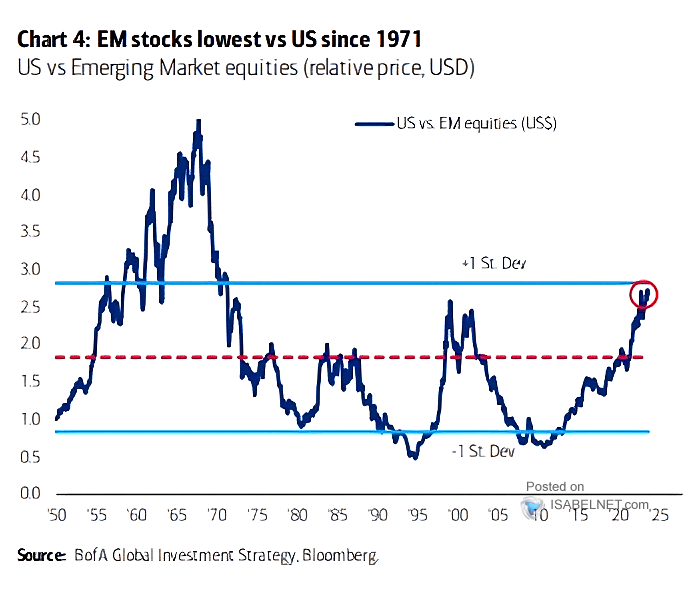

Strong Performance Of Emerging Market Stocks In Contrast To US Decline

Table of Contents

Diversification Benefits of Emerging Market Stocks

Investing in emerging market stocks offers significant diversification advantages, particularly in times of US market uncertainty. A well-diversified portfolio isn't just about owning a variety of assets; it's also about minimizing correlation between those assets.

Reduced Correlation with US Markets

- Lower correlation reduces overall portfolio volatility: Emerging markets often exhibit lower correlation with US markets. This means their price movements don't always mirror those of US stocks, reducing the overall volatility of a globally diversified portfolio. This is a key advantage during periods of US market decline.

- Provides a hedge against US market downturns: When the US market experiences a downturn, emerging market stocks can sometimes provide a counterbalance, mitigating potential losses in your overall investment portfolio. This "hedge" effect is a crucial aspect of risk management.

- Historically, emerging markets haven't always mirrored US market trends: A historical analysis of emerging market performance demonstrates that they haven't always followed the same trajectory as the US. This independent movement is a key factor in their appeal as a diversification tool.

Access to High-Growth Economies

Emerging markets often boast faster economic growth rates compared to developed economies like the US. This translates into higher potential returns for investors willing to navigate the inherent risks.

- Stronger GDP growth in many emerging markets: Many emerging economies exhibit significantly higher GDP growth rates, providing a fertile ground for investment. This growth is fueled by various factors, including increased domestic consumption and infrastructure development.

- Expanding middle classes fueling consumer spending: The expanding middle class in many emerging markets is driving increased consumer spending, creating lucrative opportunities for businesses and investors alike. This expanding consumer base creates a strong foundation for sustained growth.

- Technological advancements driving economic expansion: Rapid technological advancements in many emerging markets are accelerating economic expansion and creating new investment opportunities across a range of sectors.

Factors Driving Emerging Market Stock Performance

The strong performance of emerging market stocks isn't just a matter of luck; several key macroeconomic factors and regional trends are at play.

Favorable Macroeconomic Conditions

Specific macroeconomic conditions in several emerging markets have created a favorable environment for investment.

- Rising commodity prices benefiting resource-rich economies: Countries rich in natural resources have seen significant benefits from rising commodity prices, boosting their economic growth and, in turn, their stock markets.

- Supportive monetary policies stimulating growth: Many emerging market central banks have implemented supportive monetary policies, such as lower interest rates, to stimulate economic growth and attract foreign investment.

- Government initiatives promoting infrastructure development: Government initiatives focused on infrastructure development are creating further investment opportunities and boosting long-term economic growth in several emerging markets.

Specific Regional Outperformers

Certain regions within the emerging market landscape have shown exceptional growth.

- Examples of high-performing regions (e.g., Southeast Asia, Latin America): Southeast Asia, particularly countries like Vietnam and Indonesia, and parts of Latin America have experienced remarkable growth, driven by factors such as strong domestic demand and foreign direct investment.

- Reasons for their outperformance (e.g., specific industry growth, political stability): The reasons for their outperformance vary but often include rapid growth in specific industries (e.g., technology, manufacturing) and increasing political stability.

Investment Strategies for Emerging Market Stocks

Successfully navigating the emerging market landscape requires a well-defined investment strategy.

Diversified Portfolio Approach

A diversified approach is crucial to mitigate risk.

- Investing across various sectors and geographies: Diversification across different sectors and geographies within emerging markets reduces the impact of any single negative event on your overall portfolio.

- Utilizing ETFs or mutual funds for broad market exposure: Exchange-Traded Funds (ETFs) and mutual funds offer a convenient way to gain broad exposure to emerging markets with a single investment.

- Considering factors like political risk and currency fluctuations: It's crucial to carefully consider factors like political risk and currency fluctuations when investing in emerging markets.

Long-Term Investment Horizon

Patience is key when investing in emerging markets.

- Emerging markets can be volatile in the short term: Emerging markets can experience significant short-term volatility due to various factors, including political instability and economic fluctuations.

- Long-term growth potential outweighs short-term fluctuations: Despite short-term volatility, the long-term growth potential of emerging markets often outweighs these fluctuations.

- Patience and discipline are key for success: A long-term investment horizon, coupled with patience and discipline, is essential for success in emerging market investing.

