fitzgerald’s previous investments: (Insert details of Cantor Fitzgerald’s past investments, showcasing their experience and diversification).

- Strategic goals: Diversification into high-growth sectors, capturing market share in the rapidly expanding crypto market, and positioning for future technological advancements.

- Market analysis driving this decision: A thorough assessment of the crypto market's potential for growth and its increasing integration into the mainstream financial system.

The Role of Tether and SoftBank in the Deal

Tether's Involvement and its Impact

Tether, the world's largest stablecoin, plays a crucial role in this deal. Its involvement provides a level of stability and potentially enhanced liquidity within the transaction. However, it's important to acknowledge the ongoing controversies surrounding Tether's reserves and its relationship with the wider crypto market. Its participation could also attract further scrutiny on its operations and transparency.

- Tether’s market capitalization: (Insert current market cap data).

- Its role as a stablecoin: Providing a relatively stable price point within the volatile crypto market.

- Potential benefits and risks of Tether’s participation: Increased legitimacy for the acquired company, improved accessibility for investors, but also potential for increased regulatory scrutiny and reputational risk.

SoftBank's Investment and Future Outlook

SoftBank, a prominent Japanese multinational conglomerate with a history of significant investments in technology and innovation, further strengthens this crypto SPAC deal. Their involvement signals a growing confidence in the long-term growth potential of the cryptocurrency sector from a major global player. SoftBank's vast network and resources can potentially accelerate the acquired company's expansion and market penetration.

- SoftBank's previous investments in crypto: (Insert details of SoftBank's previous investments in the crypto space).

- Its investment thesis: Likely driven by a long-term view of the potential for blockchain technology to transform various industries.

- Analysis of the potential returns: SoftBank anticipates significant returns based on the expected growth trajectory of the crypto market.

Market Implications and Future Predictions

Impact on the Cryptocurrency Market

Cantor Fitzgerald's $3 billion crypto SPAC deal is expected to have far-reaching consequences for the cryptocurrency market. It represents a significant step towards increased institutional adoption, potentially boosting market capitalization and attracting further investment. However, it may also trigger price volatility and increased regulatory scrutiny.

- Increased institutional adoption: Encourages other institutional investors to enter the crypto market.

- Potential price surges or corrections: The deal might initially trigger price increases, followed by potential corrections depending on market sentiment and regulatory developments.

- Effects on other crypto projects: Could inspire similar deals and drive further innovation within the crypto ecosystem.

Regulatory Scrutiny and Potential Challenges

The deal will undoubtedly face regulatory scrutiny, particularly given the involvement of Tether. Navigating regulatory hurdles will be crucial for the success of this venture. The future regulatory landscape for crypto SPACs will significantly impact similar future ventures.

- Regulatory compliance issues: Ensuring compliance with various jurisdictions' regulations regarding cryptocurrencies and securities laws.

- Potential investigations: Scrutiny from regulatory bodies regarding the deal's structure and the involvement of key players.

- Future regulatory landscape for crypto SPACs: The deal could influence the development and implementation of specific regulations targeting crypto SPACs.

Conclusion

Cantor Fitzgerald's $3 billion crypto SPAC deal, facilitated by the involvement of Tether and SoftBank, represents a pivotal moment in the cryptocurrency market's evolution. The deal signifies increased institutional adoption, potential for significant market growth, and the ongoing challenges of navigating a complex regulatory landscape. The long-term impact remains to be seen, but it undoubtedly marks a major shift in the industry.

The Cantor Fitzgerald deal marks a significant milestone in the evolution of the crypto industry. Stay informed about the latest developments in crypto SPACs and the evolving world of cryptocurrency investment by following our updates. Learn more about the intricacies of Cantor Fitzgerald’s strategic moves and the impact of major players like Tether and SoftBank in shaping the future of financial technology.

