Understanding The Changes At X: A Look At The Recent Debt Financing

Table of Contents

The Details of the New Debt Financing

Company X's recent debt financing involves a significant issuance of corporate bonds. This is a key development impacting its financial health and overall investment strategy.

Type of Debt

- Type: Senior unsecured bonds.

- Amount: $500 million.

- Maturity Date: 10 years.

- Interest Rate: 6.5% per annum, payable semi-annually.

- Covenants: Standard covenants restricting further debt issuance and maintaining certain financial ratios.

- Credit Rating: Rated Baa1 by Moody's and BBB+ by S&P, indicating an investment-grade rating. This positive assessment from credit rating agencies suggests confidence in X's ability to service its debt. The rating agencies took into account X's strong historical performance and future projections when assigning this rating. This is a key factor for investors considering investing in the bonds.

Impact on X's Capital Structure

The $500 million debt issuance significantly impacts X's capital structure. This increase in debt will likely result in a higher debt-to-equity ratio.

- Debt-to-Equity Ratio: Projected to increase from 0.8 to 1.2. This signifies a shift toward increased financial leverage.

- Shareholder Equity: While the increased debt might dilute shareholder equity in the short term, the intended use of funds (detailed below) could generate future growth and potentially offset this dilution.

- Financial Leverage: The increased leverage introduces both risk and reward. While it amplifies potential returns, it also increases the company's vulnerability to economic downturns and interest rate fluctuations. X's management will need to carefully manage this increased leverage.

Reasons Behind the Debt Financing

Company X's decision to pursue this debt financing is driven by a multifaceted strategy. The core reasons appear to be growth-oriented, but a closer analysis is warranted.

Growth and Expansion

The primary driver behind this debt financing is to fund a significant expansion into new markets.

- Expansion Projects: X plans to invest in the development of its new product line, requiring substantial capital expenditure.

- Return on Investment (ROI): X's financial projections indicate a strong ROI for these expansion projects, justifying the use of debt financing. The projects are expected to significantly increase revenue streams, offsetting the interest expense incurred from the debt.

Debt Refinancing

A secondary but important reason is the refinancing of existing high-interest debt.

- Refinancing Benefits: This refinancing will lower X's overall interest expense, improving its profitability.

- Impact on Interest Expense: The reduction in interest expense is projected to be approximately $15 million annually, significantly boosting the company's net income.

Financial Distress (Not Applicable)

In this case, there is no indication of financial distress. The debt issuance is strategically planned and aligns with the company's growth ambitions.

Analysis and Outlook for X's Future

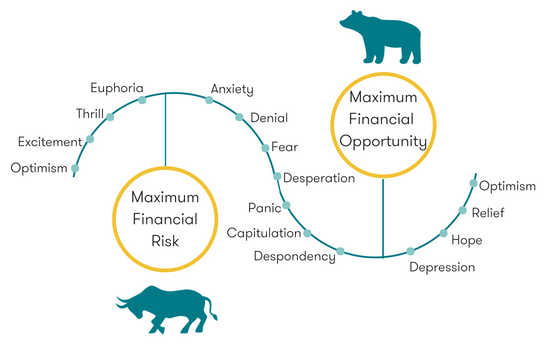

The new debt financing presents both opportunities and challenges for Company X. The long-term success of this strategy hinges on careful management and execution.

Opportunities and Challenges

- Opportunities: Increased market share, enhanced profitability, and diversification of revenue streams.

- Challenges: Managing increased financial leverage, potential interest rate hikes, and the risk of economic downturns affecting repayment capacity.

Investor Implications

The new debt financing carries implications for investors.

- Share Price: The immediate impact on share price is uncertain and depends on market sentiment and the success of the expansion plans.

- Dividends and Future Investment: While dividends might be temporarily affected, the long-term prospects of increased profitability could lead to higher dividend payouts in the future.

Conclusion

This analysis of Company X's recent debt financing reveals a calculated financial strategy aimed at fueling growth and enhancing profitability. While the increased financial leverage introduces certain risks, the potential returns associated with the planned expansion projects make this a strategically significant move. Understanding the specifics of this debt financing, the motivations behind it, and its potential impact is crucial for investors. Continuous monitoring of X's financial performance and adherence to debt covenants will be key to evaluating the long-term success of this strategy. Stay informed about future developments concerning the debt financing at X, and gain a deeper understanding of corporate debt and financial restructuring to make well-informed investment decisions.

Featured Posts

-

Understanding Market Sentiment When Professionals Sell Should You Buy

Apr 28, 2025

Understanding Market Sentiment When Professionals Sell Should You Buy

Apr 28, 2025 -

U S Iran Nuclear Talks Stalemate On Key Issues

Apr 28, 2025

U S Iran Nuclear Talks Stalemate On Key Issues

Apr 28, 2025 -

Emotional Goodbye Espn Bids Farewell To Cassidy Hubbarth

Apr 28, 2025

Emotional Goodbye Espn Bids Farewell To Cassidy Hubbarth

Apr 28, 2025 -

Mets Roster Moves Nez Optioned Megill In Starting Rotation

Apr 28, 2025

Mets Roster Moves Nez Optioned Megill In Starting Rotation

Apr 28, 2025 -

Key Performances By Judge And Goldschmidt Help Yankees Avoid Series Sweep

Apr 28, 2025

Key Performances By Judge And Goldschmidt Help Yankees Avoid Series Sweep

Apr 28, 2025