Emerging Market Stocks Outperform US Equities In 2023

Table of Contents

Economic Factors Fueling Emerging Market Growth

Several key economic factors have contributed to the robust performance of emerging market stocks in 2023, creating a favorable environment for investment.

Stronger GDP Growth in Emerging Markets

Many emerging economies are projected to experience significantly higher GDP growth rates in 2023 compared to the US. This robust growth is a primary driver of the outperformance of emerging market stocks.

- India: Projected GDP growth of [Insert Projected GDP Growth Rate]% (Source: IMF)

- China: Projected GDP growth of [Insert Projected GDP Growth Rate]% (Source: World Bank)

- Indonesia: Projected GDP growth of [Insert Projected GDP Growth Rate]% (Source: IMF)

These strong growth forecasts reflect the dynamism and resilience of these emerging economies. The data clearly indicates a significant disparity between the growth trajectories of these emerging markets and the comparatively slower growth predicted for the US economy.

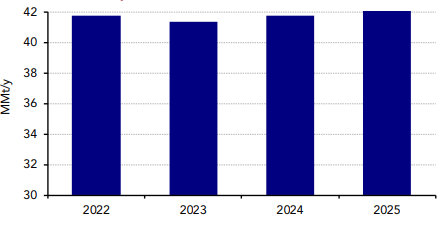

Commodity Price Increases Benefiting Emerging Economies

The rise in prices of key commodities like oil, metals, and agricultural products has significantly benefited export-oriented emerging markets. Many emerging economies are major producers and exporters of these commodities, leading to increased revenue and economic activity.

- Oil: The price of Brent crude oil has [Insert Price Movement and Percentage Change] (Source: [Reliable Data Source, e.g., Bloomberg]) positively impacting oil-exporting nations.

- Metals: Increased demand for metals like copper and iron ore has boosted the economies of countries like [Example Countries]. (Source: [Reliable Data Source])

[Include a chart or graph illustrating commodity price trends over the relevant period.] This demonstrates a direct correlation between commodity price increases and the improved performance of related emerging market economies.

Resilience to Global Economic Slowdown

While the global economy faced headwinds in 2023, some emerging markets showed surprising resilience. This is attributable to factors like:

- Less reliance on global trade compared to developed nations.

- Strong domestic demand fueled by growing middle classes.

- Government initiatives promoting economic diversification.

However, it is crucial to note that not all emerging markets are created equal. Some remain vulnerable to external shocks and internal challenges. [Mention specific examples and counterarguments, providing balanced perspective].

Investment Opportunities in Emerging Markets

The superior performance of emerging market stocks in 2023 highlights several compelling investment opportunities for discerning investors.

Attractive Valuation of Emerging Market Stocks

Many analysts believe that emerging market stocks are currently more attractively valued compared to their US counterparts. This presents a potential for higher returns.

- Lower Price-to-Earnings (P/E) ratios are observed in several emerging markets compared to the US. (Source: [Reliable Financial Data Source])

- This suggests that investors may be getting more value for their money in emerging markets.

Understanding these valuation metrics is critical for informed investment decisions within the emerging market landscape.

Sector-Specific Opportunities

Several sectors within emerging markets offer significant growth potential:

- Technology: The rapid adoption of technology in many emerging markets presents numerous opportunities.

- Infrastructure: Massive infrastructure development projects in many countries present lucrative investment prospects.

- Renewable Energy: The transition to renewable energy sources is creating a booming sector in several emerging markets.

[Provide specific examples of companies within these sectors that are demonstrating strong performance]. Focusing on these high-growth sectors can significantly enhance investment returns within emerging markets.

Diversification Benefits

Investing in emerging markets provides significant portfolio diversification, reducing overall risk.

- Emerging market stocks often exhibit low correlation with US stock markets.

- This diversification can help to mitigate losses during market downturns.

However, it’s important to acknowledge the inherent risks involved in emerging market investments.

Risks and Considerations for Investing in Emerging Markets

While the potential rewards are significant, investing in emerging markets also presents certain risks that investors should carefully consider.

Geopolitical Risks

Geopolitical instability, trade wars, and political uncertainties can significantly impact emerging market investments.

- [Provide specific examples of geopolitical risks and their potential consequences].

- Thorough due diligence and a long-term investment horizon are crucial for navigating geopolitical uncertainties.

Currency Volatility

Fluctuations in exchange rates can significantly impact returns from emerging market investments.

- [Explain strategies to mitigate currency risk, such as hedging].

- Understanding currency risk is essential for effective risk management.

Regulatory and Governance Issues

Regulatory frameworks and corporate governance standards can vary significantly across emerging markets.

- [Discuss the importance of due diligence and selecting reputable investment vehicles].

- Thorough research and a cautious approach are crucial for mitigating these risks.

Conclusion: Investing in Emerging Markets for Superior Returns

The outperformance of emerging market stocks over US equities in 2023 highlights the significant potential for higher returns and portfolio diversification. Stronger GDP growth, commodity price increases, and resilience to global slowdowns have contributed to this trend. While geopolitical risks, currency volatility, and regulatory issues exist, careful due diligence and a well-diversified approach can mitigate these concerns. Explore the opportunities in emerging markets and learn more about investing in emerging market stocks that outperform US equities. Start diversifying your portfolio with high-growth emerging market stocks today to potentially unlock superior returns.

Featured Posts

-

Behind The Scenes The Work And Lives Of Chalet Girls In European Ski Destinations

Apr 24, 2025

Behind The Scenes The Work And Lives Of Chalet Girls In European Ski Destinations

Apr 24, 2025 -

Activision Blizzard Acquisition Ftcs Appeal And The Road Ahead

Apr 24, 2025

Activision Blizzard Acquisition Ftcs Appeal And The Road Ahead

Apr 24, 2025 -

Sophie Nyweide Child Actor In Mammoth And Noah Dies At 24

Apr 24, 2025

Sophie Nyweide Child Actor In Mammoth And Noah Dies At 24

Apr 24, 2025 -

Independence Concerns Prompt 60 Minutes Executive Producers Exit

Apr 24, 2025

Independence Concerns Prompt 60 Minutes Executive Producers Exit

Apr 24, 2025 -

Chinas Lpg Market A Shift Eastward Due To Us Trade Policies

Apr 24, 2025

Chinas Lpg Market A Shift Eastward Due To Us Trade Policies

Apr 24, 2025