Examining The Economic Impact Of Minnesota Film Tax Credits

Table of Contents

Job Creation and Employment in the Minnesota Film Industry

The Minnesota film tax credits program has a demonstrably positive impact on employment within the state. Film productions, incentivized by these credits, create a substantial number of jobs, both directly and indirectly. Direct jobs include those filled by on-set crew members such as camera operators, editors, production assistants, sound technicians, and actors. Indirect jobs are created within supporting industries like catering, transportation, and hotel services.

- Direct Job Creation: Estimates suggest that Minnesota film tax credits lead to thousands of new jobs annually. Precise figures vary year to year, depending on the number and scale of productions. The program is a significant contributor to employment growth in creative industries.

- Indirect Job Creation: The economic ripple effect extends far beyond the film set. Hotels, restaurants, and local businesses experience increased revenue as crews and cast members spend money in the community. Transportation services, equipment rental companies, and other support industries also benefit significantly.

- Types of Jobs: The range of jobs created is diverse, supporting professionals with a variety of skills and experience levels. From highly skilled film crew jobs in Minnesota to entry-level positions, the program fosters a thriving and inclusive workforce.

Revenue Generation and Increased Spending through Film Production

Film productions utilizing Minnesota film tax credits inject significant capital into the state's economy. This increased spending stimulates economic activity and generates substantial revenue for both local businesses and state coffers.

- Direct Spending: Film productions directly contribute millions of dollars to the Minnesota economy through salaries, equipment rentals, location fees, and other expenses.

- Indirect Spending: This direct spending creates a multiplier effect, leading to increased activity in related industries. Hotels see increased occupancy, restaurants experience higher demand, and local businesses benefit from increased sales. This film production spending in Minnesota boosts the overall economic vitality of the state.

- Tax Revenue: The resulting economic activity translates to increased tax revenue for the state, helping offset the cost of the Minnesota film tax credits program and contributing to the overall financial health of the state. This positive economic stimulus underscores the value of these incentives.

Attracting Film Productions and Boosting Minnesota's Profile

The Minnesota film tax credits program plays a crucial role in making Minnesota a more competitive location for film productions. Compared to other states with similar programs, Minnesota’s incentives can be highly attractive, encouraging filmmakers to choose Minnesota as their filming destination.

- Competitive Incentives: The competitiveness of Minnesota's incentives is a key factor in attracting productions. By offering comparable or even superior incentives to neighboring states, the program helps ensure that Minnesota remains a desirable filming location.

- Successful Productions: Many successful film and television productions have been attracted to Minnesota due to the availability of state film incentives. These projects contribute significantly to the state’s economic activity and raise its profile on the national and international stage.

- Tourism and Media Coverage: The increased filming activity also benefits Minnesota tourism. Positive media coverage associated with productions filmed in the state can attract tourists eager to visit filming locations, boosting tourism revenue and enhancing Minnesota’s image as a vibrant and dynamic destination. This positive film tourism in Minnesota is a significant long-term benefit of the program.

Evaluating the Cost-Effectiveness of Minnesota Film Tax Credits

A comprehensive analysis is needed to accurately assess the cost-benefit analysis of the Minnesota film tax credits program. While the program incurs costs through tax revenue foregone, the resulting economic benefits in terms of job creation and revenue generation need to be carefully weighed.

- Return on Investment: A thorough return on investment analysis is crucial to evaluating the program's effectiveness. This analysis should consider both direct and indirect economic impacts, comparing the cost of the program against the resulting economic activity.

- Program Optimization: While generally beneficial, the program may benefit from optimization. Potential adjustments could include refining eligibility criteria to target specific types of productions or adjusting the incentive rate to maximize its economic impact. Such improvements could enhance the overall film tax credit effectiveness.

- Economic Development: Ultimately, the success of the Minnesota film tax credits program should be judged based on its contribution to the overall Minnesota economic development goals. This includes job creation, revenue generation, and the enhancement of the state's image and reputation.

Conclusion: The Future of Minnesota Film Tax Credits and Their Economic Impact

In summary, the Minnesota film tax credits program demonstrates a significant and multifaceted positive impact on the state's economy. The program has proven successful in creating jobs, generating revenue, and boosting Minnesota's profile as a desirable filming location. While a detailed cost-benefit analysis is continuously needed, and improvements can be considered to enhance the program's effectiveness, the overall benefits are substantial. To ensure the continued success of this valuable program, ongoing research, open discussion, and appropriate policy adjustments are crucial. We encourage you to learn more about the Minnesota film tax credits program and advocate for its continued success as a catalyst for economic growth in Minnesota.

Featured Posts

-

Adidas Anthony Edwards 2 Initial Impressions And Performance Review

Apr 29, 2025

Adidas Anthony Edwards 2 Initial Impressions And Performance Review

Apr 29, 2025 -

Mlb 160km H

Apr 29, 2025

Mlb 160km H

Apr 29, 2025 -

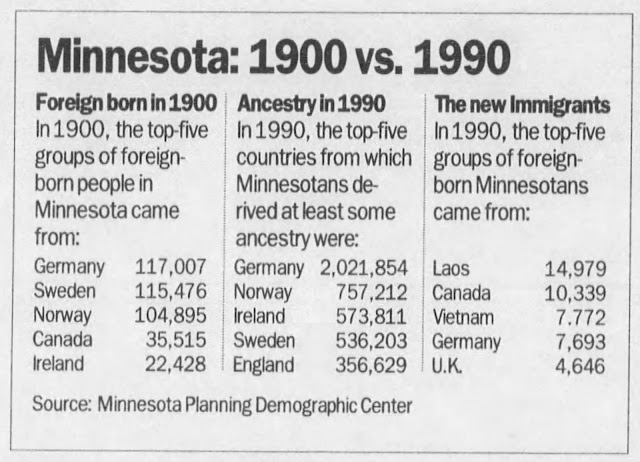

Higher Paying Jobs Study Highlights Success Of Minnesota Immigrants

Apr 29, 2025

Higher Paying Jobs Study Highlights Success Of Minnesota Immigrants

Apr 29, 2025 -

Examining The Economic Impact Of Minnesota Film Tax Credits

Apr 29, 2025

Examining The Economic Impact Of Minnesota Film Tax Credits

Apr 29, 2025 -

160km H Mlb

Apr 29, 2025

160km H Mlb

Apr 29, 2025