1,050% Price Hike: AT&T Challenges Broadcom's VMware Deal

Table of Contents

AT&T's Stance and the 1,050% Price Increase

AT&T's dramatic price increase centers on interconnection services—the fees VMware would pay to access AT&T's network. This 1,050% jump represents a seismic shift in the dynamics of the Broadcom-VMware deal. The rationale behind AT&T's actions remains unclear. Is this a genuine concern about pricing, reflecting the strategic importance of network access for VMware's operations? Or is it a calculated strategic maneuver designed to obstruct the acquisition, leveraging AT&T's market power to influence the outcome? This ambiguity fuels speculation and raises concerns about potential anti-competitive practices.

The potential impact on VMware's business model is substantial. The exorbitant increase in interconnection fees could significantly impact VMware's profitability and potentially lead to higher prices for its customers.

- Financial Implications: The 1,050% increase translates to billions of dollars in added costs for VMware, potentially jeopardizing the financial viability of the Broadcom acquisition.

- AT&T's Market Power: AT&T's significant market share in network infrastructure gives it considerable leverage in these negotiations. Its actions highlight the potential for powerful players to influence mergers and acquisitions through strategic pricing.

- AT&T's Public Statements: AT&T has yet to provide a fully transparent explanation for its justification of the price hike, fueling further speculation and scrutiny.

Broadcom's Response and the Future of the VMware Acquisition

Broadcom's response to AT&T's aggressive price hike will be crucial in determining the future of the VMware acquisition. The company faces significant legal and regulatory hurdles, with the price hike potentially delaying or derailing the entire process. The ongoing regulatory review of the acquisition is now further complicated by this unexpected development.

- Broadcom's Public Statements: Broadcom has publicly expressed its disapproval of AT&T's actions, emphasizing their commitment to completing the acquisition. However, concrete action and strategy remain to be seen.

- Potential Delays: The price hike inevitably introduces significant delays, requiring renegotiation and potentially affecting the timing of regulatory approvals.

- Alternative Strategies: Broadcom may need to explore alternative strategies, such as renegotiating with AT&T, seeking alternative network providers, or potentially even challenging AT&T's actions legally.

Antitrust Concerns and Competitive Landscape

AT&T's actions have raised serious antitrust concerns. The dramatic price hike could be interpreted as an attempt to stifle competition and leverage market power to influence the outcome of a major acquisition. Regulatory bodies will be closely scrutinizing the situation, potentially launching investigations into potential anti-competitive behavior.

- Relevant Antitrust Regulations: The Sherman Antitrust Act and other relevant regulations will be central to determining the legality of AT&T's actions.

- Government Intervention: There is a real possibility of government intervention, potentially including investigations and potential legal action against AT&T.

- Concerns of Smaller Competitors: Smaller players in the technology industry are likely concerned that AT&T's actions set a precedent for larger companies to use their market power to suppress competition.

Implications for the Technology Industry and Consumers

This dispute between AT&T, Broadcom, and VMware has far-reaching implications for the entire technology sector and its consumers. The outcome will shape the future of mergers and acquisitions, influencing the competitive landscape and potentially impacting technology prices and services for years to come.

- Potential Price Increases for End-Users: Depending on the outcome, consumers could face higher prices for VMware products and services if the increased interconnection costs are passed down the line.

- Impact on Technological Innovation: Uncertainty surrounding the acquisition could hamper technological innovation, as businesses hesitate to invest in uncertain markets.

- Future Disputes: This situation could set a precedent for similar disputes in the future, potentially leading to increased regulatory scrutiny of mergers and acquisitions within the technology sector and impacting network infrastructure costs.

Conclusion

The 1,050% price hike proposed by AT&T in response to the Broadcom-VMware deal marks a significant turning point. This unprecedented move has injected considerable uncertainty into the future of the acquisition and highlighted the complexities of mergers and acquisitions in the highly competitive technology industry. The outcome will have profound implications for competition, innovation, and consumer prices. The regulatory response, Broadcom’s counter-strategy, and AT&T’s ultimate justification will be closely scrutinized, defining the future landscape of this crucial sector.

Call to Action: Stay informed about the unfolding drama surrounding the AT&T-Broadcom-VMware battle. Follow [Your Website/News Source] for continuous updates and in-depth analysis of this pivotal technology deal and its implications for the future. Learn more about the impact of the Broadcom VMware acquisition and the potential effects of the AT&T price hike.

