China's Tariff Exemptions: Impact On US Goods

Table of Contents

The History and Evolution of China's Tariff Exemptions for US Goods

The relationship between the US and China has been marked by periods of cooperation and intense trade disputes, significantly shaping the evolution of tariff policies. The imposition and subsequent lifting or modification of tariffs on US goods reflect the ongoing negotiations and agreements between the two economic giants. China's process for granting tariff exemptions is often complex and opaque, involving various government agencies and bureaucratic procedures.

- Key dates and events impacting US-China trade tariffs: The 2018 trade war, the "Phase One" trade deal, and subsequent negotiations have all led to significant shifts in tariff policies and exemption processes.

- Types of goods previously exempted (examples): Certain agricultural products, some technology components, and specific manufactured goods have historically been granted exemptions. The specifics vary widely based on evolving political and economic priorities.

- Changes in exemption criteria over time: Initially, exemptions might have focused on mitigating immediate economic hardship. More recently, exemptions have potentially been linked to broader strategic trade goals and negotiations.

Identifying Eligible US Goods for Tariff Exemptions

Determining eligibility for China's tariff exemptions requires careful attention to detail. China employs specific criteria to evaluate applications, often considering factors like product origin, economic impact, and national interests. The application process is rigorous and requires meticulous documentation.

- Specific product categories often considered for exemptions: While the exact criteria are not always publicly transparent, certain product categories may be more likely to receive consideration, depending on China's current economic and political priorities.

- Necessary documentation (e.g., certificates of origin): Applicants must provide comprehensive documentation, including certificates of origin, proof of manufacturing processes, and other relevant paperwork demonstrating compliance with Chinese regulations.

- The role of customs brokers in the application process: Engaging experienced customs brokers familiar with Chinese regulations and procedures is crucial for navigating the complexities of the application process and increasing the likelihood of a successful outcome.

The Economic Impact of China's Tariff Exemptions on US Businesses

China's tariff exemptions exert a profound influence on US businesses. The availability of exemptions can significantly impact export volumes, market share, and overall profitability for US companies operating in the Chinese market.

- Case studies illustrating the impact on specific US industries: Analysis of specific industries, like agriculture or technology, can showcase how tariff exemptions have affected export growth and competitiveness within the Chinese market.

- Statistical data on export growth (or decline) related to exemptions: Data on export values and volumes can directly correlate the impact of tariff exemptions on the success of US companies in China.

- Analysis of price changes for exempted goods in the Chinese market: Examining price fluctuations for exempted goods provides insights into the effectiveness of the exemptions in improving market access and affordability for US products.

Future Outlook and Predictions for China's Tariff Policies Affecting US Goods

Predicting future trends in China's tariff policies is inherently challenging. However, analyzing current geopolitical factors and economic strategies offers some insights into potential future changes.

- Potential scenarios for future tariff adjustments: Possible scenarios include further liberalization, targeted adjustments based on specific trade negotiations, or increased protectionist measures depending on the broader geopolitical landscape.

- Recommendations for US businesses to mitigate tariff risks: Proactive strategies include diversification of export markets, exploration of alternative supply chains, and close monitoring of Chinese regulatory changes.

- Importance of proactive trade policy monitoring: Continuous monitoring of changes in Chinese trade policies and regulations is crucial for US businesses to adapt their strategies and remain competitive in the Chinese market.

Conclusion: Understanding and Leveraging China's Tariff Exemptions for US Business Success

China's tariff exemptions play a vital role in shaping the economic relationship between the US and China. Understanding their complexities and nuances is essential for US businesses seeking to thrive in the Chinese market. Staying informed about evolving tariff policies, engaging experienced professionals, and actively managing potential risks are crucial for success. Stay informed about changes to China's Tariff Exemptions and optimize your business strategy for success in the Chinese market.

