Impact Of China's Rare Earth Policy On Tesla's Optimus Humanoid Robot

Table of Contents

Rare Earth Elements Crucial for Optimus's Functionality

Optimus's impressive capabilities are inextricably linked to the use of rare earth elements (REEs). These 17 elements, while not actually rare in the Earth's crust, are difficult and costly to extract and refine, giving China significant leverage over their global supply.

Permanent Magnets in Motors and Actuators

Neodymium magnets, a type of rare earth magnet, play a crucial role in Optimus's motors and actuators. These powerful magnets are responsible for the robot's movement, enabling the precision and strength required for complex tasks.

- High-strength magnetic fields: Neodymium magnets provide the high-strength magnetic fields necessary for efficient motor operation.

- Compact size and weight: Their high energy density allows for smaller and lighter motors, crucial for Optimus's design.

- Supply chain vulnerability: China's dominance in neodymium magnet production creates a significant vulnerability in Optimus's supply chain. Any disruption in exports could severely hamper production.

Other Rare Earth Applications in Optimus

Beyond neodymium magnets, other rare earth elements likely contribute to Optimus's functionality. For example:

- Dysprosium: Often used in conjunction with neodymium in high-performance magnets, enhancing their temperature resistance and overall performance. This is vital for ensuring reliable operation in varying conditions.

- Lanthanum: Used in capacitors for energy storage, essential for powering various components of the robot.

- Other REEs: Other rare earth elements could be incorporated into various sensors, control systems, and other internal components.

The intricate network of rare earth elements within Optimus highlights the complexity of its supply chain and Tesla's dependence on stable access to these crucial materials. While alternative materials are being researched, the current reliance on rare earths is undeniable.

China's Rare Earth Export Policies and Their Potential Impact

China's control over rare earth element production and processing allows it to significantly influence global markets through its export policies.

Export Quotas and Restrictions

China has a history of using export quotas and restrictions to control the flow of rare earth elements. This creates uncertainty for companies like Tesla that rely on a steady supply of these materials. Future restrictions or quotas could:

- Limit Optimus production: Reduced access to REEs would directly impact Tesla's ability to manufacture Optimus at scale.

- Increase production costs: Supply shortages would inevitably lead to higher prices for rare earth elements, increasing the cost of producing Optimus.

- Geopolitical tensions: China's control over these critical materials has significant geopolitical implications, potentially influencing international relations and trade.

Pricing Volatility and Market Manipulation

China's dominance allows for potential market manipulation, leading to price volatility. Sudden price increases could:

- Undermine Optimus's profitability: Higher material costs directly reduce Tesla's profit margins on each robot.

- Delay Optimus's market entry: Unpredictable pricing makes it challenging for Tesla to accurately forecast costs and set production schedules.

- Force price increases for consumers: Ultimately, increased costs may be passed onto consumers, potentially affecting the market viability of Optimus.

Tesla's Strategies to Mitigate Rare Earth Dependence

To mitigate the risks associated with China's rare earth dominance, Tesla needs to implement proactive strategies.

Diversification of Supply Chains

Tesla is likely exploring (or needs to explore) diversification of its rare earth supply chains by:

- Sourcing from other countries: Countries like Australia, the USA, and Canada are developing their own rare earth mining and processing capabilities, offering potential alternative sources.

- Establishing strategic partnerships: Collaborating with mining companies and processors in other countries can secure stable and reliable supplies.

- Investing in upstream processing: Investing in processing facilities outside of China reduces reliance on Chinese refineries.

Research and Development of Alternative Materials

Tesla's long-term strategy likely includes investing heavily in research and development of alternative materials that can replace rare earth elements in Optimus's components. This is a challenging but potentially crucial endeavor.

- Technological breakthroughs: Significant advancements are needed to develop materials with comparable performance characteristics at a competitive cost.

- Long-term investment: Research and development in materials science is a long-term process requiring substantial investment and time.

- Collaboration with research institutions: Partnering with universities and research institutions can accelerate the development of alternative materials.

Conclusion: Navigating the Rare Earth Landscape for Optimus's Future

China's influence on the availability and price of rare earth elements presents a significant challenge to the future of Tesla's Optimus robot. The critical role of these materials in Optimus's functionality cannot be overstated. To ensure the long-term success of Optimus, Tesla must prioritize diversifying its rare earth supply chains and invest heavily in the research and development of alternative materials. Understanding the impact of China's rare earth policy on the future of robotics, such as Tesla's Optimus, is crucial. Further research into sustainable and diversified rare earth sourcing is vital for the continued advancement of humanoid robotics.

Featured Posts

-

Liams Fate On The Bold And The Beautiful Will He Survive His Collapse

Apr 24, 2025

Liams Fate On The Bold And The Beautiful Will He Survive His Collapse

Apr 24, 2025 -

Canadas Economic Vision Prioritizing Fiscal Responsibility

Apr 24, 2025

Canadas Economic Vision Prioritizing Fiscal Responsibility

Apr 24, 2025 -

The Impact Of Trumps Budget Cuts On Tornado Preparedness And Response

Apr 24, 2025

The Impact Of Trumps Budget Cuts On Tornado Preparedness And Response

Apr 24, 2025 -

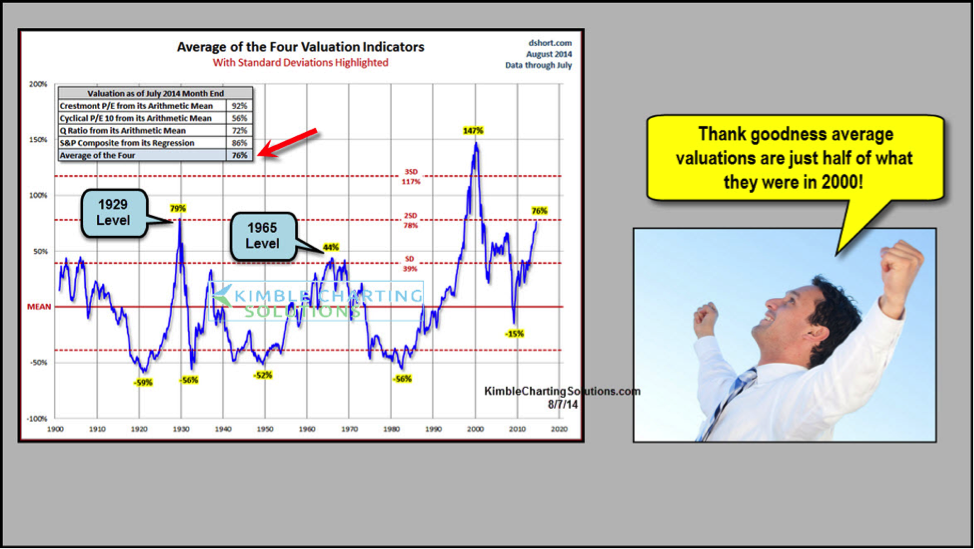

Bof As Take Why Current Stock Market Valuations Shouldnt Worry You

Apr 24, 2025

Bof As Take Why Current Stock Market Valuations Shouldnt Worry You

Apr 24, 2025 -

Bold And The Beautiful Spoilers Wednesday April 23 Finns Pledge To Liam

Apr 24, 2025

Bold And The Beautiful Spoilers Wednesday April 23 Finns Pledge To Liam

Apr 24, 2025