Bitcoin (BTC) Rally: Trade Easing And Reduced Fed Tension Boost Crypto

Table of Contents

Easing Trade Tensions and Their Impact on Bitcoin (BTC)

The recent progress in easing trade tensions, particularly between the US and China, has played a crucial role in the Bitcoin rally. For years, the uncertainty surrounding trade wars created a "risk-off" sentiment among investors, pushing them towards safer haven assets. However, the progress in trade negotiations, while still ongoing, has significantly reduced this uncertainty.

This reduced trade uncertainty has had a profound impact on investor sentiment. With less fear of global economic disruption, investors are showing increased risk appetite, seeking higher potential returns from assets considered riskier, including Bitcoin. The correlation between reduced trade tensions and Bitcoin's price appreciation is becoming increasingly clear.

- Reduced uncertainty encourages investment in riskier assets like Bitcoin. Investors are less hesitant to allocate capital to assets with higher volatility potential.

- Improved global economic outlook boosts investor confidence. A more stable global trade environment fosters a positive outlook, leading to increased investment across various asset classes, including cryptocurrencies.

- Less trade-related volatility leads to a more stable Bitcoin market. The decreased uncertainty translates into a less volatile Bitcoin market, attracting investors seeking less risk.

The lessening of the US-China trade war, for example, has significantly contributed to this positive shift. The potential for a more stable global trade landscape has encouraged investors to re-evaluate their portfolios and consider alternative investment options like Bitcoin.

Reduced Fed Tension and its Influence on the Crypto Market

The Federal Reserve's recent stance on monetary policy has also significantly contributed to the Bitcoin rally. A less hawkish approach, implying slower interest rate hikes and potentially even quantitative easing, has calmed market anxieties. This reduction in Fed tension impacts the crypto market in several ways.

A less aggressive Fed reduces uncertainty about future interest rate movements. This decreased uncertainty is a boon for investors, as it allows them to make more informed investment decisions with less fear of unexpected economic shocks. Moreover, a less hawkish Fed often leads to a weakening dollar. Since Bitcoin often shows an inverse correlation to the dollar's strength, a weakening dollar can fuel Bitcoin demand.

- Lower interest rates can stimulate investment in alternative assets like Bitcoin. When traditional investment yields are low, investors may seek higher returns in other asset classes.

- A less aggressive Fed reduces fear of a market crash. This increased stability in traditional markets can translate into a more positive sentiment for riskier assets like Bitcoin.

- A weakening dollar can drive demand for Bitcoin. As the dollar loses value, investors may seek to diversify their holdings into assets like Bitcoin, which are seen as a potential hedge against inflation and currency devaluation.

Bitcoin's potential as an inflation hedge is a significant driver of its appeal in times of economic uncertainty. The limited supply of Bitcoin, unlike fiat currencies, makes it a potentially attractive asset during periods of inflation or economic instability.

Analyzing the Bitcoin (BTC) Price Surge and Market Trends

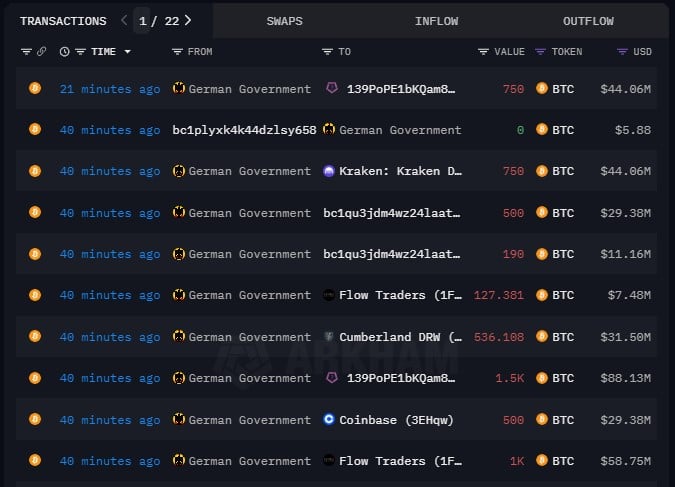

The Bitcoin price surge is evident in recent market data. We've seen substantial increases in both trading volume and market capitalization, indicating a growing interest in Bitcoin. This isn't just driven by retail investors; institutional investment is playing an increasingly significant role. More and more large financial institutions are incorporating Bitcoin into their portfolios, adding further legitimacy and fueling the price increases.

The growing adoption of Bitcoin by businesses and individuals further contributes to the rally. More and more companies are accepting Bitcoin as a form of payment, and the number of Bitcoin users continues to grow globally. This increased adoption strengthens Bitcoin's position as a viable alternative currency and a store of value.

- (Insert relevant chart/graph illustrating recent Bitcoin price movements) Visual representations clearly show the significant price increase.

- Analyze key technical indicators (e.g., moving averages, RSI). Technical analysis provides further insights into the current market trends and potential future movements.

- Discuss potential future price predictions (with caveats). While accurate predictions are impossible, analyzing current trends can give a reasonable outlook (always include disclaimers).