Featured Posts

-

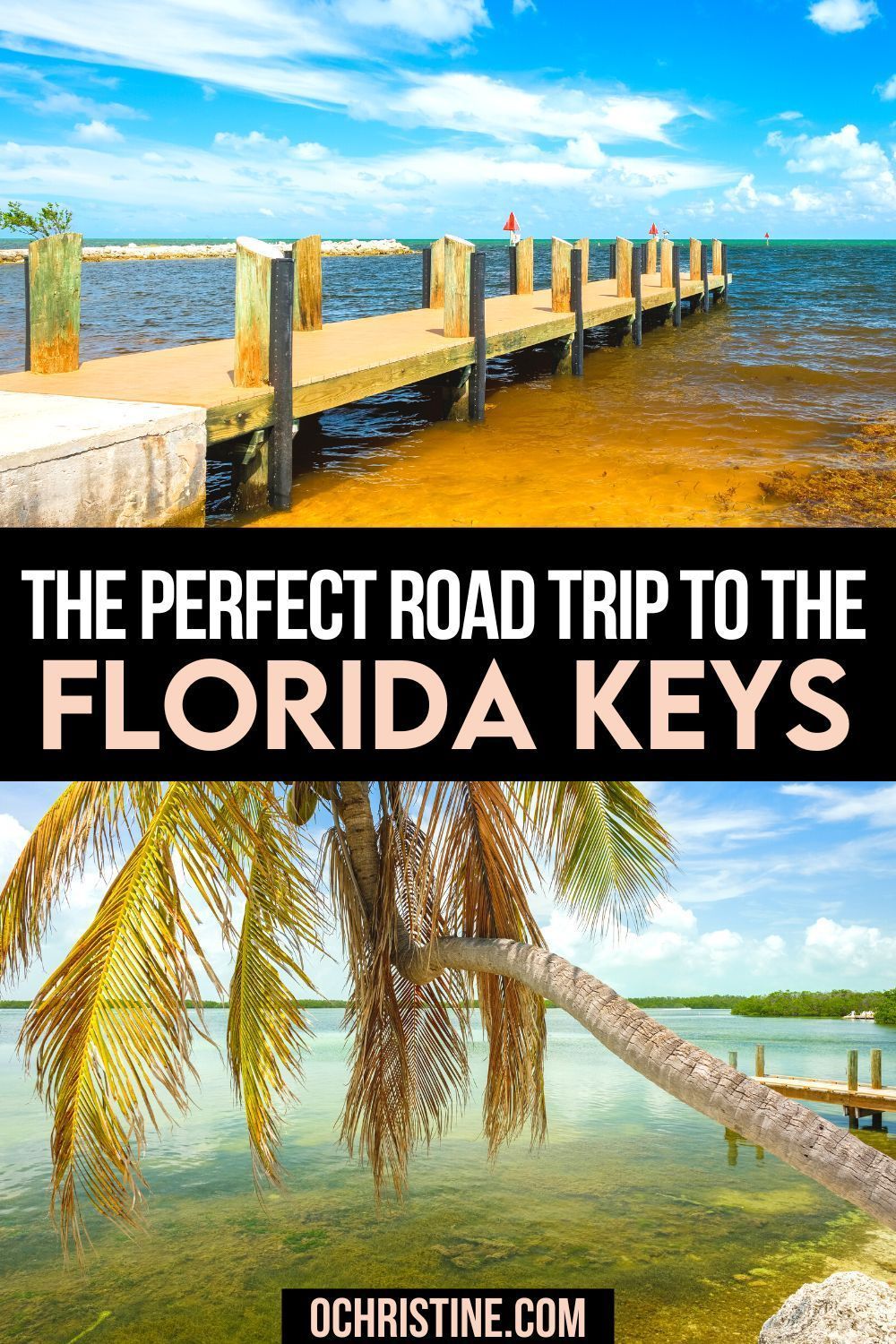

Florida Keys Road Trip From Railroad To Highway

Apr 28, 2025

Florida Keys Road Trip From Railroad To Highway

Apr 28, 2025 -

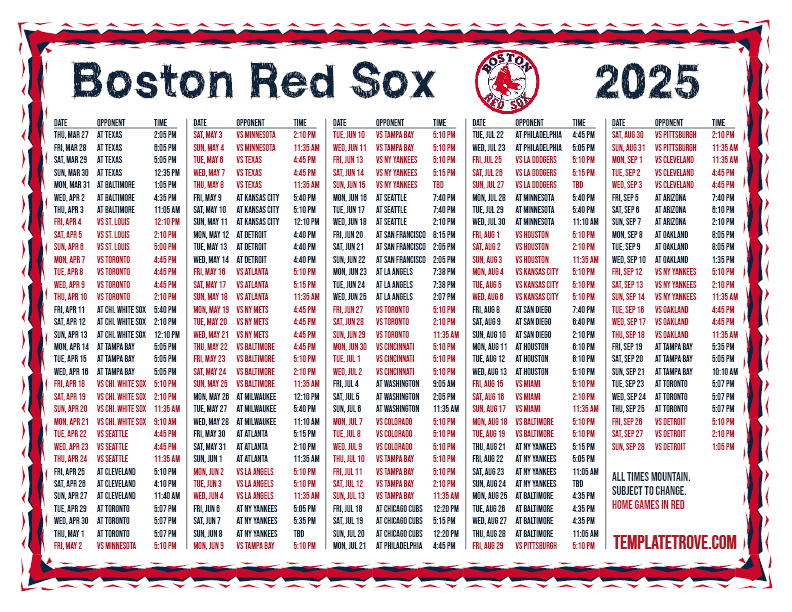

Red Sox 2025 Season A Bold Prediction From Espn

Apr 28, 2025

Red Sox 2025 Season A Bold Prediction From Espn

Apr 28, 2025 -

January 6th Hearing Witness Cassidy Hutchinson To Publish Memoir

Apr 28, 2025

