India's Nifty 50: Current Market Trends And Growth Drivers

Table of Contents

Current Market Trends Shaping the Nifty 50

The Nifty 50's performance is a complex interplay of global and domestic economic forces. Understanding these trends is crucial for navigating the Indian stock market effectively.

Global Economic Influences on Nifty 50 Performance

Global economic headwinds significantly impact the Nifty 50's volatility. Factors like inflation, interest rate hikes by major central banks, and geopolitical uncertainties create ripple effects across global markets, including India.

- Inflationary pressures: High inflation in developed economies leads to tighter monetary policies, potentially impacting foreign investment flows into India and influencing the Nifty 50.

- Interest rate hikes: Increased interest rates in the US and other major economies can attract capital away from emerging markets like India, leading to potential short-term volatility in the Nifty 50.

- Geopolitical risks: Global conflicts and political instability create uncertainty, affecting investor sentiment and impacting the Nifty 50's performance. For example, the Russia-Ukraine conflict has had a significant impact on commodity prices, influencing inflation and market sentiment globally, indirectly affecting the Nifty 50. Keywords: global economy, inflation, interest rates, geopolitical risks, Nifty 50 volatility.

Domestic Economic Factors Driving Nifty 50 Growth

Despite global uncertainties, strong domestic economic fundamentals continue to support the Nifty 50's long-term growth.

- Robust GDP growth: India's consistent GDP growth, though recently showing some moderation, remains a significant driver of the Nifty 50's performance. The sustained growth in various sectors fuels overall market optimism.

- Rising consumption: A growing middle class and increasing consumer spending power are boosting demand across multiple sectors, particularly in consumer goods and services.

- Government policies: Initiatives like "Make in India" and "Digital India" are aimed at stimulating domestic manufacturing and digital adoption, creating positive growth momentum for relevant Nifty 50 companies. Keywords: Indian GDP, consumption growth, government policies, fiscal policy, monetary policy, Nifty 50 performance.

Sectoral Performance within the Nifty 50

Analyzing the performance of individual sectors within the Nifty 50 provides a granular view of market dynamics.

- IT sector: The Indian IT sector has historically been a significant contributor to the Nifty 50's growth, although recent global economic slowdown has presented some challenges.

- Financial services: The financial services sector, including banking and insurance, plays a vital role in the Nifty 50's performance, often reflecting the overall health of the Indian economy.

- FMCG (Fast-moving consumer goods): The FMCG sector usually exhibits resilience during economic downturns, making it a relatively stable component of the Nifty 50. Keywords: Nifty 50 sectors, IT sector, financial services, FMCG, sectoral analysis, stock market performance.

Key Growth Drivers for the Nifty 50

Several powerful forces are driving the long-term growth potential of the Nifty 50.

The Rise of the Indian Consumer

India's burgeoning middle class is a major catalyst for economic growth and a key driver of the Nifty 50's performance.

- Increased disposable income: A growing middle class with higher disposable income fuels demand for consumer goods and services, boosting related sectors within the Nifty 50.

- Changing consumption patterns: Shifting preferences towards higher-value products and services create new growth opportunities for businesses within the Nifty 50. Keywords: Indian middle class, consumer spending, consumption growth, retail sector, consumer durables.

Government Initiatives and Reforms

Government policies and reforms play a crucial role in shaping the Indian economy and the Nifty 50's trajectory.

- Infrastructure development: Massive investments in infrastructure projects create jobs, stimulate economic activity, and boost related sectors in the Nifty 50.

- Tax reforms: Simplification and rationalization of tax structures encourage investment and business growth, contributing to positive Nifty 50 performance. Keywords: Government policies, infrastructure development, tax reforms, Make in India, digital India, economic reforms, Nifty 50 growth.

Technological Advancements and Digitalization

India's rapid digitalization is transforming various sectors, creating new opportunities and driving Nifty 50 growth.

- Fintech revolution: The rise of Fintech companies is disrupting traditional financial services, offering innovative solutions and boosting the financial services sector's contribution to the Nifty 50.

- E-commerce boom: The expansion of e-commerce platforms is revolutionizing retail and creating new opportunities for businesses, significantly impacting the Nifty 50's composition and performance. Keywords: Digital India, Fintech, e-commerce, technological advancements, digital transformation, Nifty 50 future.

