Stock Market Rally: Futures Soar On Trump's Stance Towards Powell

Table of Contents

Trump's Criticism of Powell and its Market Impact

President Trump's public pronouncements regarding the Federal Reserve and its chairman, Jerome Powell, have repeatedly sent shockwaves through the financial markets. His comments often express dissatisfaction with the Fed's monetary policy, particularly interest rate decisions. Understanding the impact of these statements is crucial to navigating the complexities of the current stock market environment.

The President's Statements:

Analyzing President Trump's statements is key to understanding the recent stock market rally. His criticisms of Powell have ranged from subtle disapproval to outright condemnation of the Fed's actions.

- Tone and Content: The tone of the statements has varied, sometimes appearing critical and at other times overtly hostile. The content frequently focuses on the perceived negative economic consequences of interest rate hikes and a slower pace of quantitative easing.

- Contrast with Previous Communications: These comments represent a departure from periods of apparent tacit agreement, showcasing the dynamic and often unpredictable nature of the relationship between the executive branch and the independent central bank.

- Verifying Sources: Reputable news sources such as the New York Times, Wall Street Journal, and Reuters regularly report on presidential statements related to the Federal Reserve. These sources provide verifiable accounts of the President's comments.

Market Reaction to Presidential Intervention:

The market's reaction to Trump's comments has been swift and dramatic, often resulting in short-term volatility.

- Major Index Gains: The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all experienced significant gains following certain presidential pronouncements, illustrating the immediate impact on investor sentiment.

- Futures Trading Surge: Futures contracts, which reflect expectations for future price movements, show a notable increase in trading volume in response to Trump's comments, signifying heightened investor activity and speculation.

- Volatility Before and After: Market volatility, measured by metrics like the VIX index (the "fear gauge"), often shows spikes both before and after these presidential interventions, reflecting the uncertainty surrounding policy decisions and their potential impact.

The Influence of Uncertainty on Investor Behavior:

Uncertainty, fueled by political pronouncements, significantly impacts investor behavior and decision-making.

- Risk-On vs. Risk-Off Sentiment: When investors perceive increased certainty (often after perceived positive statements), a "risk-on" sentiment emerges, leading to increased investment in equities. Conversely, uncertain periods lead to a "risk-off" attitude, causing investors to shift towards safer assets like government bonds.

- Market Psychology and Speculation: Market psychology plays a vital role. Investor confidence, often influenced by news and political rhetoric, drives short-term fluctuations in asset prices, creating opportunities for both gains and losses.

- Short-Term and Long-Term Strategies: Investors must adapt their strategies based on the level of uncertainty. Short-term traders may capitalize on short-term volatility, while long-term investors may seek to maintain a diversified portfolio to mitigate risk.

Analyzing the Underlying Economic Factors

Understanding the underlying economic conditions is crucial for interpreting the impact of political statements on the stock market.

Current Economic Indicators:

Economic indicators provide context for assessing the strength and sustainability of the recent stock market rally.

- Relevance to the Rally: Key indicators like GDP growth, inflation rates, and unemployment figures influence investor confidence and market valuations. Strong economic data generally supports a positive market outlook.

- Conflicts Between President's Goals and Fed's Mandate: The President’s desires for specific economic outcomes (e.g., faster growth, lower unemployment) might conflict with the Fed's mandate of price stability and maximum employment, creating tension and uncertainty.

- Reliable Economic Data Sources: The Federal Reserve, the Bureau of Economic Analysis (BEA), and the Bureau of Labor Statistics (BLS) provide reliable economic data that investors should consult to form their own informed opinions.

The Federal Reserve's Role:

The Federal Reserve's role in maintaining economic stability is paramount, and its independence from political influence is essential for its effectiveness.

- Consequences of Political Pressure: Political pressure on the Fed’s decision-making process could compromise its ability to act independently in the best interests of the economy. This could lead to erratic monetary policy and increased market volatility.

- Long-Term Effects of Politicizing Monetary Policy: Politicizing monetary policy can erode investor confidence in the central bank's ability to manage the economy effectively, potentially leading to higher inflation and increased economic instability in the long run.

- Past Instances of Political Interference: Historical examples of political interference in central bank operations highlight the potential negative consequences of such actions on economic stability and market confidence.

Potential Implications and Future Outlook for the Stock Market Rally

Predicting the future of the stock market is inherently challenging, but analyzing potential factors can help investors prepare.

Sustainability of the Rally:

The sustainability of the current stock market rally is debatable and depends on several interacting factors.

- Factors Supporting Upward Trend: Continued strong economic growth, positive corporate earnings, and low interest rates could contribute to a sustained rally.