Conclusion

The recent Bitcoin (BTC) rally is a compelling demonstration of the interconnectedness of macroeconomic factors and the cryptocurrency market. Easing trade tensions and a less aggressive Federal Reserve have significantly increased investor confidence, driving up demand for Bitcoin and boosting its price. This highlights Bitcoin's growing importance as an alternative asset class and a potential hedge against economic uncertainty.

Call to Action: Stay informed about the ever-changing landscape of the Bitcoin (BTC) market. Understand how global events and monetary policies can impact your Bitcoin investments. Learn more about the factors driving the Bitcoin rally and how to navigate this dynamic market. Don't miss out on the potential of Bitcoin – stay informed and strategize your approach to this exciting asset class. Understanding the interplay between macroeconomic factors and Bitcoin price movements is crucial for successful Bitcoin trading and investment.

Featured Posts

-

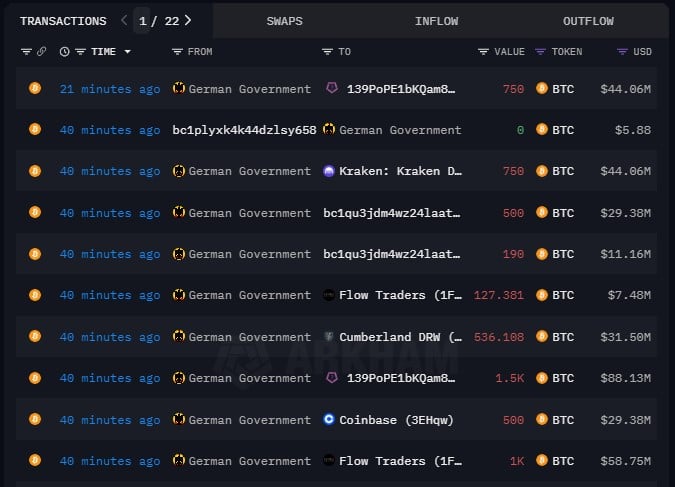

Reduced Funding Increased Danger How Trumps Cuts Impact Tornado Season

Apr 24, 2025

Reduced Funding Increased Danger How Trumps Cuts Impact Tornado Season

Apr 24, 2025 -

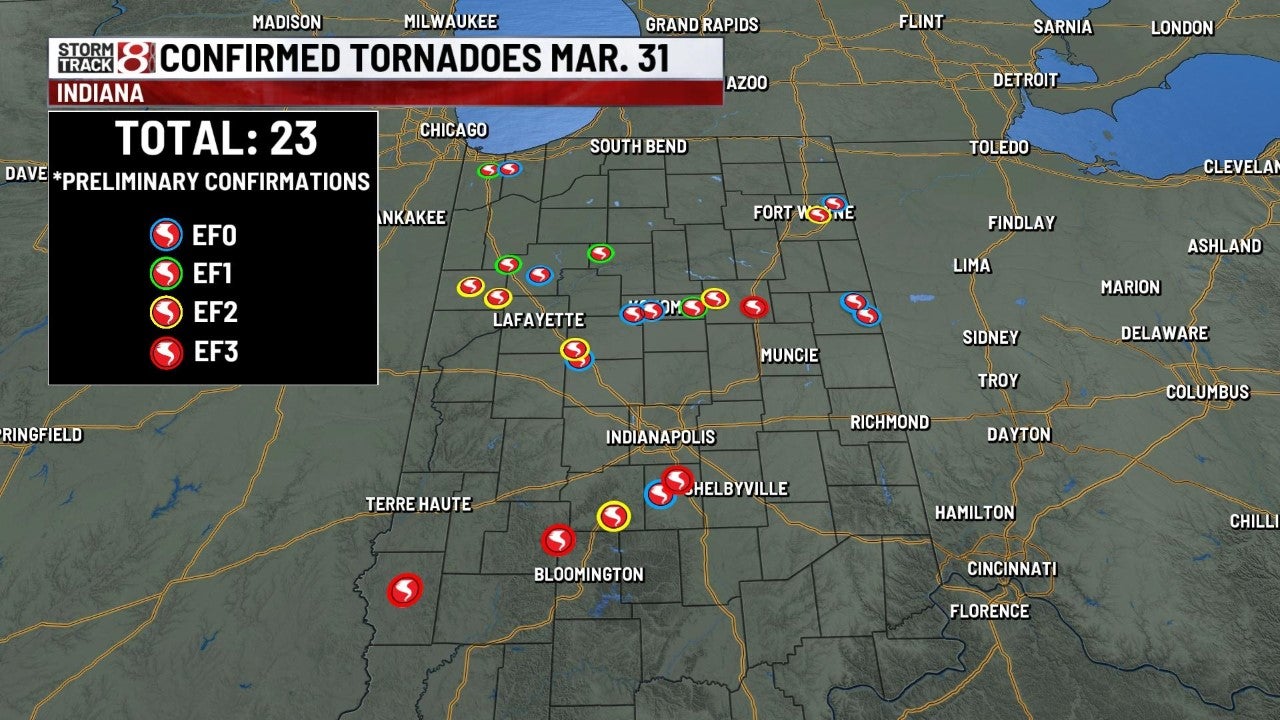

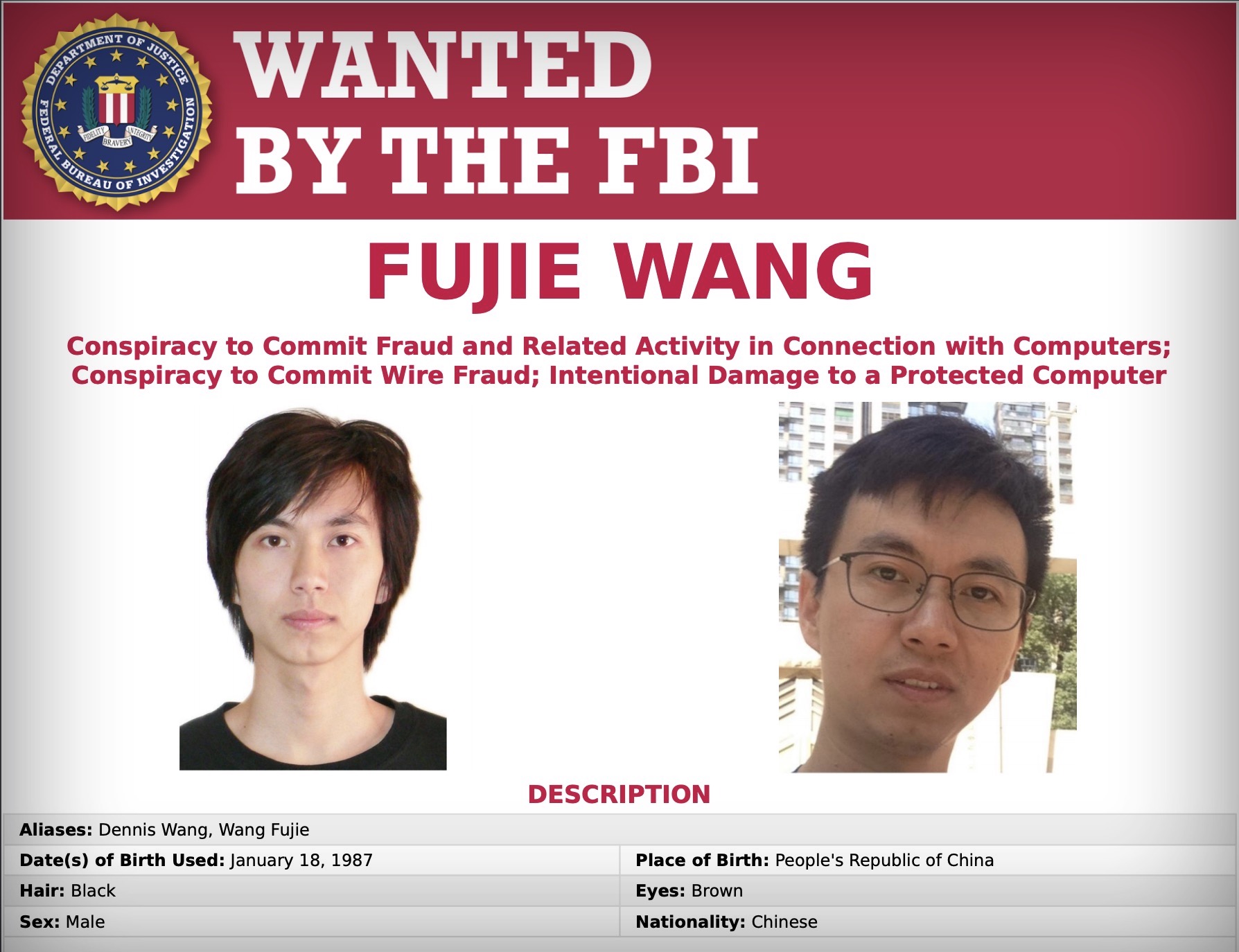

Office365 Data Breach Millions Stolen Hacker Indicted

Apr 24, 2025

Office365 Data Breach Millions Stolen Hacker Indicted

Apr 24, 2025 -

Open Ai And Google Chrome A Potential Merger Based On Chat Gpt Ceos Remarks

Apr 24, 2025

Open Ai And Google Chrome A Potential Merger Based On Chat Gpt Ceos Remarks

Apr 24, 2025 -

Minnesota Takes Legal Action Against Trumps Transgender Athlete Ban

Apr 24, 2025

Minnesota Takes Legal Action Against Trumps Transgender Athlete Ban

Apr 24, 2025 -

The Need For Fiscal Responsibility In Canadas Vision

Apr 24, 2025

The Need For Fiscal Responsibility In Canadas Vision

Apr 24, 2025