Featured Posts

-

Emerging Markets A Winning Investment Strategy Amidst Us Market Weakness

Apr 24, 2025

Emerging Markets A Winning Investment Strategy Amidst Us Market Weakness

Apr 24, 2025 -

The Bold And The Beautiful April 9 Recap Steffy Blames Bill Finn In Icu Liams Secret

Apr 24, 2025

The Bold And The Beautiful April 9 Recap Steffy Blames Bill Finn In Icu Liams Secret

Apr 24, 2025 -

Harvard And The Trump Administration A Legal Showdown And The Path To Resolution

Apr 24, 2025

Harvard And The Trump Administration A Legal Showdown And The Path To Resolution

Apr 24, 2025 -

Chinese Stocks In Hong Kong Surge On Easing Trade Tension Hopes

Apr 24, 2025

Chinese Stocks In Hong Kong Surge On Easing Trade Tension Hopes

Apr 24, 2025 -

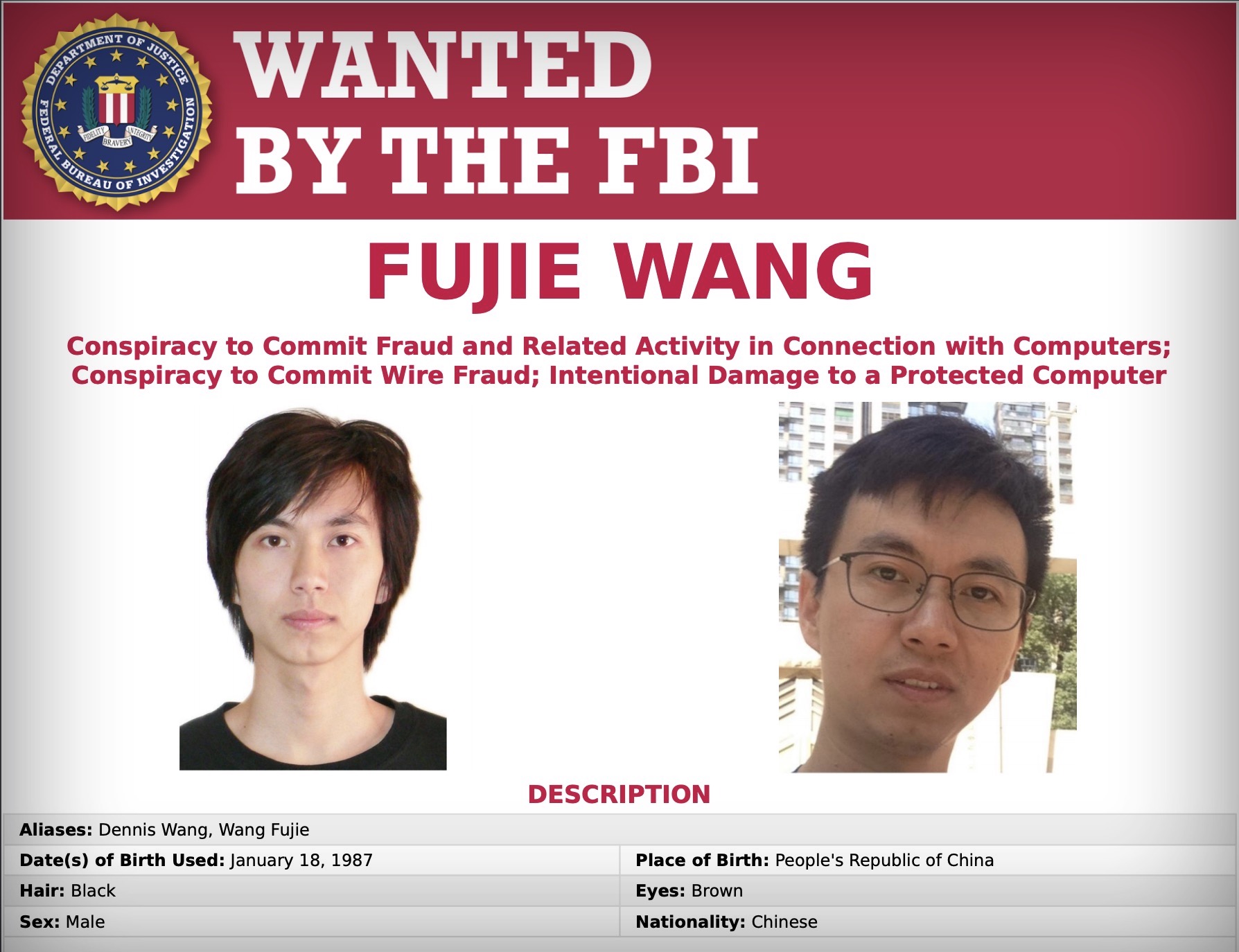

Office365 Data Breach Millions Stolen Hacker Indicted

Apr 24, 2025

Office365 Data Breach Millions Stolen Hacker Indicted

Apr 24, 2025