January 6th Hearing Witness Cassidy Hutchinson To Publish Memoir

Apr 28, 2025 -

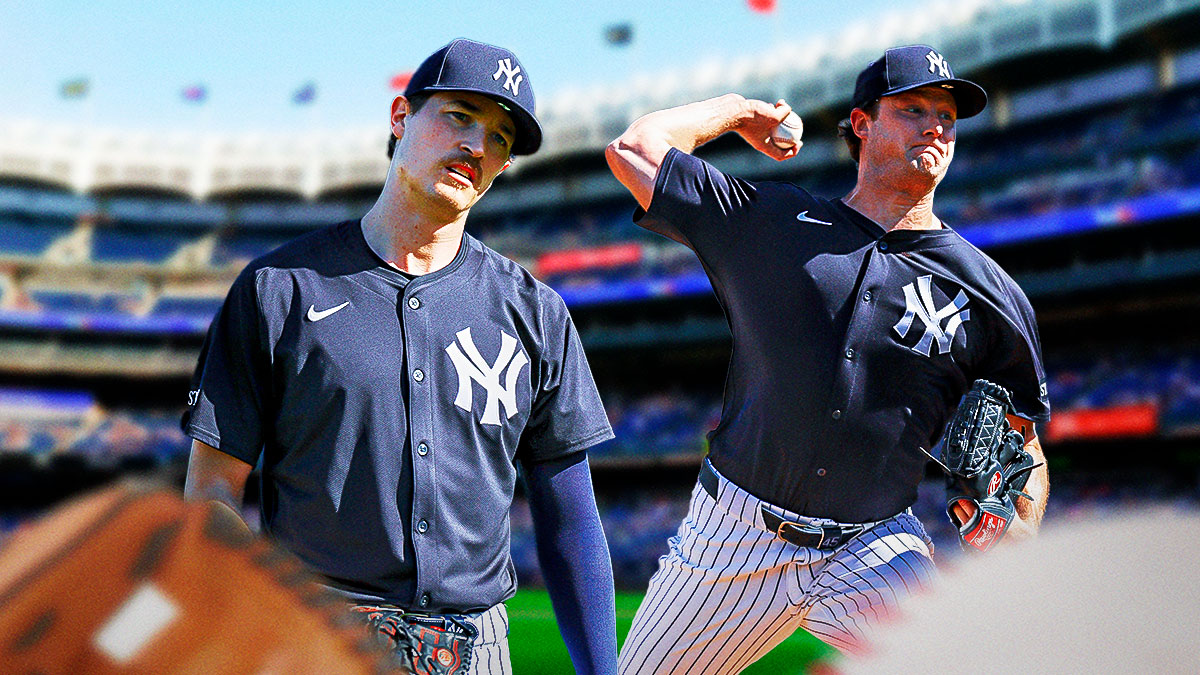

12 3 Win For Yankees Max Frieds Debut And Offensive Explosion

Apr 28, 2025

12 3 Win For Yankees Max Frieds Debut And Offensive Explosion

Apr 28, 2025 -

State And Local Government Jobs A Realistic Look For Laid Off Federal Workers

Apr 28, 2025

State And Local Government Jobs A Realistic Look For Laid Off Federal Workers

Apr 28, 2025