Minnesota Film Production: The Impact Of Tax Credits

Table of Contents

The Mechanics of Minnesota Film Tax Credits

Understanding the intricacies of Minnesota's film tax credit program is crucial for filmmakers looking to leverage these incentives. The program offers a percentage-based credit on qualified spending within the state. This includes expenses such as:

- Production labor costs (crew, actors)

- Location rentals and permits

- Equipment rentals

- Post-production services

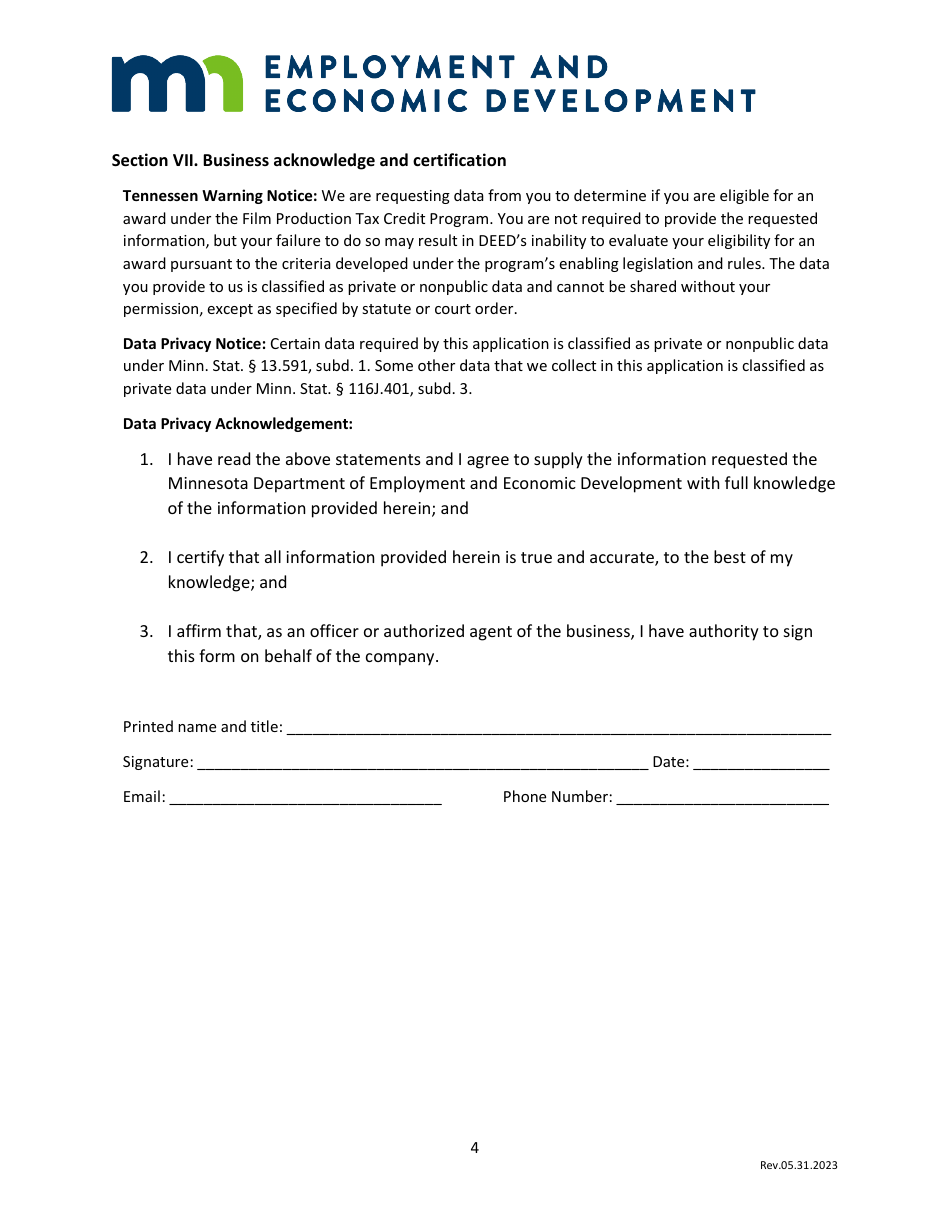

The Minnesota film tax credit application process involves submitting detailed documentation, including a budget breakdown, production schedule, and proof of expenditure. Eligibility requirements are carefully defined, focusing on projects that meet specific criteria, such as a minimum level of spending within Minnesota and adherence to certain employment guidelines. The Minnesota film credit requirements are designed to ensure the program effectively stimulates the local economy. There are limitations, of course; these film production tax incentives Minnesota are not unlimited and are subject to annual budget allocations. Careful planning and adherence to the guidelines laid out in the qualified film production expenses guidelines are vital for maximizing the benefits.

