Land Your Dream Job: 5 Do's & Don'ts In The Private Credit Industry

Table of Contents

5 Do's to Land Your Dream Private Credit Job

Do 1: Network Strategically

Networking is paramount in the private credit industry. Building strong relationships can open doors that online applications simply can't. Don't underestimate the power of personal connections.

- Attend industry conferences: Private equity conferences and specialized private credit events offer invaluable networking opportunities.

- Join relevant LinkedIn groups: Engage in discussions, share insightful articles, and connect with professionals in the field. Search for groups focused on private credit, direct lending, or mezzanine finance.

- Personalize connection requests: Don't send generic connection requests. Tailor your message to each person, highlighting your shared interests or professional goals within the private credit space.

- Conduct informational interviews: Reach out to individuals working in roles you admire to learn about their career paths and gain valuable insights. These private credit connections can be invaluable.

Do 2: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count. Generic applications rarely succeed in the competitive private credit jobs market.

- Quantify achievements: Instead of simply stating your responsibilities, showcase quantifiable results. For example, "Increased portfolio returns by 15% through strategic credit analysis."

- Use action verbs: Start your bullet points with strong action verbs to highlight your accomplishments and skills relevant to private credit roles.

- Tailor to each application: Customize your resume and cover letter for each job application, highlighting the skills and experiences most relevant to the specific role and company.

- Proofread carefully: Typos and grammatical errors can significantly hurt your chances. Have someone else review your application materials before submitting them. This is especially crucial for private credit resume submissions.

Do 3: Master the Interview Process

The interview stage is where you can truly showcase your knowledge and passion. Preparation is key to success in private credit interviews.

- Research the firm and interviewers: Understand the firm's investment strategy, recent transactions, and the interviewers' backgrounds. This demonstrates your genuine interest in private credit opportunities.

- Prepare STAR method answers: Use the STAR method (Situation, Task, Action, Result) to structure your answers to behavioral questions, providing concrete examples of your skills and experiences.

- Practice technical skills: Brush up on your financial modeling, valuation, and credit analysis skills. Be prepared to tackle technical questions related to private credit case studies.

- Ask insightful questions: Prepare thoughtful questions to ask the interviewers. This demonstrates your genuine interest and engagement in the private credit market.

Do 4: Showcase Your Understanding of Private Credit

Demonstrate a deep understanding of the private credit market, its nuances, and its various strategies.

- Stay updated on industry news: Follow reputable financial news sources and industry publications to stay abreast of market trends and significant transactions within the private credit space.

- Read industry publications: Familiarize yourself with key industry publications and research reports to demonstrate your expertise in direct lending, mezzanine financing, and distressed debt.

- Understand key players and transactions: Know the major players in the private credit market and be familiar with recent significant transactions. This shows your deep understanding of private credit market trends.

Do 5: Follow Up Effectively

Following up after interviews is crucial. It demonstrates your continued interest and initiative.

- Send personalized thank-you notes within 24 hours: Express your gratitude for the interview and reiterate your enthusiasm for the opportunity. Mention specific details from the conversation to personalize the note.

- Reiterate your enthusiasm: Re-emphasize your interest in the role and the firm, highlighting why you're a strong fit for their private credit team.

- Mention specific details from the interview: Referencing specific aspects of the discussion shows you were attentive and engaged during the interview process.

5 Don'ts in Your Private Credit Job Search

Don't 1: Neglect Networking

Don't rely solely on online job boards. Networking significantly increases your chances of landing a private credit job.

- Avoid passive job searching: Actively participate in industry events and engage with professionals on LinkedIn.

- Attend industry events: Network at conferences and private events to build relationships with people working in private credit.

- Actively engage on LinkedIn: Participate in discussions, share relevant articles, and connect with people in the industry.

Don't 2: Submit Generic Applications

Tailoring your application materials to each specific role is critical for success.

- Customize your application materials: Don't send the same resume and cover letter to multiple firms. Adjust them to reflect the specific requirements of each position and the company's investment strategy.

- Highlight relevant experience for each role: Focus on the skills and experiences most relevant to the specific job description.

- Proofread meticulously: Ensure your application materials are free of errors.

