Trump's Economic Policies And Bitcoin's (BTC) Recent Price Increase

Table of Contents

Trump's Deregulation and its Impact on Bitcoin

Trump's administration pursued a significant deregulation agenda, potentially impacting investment flows into riskier assets like Bitcoin.

Reduced Financial Regulations

The easing of financial regulations may have inadvertently encouraged investment in alternative assets, including cryptocurrencies.

- Examples of Deregulation: Specific deregulatory actions, while not directly targeting cryptocurrencies, may have created a more permissive environment for investment in higher-risk assets. This includes measures that reduced oversight in certain financial sectors.

- Increased Investor Appetite: The perceived reduction in regulatory burden could have encouraged investors seeking higher returns to explore alternative investment avenues, including Bitcoin. This heightened investor appetite for riskier assets contributed to increased market volatility.

- Market Volatility Impact: Deregulation, while potentially stimulating economic growth, can also lead to increased market volatility. The cryptocurrency market, already known for its volatility, might have experienced amplified price swings due to this broader effect.

Tax Cuts and their Effect on Crypto Investment

Tax cuts implemented during the Trump era might have indirectly influenced the amount of capital available for cryptocurrency investments.

- Impact on High-Net-Worth Individuals: Tax cuts, particularly those benefiting high-net-worth individuals, could have freed up more disposable income for investment. A portion of this increased disposable income may have flowed into the cryptocurrency market, driving up demand for assets like Bitcoin.

- Increased Disposable Income: The availability of additional capital for investment, coupled with the potential for significant returns in the cryptocurrency market, may have contributed to the rise in Bitcoin's price.

- Capital Gains Taxes: While the specific tax implications of cryptocurrency trading varied, the overall impact of tax cuts could have influenced investment decisions by affecting the net returns after taxes on cryptocurrency gains.

The Dollar's Weakening and Bitcoin's Safe Haven Status

Trump's trade policies and economic decisions contributed to fluctuations in the US dollar's value, which may have indirectly boosted Bitcoin's appeal as a safe haven asset.

Trade Wars and the Dollar

Trade tensions and the resulting uncertainty in the global economy potentially led to a weakening of the US dollar. This could have increased demand for alternative assets, including Bitcoin, as investors sought to diversify their portfolios and hedge against potential risks.

- USD Weakening Statistics: Analyzing the USD exchange rate during this period reveals fluctuations that can be correlated with trade policy decisions. The degree of correlation needs further detailed analysis.

- Increased Demand for Alternative Currencies: The weakening dollar likely motivated investors to seek assets less susceptible to US dollar fluctuations. Bitcoin, as a decentralized and globally accessible currency, became a more attractive option.

- Bitcoin as a Decentralized Asset: Bitcoin's decentralized nature, independent of any single government or institution, made it appealing as a hedge against potential geopolitical and economic instability caused by trade conflicts. This is in comparison to gold, a traditional safe haven asset.

Inflationary Pressures and Bitcoin's Value Proposition

Inflationary pressures, whether exacerbated or mitigated by Trump's economic policies, potentially affected Bitcoin's perceived value.

- Inflation and Bitcoin's Value: Bitcoin is often seen as a hedge against inflation. During periods of rising inflation, investors might flock to Bitcoin as a store of value, believing its limited supply will protect its purchasing power.

- Monetary Policy's Impact: The Federal Reserve's monetary policy responses to economic conditions during this period also played a role. The interplay of monetary policy and the cryptocurrency market requires further in-depth investigation.

- Bitcoin's Price Movements During Inflation: A detailed analysis of Bitcoin's price movements during periods of perceived or actual inflation is needed to assess the direct correlation.

Increased Institutional Interest and Bitcoin's Growth

Trump's pro-business stance may have indirectly fostered increased institutional interest in Bitcoin, further contributing to its price increase.

Trump's Pro-Business Stance and Bitcoin Adoption

A generally pro-business environment, while not directly targeting cryptocurrencies, could have had a positive impact on investment in emerging technologies, including Bitcoin.

- Increased Venture Capital: An increase in venture capital investment in the cryptocurrency space is observed during this period, potentially influenced by the overall positive sentiment towards business and technological innovation.

- Rise of Institutional Bitcoin Holdings: Some large institutional investors started accumulating Bitcoin during this time, which contributed significantly to the price increase.

- Market Sentiment Correlation: Positive market sentiment resulting from pro-business policies might have generally improved investor confidence, positively impacting the cryptocurrency market's performance.

