Investing In Elon Musk's Private Ventures: A Lucrative Side Hustle?

Table of Contents

Understanding Elon Musk's Investment Landscape

Elon Musk's entrepreneurial empire extends far beyond Tesla and SpaceX (though those are publicly traded, and thus a different investment avenue). Understanding his investment landscape requires examining his key private ventures:

Identifying Key Private Ventures:

-

SpaceX: Revolutionizing space exploration through reusable rockets and ambitious plans for Mars colonization. SpaceX's successes in launching satellites and cargo to the International Space Station represent significant milestones, hinting at future growth in space tourism and interplanetary travel. This venture offers exposure to the rapidly expanding space industry.

-

The Boring Company: Addressing urban transportation challenges with innovative tunnel-boring technology. While still in its early stages, successful projects could disrupt the transportation sector and generate substantial returns for investors. This is a high-risk, high-reward investment in infrastructure.

-

Neuralink: Developing brain-computer interfaces with the potential to revolutionize healthcare and human capabilities. While highly speculative, successful development of Neuralink's technology could create a massive market in neurotechnology, impacting fields ranging from medicine to computing. This represents a venture into cutting-edge biomedical engineering.

-

X Corp (formerly Twitter): Musk’s acquisition and restructuring of X Corp presents a different kind of investment opportunity, with both significant risks and potential upsides. The company's future is evolving rapidly, and investment should consider this volatility.

These Elon Musk investments, and others, represent a diverse range of sectors, potentially offering diversification benefits for a sophisticated investor. However, accessing these Musk's ventures requires a deep understanding of private investment strategies.

Accessing Elon Musk's Private Ventures: Investment Avenues & Challenges

Investment Opportunities:

Accessing these Elon Musk investment opportunities isn't straightforward. Several avenues exist, each with its own set of prerequisites and challenges:

-

Private equity or venture capital funds: Many funds focus on early-stage companies, and some may hold stakes in Musk's ventures. However, these typically require substantial capital commitments and often have limited liquidity. Investing through such funds represents a higher degree of indirect exposure to Elon Musk's private ventures.

-

Angel investing: This involves directly investing in a private company. For Elon Musk investments, this would require a substantial net worth and a proven track record of successful investments. The risks are extremely high, and success hinges on careful due diligence and a high-risk tolerance.

-

Indirect investment: Some publicly traded companies may benefit indirectly from Musk's ventures, though identifying strong correlations requires careful analysis. This can offer some degree of exposure with lower direct involvement in private company investments.

Navigating the Complexities:

Investing in private companies presents unique challenges:

-

Limited information: Private companies aren't subject to the same disclosure requirements as publicly traded firms, making it difficult to assess their true value and potential.

-

Stringent eligibility criteria: Private investments often have high minimum investment thresholds and strict eligibility requirements.

-

Regulatory hurdles and legal complexities: Navigating regulations and legal issues associated with private investments can be complex and require specialized legal counsel.

-

Illiquidity: It can be extremely difficult to sell private investments quickly, limiting your ability to access your capital when needed. This lack of liquidity is a key risk in accessing private investments.

Risk Assessment & Return Potential

Investing in Elon Musk's private ventures presents a high-risk, high-reward scenario.

Assessing the Risks:

-

Market volatility: The value of early-stage companies can fluctuate wildly, and the inherent uncertainties associated with disruptive technologies magnify this volatility.

-

Complete loss of investment: There's always a significant chance of losing your entire investment in a private company, particularly one as ambitious and high-risk as those run by Elon Musk.

-

Lack of liquidity: As previously discussed, selling your stake in a private company can be incredibly difficult, if not impossible, for years.

Evaluating the Potential Rewards:

Despite the risks, the potential rewards are substantial:

-

Exponential growth: Successful ventures like SpaceX and Tesla demonstrate the potential for exponential growth in innovative companies. Early investors in such ventures have realized enormous returns.

-

High-growth company potential: Investing in high-growth companies, especially at their inception, has historically generated some of the highest returns. This is true even considering the numerous companies that fail to achieve this growth.

-

Portfolio diversification: Diversifying your investment portfolio with carefully selected private investments can help mitigate overall risk.

Conclusion: Is Investing in Elon Musk's Private Ventures Right for You?

