Retail Sales Slump: A Precursor To Bank Of Canada Rate Cuts?

Table of Contents

The Severity of the Retail Sales Slump

The recent retail sales decline in Canada is a significant cause for concern. Statistics Canada's latest reports reveal a substantial drop in consumer spending, indicating weakening consumer confidence and shifting spending habits. This downturn reflects a broader economic slowdown and warrants careful analysis.

- Percentage decrease: [Insert actual percentage decrease from reliable source, e.g., Statistics Canada]. This represents a [description of the significance, e.g., the largest monthly drop in X years].

- Struggling sectors: The slump is particularly pronounced in the [mention specific sectors, e.g., durable goods, automotive, and discretionary spending] sectors, suggesting consumers are prioritizing essential purchases amidst economic uncertainty. The housing market slowdown is also significantly impacting furniture and home improvement retail sales.

- Year-over-year comparison: Compared to the same period last year, retail sales are down by [insert percentage] showcasing a sustained decline in consumer spending.

- Geographic variations: While the nationwide trend shows a decline, some regions are experiencing a more pronounced drop than others. [Mention regional variations if data is available and relevant].

Inflation's Persistent Grip

Inflation remains a persistent challenge, significantly impacting consumer spending and contributing to the retail sales slump. High inflation erodes purchasing power, forcing consumers to cut back on discretionary spending. The Bank of Canada's current inflation targets are [state the target inflation rate], but the current rate remains stubbornly above this target at [state the current inflation rate].

- Impact on purchasing power: With inflation at [current inflation rate], the cost of goods and services is increasing faster than wages for many Canadians, reducing their disposable income and leading to decreased retail spending.

- Bank of Canada's inflation targets: The Bank of Canada aims to bring inflation back to its 2% target, but achieving this goal in the current economic climate presents significant challenges.

- Effectiveness of current monetary policy: The Bank of Canada's previous interest rate hikes, aimed at curbing inflation, seem to be impacting consumer spending more than anticipated, contributing to the retail sales slump.

