Emerging Markets: A Winning Investment Strategy Amidst US Market Weakness

Table of Contents

Diversification Benefits of Emerging Market Investments

Investing in emerging markets offers significant diversification benefits, crucial in navigating volatile global financial landscapes. A well-diversified portfolio minimizes risk by reducing reliance on any single market's performance.

Reduced Portfolio Volatility

Emerging markets often exhibit low correlation with developed markets like the US. This means their price movements don't always mirror those of US stocks. This lack of correlation is a powerful tool for risk management.

- Example: While the US market experienced a downturn in [insert recent example of US market downturn], several emerging markets showed resilience or even positive growth.

- Benefit: Diversification significantly reduces the overall volatility of your investment portfolio, protecting your capital during periods of US market weakness.

Accessing High-Growth Potential

Emerging economies often boast significantly higher growth rates than developed nations. This presents investors with the potential for substantial returns.

- High-Growth Markets: India, with its burgeoning tech sector and large consumer base, and Vietnam, known for its manufacturing prowess, are prime examples. Several African nations are also showing remarkable growth potential in sectors like renewable energy and infrastructure.

- High-Growth Sectors: Technology, infrastructure development (particularly in renewable energy), and consumer goods are experiencing rapid expansion in many emerging markets. For instance, the adoption of mobile technology in some emerging markets surpasses that of developed countries.

- Data Point: [Insert data supporting higher growth rates in emerging markets compared to developed markets, citing a reputable source].

Identifying Promising Emerging Market Opportunities

Successfully investing in emerging markets requires careful research and a strategic approach.

Fundamental Analysis in Emerging Markets

Thorough due diligence is paramount. This involves analyzing macroeconomic factors, assessing political stability, and scrutinizing company-specific financials.

- Key Indicators: Monitor GDP growth, inflation rates, currency stability, and the overall regulatory environment of the target market.

- Political Risk Assessment: Evaluate the political landscape, considering factors such as government stability, corruption levels, and potential policy changes.

- Financial Health: Analyze the financial statements of companies, assessing their profitability, debt levels, and future growth prospects.

Strategic Sector Selection

Focusing on specific sectors with strong growth potential within emerging markets can maximize returns.

- Renewable Energy: The global shift towards sustainable energy presents significant opportunities, particularly in emerging markets with rapidly expanding energy demands.

- Technology: The digital revolution continues to transform emerging economies, creating opportunities in areas such as fintech, e-commerce, and mobile technology.

- Consumer Goods: Rapidly growing middle classes in many emerging markets drive significant demand for consumer products.

- Infrastructure: Massive investments in infrastructure are needed to support economic growth in many emerging markets, creating opportunities in construction, transportation, and utilities.

Mitigating Risks in Emerging Markets

While emerging markets offer high growth potential, they also present unique risks.

Geopolitical Risks

Political instability, social unrest, and conflicts can significantly impact investments.

- Mitigation Strategies: Diversification across multiple countries and sectors helps to mitigate geopolitical risks. Thorough due diligence is also crucial.

Currency Fluctuations

Exchange rate fluctuations between the local currency and your home currency can affect your returns.

- Mitigation Strategies: Hedging strategies, such as using currency forwards or options contracts, can help to manage currency risk.

Regulatory Uncertainty

Changes in regulations can impact the profitability and viability of investments.

- Mitigation Strategies: Conduct thorough research on the regulatory environment and consult with local experts. Staying updated on regulatory changes is crucial.

Conclusion

Investing in emerging markets offers a compelling strategy for diversification and potentially higher returns, especially when considering the current challenges facing the US market. The benefits of diversification, the potential for high growth in specific sectors, and the availability of strategies for risk mitigation all make emerging markets an attractive option. Don't let US market uncertainty sideline your investment goals. Start exploring the potential of emerging markets today. Diversify your portfolio and unlock the high-growth opportunities available in these dynamic economies. Consider consulting a financial advisor to create a personalized emerging market investment strategy tailored to your risk tolerance and financial goals.

