Tesla Q1 Financial Results: Political Backlash And Its Effect On Profitability

Table of Contents

Tesla's Q1 2024 Financial Performance Overview

Record Deliveries Despite Challenges

Tesla reported record vehicle deliveries in Q1 2024, exceeding expectations despite global supply chain disruptions and increasing competition.

- Deliveries: [Insert actual Q1 2024 delivery numbers]. This represents a [percentage]% increase compared to Q4 2023 and a [percentage]% increase year-over-year.

- Market Share: Tesla maintained a strong market share in the [mention specific market segment, e.g., luxury electric vehicle] sector, but faced growing competition from [mention key competitors].

- Revenue Growth: Revenue also saw substantial growth, reaching [insert revenue figures], driven primarily by strong vehicle sales and growth in energy generation and storage.

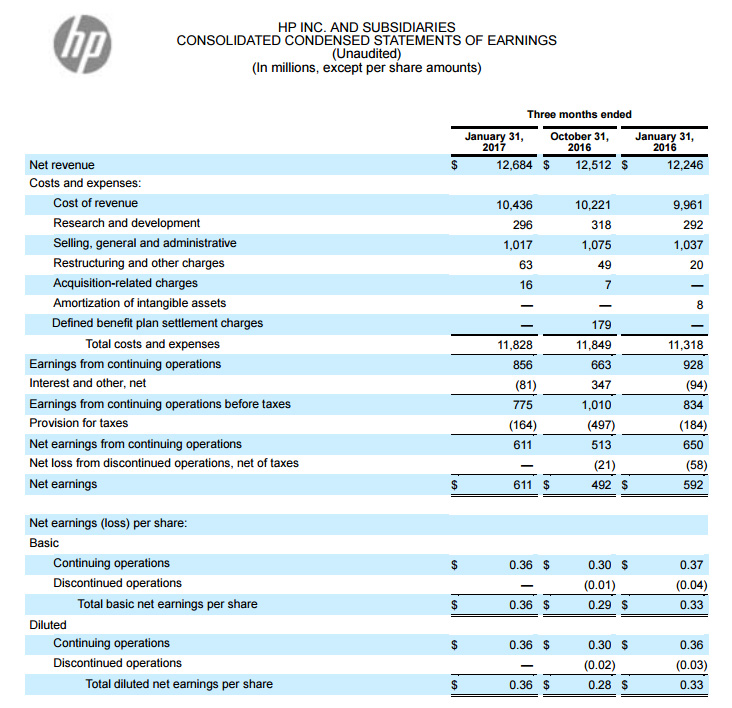

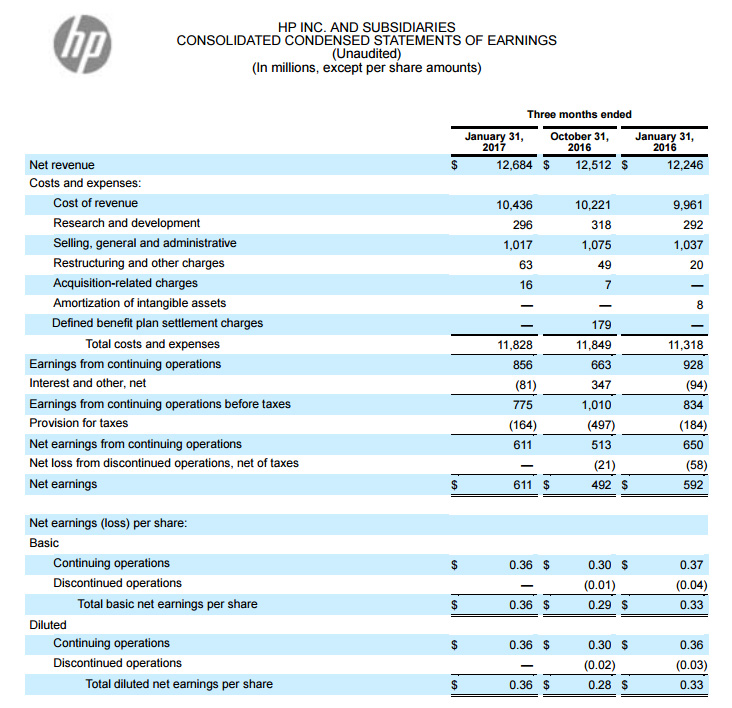

Profitability Metrics and Key Indicators

While deliveries were impressive, Tesla's Q1 2024 profitability metrics showed some concerning trends.

