Stock Market Today: Dow Futures Fall, Dollar Weakens Amid Trade Tensions

Table of Contents

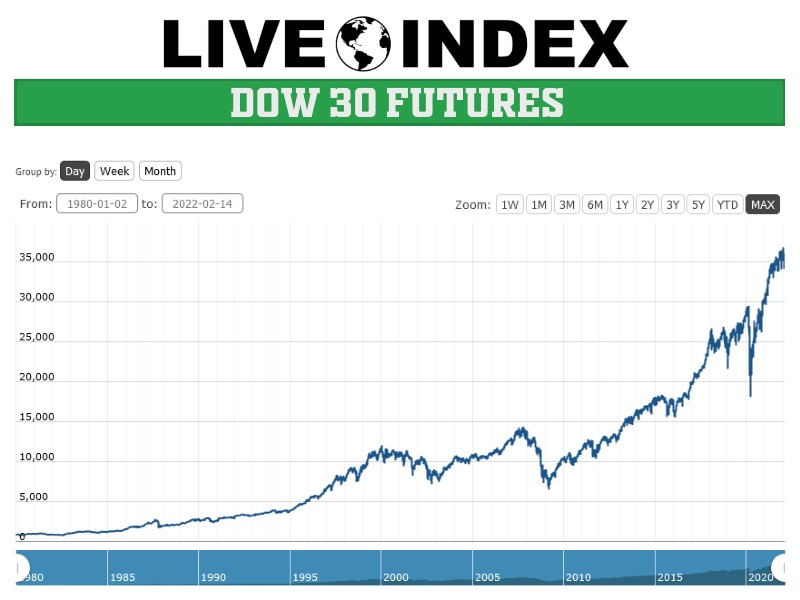

Dow Futures Decline: A Deeper Dive

Impact of Trade War Uncertainty

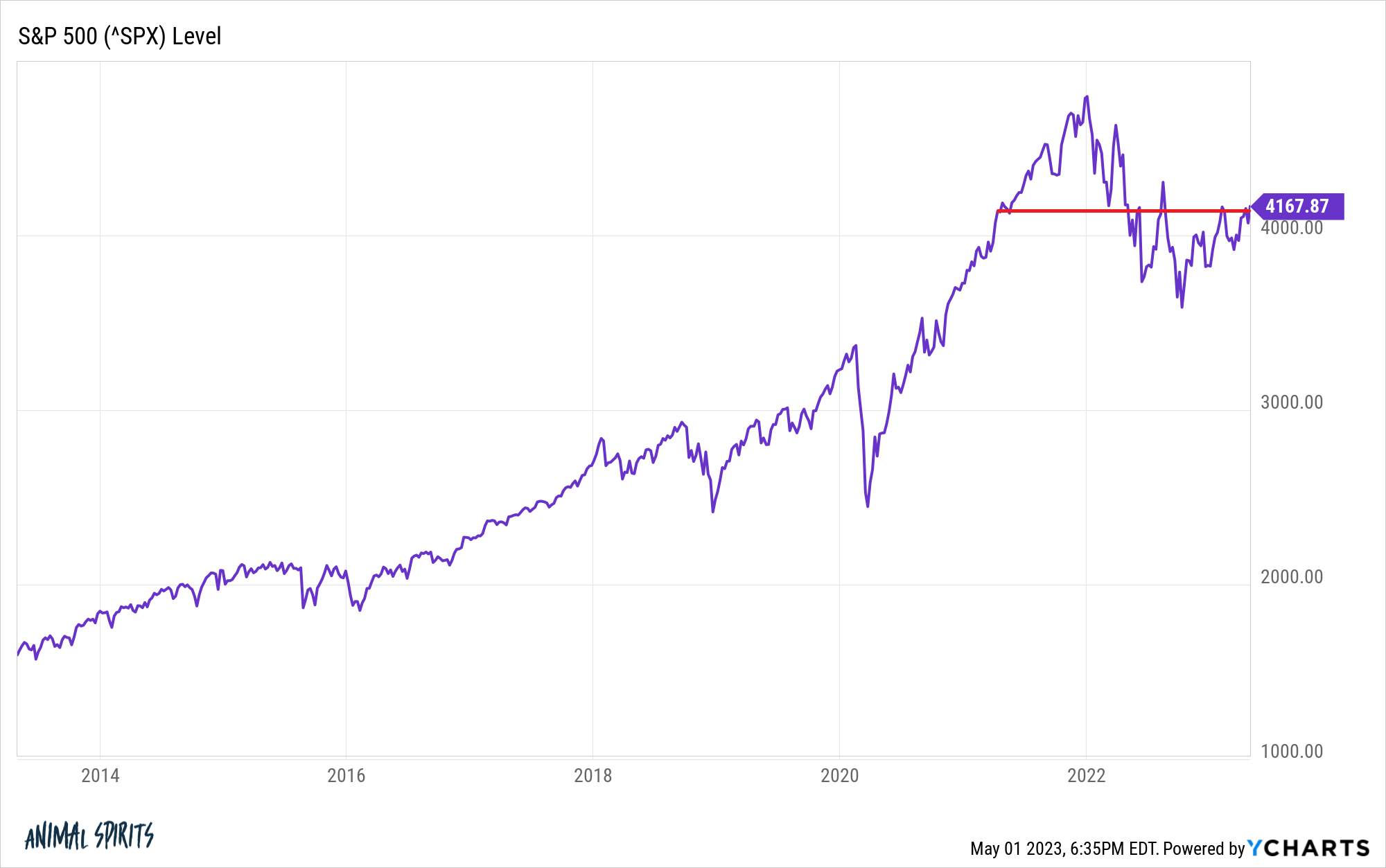

Rising trade protectionism and uncertainty surrounding future trade agreements are fostering a pessimistic outlook among investors, resulting in a sell-off in Dow futures. This uncertainty creates a ripple effect throughout the global economy.

