Sharp Decline In Tesla's Q1 Profit: The Musk Factor And Its Consequences

Table of Contents

Price Wars and Reduced Margins

Tesla's aggressive price cuts, initiated in response to intensifying competition in the EV market, significantly impacted profit margins during Q1. This strategy, while boosting sales volume and Tesla sales, eroded profitability. The company's aim was to maintain its market share and increase its presence in a rapidly growing yet increasingly competitive sector. However, this decision came at a cost.

-

Magnitude of Price Reductions: Tesla implemented substantial price reductions across its model range, impacting the per-unit profit margin significantly. These cuts varied depending on the specific model and region but were substantial enough to create a noticeable impact on the overall financial results.

-

Comparison with Competitors: While other EV manufacturers also engaged in some price adjustments, Tesla's cuts were arguably more aggressive, potentially triggering a price war within the automotive industry and affecting the entire EV price landscape. This competitive pricing strategy put pressure on profit margins across the board.

-

Impact on Per-Unit Profitability: The direct consequence of these price cuts was a considerable reduction in per-unit profitability. While the increase in sales volume offered some compensation, it wasn't enough to offset the losses incurred from lower prices. This directly impacted the Tesla Q1 profit.

-

Long-Term Viability: The long-term viability of this pricing strategy remains questionable. While it might secure short-term market share gains, sustained price wars rarely benefit any participant long-term. Tesla needs to find a balance between volume and profitability to ensure sustainable growth.

The Elon Musk Factor: Leadership and Market Volatility

Elon Musk's leadership style and involvement in ventures outside of Tesla (most notably, Twitter) have significantly contributed to market volatility and uncertainty surrounding the company's future. This has negatively impacted investor confidence and, consequently, Tesla's stock price. The perception of risk associated with Musk's leadership has played a crucial role in the recent decline.

-

Impact of Twitter Acquisition: The Twitter acquisition, along with its associated financial burdens and distractions, significantly impacted Tesla's stock performance. Investor concerns about resource allocation and potential conflicts of interest led to fluctuations and a decline in stock value.

-

Musk's Public Statements: Musk's public statements, often controversial and unpredictable, have repeatedly influenced market sentiment. His pronouncements on various topics, both related and unrelated to Tesla, can trigger significant shifts in the company's stock price.

-

Alternative Leadership Styles: A more focused and less volatile leadership style might have mitigated some of the negative impacts on Tesla's market valuation. A more predictable approach might have instilled greater confidence among investors.

-

Long-Term Implications: The long-term implications of Musk's influence remain to be seen. The need for a more stable leadership structure to build long-term investor confidence within the company becomes increasingly apparent.

Increased Competition in the EV Market

The electric vehicle market is becoming increasingly competitive. Established automakers and new entrants are launching compelling alternatives to Tesla's offerings. This heightened competition puts pressure on Tesla's market share and profitability. The days of Tesla dominating the EV landscape without significant competition are over.

-

Key Competitors and Strategies: Competitors such as BYD, Volkswagen, and Ford are aggressively investing in EV technology and expanding their product portfolios, directly challenging Tesla's dominance. Their strategies often include competitive pricing and advancements in battery technology.

-

Competitive Landscape Impact: This competitive landscape significantly impacts Tesla's position. The company faces increasing pressure to innovate, improve efficiency, and maintain its competitive edge.