- Profit Margin: Gross profit margin decreased to [insert percentage] compared to [percentage] in Q4 2023 and [percentage] in Q1 2023. This decline can be attributed to increased costs and pricing pressures.

- Net Profit: Net profit was [insert net profit figure], representing a [percentage]% change compared to the previous quarter and a [percentage]% change year-over-year. Factors contributing to the change included higher operating expenses.

- EPS: Earnings Per Share (EPS) came in at [insert EPS figure], indicating a [positive/negative] trend compared to the same period last year.

- Cost of Goods Sold (COGS): A significant increase in COGS, primarily due to rising raw material prices and increased manufacturing costs, put pressure on profit margins.

Political Backlash and its Manifestations

Specific Political Events and Actions

Tesla faced a significant political backlash during Q1 2024, stemming from various sources.

- Regulatory Changes: New regulations in [mention specific countries/regions] regarding vehicle emissions and safety standards increased compliance costs and potentially hindered sales.

- Government Investigations: Ongoing investigations into [mention specific investigations, e.g., Autopilot safety] created negative publicity and uncertainty for investors.

- Trade Wars & Tariffs: Escalating trade tensions in certain markets resulted in increased tariffs on Tesla vehicles, negatively impacting pricing and competitiveness.

- Public Sentiment: Negative media coverage surrounding these events fuelled public sentiment against Tesla in certain markets, potentially affecting consumer demand.

Impact on Consumer Demand and Sales

The political backlash had a measurable impact on consumer demand and sales in certain regions.

- Sales Figures: Sales in [mention specific regions] showed a notable decline compared to the previous quarter, partially attributed to the negative publicity and regulatory hurdles.

- Brand Image: The negative media coverage and government scrutiny undoubtedly affected Tesla's brand image, particularly among environmentally conscious consumers who might be more sensitive to political controversies.

- Consumer Loyalty: While Tesla maintains a loyal customer base, the political backlash could erode customer loyalty and potentially affect future sales.

The Direct Correlation Between Political Headwinds and Reduced Profitability

Quantifying the Impact

Quantifying the precise financial impact of the political backlash on Tesla's Q1 2024 profits is challenging, but several estimations can be made.

- Reduced Sales: The decline in sales in specific regions, directly attributable to the political factors mentioned above, likely contributed to a [estimated percentage or dollar amount] loss in revenue.

- Increased Operational Costs: Increased regulatory compliance costs and legal fees associated with government investigations added to Tesla's operational burden, further squeezing profit margins.

Mitigation Strategies and Future Outlook

Tesla needs to adopt several strategies to mitigate the impact of future political risks.

- Proactive Lobbying: Engaging in proactive lobbying efforts to influence regulatory decisions and mitigate the impact of potentially harmful legislation.

- Diversification of Manufacturing: Expanding manufacturing capacity beyond its current geographical footprint to reduce dependence on politically volatile markets.

- Improved Public Relations: Investing in a robust public relations strategy to address negative publicity and improve its brand image.

- Future Outlook: The long-term effects of the Q1 political backlash remain uncertain. Tesla’s ability to navigate future political challenges will be crucial for maintaining sustainable profitability.

Conclusion

Tesla's Q1 2024 financial results highlight a significant correlation between strong delivery numbers and a substantial negative impact from political headwinds, directly impacting profitability. The regulatory challenges, government investigations, and negative public sentiment all contributed to reduced profit margins. Tesla's response to these challenges and its ability to navigate future political complexities will be key to its continued success. Stay informed on the ongoing impact of political factors on Tesla's financial performance. Follow us for future updates on Tesla Q2 financial results and further analyses of the company's political landscape.

Featured Posts

-

John Travoltas Miami Steakhouse Adventure A Pulp Fiction Inspired Meal

Apr 24, 2025

John Travoltas Miami Steakhouse Adventure A Pulp Fiction Inspired Meal

Apr 24, 2025 -

Us Stock Futures Surge Trumps Powell Comments Boost Markets

Apr 24, 2025

Us Stock Futures Surge Trumps Powell Comments Boost Markets

Apr 24, 2025 -

Ella Bleu Travoltas New Look Daughter Of John Travolta Makes A Bold Statement

Apr 24, 2025

Ella Bleu Travoltas New Look Daughter Of John Travolta Makes A Bold Statement

Apr 24, 2025 -

The Value Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 24, 2025

The Value Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 24, 2025 -

Ftc Challenges Court Ruling On Microsofts Activision Blizzard Purchase

Apr 24, 2025

Ftc Challenges Court Ruling On Microsofts Activision Blizzard Purchase

Apr 24, 2025