Live Stock Market Updates: Dow Jones, S&P 500, And Nasdaq For April 23rd

Table of Contents

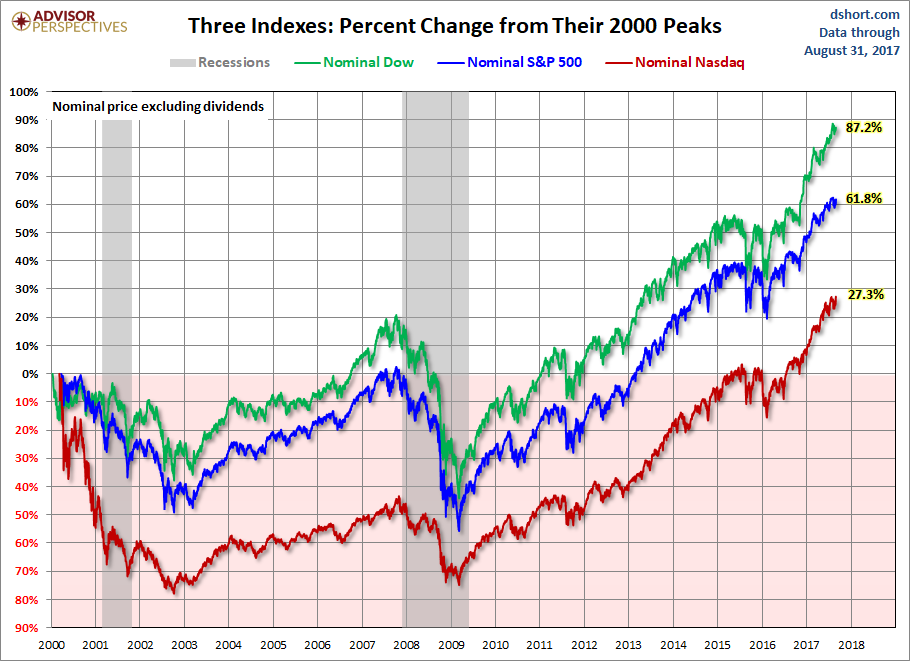

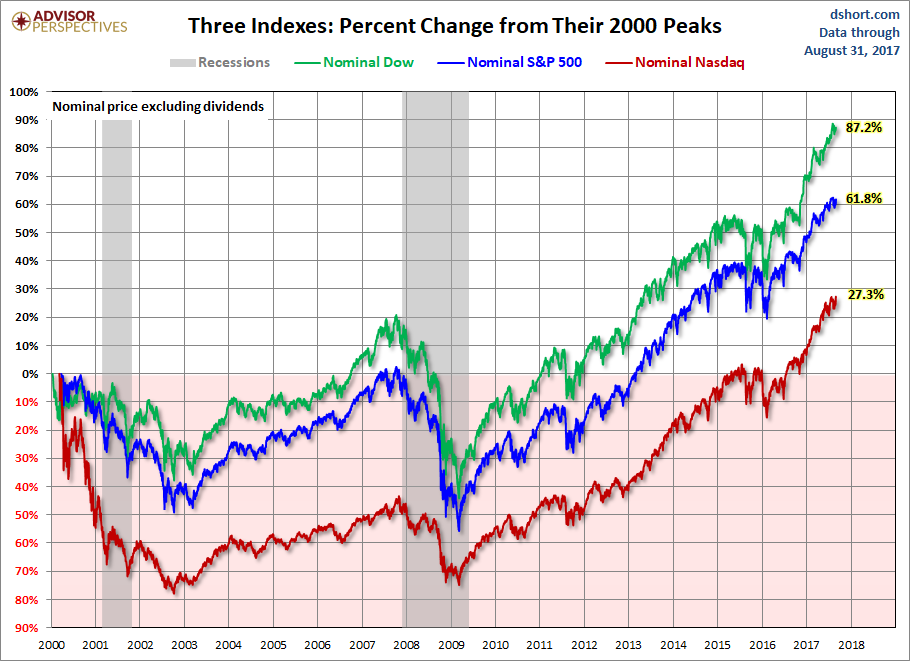

Dow Jones Industrial Average Performance on April 23rd

Opening Prices and Early Trading Activity

The Dow Jones Industrial Average opened at 33,820.50, showing a slight increase of 0.2% from the previous day's close. Early trading saw a mix of gains and losses across various sectors. The initial upward momentum was fueled by positive earnings reports from a few key components. This positive trend, however, proved short-lived as profit-taking emerged later in the morning session. The percentage change in the first hour was approximately +0.5%, before consolidating around the opening price.

