U.S. Stock Market Rally Fueled By Tech Giants, Tesla In The Lead

Table of Contents

Tesla's Leading Role in the Rally

Tesla's exceptional performance is a major catalyst for the current U.S. stock market rally. Its influence extends beyond its own market capitalization, affecting investor confidence in the broader technology and electric vehicle (EV) sectors.

Record-Breaking Deliveries and Production

Tesla's recent production and delivery figures have been nothing short of spectacular, directly impacting its stock price.

- Q[Insert Quarter]: Tesla delivered [Insert Number] vehicles, exceeding analysts' expectations by [Insert Percentage] and marking a [Insert Percentage] increase compared to the same quarter last year.

- Production Capacity: Increased production capacity at Gigafactories worldwide is contributing to this surge, demonstrating Tesla's ability to meet growing global demand for electric vehicles.

- Analyst Comments: Several prominent analysts have upgraded their price targets for Tesla stock, citing the strong delivery numbers and positive outlook for future growth. This positive sentiment further fuels the U.S. Stock Market Rally.

Innovation and Future Outlook

Tesla's relentless innovation and ambitious future plans are key drivers of investor confidence.

- Cybertruck Launch: The anticipated launch of the Cybertruck is expected to significantly expand Tesla's market reach and appeal to a wider customer base.

- Autonomous Driving Technology: Continued advancements in Tesla's autonomous driving technology (Full Self-Driving, or FSD) represent a significant competitive advantage and a major source of long-term growth potential.

- Energy Business Expansion: Tesla's expansion into solar energy and energy storage solutions further diversifies its revenue streams and positions it for long-term sustainable growth. This diversification reduces risk and further supports the U.S. stock market rally.

Investor Sentiment and Market Cap

Investor confidence in Tesla is directly impacting the broader U.S. stock market rally.

- Stock Price Fluctuations: Tesla's stock price has experienced significant upward momentum, attracting both retail and institutional investors.

- Market Capitalization Changes: Tesla's market capitalization has consistently increased, solidifying its position as a leading player in the global automotive and technology sectors.

- Institutional Investor Activity: Large institutional investors are increasingly adding Tesla to their portfolios, further signaling confidence in the company's long-term prospects. This strong institutional support contributes substantially to the overall U.S. stock market rally.

Other Tech Giants Contributing to the U.S. Stock Market Rally

Tesla's success is not an isolated event. Other major tech companies are contributing significantly to the overall market rally.

Strong Earnings Reports

The strong earnings reports released during the recent earnings season have boosted investor sentiment and fueled the U.S. stock market rally.

- FAANG Stocks: Companies like Apple, Microsoft, Amazon, Meta (formerly Facebook), and Google (Alphabet) have all reported strong earnings, exceeding analysts' expectations in many cases.

- Revenue and Profit Margins: These companies have demonstrated robust revenue growth and healthy profit margins, showcasing the strength of the tech sector.

- Positive Analyst Forecasts: Analysts remain optimistic about the future prospects of these companies, contributing to sustained market confidence.

AI-Driven Growth

The growing role of artificial intelligence (AI) is a major factor in the success of many tech companies.

- AI Investments: Increased investment in AI research and development is driving innovation across various sectors, leading to increased efficiency and productivity gains.

- Artificial Intelligence Market: The explosive growth of the artificial intelligence market is creating significant opportunities for tech companies involved in AI development and applications.

- Tech Sector Growth: AI is a crucial driver of the broader tech sector’s growth, significantly contributing to the overall U.S. stock market rally.

Positive Economic Indicators

The strong performance of tech giants is also linked to positive economic indicators.

- Inflation Data: Although inflation remains a concern, recent data suggests it may be cooling, easing investor anxieties.

- Consumer Confidence Indices: Consumer confidence indices have shown improvement, indicating increased spending and economic activity.

- Interest Rate Trends: While interest rates have risen, the pace of increases may be slowing, supporting the positive sentiment driving the U.S. stock market rally.

Potential Risks and Challenges

While the current U.S. stock market rally is impressive, several factors could potentially disrupt the upward trend.

Geopolitical Uncertainty

Geopolitical events can significantly influence investor sentiment and market stability.

- Geopolitical Risks: Ongoing conflicts and international tensions introduce uncertainty and volatility into the market.

- Market Corrections: Geopolitical events can trigger market corrections, leading to temporary declines in stock prices.

- Investor Sentiment: Increased geopolitical uncertainty can negatively impact investor confidence, potentially reversing the current U.S. stock market rally.

Inflation and Interest Rates

Inflation and interest rate policies remain significant factors influencing market performance.

- Inflation Impact: Persistent inflation can erode corporate profits and reduce investor confidence.

- Interest Rate Hikes: Continued interest rate hikes by the Federal Reserve could dampen economic growth and negatively affect stock valuations.

- Economic Outlook: The overall economic outlook, including inflation and interest rate trajectories, remains a crucial factor influencing the sustainability of the U.S. stock market rally.