-

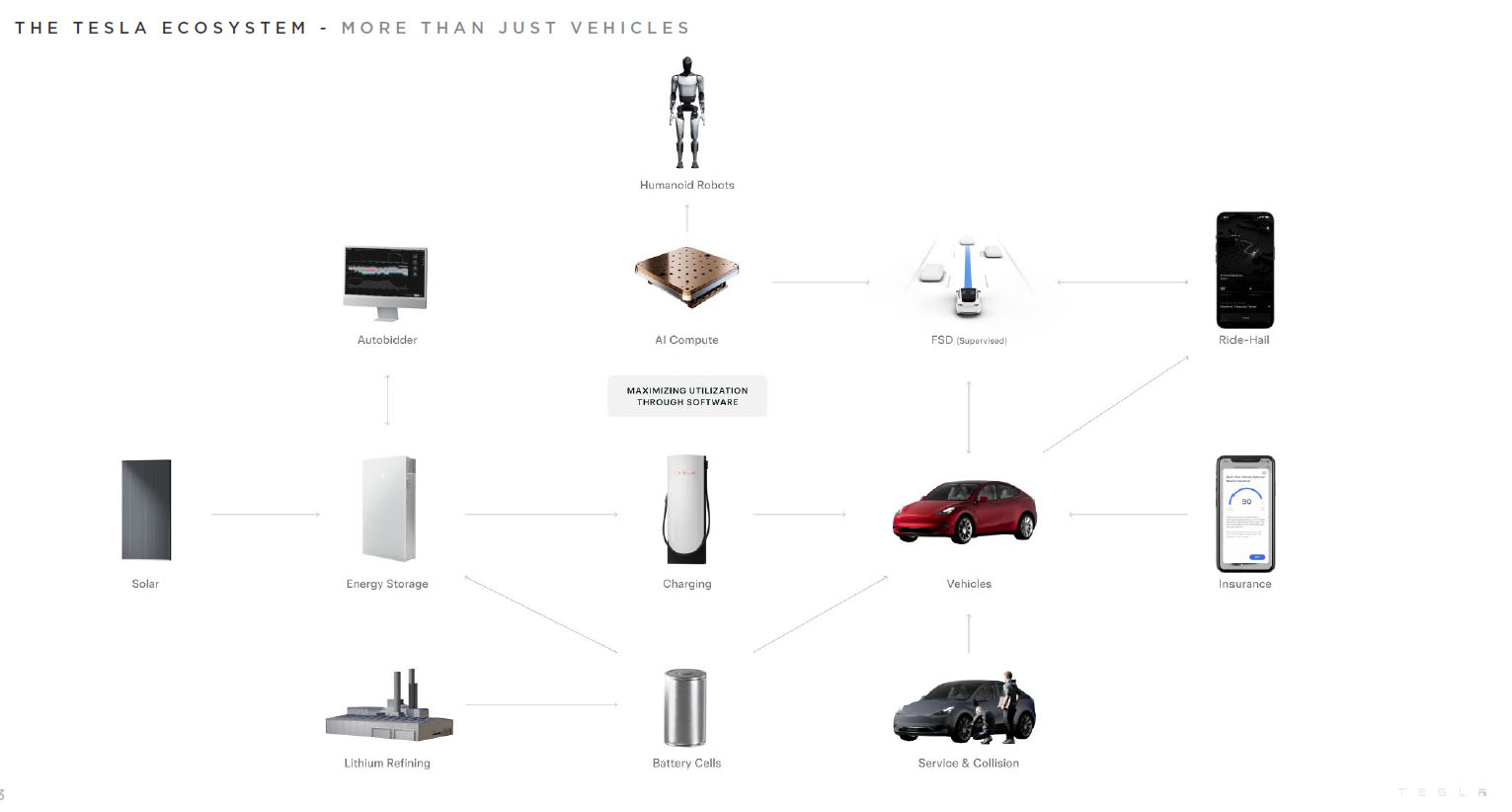

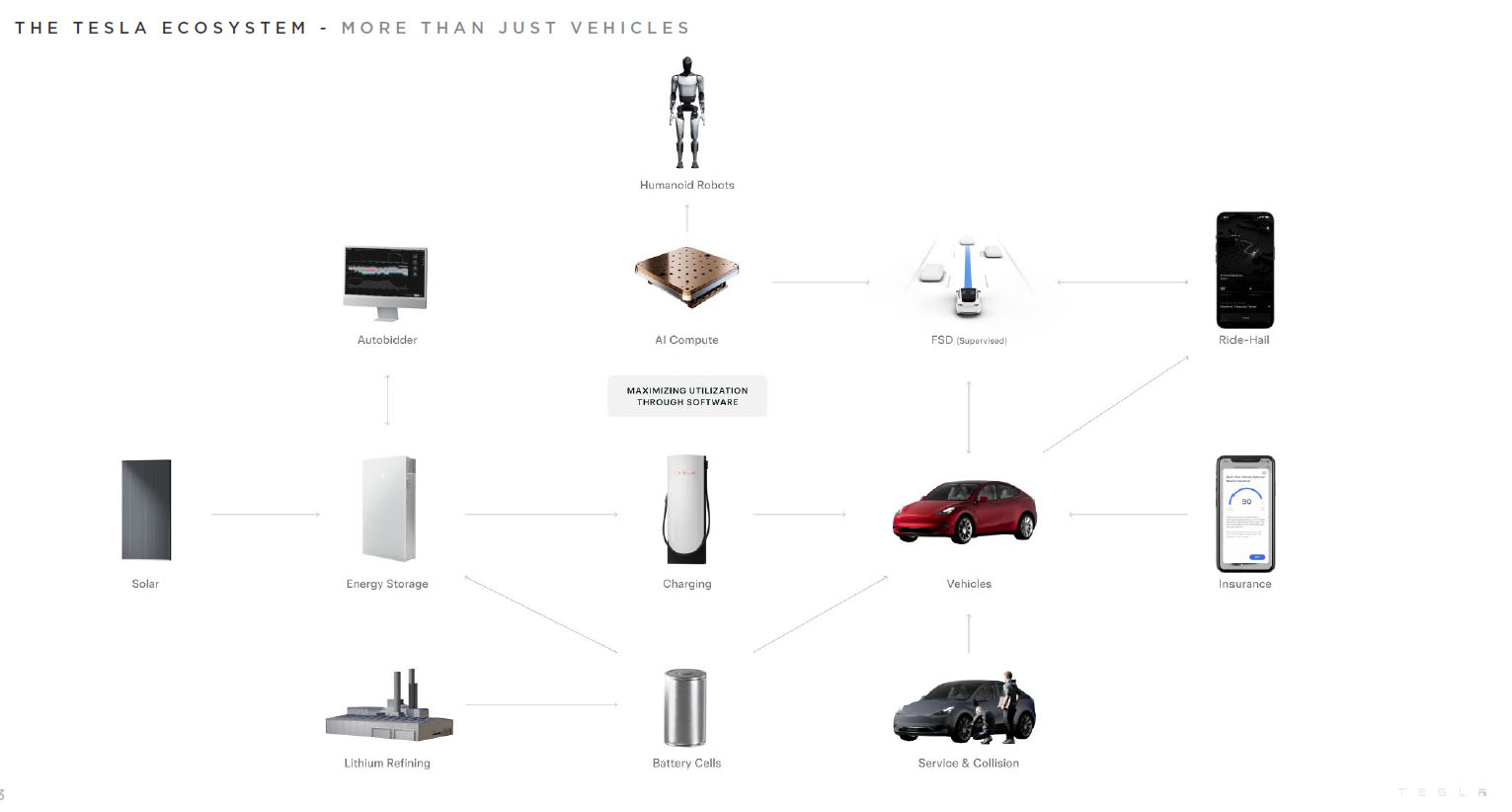

Tesla's Competitive Advantages and Disadvantages: While Tesla retains advantages in brand recognition and Supercharger network, it faces challenges in areas such as affordability, supply chain management, and certain aspects of vehicle technology.

Supply Chain Challenges and Production Bottlenecks

Ongoing global supply chain disruptions and potential production bottlenecks have played a significant role in the decline of Tesla’s Q1 profit. Increased costs associated with sourcing raw materials and managing logistics can significantly affect profitability. These issues underscore the vulnerability of even the largest manufacturers to external factors.

-

Impact of Supply Chain Challenges: Disruptions in the supply of critical components, such as battery materials and semiconductors, have constrained Tesla's production capacity, leading to lost revenue and increased costs.

-

Strategies to Mitigate Supply Chain Risks: Tesla has implemented various strategies to mitigate supply chain risks, including diversification of suppliers and investment in vertical integration. However, the effectiveness of these strategies is still being tested.

-

Potential for Future Disruptions: The potential for future supply chain disruptions remains a significant concern, and Tesla needs to continue to invest in robust contingency planning.

-

Manufacturing Efficiency: Improving manufacturing efficiency and streamlining production processes is crucial for Tesla to counter the impact of supply chain issues and regain profitability.

Conclusion

