China Seeks Middle East LPG To Offset US Tariff Impacts

Table of Contents

Rising Demand for LPG in China

China's burgeoning demand for LPG is fueled by rapid economic growth and evolving energy consumption patterns. Several key sectors are driving this surge:

-

Growing Urbanization and Industrialization: The rapid expansion of Chinese cities and industries necessitates increased energy supplies. LPG, with its versatility and relative ease of transportation, fills this demand gap. Year-on-year growth in LPG consumption has consistently exceeded 5% in recent years, according to industry reports.

-

Petrochemical Industry: LPG serves as a crucial feedstock in China's thriving petrochemical industry, contributing to the production of valuable plastics, polymers, and other essential materials. The expansion of this sector directly translates to higher LPG demand.

-

Residential Heating: Particularly in rural areas, LPG is increasingly replacing traditional fuels for heating, offering a cleaner and more efficient alternative. Government initiatives promoting cleaner energy sources also bolster this trend.

-

Automotive Fuel: The adoption of LPG as an automotive fuel is steadily gaining momentum, driven by both environmental concerns and cost considerations. This emerging sector represents a significant growth area for LPG consumption in the future.

The projected demand for LPG in China continues to rise, prompting the nation to seek diverse and reliable sources to ensure energy security.

Impact of US Tariffs on China's LPG Imports

The US-China trade war introduced significant tariffs on LPG imports into China, creating substantial challenges for Chinese energy importers. These tariffs:

-

Increased Import Costs: The tariffs added a significant financial burden to Chinese importers, dramatically increasing the price of US-sourced LPG.

-

Disrupted Supply Chains: Established import routes and partnerships were disrupted, forcing Chinese companies to seek alternative suppliers and navigate complex logistical hurdles.

-

Reduced Import Volume: The higher costs and logistical complexities led to a decrease in the volume of LPG imported from the US.

The impact of these tariffs is measurable in the significant shift towards Middle Eastern suppliers. The additional cost imposed by tariffs forced a reevaluation of supply chain strategies, highlighting the vulnerability of relying on a single major supplier. China's response demonstrates a clear commitment to energy independence and diversified sourcing.

Shifting to Middle East LPG Suppliers

To mitigate the effects of US tariffs and ensure a stable LPG supply, China has significantly increased its imports from Middle Eastern nations. This shift involves:

-

Key Suppliers: Saudi Arabia, Qatar, and other Middle Eastern countries have become major LPG exporters to China, capitalizing on the increased demand. While Iran holds significant potential, geopolitical factors influence the volume of its exports.

-

New Trade Agreements: China has actively pursued new trade agreements and strengthened existing partnerships with Middle Eastern nations to facilitate seamless LPG imports. This includes improved infrastructure and streamlined customs procedures.

-

Transportation Logistics: The transportation of LPG from the Middle East to China involves sophisticated logistical planning, utilizing large-scale LNG carriers and specialized infrastructure. This requires considerable investment and coordination.

The shift to Middle Eastern LPG offers advantages in terms of proximity and established trade relationships, but it also introduces new geopolitical complexities.

Strategic Implications for Regional Energy Security

The diversification of China's LPG sources has profound implications for both regional energy security and the global LPG market:

-

China's Energy Security: This shift enhances China’s energy security by reducing its reliance on a single supplier and mitigating the risks associated with trade disputes.

-

Middle East's Geopolitical Influence: The increased demand for Middle Eastern LPG strengthens the region's geopolitical influence in the global energy market.

-

Global LPG Market Dynamics: Increased competition and shifts in supply routes will impact global LPG pricing and market stability.

-

Environmental Implications: Increased transportation of LPG across vast distances raises concerns about carbon emissions and the environmental impact of this energy source. The sustainability of long-distance shipping requires careful consideration.

Conclusion:

China's strategic shift towards Middle Eastern LPG suppliers represents a significant response to US tariffs and a proactive move toward energy security. This diversification significantly impacts the global LPG market, reshaping trade relationships and influencing geopolitical dynamics in the region. The long-term effects will continue to unfold, requiring ongoing monitoring and analysis. Stay updated on the latest developments in China's LPG imports and learn more about the impact of US tariffs on global energy trade. Follow us for insights into the future of China's energy security and the shifting landscape of Middle East-China energy partnerships.

