Understanding Market Sentiment: When Professionals Sell, Should You Buy?

Table of Contents

Deciphering Market Sentiment: Beyond the Headlines

What is Market Sentiment?

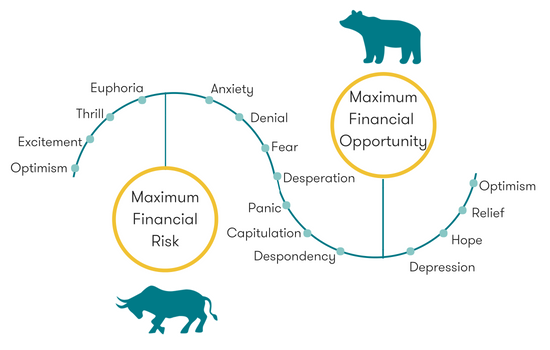

Market sentiment reflects the overall feeling or attitude of investors toward a particular security, sector, or the market as a whole. It's a crucial factor influencing asset prices and investment decisions. Understanding market sentiment can provide valuable insights into potential market trends.

- Bullish sentiment: Characterized by optimism and expectations of rising prices. Investors are confident and actively buying.

- Bearish sentiment: Marked by pessimism and expectations of falling prices. Investors are cautious and may be selling assets.

Market sentiment is gauged through various channels:

- News media: Headlines, analyst reports, and economic news significantly impact sentiment.

- Social media: Platforms like Twitter and StockTwits offer real-time insights into investor opinions.

- Investor surveys: These provide aggregated data on investor confidence and expectations.

- Fear and Greed Index: This indicator quantifies market sentiment based on investor behavior, revealing prevailing emotions.

Identifying Professional Selling

Professional selling encompasses various activities:

- Insider trading: The buying or selling of a publicly traded company's stock by someone with non-public, material information. While legal insider trading is permissible, it's subject to strict regulations. Illegal insider trading is a serious offense.

- Large institutional trades: Significant buying or selling activity by mutual funds, pension funds, or other large institutions can heavily influence market sentiment.

- Hedge fund activity: Hedge funds, known for their sophisticated investment strategies, can reveal valuable market insights through their trading behavior.

Locating information on institutional selling involves:

- SEC filings (Form 4): These filings disclose insider trading activities.

- Financial news websites and publications: These often report on large institutional trades and hedge fund activity.

Analyzing the "Why" Behind Professional Selling

Reasons for Professional Selling (Beyond Negative Outlook)

Professionals may sell for various reasons unrelated to a negative market outlook:

- Profit-taking: After a significant price increase, professionals might sell to secure profits.

- Portfolio rebalancing: Professionals adjust their portfolios to maintain a desired asset allocation.

- Meeting capital requirements: Institutions might sell assets to meet regulatory or liquidity requirements.

- Tax implications: Selling assets at year's end for tax optimization reasons.

It's crucial to distinguish between these reasons and those reflecting genuine market concerns.

Identifying Warning Signs

Certain indicators suggest professional selling reflects underlying market worries:

- High volume of insider selling: A significant number of insiders selling shares can be a red flag.

- Consistent downward trends in key market indicators coupled with selling: Falling stock prices, decreasing earnings, or negative economic data alongside high professional selling volume is a bearish sign.

- Negative analyst revisions: Downgrades by reputable analysts indicate reduced confidence in the company's or market's future performance.

Developing Your Investment Strategy Based on Market Sentiment

When to Buy the Dip

Professional selling can sometimes create buying opportunities:

- Undervalued assets: If professional selling leads to a sharp price drop, it might present a chance to buy undervalued assets.

- Mitigating risk: Diversification and thorough due diligence are crucial to mitigate risk.

Remember, thorough research and risk tolerance are paramount before acting on these opportunities.

When to Proceed with Caution

In certain situations, professional selling necessitates caution:

- Ignoring negative market sentiment: Ignoring widespread negative sentiment can lead to substantial losses.

- Preserving capital: Protecting your investment during periods of uncertainty is vital.

Conclusion

Market sentiment is a crucial factor in investment decisions. While professional selling doesn't always signal a bearish market, careful analysis is needed to discern opportunities from risks. Understanding the "why" behind professional selling, coupled with a thorough evaluation of market indicators, is essential. Learn to interpret market sentiment and professional selling behavior to make better investment choices. Understanding market sentiment is key to navigating market volatility. The dynamic nature of the stock market requires continuous learning and adaptation to thrive.

Featured Posts

-

Canadian Energy Sector Expands Southeast Asia Trade Mission Results

Apr 28, 2025

Canadian Energy Sector Expands Southeast Asia Trade Mission Results

Apr 28, 2025 -

Bubba Wallaces Nascar Phoenix Race Ends In Wall Crash Due To Brake Problems

Apr 28, 2025

Bubba Wallaces Nascar Phoenix Race Ends In Wall Crash Due To Brake Problems

Apr 28, 2025 -

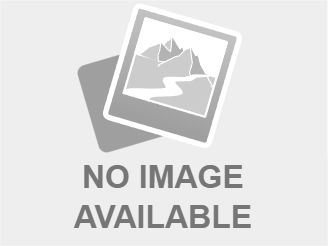

Double Trouble In Hollywood Actors Strike Amplifies Industry Shutdown

Apr 28, 2025

Double Trouble In Hollywood Actors Strike Amplifies Industry Shutdown

Apr 28, 2025 -

U S Stock Market Rally Fueled By Tech Giants Tesla In The Lead

Apr 28, 2025

U S Stock Market Rally Fueled By Tech Giants Tesla In The Lead

Apr 28, 2025 -

Another Williams Implosion Blue Jays Defeat Yankees

Apr 28, 2025

Another Williams Implosion Blue Jays Defeat Yankees

Apr 28, 2025