Colgate (CL): Impact Of $200 Million Tariff Increase On Q[Quarter Number] Results

![Colgate (CL): Impact Of $200 Million Tariff Increase On Q[Quarter Number] Results Colgate (CL): Impact Of $200 Million Tariff Increase On Q[Quarter Number] Results](https://emilnoldeinberlin.de/image/colgate-cl-impact-of-200-million-tariff-increase-on-q-quarter-number-results.jpeg)

Table of Contents

Main Points:

2.1. Direct Impact on Colgate's Q3 Revenue and Profitability:

H3: Revenue Decline:

The $200 million tariff increase directly contributed to a noticeable revenue decline in Colgate's Q3 2023 report. While the exact figures require referencing Colgate's official financial statements, we can expect a substantial decrease. This impact likely varied across product categories. For instance, the impact might be more pronounced on products with a higher import component, potentially affecting oral care products more significantly than certain personal care items, depending on their manufacturing and sourcing locations.

- Data Analysis: A detailed analysis of Colgate's Q3 financial report is needed to determine the precise revenue reduction attributable to tariffs. This requires comparing Q3 2023 revenue with Q3 2022 and adjusting for other factors influencing revenue.

- Visual Representation: Charts and graphs illustrating the revenue decline by product category would provide a clear visual representation of the tariff's impact.

H3: Margin Squeeze:

The tariff increase significantly squeezed Colgate's profit margins. Increased input costs directly reduced gross profit, impacting the bottom line. The company's operating profit margins also likely suffered due to the higher costs of goods sold.

- Impact on Profitability: The higher cost of imported raw materials and components directly translated to lower profitability. The extent of this impact would depend on the company's pricing strategies and ability to absorb the increased costs.

- Cost-Cutting Measures: Colgate likely implemented cost-cutting measures, such as streamlining operations or optimizing its supply chain, to mitigate the impact on margins. Identifying and quantifying these cost savings is crucial for a thorough analysis.

- Margin Comparison: Comparing Q3 2023 gross and operating profit margins to previous quarters (and ideally to industry competitors) would highlight the extent of the negative impact caused by the tariffs.

H3: Geographic Impact:

The tariff's impact varied geographically. Markets heavily reliant on imported Colgate products experienced a more significant impact than those with strong local manufacturing.

- Regional Variations: Some regions might have seen stronger consumer demand resilience to price increases, while others experienced reduced sales volume due to higher prices. Analyzing these regional differences is vital to understand the diverse impact of the tariffs.

- Pricing Strategies: Colgate's pricing strategies likely varied by region, reflecting differences in consumer sensitivity to price changes and competition.

2.2. Colgate's Response to the Tariff Increase:

H3: Pricing Strategies:

To offset the increased costs, Colgate likely adjusted its pricing strategies. This could include raising prices on certain products or implementing selective price increases in specific markets.

- Impact on Consumer Demand: Price increases can lead to reduced consumer demand. The elasticity of demand for Colgate's products will determine how significantly sales volumes are affected by the price adjustments.

- Price Elasticity Analysis: Analyzing the price elasticity of demand for Colgate products in different markets will help gauge the success of its pricing strategies.

H3: Cost Optimization Measures:

Colgate implemented cost-cutting measures to mitigate the tariff's impact. This might have included supply chain optimization, improving manufacturing efficiency, and streamlining marketing expenses.

- Supply Chain Optimization: Shifting sourcing to alternative suppliers or regions might have been a key strategy.

- Efficiency Improvements: Internal process improvements aimed at reducing operational costs are also likely.

- Marketing Expense Reduction: Reducing marketing spending might have been necessary to preserve profitability in the short term.

H3: Investment in New Markets/Products:

To diversify revenue streams and lessen reliance on tariff-affected regions, Colgate might have invested in new markets or product lines.

- Market Expansion: Entering new, less tariff-affected markets could reduce dependence on the impacted regions.

- Product Diversification: Developing new products or expanding existing product lines could also help offset the negative impact.

2.3. Future Outlook for Colgate (CL) in Light of Tariffs:

H3: Long-Term Implications:

The long-term effects of the tariff increase on Colgate's business model and financial projections are uncertain. The company's ability to adapt to the changing trade environment will be crucial.

- Strategic Shifts: Colgate might need to adjust its supply chain strategies long-term, potentially involving reshoring or nearshoring of manufacturing.

- Pricing Adjustments: Long-term pricing strategies will need to balance profitability with consumer demand.

H3: Investor Sentiment and Stock Performance:

The market's reaction to the tariff news and its impact on Colgate's stock price provides valuable insights into investor sentiment.