Featured Posts

-

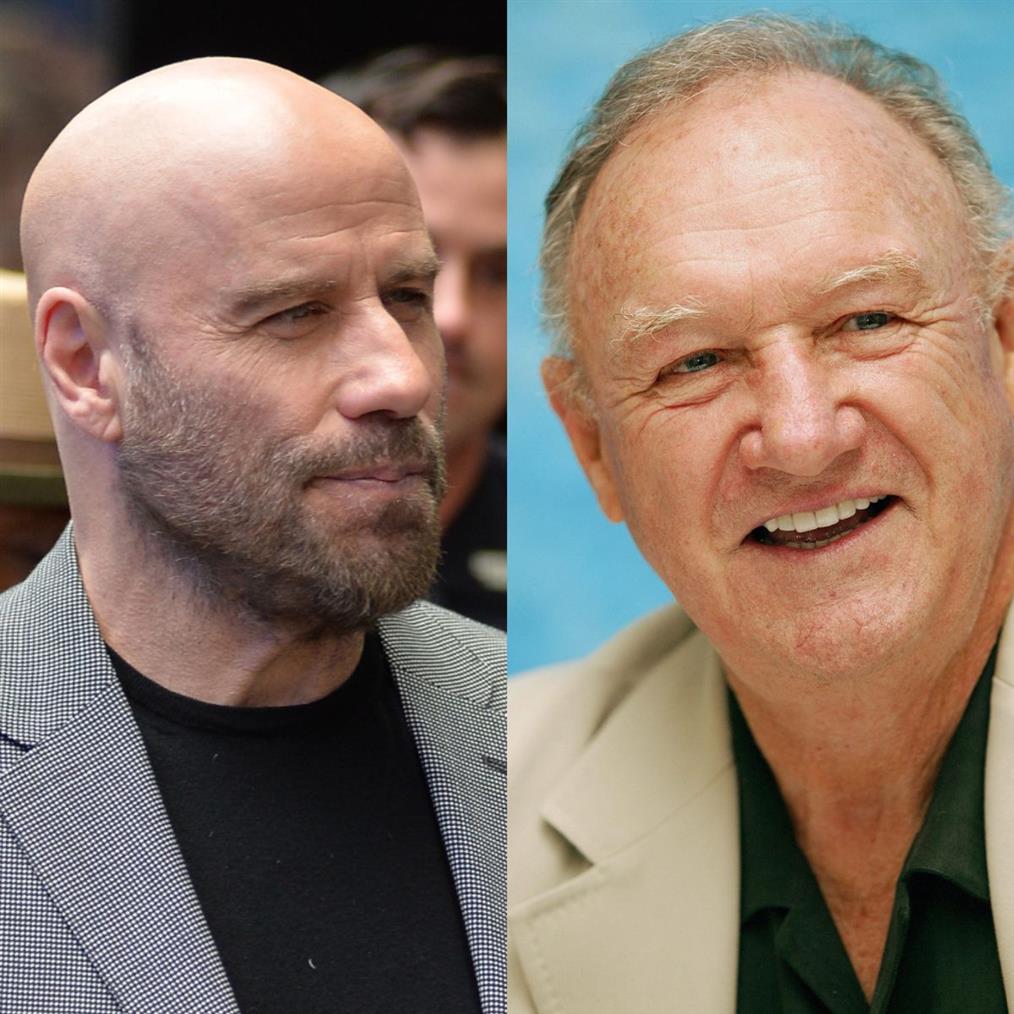

I Sygkinitiki Anartisi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025

I Sygkinitiki Anartisi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025 -

Court Challenges Slow Trumps Immigration Enforcement Efforts

Apr 24, 2025

Court Challenges Slow Trumps Immigration Enforcement Efforts

Apr 24, 2025 -

Emerging Market Stocks Outperform Us Equities In 2023

Apr 24, 2025

Emerging Market Stocks Outperform Us Equities In 2023

Apr 24, 2025 -

Canadian Dollar Performance Mixed Signals Amidst Global Market Volatility

Apr 24, 2025

Canadian Dollar Performance Mixed Signals Amidst Global Market Volatility

Apr 24, 2025 -

Ryujinx Emulators End A Report On Nintendos Involvement

Apr 24, 2025

Ryujinx Emulators End A Report On Nintendos Involvement

Apr 24, 2025