- Potential Risks and Headwinds: Geopolitical risks, escalating trade tensions, unexpected economic downturns, and changes in interest rate policies could reverse the rally.

- Balanced Perspective: It is important to maintain a balanced perspective; while the current rally may continue, the inherent volatility of the market necessitates careful monitoring and strategic adjustments.

Advice for Investors:

Navigating the complexities of the stock market requires informed decision-making and risk management.

- Managing Risk and Capitalizing on Opportunities: Diversification, disciplined investing, and a long-term perspective are essential for mitigating risk. Opportunities may exist within specific sectors or individual companies.

- Informed Decision-Making: Thorough research, understanding market dynamics, and staying updated on current events are crucial for effective investment strategies.

- Consulting a Financial Advisor: Seeking professional advice from a qualified financial advisor is highly recommended to create a personalized investment plan that aligns with individual financial goals and risk tolerance.

Conclusion

President Trump's comments on Federal Reserve Chairman Jerome Powell have demonstrably impacted market sentiment, leading to a significant stock market rally. This highlights the considerable influence of political factors on investor behavior and market volatility. Understanding the underlying economic factors, the Federal Reserve's role, and the potential risks associated with this stock market rally is crucial for making informed investment decisions. The sustainability of this market rally remains uncertain, highlighting the need for a balanced approach and informed decision-making. Stay informed about the ongoing developments affecting the stock market, continue to monitor news and economic data, and consider consulting with a financial advisor to effectively manage your portfolio. Understanding the nuances of the stock market rally is vital for navigating this dynamic environment.