- Stock Price Analysis: Analyzing Colgate's stock price performance following the earnings announcement and subsequent news reports is crucial.

- Analyst Opinions: Following analyst ratings and predictions for Colgate's future performance will provide further insight into investor expectations.

H3: Potential Mitigation Strategies:

Analyzing the efficacy of the strategies employed by Colgate, while exploring potential alternative mitigation strategies is essential.

- Strategic Partnerships: Collaborations with suppliers or other businesses in the industry might help navigate tariff challenges.

- Lobbying Efforts: Advocating for policy changes that could reduce or eliminate tariffs.

Conclusion: Understanding the Long-Term Effects of the Colgate (CL) $200 Million Tariff Increase

The $200 million tariff increase significantly impacted Colgate's Q3 2023 results, affecting revenue, profitability, and future outlook. The company's response, including pricing adjustments and cost optimization measures, will determine its long-term success. Monitoring Colgate's strategic responses and their effectiveness is vital. To stay informed about the ongoing impact of tariffs on Colgate's performance, closely follow the company's financial reports, news updates, and analyst commentary. Analyze future earnings reports for further insights into the Colgate tariff impact analysis, Colgate financial performance, and Colgate Q3 earnings to assess the long-term effects of this significant challenge.

![Colgate (CL): Impact Of $200 Million Tariff Increase On Q[Quarter Number] Results Colgate (CL): Impact Of $200 Million Tariff Increase On Q[Quarter Number] Results](https://emilnoldeinberlin.de/image/colgate-cl-impact-of-200-million-tariff-increase-on-q-quarter-number-results.jpeg)

Featured Posts

-

Turning Poop Into Prose An Ai Powered Podcast Revolution

Apr 26, 2025

Turning Poop Into Prose An Ai Powered Podcast Revolution

Apr 26, 2025 -

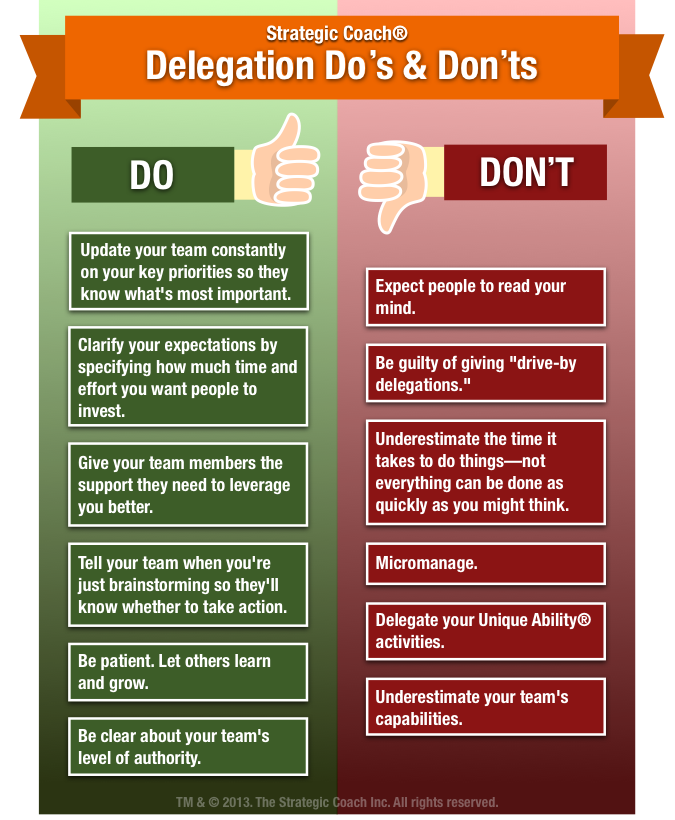

Private Credit Jobs 5 Dos And Don Ts To Increase Your Chances

Apr 26, 2025

Private Credit Jobs 5 Dos And Don Ts To Increase Your Chances

Apr 26, 2025 -

The Rise Of Otc Birth Control A Post Roe Reality Check

Apr 26, 2025

The Rise Of Otc Birth Control A Post Roe Reality Check

Apr 26, 2025 -

Hollywood Strike Actors Join Writers Bringing Production To A Halt

Apr 26, 2025

Hollywood Strike Actors Join Writers Bringing Production To A Halt

Apr 26, 2025 -

Game Stop Switch 2 Preorder My In Store Experience

Apr 26, 2025

Game Stop Switch 2 Preorder My In Store Experience

Apr 26, 2025