Restoring Fiscal Prudence: A New Vision For Canada's Economy

Table of Contents

Addressing the National Debt

Understanding the Current Debt Situation

Canada's national debt is a significant concern. Understanding the current state of affairs is crucial for implementing effective solutions.

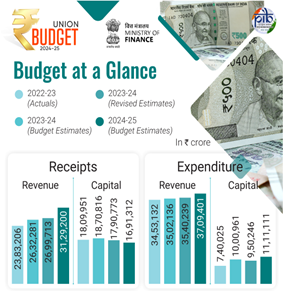

- Current national debt figures: As of [Insert most recent data – source needed], Canada's national debt stands at [Insert figure – source needed], representing [Percentage of GDP – source needed].

- Comparison to other G7 nations: Compared to other G7 countries, Canada's debt-to-GDP ratio is [Insert comparative data – source needed], highlighting the need for fiscal responsibility.

- Historical context of debt accumulation: The growth of Canada's national debt can be attributed to factors such as [List key factors – e.g., economic downturns, government spending programs, etc. – source needed].

Rising interest rates significantly impact debt servicing costs. Higher interest rates mean the government pays more to service its existing debt, leaving less money for essential public services and strategic investments. This necessitates a proactive approach to debt reduction.

Strategies for Debt Reduction

Effectively managing and reducing Canada's national debt requires a multi-pronged strategy encompassing spending cuts and revenue generation.

- Implementing targeted spending cuts: Identifying and eliminating wasteful or inefficient government spending is crucial. This requires a thorough review of all government programs and services to prioritize essential functions.

- Identifying areas of government inefficiency: Streamlining government operations, reducing bureaucratic red tape, and leveraging technology to improve efficiency can significantly reduce costs.

- Exploring innovative revenue generation models: This could involve adjusting existing taxes like the carbon tax to incentivize environmentally friendly practices, or exploring new revenue streams, all while maintaining social equity.

The potential economic and social consequences of different debt reduction strategies must be carefully considered. A balanced approach that protects vulnerable populations while promoting long-term economic sustainability is essential. Careful consideration of the impact on various socioeconomic groups is vital for ensuring equitable fiscal policies.

Prioritizing Strategic Investments

While debt reduction is important, it shouldn't come at the expense of essential investments that drive long-term economic growth.

Investing in Infrastructure

Investing in modern infrastructure is crucial for boosting economic productivity and improving the quality of life for Canadians.

- Economic benefits of infrastructure investment: Modern transportation networks, robust energy grids, and advanced digital infrastructure reduce business costs, improve efficiency, and attract investment.

- Job creation and long-term productivity gains: Infrastructure projects create jobs during construction and operation, while improved infrastructure boosts overall productivity.

Strategic investments in infrastructure are not just about building roads and bridges; they are about building a more resilient and competitive economy for the future.

Human Capital Development

Investing in education, skills training, and healthcare is vital for a productive workforce and strong economic growth.

- Importance of education, skills training, and healthcare: A well-educated and healthy workforce is more productive, adaptable, and innovative, contributing to a stronger economy.

- Long-term economic benefits of a skilled and healthy workforce: A skilled workforce attracts investment, fosters innovation, and boosts national competitiveness.

- Initiatives like apprenticeships and reskilling programs: These programs help workers acquire new skills and adapt to the evolving job market, contributing to a more resilient and adaptable workforce.

Examples from other countries demonstrating the success of human capital development initiatives provide valuable lessons for Canada’s economic policy.

Promoting Sustainable Economic Growth

Diversification and strong trade relationships are key to achieving sustainable economic growth.

Diversifying the Canadian Economy

Reducing reliance on specific sectors and investing in emerging technologies is vital for long-term economic stability.

- Reducing reliance on specific sectors: Over-reliance on sectors like oil and gas exposes the Canadian economy to price volatility and global market fluctuations. Diversification mitigates these risks.

- Investing in emerging technologies: Investing in green energy, artificial intelligence, and other emerging technologies creates new opportunities and fosters innovation.

- Promoting entrepreneurship and innovation: Supporting entrepreneurs and fostering a culture of innovation are essential for driving economic growth and diversification.

Economic diversification reduces vulnerability to external shocks and fosters resilience in the face of global economic uncertainties.

Strengthening Trade Relationships

Expanding export markets and attracting foreign investment are crucial for economic growth.

- Negotiating favorable trade agreements: Access to global markets through advantageous trade deals stimulates economic activity and generates revenue.

- Expanding export markets: Diversifying export markets reduces reliance on any single trading partner, making the economy more resilient to global shocks.

- Attracting foreign investment: Foreign investment brings capital, expertise, and creates jobs.

Successful Canadian trade partnerships demonstrate the economic benefits of international collaboration and engagement in global markets.

Enhancing Transparency and Accountability

Improving budget transparency and strengthening oversight mechanisms build public trust and ensure responsible spending.

Improving Budget Transparency

Open and accessible government budget information enhances public understanding and trust in government financial management.

- Implementing measures to improve clarity and accessibility: User-friendly online platforms and simplified budget reports can increase public comprehension.

- Promoting open data initiatives: Making government data publicly available allows citizens to track government spending and hold officials accountable.

Strengthening Oversight Mechanisms

Robust oversight mechanisms are critical for preventing wasteful spending and promoting accountability.

- Enhancing the role of parliamentary committees: Parliamentary scrutiny of government spending enhances transparency and accountability.

- Strengthening independent oversight bodies: Independent audits and reviews ensure that government funds are used effectively and efficiently.

Conclusion

Restoring fiscal prudence in Canada is paramount for building a sustainable and prosperous future. By combining debt reduction, strategic investments, and enhanced transparency, Canada can secure its long-term economic health. The path to achieving fiscal prudence requires commitment from all levels of government and a shared understanding of the long-term benefits of fiscal responsibility. Let's work together to build a Canada where fiscal prudence is the cornerstone of sustainable economic growth. Learn more about building a fiscally responsible future for Canada and the importance of fiscal prudence in Canada by [link to relevant resource].

Featured Posts

-

Ryujinx Emulators End A Report On Nintendos Involvement

Apr 24, 2025

Ryujinx Emulators End A Report On Nintendos Involvement

Apr 24, 2025 -

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025 -

Fiscal Responsibility A Critical Element Of Canadas Vision

Apr 24, 2025

Fiscal Responsibility A Critical Element Of Canadas Vision

Apr 24, 2025 -

Negotiation Possible Harvards Lawsuit Against Trump Administration

Apr 24, 2025

Negotiation Possible Harvards Lawsuit Against Trump Administration

Apr 24, 2025 -

The Los Angeles Wildfires And The Growing Problem Of Disaster Betting

Apr 24, 2025

The Los Angeles Wildfires And The Growing Problem Of Disaster Betting

Apr 24, 2025