Featured Posts

-

Ray Epps Sues Fox News For Defamation Over January 6th Claims

Apr 24, 2025

Ray Epps Sues Fox News For Defamation Over January 6th Claims

Apr 24, 2025 -

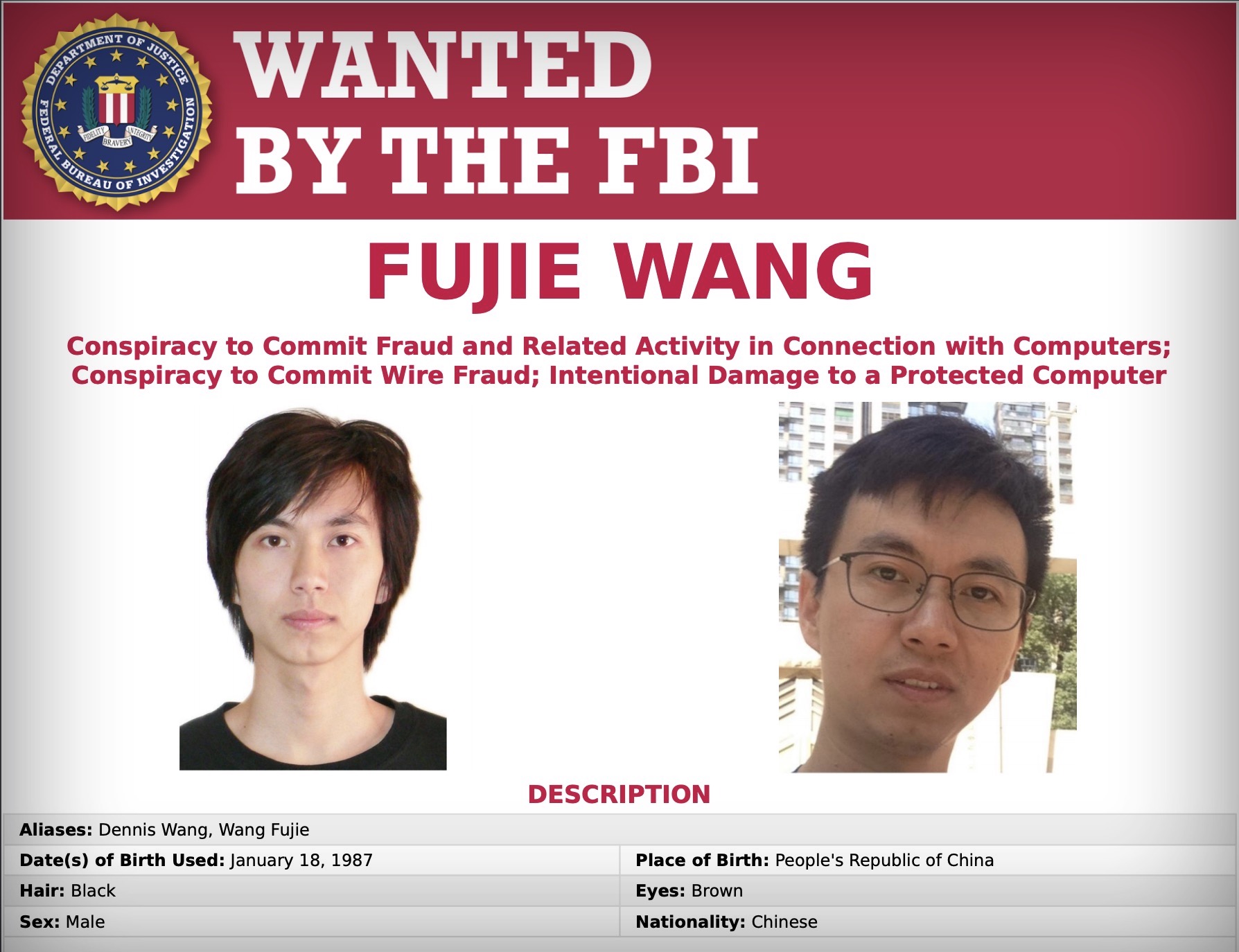

Office365 Data Breach Millions Stolen Hacker Indicted

Apr 24, 2025

Office365 Data Breach Millions Stolen Hacker Indicted

Apr 24, 2025 -

Increased Resistance To Ev Mandates From Car Dealerships

Apr 24, 2025

Increased Resistance To Ev Mandates From Car Dealerships

Apr 24, 2025 -

Gambling On Tragedy Examining The La Wildfire Betting Market

Apr 24, 2025

Gambling On Tragedy Examining The La Wildfire Betting Market

Apr 24, 2025 -

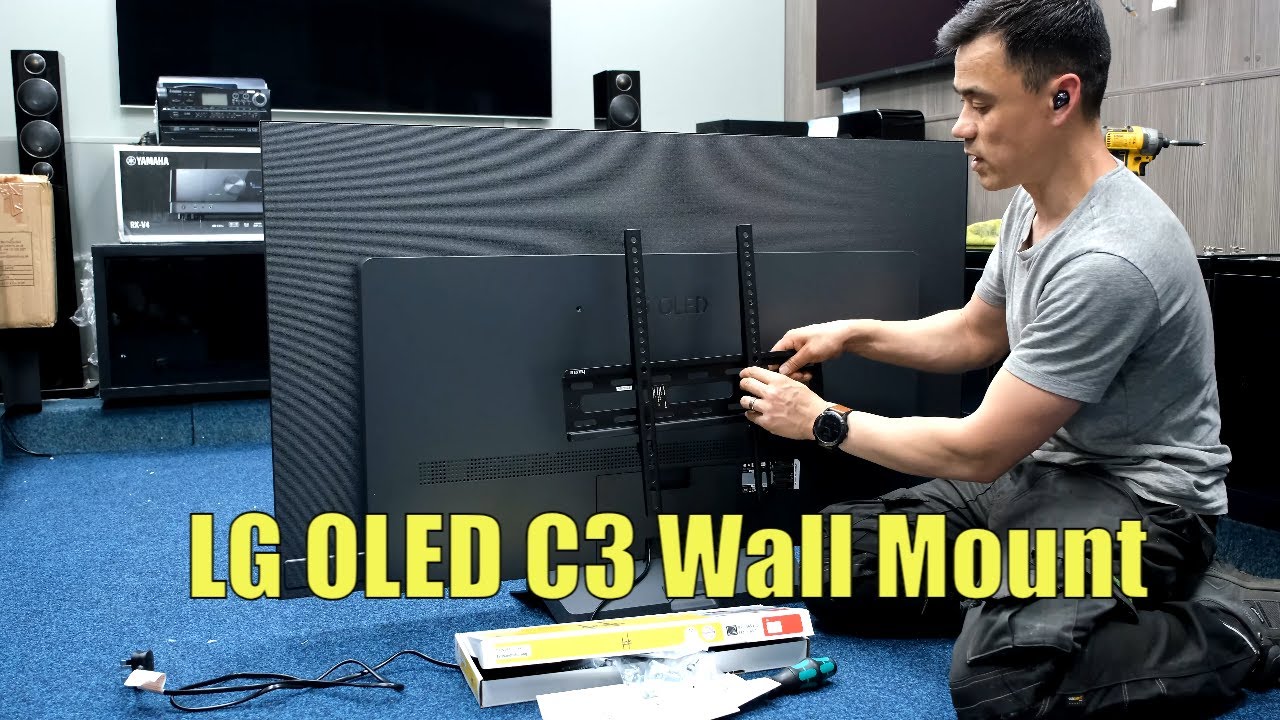

My 77 Inch Lg C3 Oled Tv A Detailed Review

Apr 24, 2025

My 77 Inch Lg C3 Oled Tv A Detailed Review

Apr 24, 2025