Economic Impact of Film Tax Credits on Minnesota

The economic ripple effects of Minnesota's film tax credits are substantial. The program fuels job creation across various sectors:

- Direct jobs: Employment for actors, directors, crew members, and production staff.

- Indirect jobs: Support roles in hotels, restaurants, transportation, and local businesses servicing film productions.

Film productions inject significant revenue into the local economy through spending on goods and services. A study by [cite a relevant source here, e.g., the Minnesota Film Office] found that [insert specific data, e.g., "film productions generated X million dollars in revenue in 2022"]. This film production spending directly benefits local businesses, generating tax revenue for the state and stimulating further economic activity. Comparing Minnesota's state film incentives to those of other states reveals that the program is competitive and effective in attracting productions. The growth of the Minnesota film industry and the increase in Minnesota film industry jobs are demonstrably linked to these incentives. Analyzing the economic benefits of film tax credits clearly shows a positive return on investment for the state.

Attracting Film Projects to Minnesota

The availability of competitive film production tax incentives positions Minnesota favorably in the quest to attract film productions. These competitive film incentives offer significant film production cost savings for filmmakers, making Minnesota a more attractive and budget-friendly location compared to other states. This translates to increased profitability for productions, encouraging filmmakers to choose Minnesota for their projects. Successful films produced in Minnesota, such as [insert examples of successful films shot in Minnesota], demonstrate the tangible benefits of the program. Moreover, the influx of film productions enhances Minnesota's Minnesota film locations and boosts its image as a vibrant and dynamic location for filmmaking, contributing positively to the state's overall boosting Minnesota's film image.

Challenges and Future of Minnesota Film Tax Credits

While the benefits of Minnesota's film tax credit program are undeniable, challenges remain. Budget constraints necessitate careful management of allocated funds, and mechanisms to prevent potential challenges of film tax credits, such as fraud or abuse, must be constantly reviewed. Ensuring the sustainability of film incentives requires ongoing evaluation and potential adjustments to the program's structure. Discussions surrounding Minnesota film tax credit reform are vital to ensure the program remains effective and competitive in the long term. Looking to the future of Minnesota film industry, exploring innovative improvements to the program and aligning it with evolving industry trends will be crucial for continued success.

Investing in Minnesota's Future Through Film Production Tax Credits

In conclusion, Minnesota's film tax credit program has demonstrably positive economic impacts, fostering the growth of the Minnesota film industry and generating significant revenue and job creation. The film tax credit benefits are clear, making Minnesota an attractive location for filmmakers seeking film tax credit benefits. We urge filmmakers to consider Minnesota for their next project, taking advantage of the attractive Minnesota film production tax credits available. Learn more about applying for the credits and discover the exciting Minnesota film opportunities available by visiting [link to relevant website, e.g., the Minnesota Film Office website]. Let's continue to grow the Minnesota film industry together!

Featured Posts

-

Minnesota Governor Under Fire Attorney Generals Transgender Sports Order

Apr 29, 2025

Minnesota Governor Under Fire Attorney Generals Transgender Sports Order

Apr 29, 2025 -

160 Mlb

Apr 29, 2025

160 Mlb

Apr 29, 2025 -

Minnesota Faces Attorney General Pressure Over Trumps Transgender Athlete Ban

Apr 29, 2025

Minnesota Faces Attorney General Pressure Over Trumps Transgender Athlete Ban

Apr 29, 2025 -

The Role Of Tax Credits In Growing Minnesotas Film Industry

Apr 29, 2025

The Role Of Tax Credits In Growing Minnesotas Film Industry

Apr 29, 2025 -

Trumps Transgender Athlete Ban Us Attorney General Issues Warning To Minnesota

Apr 29, 2025

Trumps Transgender Athlete Ban Us Attorney General Issues Warning To Minnesota

Apr 29, 2025