Conclusion

The strong performance of emerging market stocks contrasts sharply with the recent decline in the US market. This divergence is driven by a confluence of factors, including the diversification benefits they offer, favorable macroeconomic conditions in specific regions, and significant growth potential. A diversified, long-term approach to investing in emerging market stocks presents compelling opportunities for investors seeking to enhance portfolio returns. However, thorough research and a clear understanding of the inherent risks are paramount. Consider carefully exploring the potential of emerging market stocks to diversify your investment portfolio and capitalize on global growth opportunities. Don't miss out on the potential of emerging market investments!

Featured Posts

-

New Business Hot Spots Where To Invest And Grow In Country Name

Apr 24, 2025

New Business Hot Spots Where To Invest And Grow In Country Name

Apr 24, 2025 -

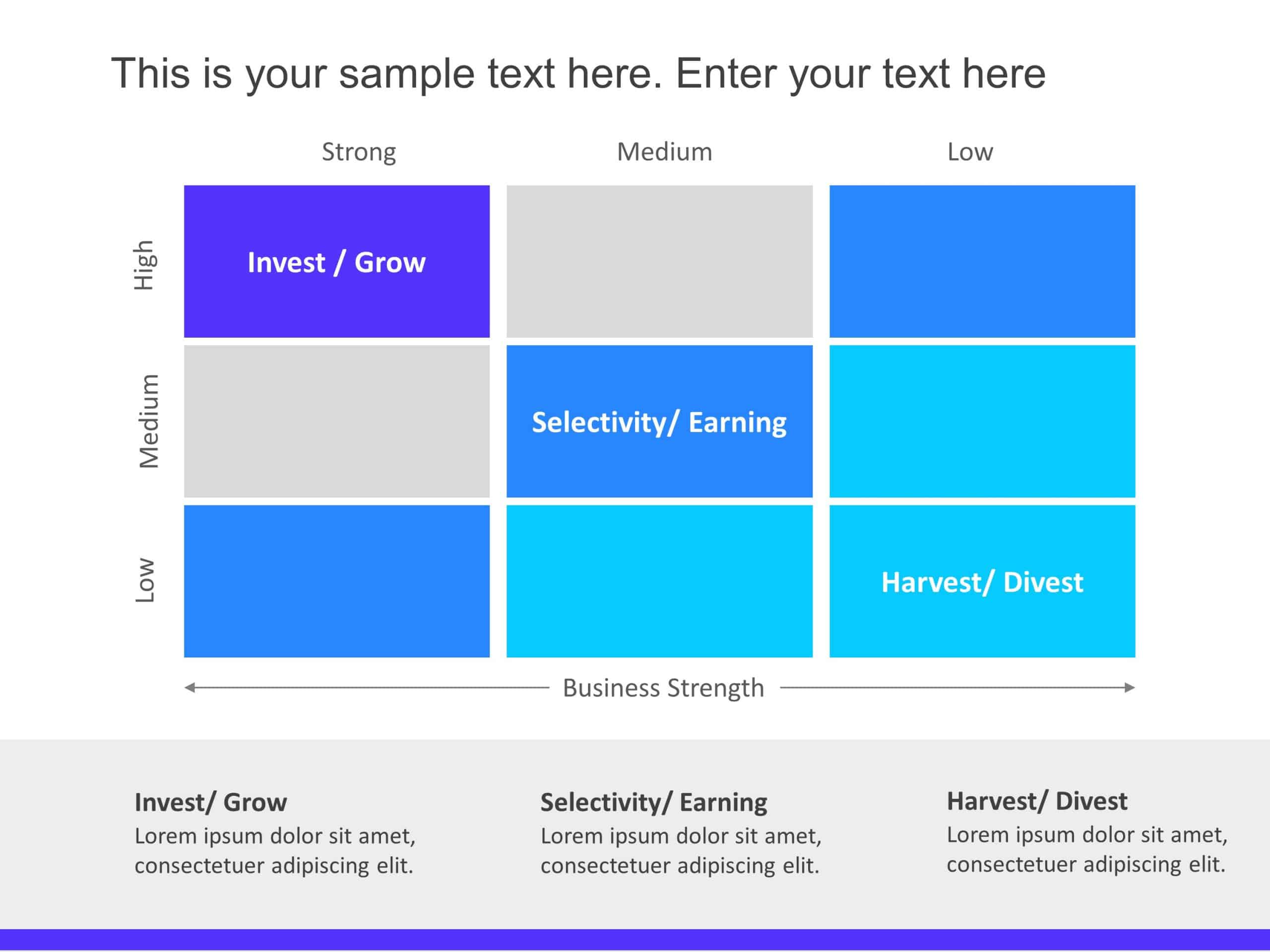

Reduced Funding Increased Danger How Trumps Cuts Impact Tornado Season

Apr 24, 2025

Reduced Funding Increased Danger How Trumps Cuts Impact Tornado Season

Apr 24, 2025 -

Actors Join Writers Strike Hollywood Faces Unprecedented Shutdown

Apr 24, 2025

Actors Join Writers Strike Hollywood Faces Unprecedented Shutdown

Apr 24, 2025 -

71 Net Income Drop For Tesla In Q1 Understanding The Political And Economic Factors

Apr 24, 2025

71 Net Income Drop For Tesla In Q1 Understanding The Political And Economic Factors

Apr 24, 2025 -

Section 230 And Banned Chemicals An E Bay Case Study

Apr 24, 2025

Section 230 And Banned Chemicals An E Bay Case Study

Apr 24, 2025