Featured Posts

-

Israeli Beach Years Of Shark Sightings Culminate In Tragedy

Apr 24, 2025

Israeli Beach Years Of Shark Sightings Culminate In Tragedy

Apr 24, 2025 -

Land Your Dream Job 5 Dos And Don Ts In The Private Credit Industry

Apr 24, 2025

Land Your Dream Job 5 Dos And Don Ts In The Private Credit Industry

Apr 24, 2025 -

India Saudi Arabia Partner For Two New Oil Refineries

Apr 24, 2025

India Saudi Arabia Partner For Two New Oil Refineries

Apr 24, 2025 -

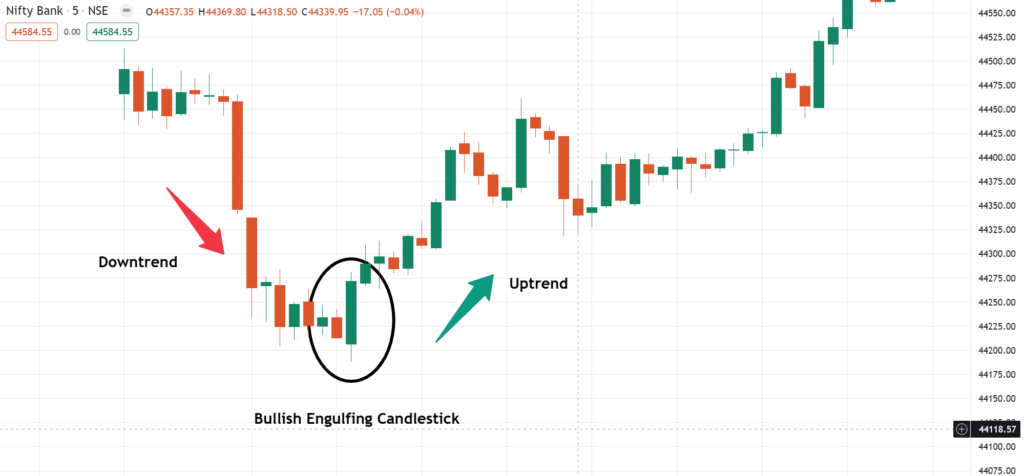

Indias Nifty Index Understanding The Current Bullish Momentum

Apr 24, 2025

Indias Nifty Index Understanding The Current Bullish Momentum

Apr 24, 2025 -

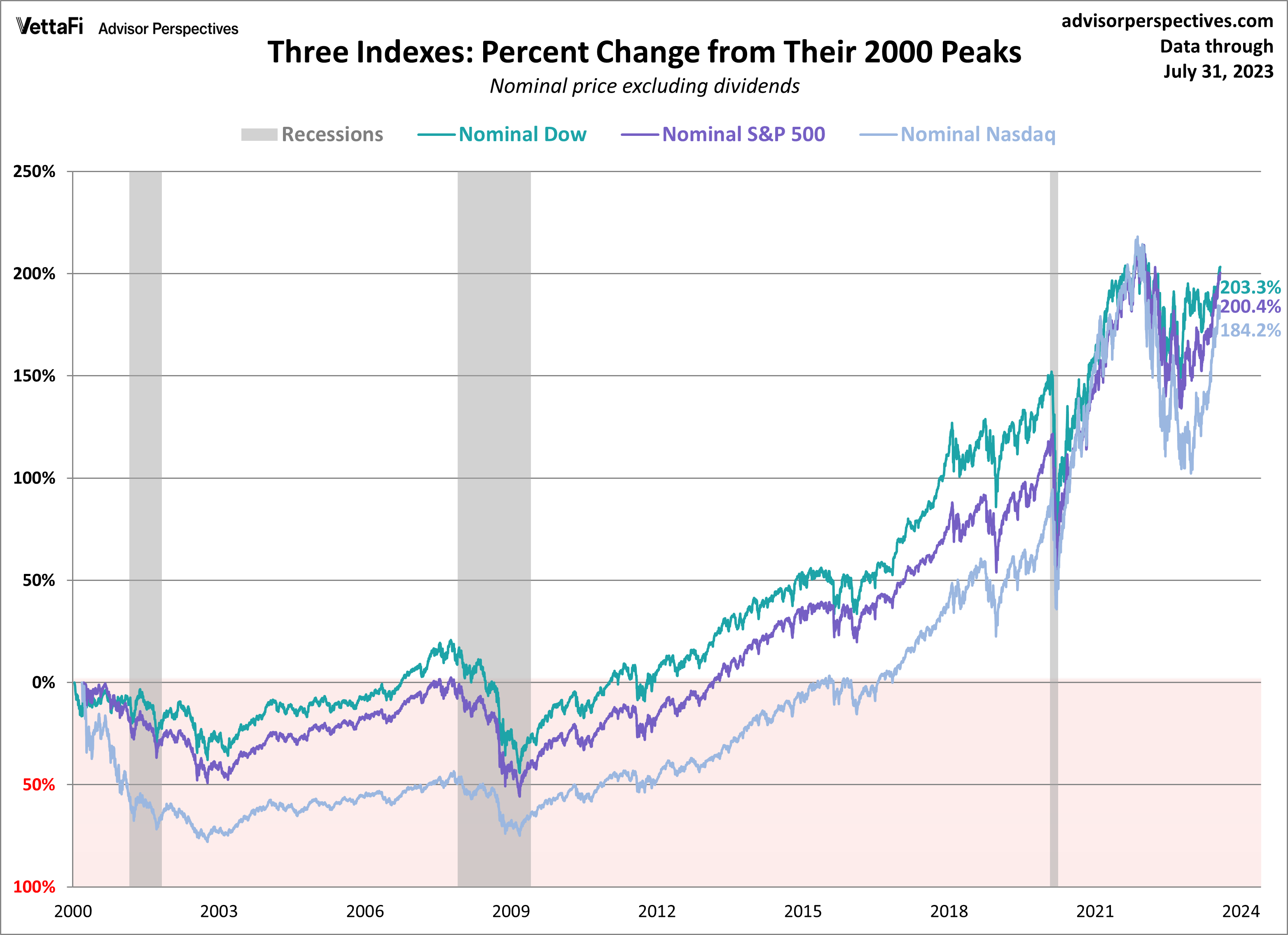

April 23rd Stock Market Summary Dow S And P 500 And Nasdaq Performance

Apr 24, 2025

April 23rd Stock Market Summary Dow S And P 500 And Nasdaq Performance

Apr 24, 2025