Why Is Gold A Safe Haven Asset Amidst Trade Wars? A Price Rally Analysis

Table of Contents

Gold's Historical Performance During Trade Wars

Examining Past Trade Conflicts

History provides compelling evidence of gold's performance during periods of heightened trade friction. The 2018-2020 US-China trade war serves as a prime example. This period of escalating tariffs and retaliatory measures created significant uncertainty in global markets.

- Data Points: Gold prices experienced a substantial increase throughout 2019, reaching their highest level in years. [Insert chart/graph showing gold price increase during 2018-2020 trade war, citing source like World Gold Council]. Similarly, analysis from [cite credible source] shows a strong positive correlation between increased trade tensions and gold price appreciation.

- Investor Behavior: Investors, fearing market volatility and potential economic downturn, flocked to gold as a safe haven, driving up demand and prices. This "flight to safety" is a recurring theme during periods of geopolitical uncertainty.

- Credible Sources: Reports from the World Gold Council consistently demonstrate the strong performance of gold during periods of trade conflict and uncertainty. [Link to relevant World Gold Council report].

Why Gold Serves as a Safe Haven

Negative Correlation with Risk Assets

Gold often exhibits a negative correlation with riskier assets like stocks and bonds. This inverse relationship is particularly pronounced during times of economic uncertainty.

- Flight to Safety: When investors perceive increased risk in the market, they tend to move away from volatile assets like stocks and bonds, seeking the relative safety and stability of gold. This "flight to safety" phenomenon significantly boosts gold demand.

- Secure Asset: Gold is considered a non-yielding but secure asset. Unlike stocks that can lose value, or bonds that can default, gold's inherent value remains relatively stable, providing investors with a sense of security during times of turmoil.

- Diversification Benefit: Gold's lack of correlation with other asset classes makes it a valuable tool for portfolio diversification, helping to mitigate overall portfolio risk during times of economic instability caused by trade wars.

Inflationary Pressures and Gold's Value

Trade Wars and Inflation

Trade wars often contribute to inflationary pressures. Tariffs and trade restrictions increase the cost of imported goods, leading to higher prices for consumers.

- Mechanism of Inflation: Tariffs imposed during trade wars directly increase the price of imported goods. This increased cost is passed on to consumers, resulting in higher inflation. Supply chain disruptions further exacerbate this inflationary pressure.

- Inflation Hedge: Throughout history, gold has served as a reliable inflation hedge. Its value tends to increase as the purchasing power of fiat currencies declines due to inflation.

- Real Return: Even during inflationary periods, gold often maintains its purchasing power or even increases its value, offering investors a positive real return—a return that exceeds inflation.

Currency Volatility and Gold's Role

Weakening Currencies and Gold Demand

Trade wars can lead to significant currency volatility. As investor confidence wanes, currencies may weaken, increasing the demand for gold as a stable store of value.

- Impact on Investor Confidence: Uncertainty surrounding trade policies and their economic impact can erode investor confidence, leading to currency devaluation.

- Gold's Price and Currency Fluctuations: When major currencies weaken, gold's price tends to rise, as investors seek refuge in a more stable asset. This is particularly true for the US dollar, whose value can be impacted by trade disputes.

- Examples: [Provide examples of how specific currencies, like the Yuan or the Euro, reacted during past trade wars and how this correlated with gold price movements, referencing reputable economic news sources].

Analyzing the Current Gold Price Rally (if applicable)

Recent Market Trends and Gold's Performance

[This section needs to be updated with current data. Replace bracketed information below with current market conditions and recent news.]

- Current Data: [Present current data on gold prices and trading volumes from reputable sources like Bloomberg or Reuters].

- Factors Driving the Rally: [Discuss the factors currently driving the gold price rally, referencing recent trade news, economic indicators, and geopolitical events]. For example, mention any recent trade disputes or sanctions that might be impacting investor sentiment.

- Cautious Outlook: While gold's price may be rising, it's important to maintain a cautious outlook, acknowledging that gold prices can be volatile and susceptible to market fluctuations.

Conclusion

In summary, gold as a safe haven asset amidst trade wars is supported by historical data, economic theory, and current market trends. Its negative correlation with riskier assets, its role as an inflation hedge, and its stability amid currency volatility make it an attractive investment during periods of geopolitical and economic uncertainty. By understanding these factors, investors can make informed decisions regarding their portfolio allocation. Consider investing in gold as part of a diversified investment strategy to help protect your portfolio during times of economic instability. Learn more about how to incorporate gold as a safe haven asset amidst trade wars into your investment plan today.

Featured Posts

-

White House Cocaine Found Secret Service Concludes Inquiry

Apr 26, 2025

White House Cocaine Found Secret Service Concludes Inquiry

Apr 26, 2025 -

Game Stop Switch 2 Preorder My In Store Experience

Apr 26, 2025

Game Stop Switch 2 Preorder My In Store Experience

Apr 26, 2025 -

Saving Harvard Insights From A Conservative Professor

Apr 26, 2025

Saving Harvard Insights From A Conservative Professor

Apr 26, 2025 -

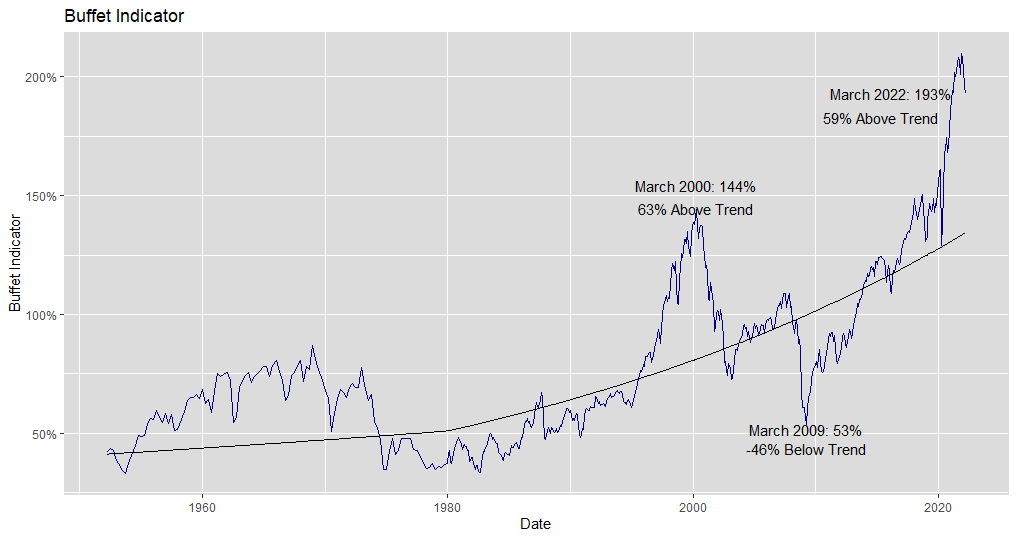

Stock Market Valuation Concerns Addressed A Bof A Perspective

Apr 26, 2025

Stock Market Valuation Concerns Addressed A Bof A Perspective

Apr 26, 2025 -

The Trump Administrations Push To Influence European Ai Policy

Apr 26, 2025

The Trump Administrations Push To Influence European Ai Policy

Apr 26, 2025