Investing in India's Nifty 50: A Look Ahead

The Nifty 50 presents a compelling blend of risks and opportunities for investors. While global uncertainties persist, India's strong domestic fundamentals, a rising consumer base, and government initiatives create a positive long-term outlook. The ongoing digital transformation and technological advancements further enhance its growth potential. However, it's crucial to conduct thorough research and understand the inherent market risks before making any investment decisions. The Nifty 50 is a dynamic index, and understanding its current market trends and growth drivers is key to navigating its potential and optimizing your investment portfolio. Learn more about navigating the opportunities within India's Nifty 50 and make informed investment decisions. Keywords: Nifty 50 investment, investment strategy, Indian stock market outlook, future of Nifty 50.

Featured Posts

-

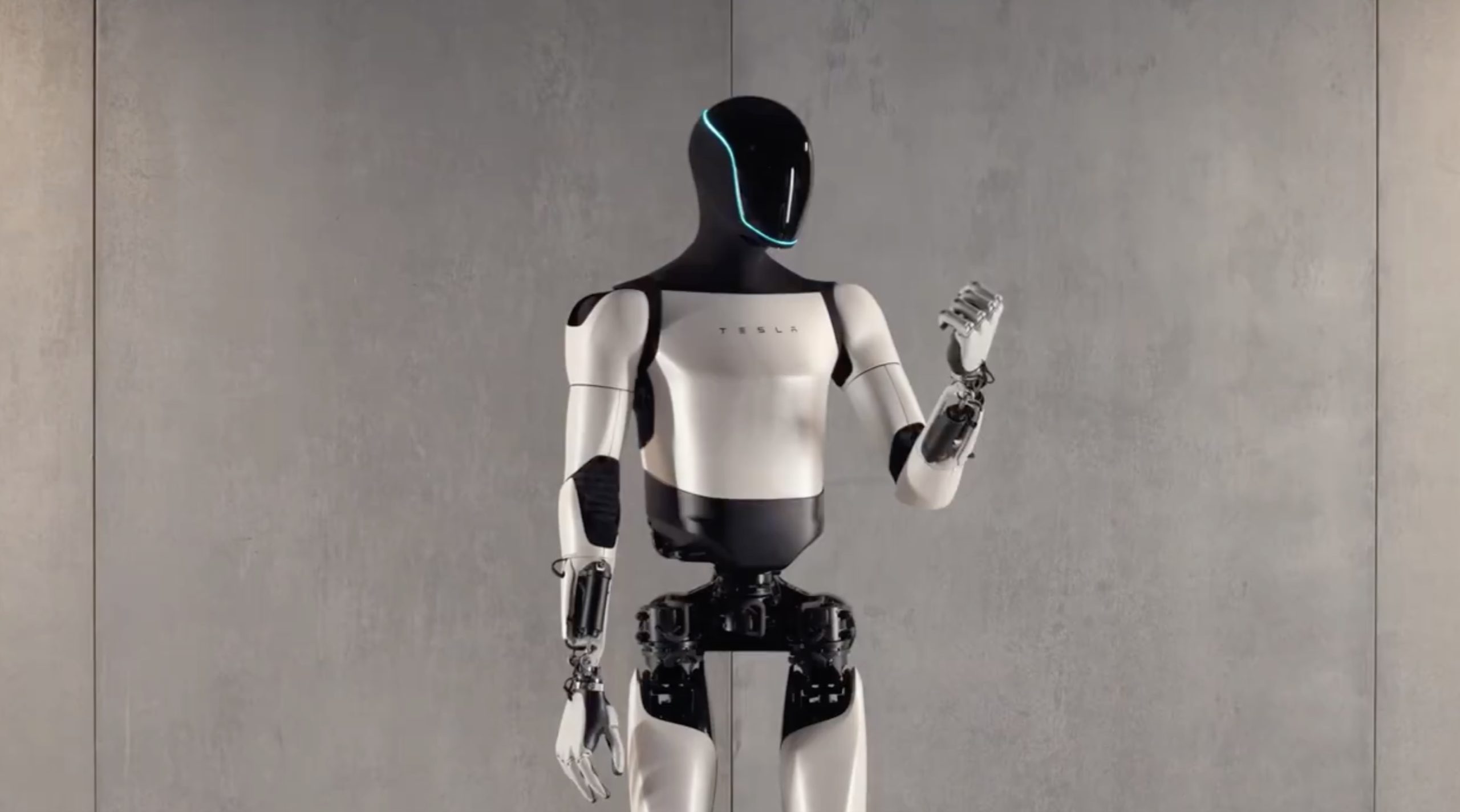

Teslas Optimus Robot Navigating The Challenges Of Rare Earth Supply

Apr 24, 2025

Teslas Optimus Robot Navigating The Challenges Of Rare Earth Supply

Apr 24, 2025 -

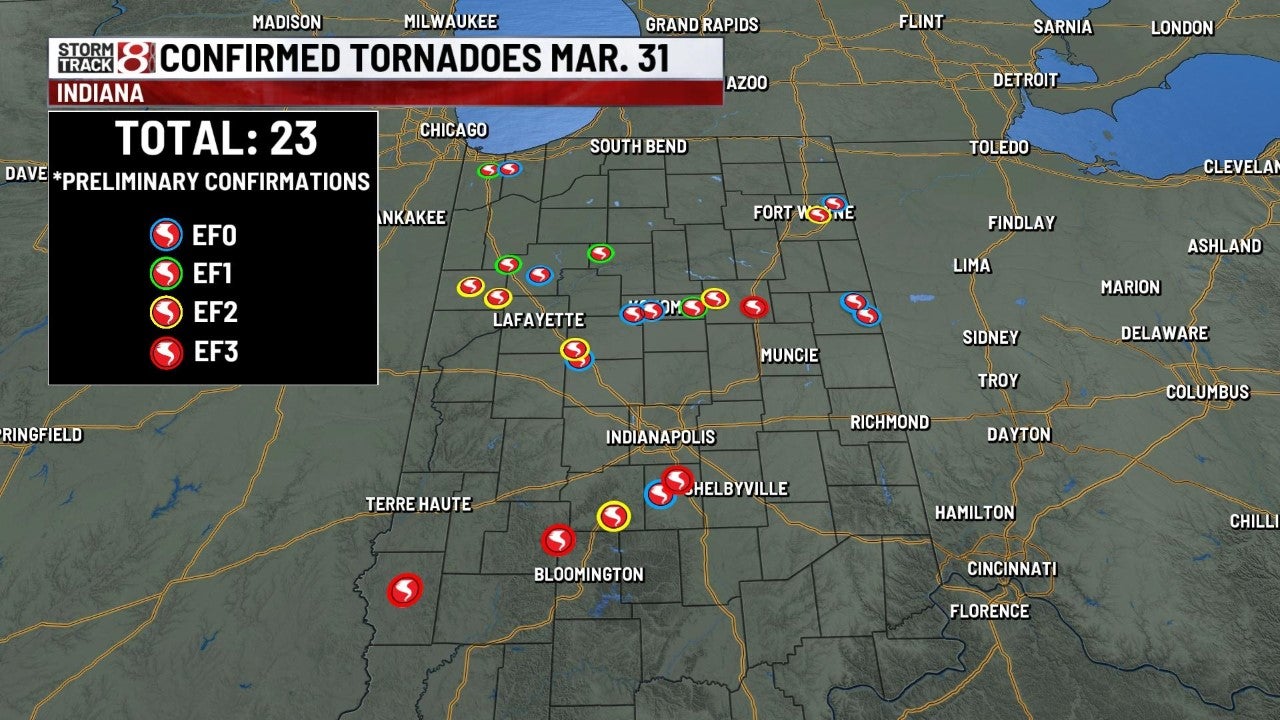

Reduced Funding Increased Danger How Trumps Cuts Impact Tornado Season

Apr 24, 2025

Reduced Funding Increased Danger How Trumps Cuts Impact Tornado Season

Apr 24, 2025 -

John Travoltas Rotten Tomatoes Record Is It Really That Bad

Apr 24, 2025

John Travoltas Rotten Tomatoes Record Is It Really That Bad

Apr 24, 2025 -

Zaboravljeni Projekt Razlog Tarantinovog Odbijanja Filma S Travoltom

Apr 24, 2025

Zaboravljeni Projekt Razlog Tarantinovog Odbijanja Filma S Travoltom

Apr 24, 2025 -

Trump Affirms Continued Employment Of Federal Reserve Chair Powell

Apr 24, 2025

Trump Affirms Continued Employment Of Federal Reserve Chair Powell

Apr 24, 2025