- Increased tariffs on goods impact corporate profits and future growth projections. Higher tariffs increase the cost of imported goods, squeezing profit margins for companies reliant on global supply chains. This directly impacts their ability to meet earnings expectations, leading to a decline in stock prices.

- Uncertainty discourages investment and fuels capital flight to safer assets. Investors are hesitant to commit capital in an environment of high uncertainty. This leads to a shift towards safer havens like government bonds, further depressing stock market performance.

- Negative news cycles surrounding trade negotiations exacerbate investor anxiety. Constant negative news coverage fuels fear and uncertainty, prompting investors to adopt a risk-averse strategy and sell off assets.

Technical Analysis of Dow Futures

A technical analysis of Dow futures reveals a bearish trend, with key support levels breached, suggesting further declines are possible in the near term. This requires careful monitoring and strategic adjustments for investors.

- Chart patterns indicating a downward trend. Technical analysts are observing bearish chart patterns, such as head and shoulders formations or descending triangles, which signal further price declines.

- Key technical indicators (e.g., moving averages, RSI) signaling bearish momentum. Indicators like the Relative Strength Index (RSI) and moving averages are displaying bearish signals, confirming the downward trend.

- Analysis of volume and trading activity. High trading volume accompanying the price decline confirms the strength of the bearish sentiment and suggests that the trend could continue.

Weakening Dollar: Implications for Global Markets

Trade War's Effect on the Dollar

The ongoing trade disputes are contributing to a weaker dollar as investors seek refuge in currencies perceived as less risky. This shift has broad implications for the global economy.

- Safe-haven assets, such as gold and the Japanese Yen, are seeing increased demand. Investors are moving their capital into assets considered less volatile during times of economic uncertainty.

- The dollar's decline impacts international trade and investment flows. A weaker dollar makes US exports cheaper and imports more expensive, impacting the balance of trade.

- Analysis of currency exchange rates and their correlation with trade news. Analyzing currency exchange rates alongside trade news helps to understand the market’s reaction to ongoing trade negotiations.

Impact on US Businesses

A weaker dollar presents a double-edged sword for US businesses, potentially boosting exports but simultaneously increasing the cost of imports. This creates a complex scenario for businesses to navigate.

- Increased competitiveness of US exports in international markets. A weaker dollar makes US goods cheaper for foreign buyers, potentially boosting export volumes.

- Higher import costs impacting businesses reliant on imported goods. Companies that rely on imported raw materials or finished goods will see increased costs, potentially squeezing their profit margins.

- Overall impact on US corporate profitability. The net effect on US corporate profitability depends on the balance between increased export revenues and higher import costs.

Geopolitical Risks and Market Volatility

Global Uncertainty

Beyond trade, other geopolitical factors, such as political instability in certain regions, are contributing to heightened market volatility. Investors need to consider a wide range of factors when assessing risk.

- Analysis of current geopolitical events and their market impact. Events such as political upheaval or international conflicts can significantly impact investor sentiment and market performance.

- Discussion of risk assessment and diversification strategies. Diversification of investment portfolios is crucial to mitigate risks associated with geopolitical uncertainty.

- Expert opinions on the current global landscape. Consulting with financial experts provides valuable insights into the overall economic outlook and potential risks.

Conclusion

Today's stock market reflects a climate of uncertainty, primarily driven by ongoing trade tensions. The decline in Dow futures and the weakening dollar highlight the significant impact of these geopolitical factors on global markets. Understanding these dynamics is essential for investors navigating this volatile landscape. Stay informed about the latest developments in the stock market today by regularly consulting reputable financial news sources and financial advisors to make well-informed investment decisions. Monitor the stock market closely and consider adjusting your portfolio accordingly to minimize risk during this period of uncertainty. Regularly check the daily stock market news to make smart investment choices.

Featured Posts

-

La Fire Victims Face Exploitative Rental Prices A Selling Sunset Stars Accusation

Apr 22, 2025

La Fire Victims Face Exploitative Rental Prices A Selling Sunset Stars Accusation

Apr 22, 2025 -

Lab Owner Admits To Falsifying Covid 19 Test Results

Apr 22, 2025

Lab Owner Admits To Falsifying Covid 19 Test Results

Apr 22, 2025 -

Live Stock Market Updates Dow Futures Dollar And Trade War Concerns

Apr 22, 2025

Live Stock Market Updates Dow Futures Dollar And Trade War Concerns

Apr 22, 2025 -

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025 -

Us Pushes For Peace As Russia Unleashes Deadly Air Strikes On Ukraine

Apr 22, 2025

Us Pushes For Peace As Russia Unleashes Deadly Air Strikes On Ukraine

Apr 22, 2025