Don't 3: Underprepare for Interviews

Thorough preparation is essential for acing private credit interview questions.

- Practice your answers: Prepare answers to common interview questions using the STAR method.

- Research the firm: Gain an in-depth understanding of the firm's investment strategy and recent transactions.

- Anticipate common questions: Prepare for questions about your experience in financial modeling, credit analysis, and valuation.

- Prepare insightful questions to ask: Ask thoughtful questions to demonstrate your interest and understanding of the private credit market.

Don't 4: Lack Enthusiasm and Passion

Demonstrate genuine interest in the private credit industry and the specific firm you are applying to.

- Research the firm's investment strategy: Show that you understand their approach and investment focus.

- Mention specific deals or portfolio companies: Demonstrate that you've done your research and are familiar with their work.

- Express your passion for the industry: Let your enthusiasm shine through in your responses.

Don't 5: Forget to Follow Up

Following up shows initiative and reinforces your interest in the opportunity.

- Send timely thank you notes: Send personalized thank-you notes within 24 hours of each interview.

- Avoid excessive follow-up: Don't bombard interviewers with repeated emails.

- Be professional and respectful: Maintain a professional tone in all your communications.

Conclusion

Landing your dream job in the private credit industry requires a strategic and proactive approach. By following these five do's and don'ts – focusing on strategic networking, tailoring your application materials, mastering the interview process, showcasing your understanding of the industry, and following up effectively – you significantly increase your chances of success. Start your journey to landing your dream job in the private credit industry today!

Featured Posts

-

Is The 77 Inch Lg C3 Oled Tv Worth The Hype A Honest Review

Apr 24, 2025

Is The 77 Inch Lg C3 Oled Tv Worth The Hype A Honest Review

Apr 24, 2025 -

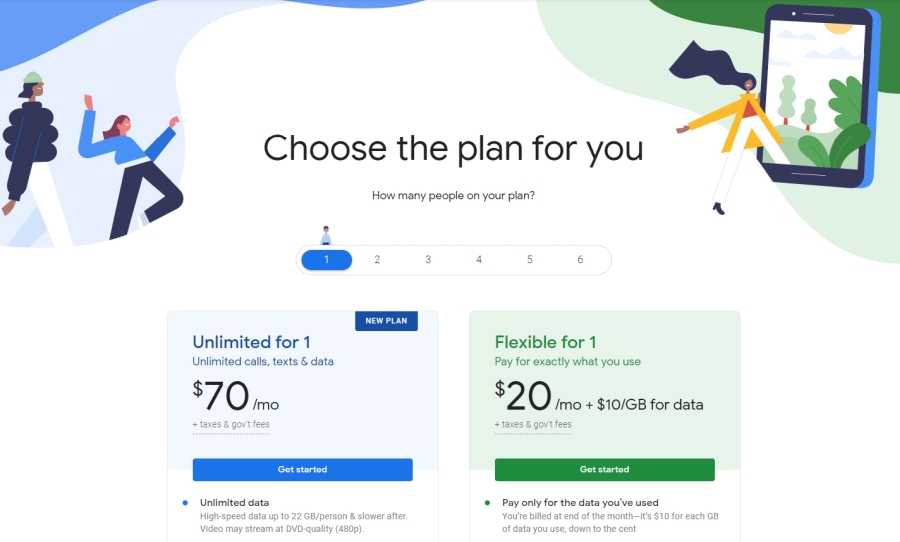

Google Fi Launches Affordable 35 Unlimited Data Plan

Apr 24, 2025

Google Fi Launches Affordable 35 Unlimited Data Plan

Apr 24, 2025 -

Ai Boom Propels Sk Hynix Past Samsung In Dram Sales

Apr 24, 2025

Ai Boom Propels Sk Hynix Past Samsung In Dram Sales

Apr 24, 2025 -

Blue Origin Cancels Launch Subsystem Issue Delays Mission

Apr 24, 2025

Blue Origin Cancels Launch Subsystem Issue Delays Mission

Apr 24, 2025 -

Faa Study Focuses On Collision Risks At Las Vegas Airport

Apr 24, 2025

Faa Study Focuses On Collision Risks At Las Vegas Airport

Apr 24, 2025