US Stock Market Today: Dow Futures Reaction To China's Economic Policies Amid Tariffs

Table of Contents

China's Economic Policies and Their Global Ripple Effect

China's recent economic policies have sent ripples across global markets. The government's efforts to stimulate growth, coupled with ongoing regulatory changes, are significantly influencing the US economy and the US stock market today. These actions impact everything from supply chains to commodity prices, creating a dynamic and often unpredictable landscape.

-

Impact on Supply Chains: Changes in Chinese manufacturing and export policies directly affect global supply chains, leading to potential disruptions and price fluctuations for US businesses. Delays and increased costs can impact profitability and, consequently, stock prices.

-

Influence on Commodity Prices: China's demand for raw materials significantly influences commodity prices worldwide. Changes in its economic activity, spurred by policy shifts, can cause price swings in oil, metals, and agricultural products, impacting related US sectors.

-

Changes in Foreign Investment: China's economic policies affect foreign investment decisions. Uncertainty about future regulations or market access can lead to shifts in investment flows, impacting the US stock market's performance.

-

Effect on Inflation and Interest Rates: Changes in Chinese economic activity influence global inflation and interest rate trends. This has a knock-on effect on the US economy, affecting monetary policy decisions by the Federal Reserve and ultimately influencing stock valuations.

Impact of Tariffs on US-China Trade Relations

The ongoing trade war between the US and China remains a significant factor affecting the US stock market today. Existing tariffs have already caused considerable disruption to specific sectors, and the potential for further escalation or de-escalation significantly impacts market sentiment.

-

Specific Sectors Most Affected by Tariffs: Industries like technology and agriculture have been particularly hard hit by tariffs, experiencing decreased exports and increased costs. This has had a direct impact on the share prices of companies in these sectors.

-

Data on Trade Volume Changes: Analyzing trade volume data before and after tariff implementation clearly illustrates the negative impact on bilateral trade between the US and China. This reduction in trade directly affects economic growth and market confidence.

-

Analysis of the Economic Cost of Tariffs: Studies have shown the significant economic costs of tariffs for both the US and China. These costs, ranging from decreased consumer surplus to reduced business investment, have weighed heavily on market sentiment.

Dow Futures Reaction: Analyzing the Market's Response

The Dow futures market provides a valuable insight into investor sentiment and expectations regarding the US stock market today. By analyzing the movements of Dow futures following significant announcements from China or updates on trade negotiations, we can discern the market's reaction to these events.

-

Charts Illustrating Dow Futures Movements: Visual representations of Dow futures movements around key policy announcements or trade updates clearly highlight the correlations between events and market reactions (Include relevant charts here).

-

Statistical Analysis of Correlations: Statistical analysis can quantify the correlation between specific events (e.g., a significant policy shift in China) and subsequent changes in Dow futures prices, revealing important insights into market sensitivity.

-

Expert Opinions and Predictions: Incorporating the views of reputable financial analysts can provide additional context and interpretation of Dow futures movements, offering valuable perspectives on potential future trends.

Understanding the Sentiment of Investors

Investor sentiment plays a crucial role in shaping the US stock market today. Understanding the overall feeling of optimism or pessimism towards both the US and Chinese economies is crucial for interpreting market movements.

-

Relevant Economic Indicators: Tracking key economic indicators such as consumer confidence indices and investor surveys can shed light on prevailing sentiment. These indicators provide valuable insights into the confidence levels of market participants.

-

Speculation and Market Psychology: It's also essential to recognize the impact of speculation and market psychology. Fear, uncertainty, and greed can significantly influence market behavior, even in the absence of significant fundamental shifts.

Conclusion: Navigating the US Stock Market Amidst Global Uncertainty

China's economic policies and the ongoing trade tariffs with the US are significantly impacting the "US Stock Market Today," as evidenced by the reaction of Dow futures to key events. Understanding these dynamics is crucial for investors navigating this period of global uncertainty. While the short-term outlook may remain volatile, maintaining awareness of ongoing developments is essential for making informed investment decisions. Stay informed about developments in the US stock market today and the continuing impact of China's economic policies and trade relations by consulting reliable financial news sources for up-to-date information on US stock market today and Dow futures.

Featured Posts

-

Strategic Location A Military Base In The Us China Power Struggle

Apr 26, 2025

Strategic Location A Military Base In The Us China Power Struggle

Apr 26, 2025 -

Wga And Sag Aftra Strike A Complete Shutdown Of Hollywood

Apr 26, 2025

Wga And Sag Aftra Strike A Complete Shutdown Of Hollywood

Apr 26, 2025 -

A Geographic Overview Of The Countrys Top Business Hotspots

Apr 26, 2025

A Geographic Overview Of The Countrys Top Business Hotspots

Apr 26, 2025 -

Florida A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025

Florida A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025 -

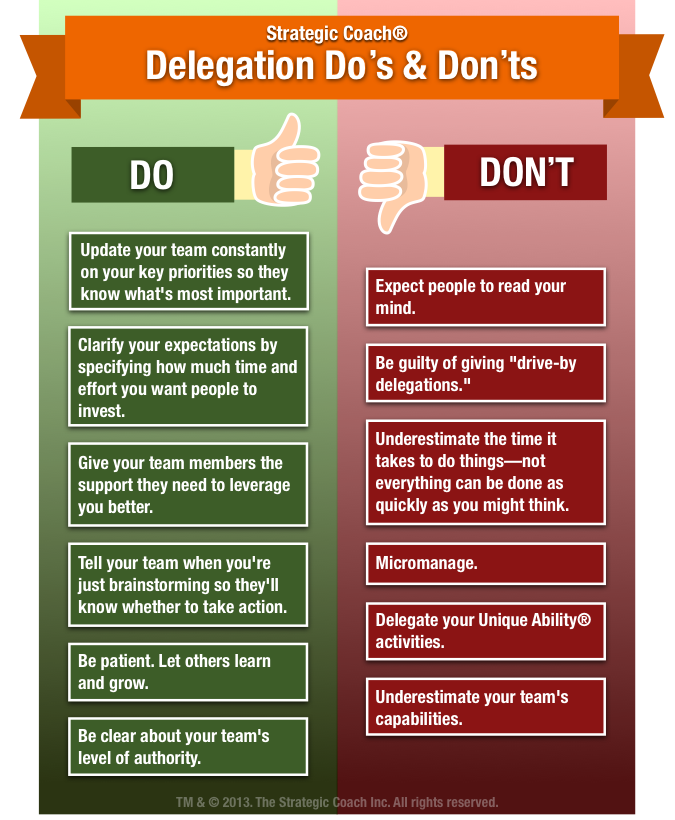

Private Credit Jobs 5 Dos And Don Ts To Increase Your Chances

Apr 26, 2025

Private Credit Jobs 5 Dos And Don Ts To Increase Your Chances

Apr 26, 2025