Featured Posts

-

Apr 24, 2025

Apr 24, 2025 -

Instagrams Rival To Tik Tok A New Video Editing App

Apr 24, 2025

Instagrams Rival To Tik Tok A New Video Editing App

Apr 24, 2025 -

Alterya Acquired By Blockchain Analysis Firm Chainalysis

Apr 24, 2025

Alterya Acquired By Blockchain Analysis Firm Chainalysis

Apr 24, 2025 -

Spot Market Crackdown Eus Plan To End Russian Gas Imports

Apr 24, 2025

Spot Market Crackdown Eus Plan To End Russian Gas Imports

Apr 24, 2025 -

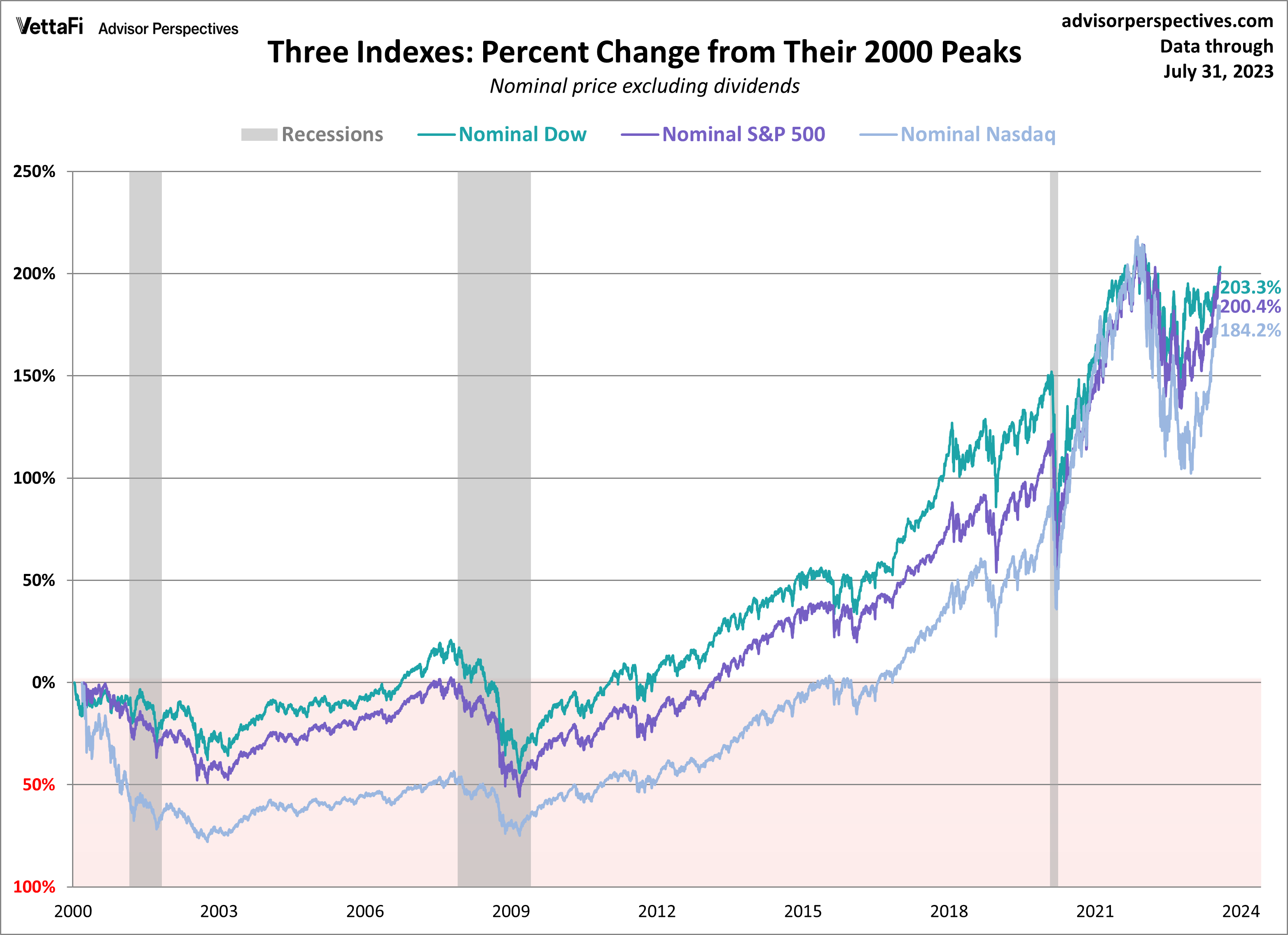

April 23rd Stock Market Summary Dow S And P 500 And Nasdaq Performance

Apr 24, 2025

April 23rd Stock Market Summary Dow S And P 500 And Nasdaq Performance

Apr 24, 2025