Stock Investors Push Market Higher Despite Looming Losses

Table of Contents

Ignoring the Warning Signs? Analyzing Investor Behavior

The current market behavior raises intriguing questions about investor psychology. Are investors ignoring potential losses due to overconfidence, the fear of missing out (FOMO), or other cognitive biases? Understanding the prevailing investor sentiment is key to interpreting this upward trend.

- Analysis of recent investor surveys and market data: Recent surveys reveal a surprisingly optimistic outlook among individual investors, potentially fueled by past market gains and a belief that positive trends will continue. However, analyzing trading volumes and market breadth reveals a less certain picture, with some sectors showing signs of weakness.

- Discussion of the role of fear and greed in market decisions: The age-old battle between fear and greed is clearly at play. While the potential for losses is evident, the allure of quick profits and the fear of missing out on further gains seem to be outweighing caution for many investors. This highlights the inherent irrationality often present in market behavior.

- Examination of potential cognitive biases impacting investor choices: Cognitive biases like confirmation bias (seeking information that confirms pre-existing beliefs) and overconfidence bias are likely playing a significant role. Investors may be selectively focusing on positive news while downplaying warnings of potential market corrections.

- Exploration of the impact of short-term vs. long-term investment strategies: The current market situation emphasizes the distinction between short-term trading and long-term investing. While short-term traders might be profiting from the upward momentum, long-term investors need to carefully assess the underlying risks before committing significant capital.

Factors Driving the Market Upward Despite Risks

Despite the looming threat of losses, several factors are contributing to the current upward trend in stock prices. Understanding these factors is crucial for evaluating the sustainability of this bullish momentum.

- Analysis of recent corporate earnings reports and their impact on stock prices: Strong corporate earnings reports, particularly from large-cap companies, have provided a significant boost to investor confidence. These positive results have outweighed concerns about future economic slowdowns in the short term.

- Examination of the influence of interest rate changes and inflation on investor decisions: While rising interest rates and persistent inflation are generally bearish factors, their impact has been somewhat muted so far. This may be due to the resilience of corporate profits or expectations of future interest rate cuts.

- Discussion of the role of government policies and economic stimulus: Government policies and potential economic stimulus packages can significantly impact market sentiment and investor confidence. Any new policy announcements could either reinforce the current bullish trend or trigger a market correction.

- Assessment of the impact of geopolitical events and global economic trends: Geopolitical instability and global economic uncertainty remain significant risks. However, the market's resilience suggests that investors are currently prioritizing the positive short-term factors over these longer-term concerns.

The Role of Institutional Investors

Institutional investors, such as hedge funds, mutual funds, and pension funds, play a significant role in shaping market trends. Their investment strategies and actions often dictate the direction of large-cap stocks and overall market sentiment.

- Analysis of institutional investment strategies and portfolio allocations: Institutional investors are constantly reassessing their portfolios, adapting to changing market conditions. Their decisions, driven by sophisticated algorithms and expert analysis, can significantly influence overall market trends.

- Examination of the impact of institutional buying and selling on stock prices: Large institutional buy orders can drive up stock prices, whereas significant selling can trigger downward pressure. Monitoring institutional activity is crucial for understanding short-term market fluctuations.

- Discussion of the potential for institutional investors to influence market sentiment: The actions of institutional investors often serve as a signal for other market participants, influencing overall investor sentiment and contributing to the current bullish trend, or a potential reversal.

Assessing the Risks: Potential for Significant Losses

While the market is currently experiencing an upward trend driven by stock investors, the potential for significant losses remains a considerable concern. Ignoring these risks could lead to substantial financial losses.

- Analysis of potential economic indicators that could trigger a market downturn: Several economic indicators, such as rising inflation, slowing economic growth, and inverted yield curves, point to a potential market correction or even a recession.

- Discussion of the impact of rising interest rates and inflation on stock valuations: Higher interest rates increase borrowing costs for companies and reduce the present value of future earnings, impacting stock valuations negatively. Persistent inflation erodes purchasing power and increases uncertainty.

- Examination of the potential for geopolitical events to disrupt market stability: Geopolitical events, such as wars, trade disputes, or political instability, can significantly impact global markets and trigger sudden market corrections.

- Advice on risk management strategies for investors: Diversification, careful risk assessment, and a well-defined investment strategy are crucial for mitigating potential losses. Investors should avoid chasing short-term gains and prioritize long-term financial health.

Conclusion

The current upward trajectory of the stock market, despite looming losses, presents a complex scenario. While positive corporate earnings and apparent investor confidence contribute to the bullish trend, substantial risks remain. Understanding the interplay of these opposing forces is crucial for informed investment decisions. Stock investors are pushing prices higher, but a prudent approach is essential to navigate this uncertain environment.

Call to Action: Stay informed about the latest developments impacting stock investors and the market. Thorough research and a diversified investment strategy are paramount when navigating the complexities of a market where stock investors are pushing prices higher despite looming losses. Continue to monitor economic indicators and market trends to make the best decisions for your portfolio.

Featured Posts

-

Tik Toks Just Contact Us Tariff Workarounds A Cnn Investigation

Apr 22, 2025

Tik Toks Just Contact Us Tariff Workarounds A Cnn Investigation

Apr 22, 2025 -

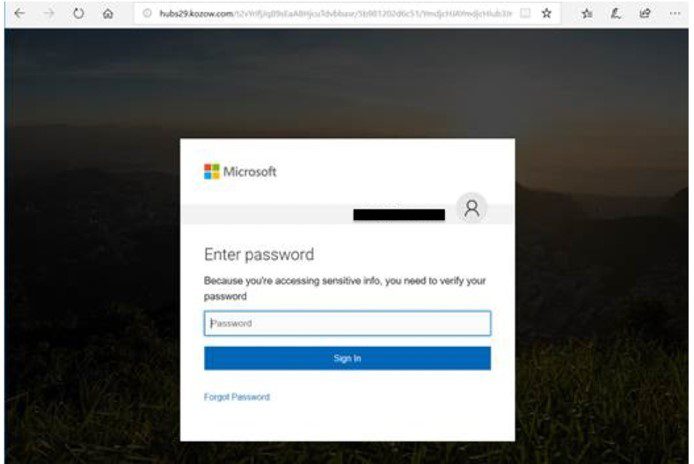

Cybercriminal Makes Millions From Executive Office365 Infiltration

Apr 22, 2025

Cybercriminal Makes Millions From Executive Office365 Infiltration

Apr 22, 2025 -

Signal Chat Leak Hegseths Military Plans And Family Connections

Apr 22, 2025

Signal Chat Leak Hegseths Military Plans And Family Connections

Apr 22, 2025 -

New Signal Chat Exposes Hegseth Amidst Claims Of Pentagon Dysfunction

Apr 22, 2025

New Signal Chat Exposes Hegseth Amidst Claims Of Pentagon Dysfunction

Apr 22, 2025 -

Ftc Probe Into Open Ai Implications For Ai Development And Regulation

Apr 22, 2025

Ftc Probe Into Open Ai Implications For Ai Development And Regulation

Apr 22, 2025