ECB's Simkus Hints At Two More Interest Rate Cuts Amidst Trade War Impact

Table of Contents

Simkus's Statements and Their Significance

The Context of Simkus's Comments

The Eurozone currently finds itself navigating a complex economic landscape. Inflation remains stubbornly low, well below the ECB's target of "below, but close to, 2%". GDP growth is sluggish, hampered by external factors like the ongoing trade war. This uncertainty, fueled by escalating trade tensions between major global powers, creates a significant headwind for economic recovery.

- Low Inflation: Eurozone inflation rates have consistently undershot the ECB's target, signaling a risk of deflation.

- Sluggish Growth: GDP growth in the Eurozone has slowed considerably, reflecting weaker global demand and investment.

- Trade War Uncertainty: The ongoing trade dispute is creating significant uncertainty for businesses, impacting investment decisions and dampening overall economic sentiment. Data from Eurostat reveals a marked decline in exports to key trading partners.

Analysis of the Proposed Two Interest Rate Cuts

Simkus's suggestion of two further ECB interest rate cuts aims to stimulate economic activity and counter deflationary pressures. Lowering interest rates makes borrowing cheaper for businesses and consumers, potentially encouraging investment and spending. This could involve lowering the deposit rate, influencing lending rates across the Eurozone, and potentially adjusting the terms of refinancing operations.

- Impact on Lending Rates: Lower interest rates translate to lower borrowing costs for banks, allowing them to offer more competitive loan rates to businesses and consumers.

- Consumer Spending: Cheaper credit can boost consumer spending, a key driver of economic growth.

- Business Investment: Lower borrowing costs can incentivize businesses to invest in expansion and new projects, creating jobs and boosting economic activity.

- Contrasting Opinions: It's important to note that not all members of the ECB Governing Council agree on the necessity of further rate cuts. Some voice concerns about the potential risks of overly stimulative monetary policy.

Market Reaction to Simkus's Hints

Financial markets reacted swiftly to Simkus's hints of further ECB interest rate cuts. The Euro experienced a slight depreciation against the US dollar (EUR/USD), reflecting the expectation of a more accommodative monetary policy. Bond yields, particularly on German Bunds, fell, indicating increased demand for safe-haven assets. Major European stock indices, including the DAX, CAC 40, and FTSE MIB, showed a mixed reaction, with some indices experiencing modest gains while others remained relatively flat.

- EUR/USD Exchange Rate: The Euro weakened slightly against the dollar following Simkus's comments.

- German Bund Yields: Yields on German government bonds decreased, reflecting investor demand for safe assets.

- European Stock Indices: European stock markets reacted with a mix of gains and minimal changes. Many analysts attributed the muted reaction to the already low interest rates and the lingering uncertainty surrounding the trade war.

The Impact of the Trade War on the ECB's Decision

Trade War's Effect on Eurozone Economy

The ongoing trade war is significantly impacting the Eurozone economy, primarily by reducing export demand and creating uncertainty among businesses. This uncertainty is leading to decreased investment and reduced consumer confidence, further slowing economic growth. Many export-oriented businesses in the Eurozone are feeling the direct impact of tariffs and trade restrictions.

- Decreased Export Demand: Tariffs and trade barriers imposed by other countries are reducing the demand for Eurozone exports.

- Uncertainty Among Businesses: The unpredictable nature of the trade war is making businesses hesitant to invest in expansion or new projects.

- Reduced Consumer Spending: Economic uncertainty is leading to cautious consumer behavior, impacting overall spending.

The ECB's Balancing Act

The ECB faces a challenging balancing act. It needs to stimulate economic growth in the face of the trade war's negative impacts, while simultaneously maintaining financial stability and avoiding excessive inflationary pressures down the line. Further ECB interest rate cuts, while potentially boosting growth in the short term, carry risks.

- Risks of Further Rate Cuts: Excessive rate cuts could lead to asset bubbles and increased financial instability.

- Potential Inflationary Pressures: While inflation is currently low, overly expansionary monetary policy could lead to inflationary pressures in the future.

- Effectiveness of Monetary Policy: The effectiveness of monetary policy in addressing the challenges posed by the trade war is debatable, with some arguing that fiscal policy might be a more effective tool. The ECB might also consider other policy options, such as quantitative easing (QE).

Conclusion: The Future of ECB Interest Rate Cuts and Economic Outlook

Simkus's comments highlight the significant challenges faced by the ECB in navigating the current economic climate. The ongoing trade war is a major factor influencing the ECB's decision-making, and further ECB interest rate cuts appear likely in the near term. The impact of these cuts on the Eurozone economy will depend on various factors, including the resolution of trade disputes and the overall global economic environment. The future direction of ECB interest rates remains uncertain, but it's crucial to remain informed about further developments.

To stay up-to-date on the latest developments regarding ECB interest rate cuts and their implications for the Eurozone economy, subscribe to our newsletter or follow reputable financial news sources. Understanding these developments is vital for making informed financial decisions in these uncertain times.