Regulatory Scrutiny

Increased regulatory scrutiny of tech companies could impact their growth and market valuation.

- Antitrust Concerns: Concerns about monopolies and anti-competitive practices could lead to increased regulatory intervention.

- Tech Regulation: Stringent data privacy regulations and other regulatory measures could impact the profitability of tech companies.

- Regulatory Challenges: Navigating the complexities of evolving regulations presents a challenge to tech companies and could negatively affect the current U.S. stock market rally.

Conclusion

The recent U.S. stock market rally is significantly fueled by the outstanding performance of tech giants, with Tesla's contribution being particularly noteworthy. While strong earnings, AI-driven growth, and positive economic indicators support this upward trend, investors must remain cognizant of potential risks, including geopolitical uncertainty, inflation, and regulatory scrutiny. Understanding these factors is crucial for navigating the complexities of the U.S. stock market rally and making informed investment decisions. Stay informed about the latest developments in the U.S. stock market rally and adjust your portfolio accordingly. Continue to monitor the performance of key players like Tesla and other tech giants to effectively manage your investments in this dynamic market.

Featured Posts

-

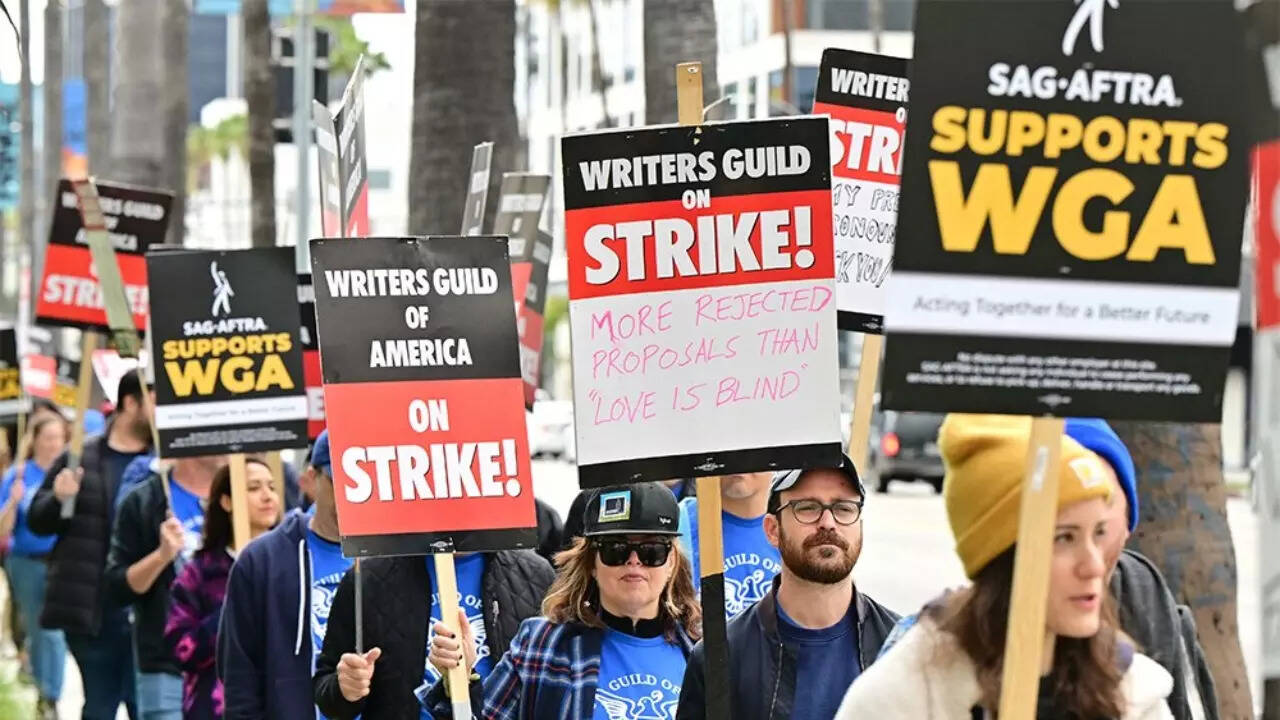

Double Trouble In Hollywood Actors Strike Amplifies Industry Shutdown

Apr 28, 2025

Double Trouble In Hollywood Actors Strike Amplifies Industry Shutdown

Apr 28, 2025 -

U S Stock Market Rally Fueled By Tech Giants Tesla In The Lead

Apr 28, 2025

U S Stock Market Rally Fueled By Tech Giants Tesla In The Lead

Apr 28, 2025 -

Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

Apr 28, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

Apr 28, 2025 -

Ohio Train Disaster Months Long Persistence Of Toxic Chemicals In Structures

Apr 28, 2025

Ohio Train Disaster Months Long Persistence Of Toxic Chemicals In Structures

Apr 28, 2025 -

Boston Red Sox Doubleheader Coras Lineup Modifications In Game 1

Apr 28, 2025

Boston Red Sox Doubleheader Coras Lineup Modifications In Game 1

Apr 28, 2025