X Corp's Financial Turnaround: Examining The Data From The Recent Debt Sale

Table of Contents

Details of the Debt Sale

Sale Amount and Terms

X Corp announced the sale of $500 million in high-yield corporate bonds on October 26th, 2024. This debt restructuring initiative involved the successful sale of bonds with a coupon rate of 7% and a maturity date of October 26th, 2029.

- Specific figures: The sale involved 5 million bonds, each with a face value of $100. The bonds were sold to a consortium of institutional investors, including prominent investment banks such as Goldman Sachs and Morgan Stanley.

- Conditions: The sale was contingent upon achieving certain financial targets over the next two years, indicating a degree of risk assessment from the investors. These targets are not publicly available but relate to improved operating margins and reduced debt-to-equity ratio.

- Keywords: Debt restructuring, debt reduction, bond sale, financial restructuring, corporate bond sale.

Strategic Rationale Behind the Sale

X Corp cited several strategic reasons for this significant debt sale. Primarily, the sale aimed to significantly reduce the company's overall debt burden, thereby improving its financial flexibility and long-term prospects. This proactive debt management strategy is seen as crucial for enhancing X Corp's financial health.

- Company statements: In a press release, X Corp emphasized the sale's importance in strengthening its balance sheet and paving the way for future investments and growth. The management team highlighted its commitment to long-term financial stability.

- Market conditions: The relatively low interest rates prevailing at the time of the sale provided a favorable window for X Corp to refinance its debt at a lower cost, potentially saving millions in future interest payments.

- Long-term benefits: By reducing its debt load, X Corp aims to enhance its credit rating, improve its access to capital, and ultimately, bolster investor confidence.

- Keywords: Financial strategy, debt management, capital structure, corporate finance, financial planning.

Impact on X Corp's Financial Health

Balance Sheet Improvements

The debt sale has demonstrably improved X Corp's key financial ratios. A direct comparison of the company's balance sheet before and after the sale reveals substantial improvements in its financial health.

- Before and after comparisons: Before the sale, X Corp’s debt-to-equity ratio stood at 1.8, a figure considered high for the industry. Post-sale, this ratio is projected to drop to 1.2, a significant improvement that signals improved financial stability. Similarly, the interest coverage ratio, which measures the company’s ability to meet its interest payments, has increased from 2.5 to 3.5.

- Industry context: Compared to its main competitors, X Corp now holds a much more favorable debt-to-equity ratio, placing it in a stronger position to compete for funding and navigate future financial challenges.

- Keywords: Debt-to-equity ratio, interest coverage ratio, financial ratios, balance sheet analysis, financial performance, financial leverage.

Credit Rating and Market Sentiment

The successful debt sale has positively impacted X Corp's credit rating and market sentiment. While ratings agencies haven’t yet formally adjusted the rating, the market's response indicates a positive outlook.

- Credit rating agencies: While no immediate upgrade has been announced, industry analysts predict a potential upgrade in the coming months, reflecting the improved financial position of the company.

- Stock price fluctuations: Following the announcement, X Corp's stock price experienced a notable increase, reflecting increased investor confidence. This positive market reaction showcases investor approval of the financial restructuring strategy.

- Analyst opinions: Several financial analysts have commented favorably on the strategic nature of the debt sale, predicting improved long-term profitability for X Corp.

- Keywords: Credit rating agencies, stock market performance, investor sentiment, market reaction, credit rating upgrade.

Long-Term Implications and Future Outlook

Sustainability of the Turnaround

The success of X Corp's financial turnaround depends on the sustainability of the changes initiated by the debt sale. The company needs to maintain its improved financial performance over the long term.

- Future financial projections: X Corp's internal projections show continued improvement in key financial metrics over the next three years, suggesting the turnaround is on track. However, these projections rely heavily on maintaining current market conditions and executing future strategic plans.

- Potential risks and challenges: Maintaining this improved financial health will depend on mitigating risks, including potential economic downturns and maintaining operational efficiency. A potential challenge lies in adapting to changing market demands and technological advancements.

- Plans for future growth and profitability: X Corp plans to invest a portion of the funds freed up by the debt reduction in research and development, aiming to create new revenue streams and sustain long-term growth.

- Keywords: Financial stability, long-term growth, sustainable finance, risk management, financial forecasting.

Comparison to Competitors

X Corp's debt sale and subsequent financial turnaround can be fruitfully compared with similar events within the industry, drawing lessons from both successes and failures.

- Case studies: Several successful debt restructurings in the sector serve as positive benchmarks, while unsuccessful examples highlight potential pitfalls to be avoided. This comparative analysis provides invaluable insight into best practices.

- Lessons learned: This analysis shows that a well-planned debt restructuring, combined with a clear financial strategy and strong operational efficiency, can lead to substantial financial improvements.

- Keywords: Benchmarking, industry comparison, competitive analysis, best practices, financial benchmarking.

Conclusion

X Corp's recent debt sale represents a significant step in its financial turnaround strategy. The sale successfully reduced the company's debt burden, improved key financial ratios, and positively impacted market sentiment. While challenges remain, the initial signs are promising. To further evaluate the effectiveness of this strategy and understand its long-term impact, it's crucial to monitor X Corp's debt management, and analyze X Corp's financial strategy over the coming years. Follow X Corp's financial turnaround closely to understand the sustained impact of this strategic debt sale and its contribution to X Corp's long-term financial stability. Further research into X Corp’s quarterly reports and analyst coverage will provide continued insight into their financial performance.