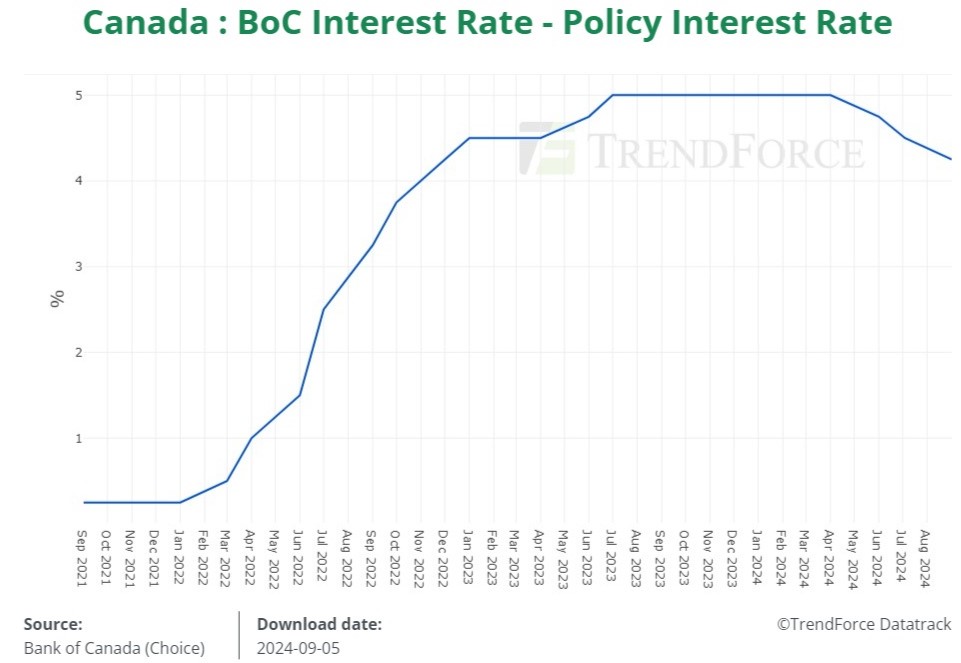

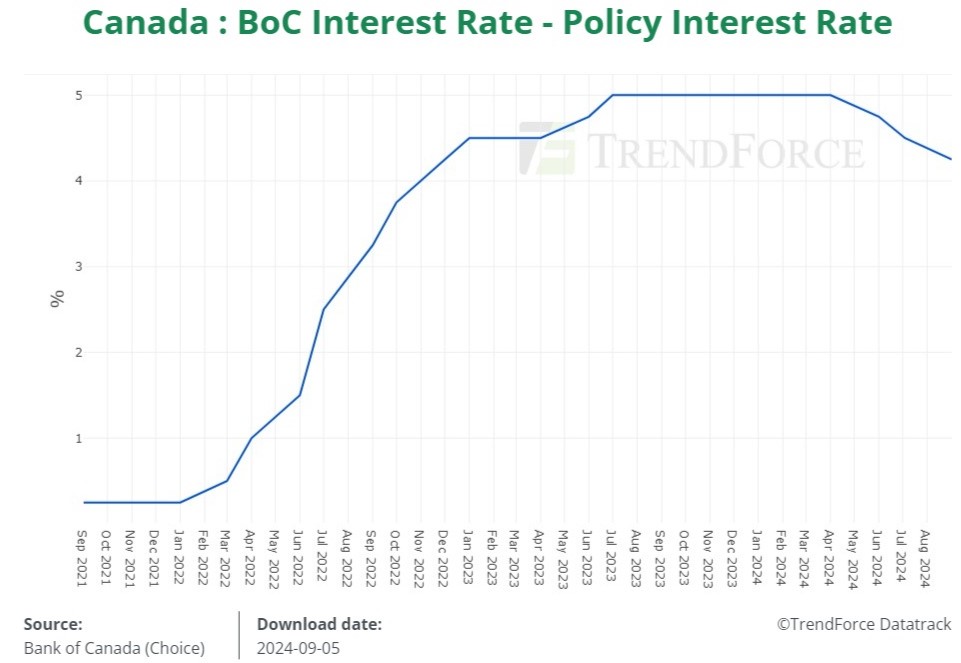

The Bank of Canada's Response

The Bank of Canada's response to the weakening economy and the retail sales slump will be crucial in shaping future economic prospects. Recent statements from the Bank suggest a cautious approach, acknowledging the economic slowdown but remaining vigilant about inflation. However, the significant retail sales slump may force a reconsideration of the current monetary policy.

- Recent announcements: The Bank of Canada's [mention recent meetings and statements, e.g., most recent interest rate announcement] indicated [summarize the key takeaways from their statements].

- Predictions for future interest rate decisions: Given the severity of the retail sales decline and other economic indicators, some economists predict [mention potential scenarios, e.g., a pause in interest rate hikes, or even potential rate cuts].

- Potential impacts: A further interest rate hike could exacerbate the economic slowdown and deepen the retail sales slump. Conversely, rate cuts could stimulate consumer spending but might also fuel inflation further.

Alternative Economic Indicators

While the retail sales slump is a significant indicator of economic weakness, it's crucial to consider other economic indicators for a more comprehensive understanding of the Canadian economy.

- GDP growth rate: [Insert current GDP growth rate and analysis]. A slowing GDP suggests broader economic weakness.

- Employment data: [Insert recent employment data and analysis]. High unemployment or slowing job growth reinforces concerns about consumer confidence.

- Housing market trends: The cooling housing market, evident in declining sales and prices, also contributes to reduced consumer spending, impacting related retail sectors.

- Consumer sentiment: Consumer confidence indices [mention specific indices and their current values] indicate [interpret the findings in relation to consumer spending].

Conclusion

The recent retail sales slump in Canada is a significant concern, highlighting a weakening economy. Persistent inflation and the cooling housing market are contributing factors. The severity of the decline raises questions about the Bank of Canada's future monetary policy decisions. While previous interest rate hikes aimed to curb inflation, the significant impact on consumer spending and the retail sector might lead the Bank to reconsider its approach, potentially paving the way for interest rate cuts or a pause in further increases. However, the Bank must carefully balance the risks of fueling inflation further with the need to prevent a deeper economic contraction. The interplay between these factors remains uncertain, emphasizing the need for continued monitoring of economic indicators beyond the retail sales slump. Stay informed about the evolving economic situation and the Bank of Canada's response to the retail sales slump and other key economic indicators. Regularly check this website and other reputable sources for updates on Bank of Canada rate decisions and their impact on the Canadian economy. Understanding the nuances of the retail sales slump and its broader economic implications is key to navigating these uncertain times.