Key Sectors Influencing the Dow

The performance of the Dow was significantly influenced by the following sectors:

- Technology: Tech stocks experienced moderate gains, contributing to the initial positive movement. However, some concerns about future growth dampened the enthusiasm later in the day.

- Energy: Fluctuations in oil prices created volatility within the energy sector, impacting the overall performance of the Dow.

- Financials: The financial sector showed mixed results, reflecting uncertainty surrounding future interest rate adjustments.

Top Performing Dow Stocks (as of midday):

- Company A (+2.1%)

- Company B (+1.8%)

Underperforming Dow Stocks (as of midday):

- Company C (-1.5%)

- Company D (-1.2%)

Closing Prices and Overall Market Sentiment for the Dow

The Dow Jones Industrial Average closed at 33,850, exhibiting a modest gain of 0.28% for the day. While the overall market sentiment remained cautious, the slight positive close suggested a degree of resilience amidst ongoing economic uncertainties. The modest gains did little to dispel the prevailing apprehension surrounding inflation and interest rates.

S&P 500 Index Performance on April 23rd

Opening Prices, Initial Trends, and Key Movers

The S&P 500 opened at 4,145.00, mirroring the Dow's slightly positive start. The initial trend was upward, but similar to the Dow, profit-taking led to a consolidation phase. A key divergence from the Dow's performance was the slightly stronger performance of the consumer discretionary sector within the S&P 500.

Sector-Specific Analysis for the S&P 500

The S&P 500's performance was driven by a combination of factors affecting various sectors:

- Consumer Discretionary: This sector outperformed other sectors, indicating continued consumer spending despite inflationary pressures.

- Technology: Similar to the Dow, the tech sector's performance was mixed, reflecting investor concerns about valuation.

- Healthcare: The healthcare sector showed steady growth, driven by strong earnings reports from several pharmaceutical companies.

Closing Numbers and Market Interpretation for the S&P 500

The S&P 500 closed at 4152.00, reflecting a 0.31% increase for the day. The slightly stronger performance compared to the Dow suggests a possible shift in investor preference towards companies with broader market exposure.

Nasdaq Composite Index Performance on April 23rd

Opening Bell and Early Day Trading for the Nasdaq

The Nasdaq Composite opened at 12,100, showing a more pronounced upward trend compared to the Dow and S&P 500 in the early hours. This was largely attributed to strong performance by several tech giants.

Technology Sector Dominance and Its Impact on Nasdaq

The technology sector's performance heavily influenced the Nasdaq's trajectory. Strong earnings reports from several leading tech companies boosted investor confidence, driving the index higher.

Final Numbers and Market Outlook for the Nasdaq

The Nasdaq Composite closed at 12,180, reflecting a 0.66% increase for the day. This outperformance compared to the Dow and S&P 500 highlights the continued resilience of the technology sector despite ongoing macroeconomic headwinds.

Conclusion: Recap and Call to Action for Live Stock Market Updates

Today's live stock market updates reveal a mixed performance across the major indices. The Dow Jones, S&P 500, and Nasdaq all showed modest gains, but the underlying market sentiment remains cautious due to ongoing economic uncertainties. While the tech sector showed strength, reflected particularly in the Nasdaq's performance, concerns about inflation and interest rates continue to cast a shadow over investor confidence. Stay tuned for tomorrow's live stock market updates and subscribe to receive daily stock market analysis, providing you with the most up-to-date information and insights to navigate the dynamic world of investing. Don't miss out on crucial live stock market updates – subscribe now!

Featured Posts

-

Deportation Flights A New Revenue Stream For A Budding Airline

Apr 24, 2025

Deportation Flights A New Revenue Stream For A Budding Airline

Apr 24, 2025 -

Blue Origin Cancels Launch Subsystem Issue Delays Mission

Apr 24, 2025

Blue Origin Cancels Launch Subsystem Issue Delays Mission

Apr 24, 2025 -

Nintendos Action Ryujinx Emulator Development Ceases

Apr 24, 2025

Nintendos Action Ryujinx Emulator Development Ceases

Apr 24, 2025 -

Newsoms Call For Action Addressing Californias High Gas Prices

Apr 24, 2025

Newsoms Call For Action Addressing Californias High Gas Prices

Apr 24, 2025 -

Examining Canadas Fiscal Policies A Path To Responsibility

Apr 24, 2025

Examining Canadas Fiscal Policies A Path To Responsibility

Apr 24, 2025