Tesla's Q1 profit decline is a complex issue resulting from a confluence of factors, including aggressive price cuts, market volatility influenced by Elon Musk's leadership, intensified competition in the EV market, and ongoing supply chain challenges. These factors highlight the significant challenges facing Tesla in maintaining its position as a leading player in the rapidly evolving electric vehicle industry. The interplay between these factors underscores the need for a more comprehensive and nuanced understanding of the company's future trajectory.

Call to Action: Understanding the intricacies of Tesla's Q1 profit decline and the "Musk factor" is crucial for investors and industry analysts alike. Stay informed about the ongoing developments and future financial performance of Tesla to navigate the complexities of this dynamic market. Continue following our analysis of Tesla's financial performance to stay ahead on the evolving story of Tesla's Q1 profit and its implications for the future.

Featured Posts

-

Trumps Stance On Powell No Plans For Fed Chair Dismissal

Apr 24, 2025

Trumps Stance On Powell No Plans For Fed Chair Dismissal

Apr 24, 2025 -

Newsoms Call For Action Addressing Californias High Gas Prices

Apr 24, 2025

Newsoms Call For Action Addressing Californias High Gas Prices

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Liams Medical Crisis And Possible Demise

Apr 24, 2025

The Bold And The Beautiful Spoilers Liams Medical Crisis And Possible Demise

Apr 24, 2025 -

Cybercriminal Accused Of Multi Million Dollar Office365 Executive Account Breach

Apr 24, 2025

Cybercriminal Accused Of Multi Million Dollar Office365 Executive Account Breach

Apr 24, 2025 -

Whataburger Video Propels Hisd Mariachi To Uil State Competition

Apr 24, 2025

Whataburger Video Propels Hisd Mariachi To Uil State Competition

Apr 24, 2025