Featured Posts

-

Frieds Strong Debut Leads Yankees To 12 3 Win Against Pirates

Apr 28, 2025

Frieds Strong Debut Leads Yankees To 12 3 Win Against Pirates

Apr 28, 2025 -

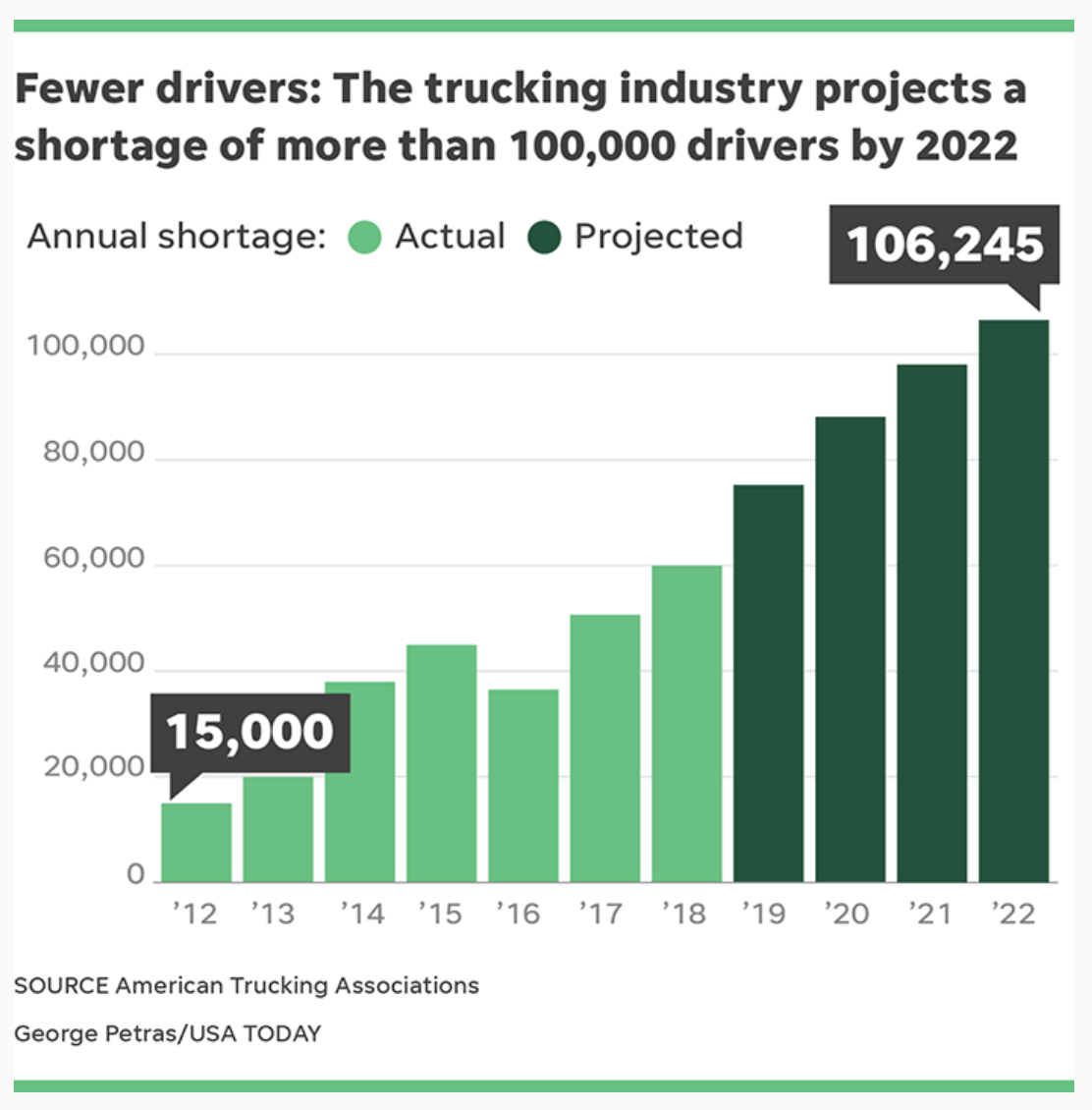

Addressing The Issue Of Excessive Truck Size In America

Apr 28, 2025

Addressing The Issue Of Excessive Truck Size In America

Apr 28, 2025 -

Florida Keys Road Trip From Railroad To Highway

Apr 28, 2025