Featured Posts

-

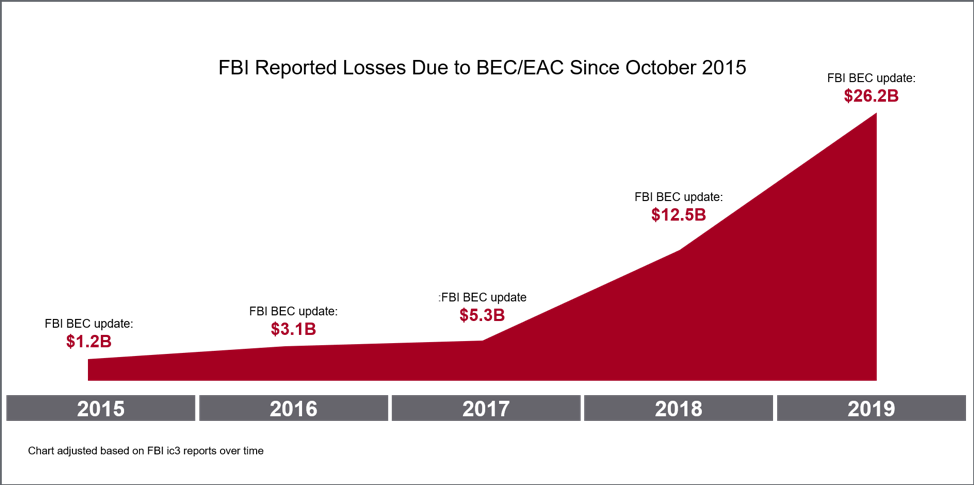

Office365 Security Breach Millions In Losses From Executive Account Compromise

Apr 27, 2025

Office365 Security Breach Millions In Losses From Executive Account Compromise

Apr 27, 2025 -

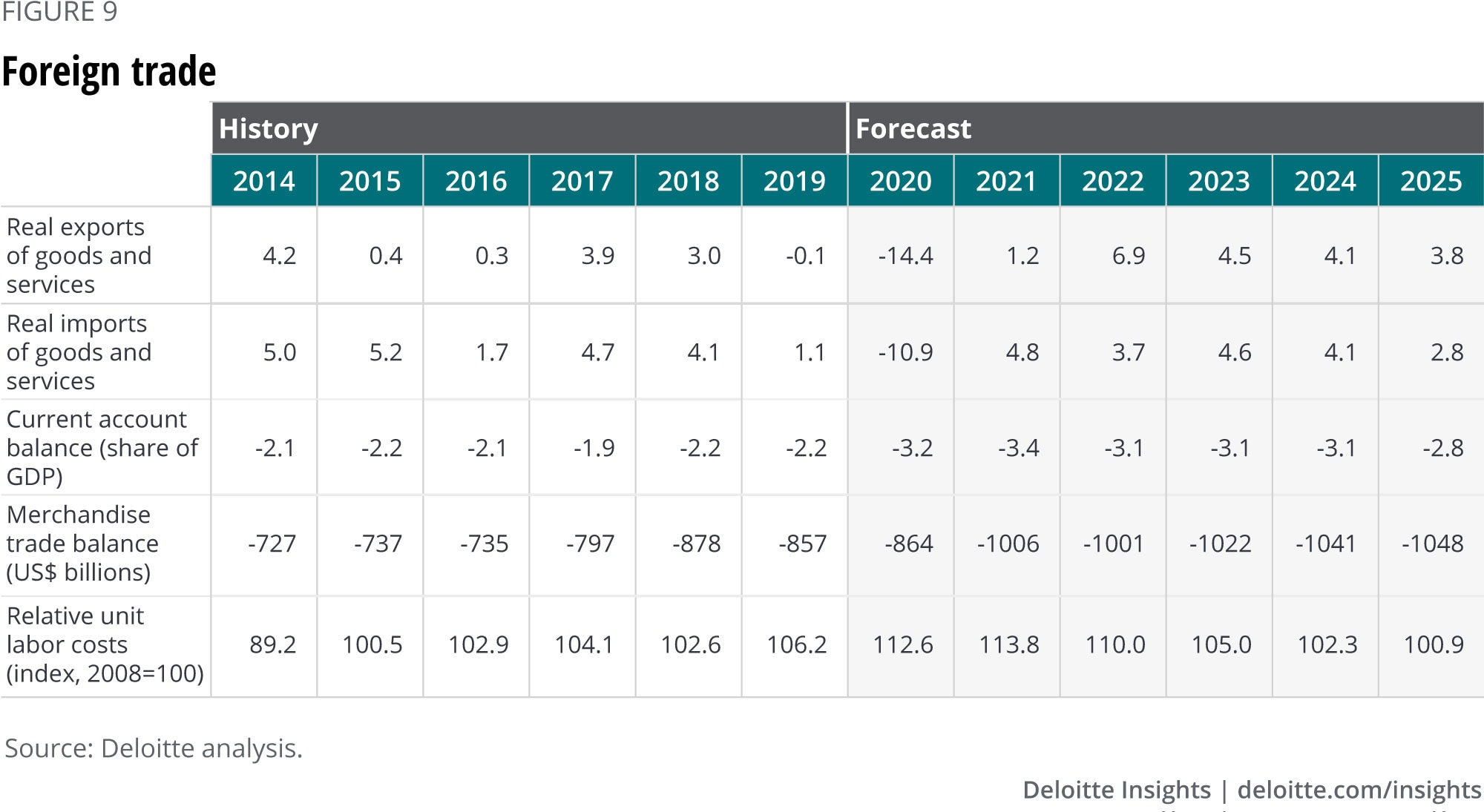

Deloitte Sees Considerable Slowdown In Us Economic Growth Outlook

Apr 27, 2025

Deloitte Sees Considerable Slowdown In Us Economic Growth Outlook

Apr 27, 2025 -

Film News Juliette Binoche Named Cannes Jury President

Apr 27, 2025

Film News Juliette Binoche Named Cannes Jury President

Apr 27, 2025 -

Alberto Ardila Olivares Evaluacion De Su Rendimiento Y Capacidad De Marcar Goles

Apr 27, 2025

Alberto Ardila Olivares Evaluacion De Su Rendimiento Y Capacidad De Marcar Goles

Apr 27, 2025 -

Wta Abu Dhabi Bencic Returns To The Final After Daughters Birth

Apr 27, 2025

Wta Abu Dhabi Bencic Returns To The Final After Daughters Birth

Apr 27, 2025