Featured Posts

-

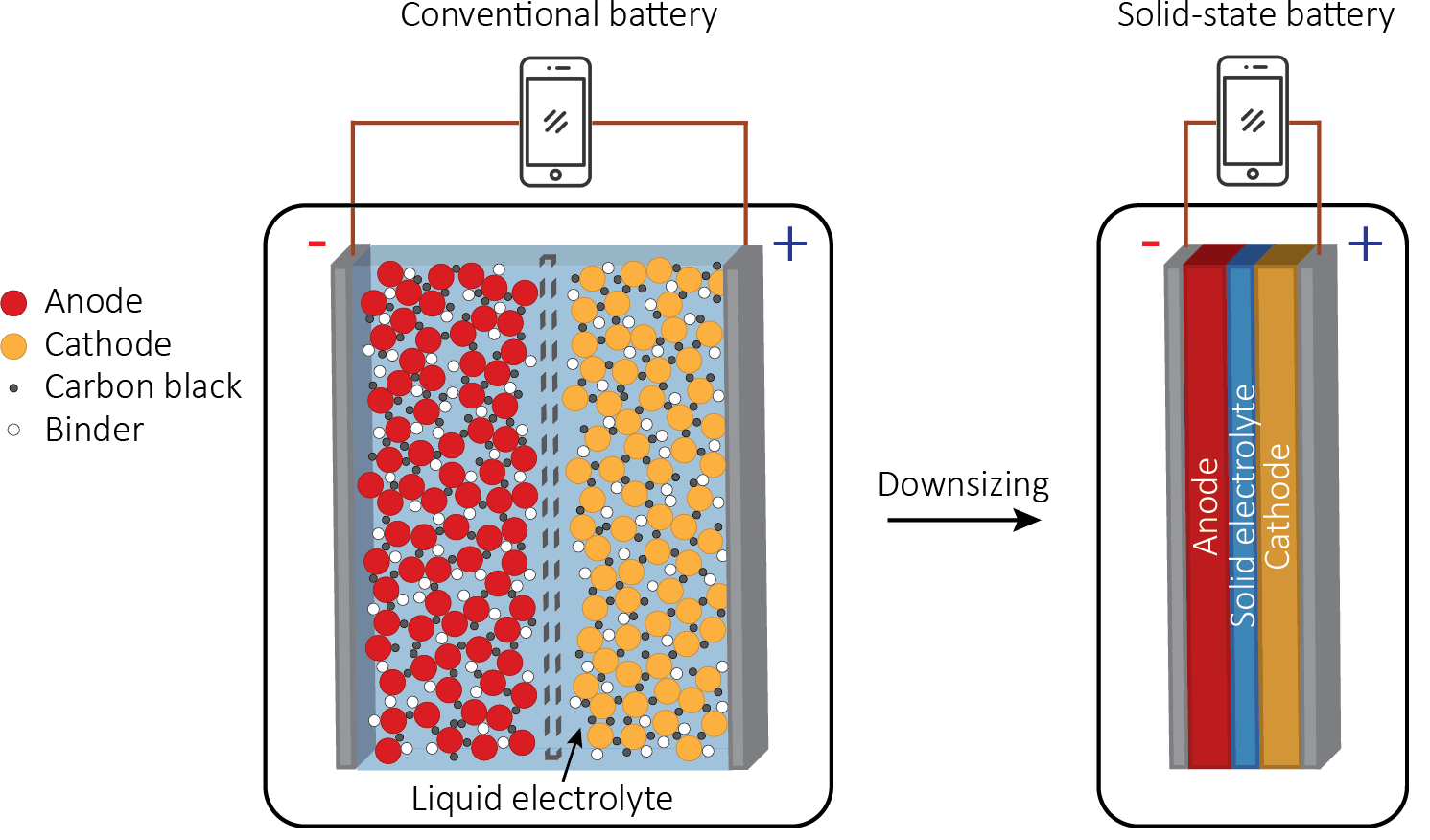

Kuxius Solid State Power Bank Higher Cost Longer Life

Apr 28, 2025

Kuxius Solid State Power Bank Higher Cost Longer Life

Apr 28, 2025 -

The Grim Truth About Retail Sales Implications For Bank Of Canada Policy

Apr 28, 2025

The Grim Truth About Retail Sales Implications For Bank Of Canada Policy

Apr 28, 2025 -

Twins Beat Mets 6 3 Minnesota Takes Control Of Series

Apr 28, 2025

Twins Beat Mets 6 3 Minnesota Takes Control Of Series

Apr 28, 2025 -

Le Bron James Responds To Richard Jefferson On Espn

Apr 28, 2025

Le Bron James Responds To Richard Jefferson On Espn

Apr 28, 2025 -

Tyran Alerbyt Yrbt Abwzby Bkazakhstan Brhlat Mbashrt

Apr 28, 2025

Tyran Alerbyt Yrbt Abwzby Bkazakhstan Brhlat Mbashrt

Apr 28, 2025