Technological Advancements and Regulatory Uncertainty

Technological advancements within the Bitcoin ecosystem, along with the regulatory landscape under Trump's administration, played an independent, yet significant role.

- Technological Developments: The advancements in Bitcoin's underlying technology, such as Lightning Network improvements, contributed to greater efficiency and adoption.

- Regulatory Clarity (or Lack Thereof): While the regulatory environment surrounding cryptocurrencies remained somewhat ambiguous, the absence of outright bans or extremely restrictive regulations in some jurisdictions could have contributed to the increased investor confidence.

- Market Maturity: The overall maturity of the cryptocurrency market increased during this period, attracting more investors.

Conclusion: Connecting Trump's Economic Legacy and the Bitcoin Market

This analysis explores the potential links between specific Trump-era economic policies – deregulation, tax cuts, trade policies, and their impact on the US dollar – and the significant price increase observed in Bitcoin. It's crucial to remember that the relationship isn't necessarily one of direct causation. Many factors influence Bitcoin's price, including technological developments, market sentiment, and geopolitical events. However, the confluence of Trump's economic policies and the cryptocurrency market's trajectory during this period suggests a potential correlation warranting further investigation. We encourage you to further research the correlation between specific Trump-era policies and Bitcoin’s performance. Share your insights on the topic and explore the broader implications of government policies on cryptocurrency markets. Analyze BTC price data in relation to specific policy announcements using tools like "BTC analysis" charts and explore the impact of "Trump's economic policies" on broader "cryptocurrency investment" strategies.

Featured Posts

-

Impact Of Reduced Non Essential Spending On Credit Card Companies

Apr 24, 2025

Impact Of Reduced Non Essential Spending On Credit Card Companies

Apr 24, 2025 -

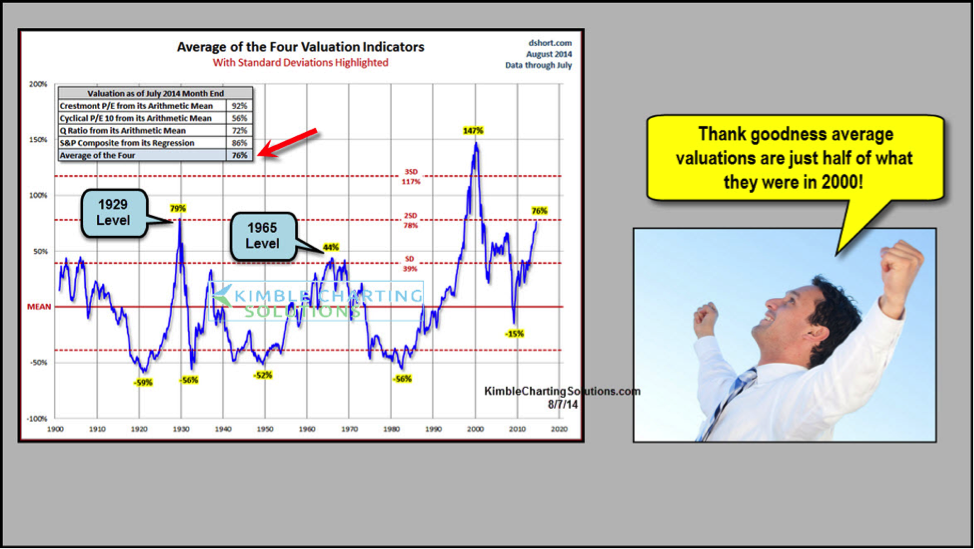

Bof As Take Why Current Stock Market Valuations Shouldnt Worry You

Apr 24, 2025

Bof As Take Why Current Stock Market Valuations Shouldnt Worry You

Apr 24, 2025 -

The Automobile Industrys Growing Opposition To Ev Mandates

Apr 24, 2025

The Automobile Industrys Growing Opposition To Ev Mandates

Apr 24, 2025 -

The Bold And The Beautiful April 9 Steffy Bill Finn And Liams Dramatic Turn Of Events

Apr 24, 2025

The Bold And The Beautiful April 9 Steffy Bill Finn And Liams Dramatic Turn Of Events

Apr 24, 2025 -

Why Pope Francis Ring Will Be Destroyed After His Death The Significance Of The Fishermans Ring

Apr 24, 2025

Why Pope Francis Ring Will Be Destroyed After His Death The Significance Of The Fishermans Ring

Apr 24, 2025