Florida Keys Road Trip From Railroad To Highway

Apr 28, 2025 -

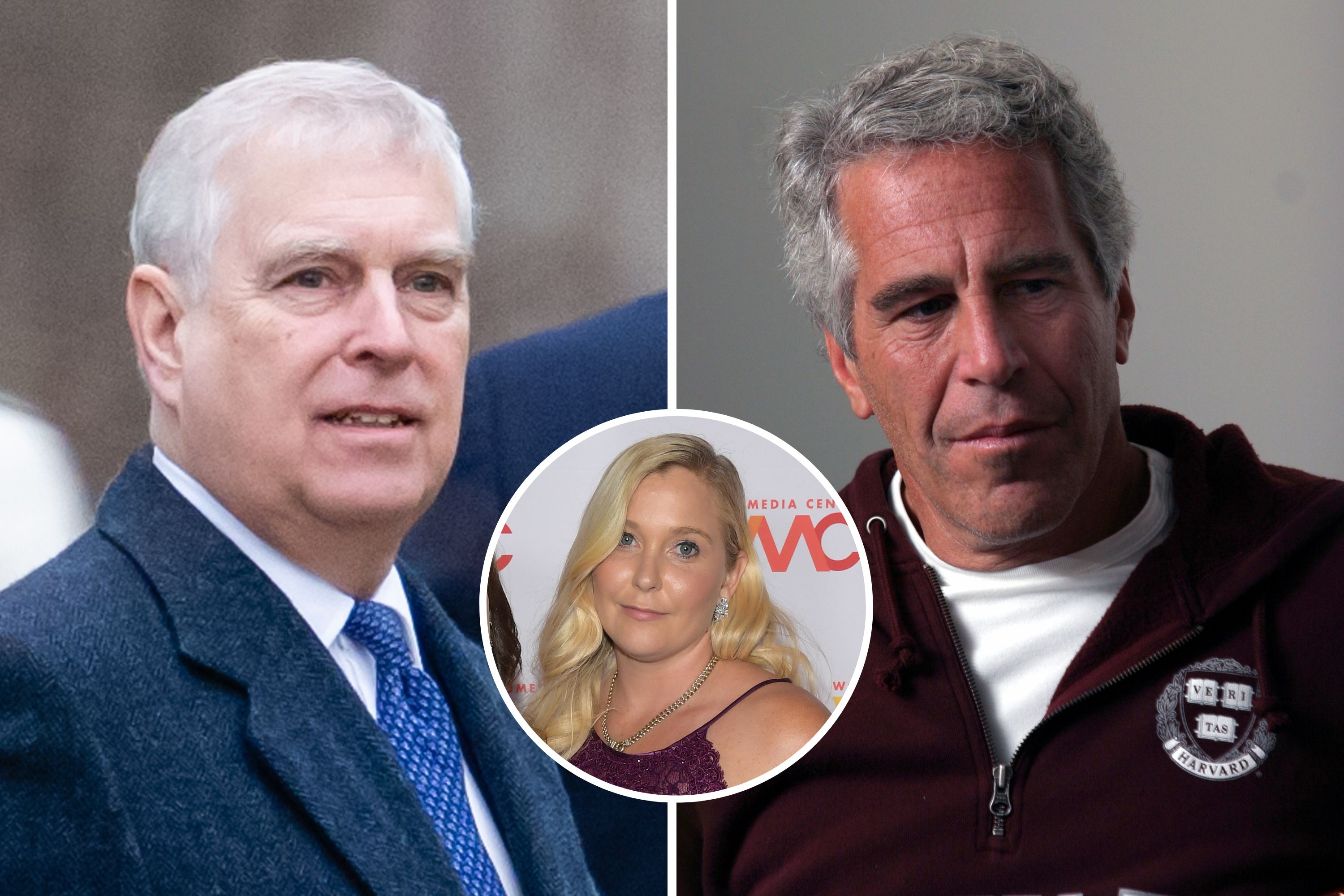

Virginia Giuffres Death A Key Figure In The Epstein Case Passes Away

Apr 28, 2025

Virginia Giuffres Death A Key Figure In The Epstein Case Passes Away

Apr 28, 2025 -

New X Financials Debt Sale Sheds Light On Company Transformation

Apr 28, 2025

New X Financials Debt Sale Sheds Light On Company Transformation

Apr 28, 2025