Investing in Elon Musk's private ventures offers the potential for significant returns but comes with considerable risk. Access is limited, requiring substantial capital and a sophisticated understanding of private investment strategies. While the allure of a lucrative side hustle is strong, careful consideration and thorough due diligence are paramount. Before taking the plunge, assess your risk tolerance, financial goals, and seek professional financial advice. While investing in Elon Musk's private ventures presents a potentially lucrative side hustle, it's crucial to approach it with caution and a well-defined investment strategy. Thorough research is essential before considering any such investment.

Featured Posts

-

A Military Base Key Player In The Us China Influence Race

Apr 26, 2025

A Military Base Key Player In The Us China Influence Race

Apr 26, 2025 -

Investing In Elon Musks Private Ventures A Lucrative Side Hustle

Apr 26, 2025

Investing In Elon Musks Private Ventures A Lucrative Side Hustle

Apr 26, 2025 -

Nintendo Switch 2 Preorder My Game Stop Waiting Game

Apr 26, 2025

Nintendo Switch 2 Preorder My Game Stop Waiting Game

Apr 26, 2025 -

Florida As A Favorite Vacation Spot A Cnn Anchors Perspective

Apr 26, 2025

Florida As A Favorite Vacation Spot A Cnn Anchors Perspective

Apr 26, 2025 -

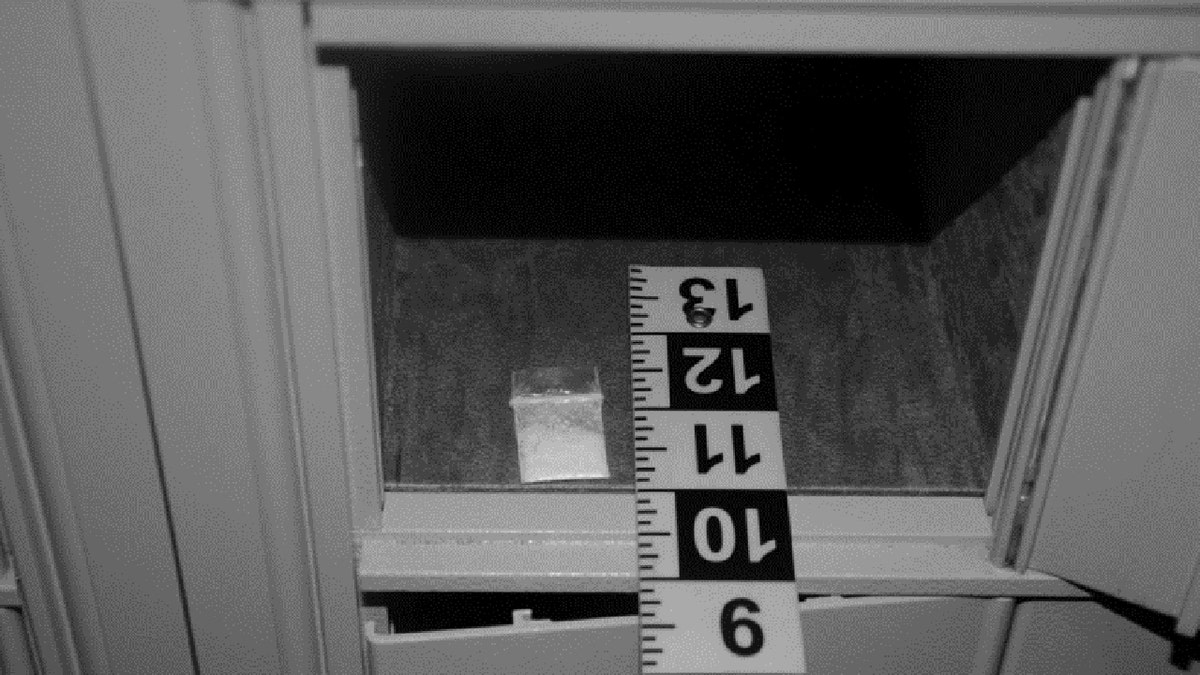

White House Cocaine Incident Secret Service Releases Findings

Apr 26, 2025

White House Cocaine Incident Secret Service Releases Findings

Apr 26, 2025