Tesla's Reduced Q1 Profits: Analyzing The Fallout From Musk's Political Associations

Table of Contents

Tesla's recent financial performance marks a departure from its typically strong growth trajectory. Elon Musk, known for his outspoken and often controversial public statements, has increasingly become a central figure in various political debates. This article will delve into the potential consequences of this confluence of events.

The Impact of Musk's Public Persona on Brand Perception and Tesla Stock

Musk's highly visible and sometimes controversial public statements have undeniably influenced Tesla's brand image and stock performance. This section examines the potential negative effects.

Negative Publicity and Brand Dilution

- Controversial Tweets and Actions: Musk's tweets, ranging from jokes about taking Tesla private to pronouncements on political issues, have frequently caused significant market volatility. For instance, his April 2023 tweet regarding a potential Twitter sale triggered a noticeable dip in Tesla's stock price.

- Resulting Stock Price Drops: Numerous studies have linked specific Musk-related events to significant short-term drops in Tesla's stock price, demonstrating a clear correlation between his public actions and investor confidence. The percentage change in stock price following controversial tweets can often be substantial, highlighting the immediate market reaction.

- Impact on Consumer Trust: While some consumers may find Musk's outspokenness appealing, many others may view it as reckless or unprofessional, potentially affecting their perception of the Tesla brand and influencing purchasing decisions. The long-term impact on consumer trust remains to be seen. Related keywords: Tesla brand image, Elon Musk controversy, stock market volatility, consumer sentiment.

Alienating Potential Customers

Musk's political leanings and public endorsements have the potential to alienate significant portions of the consumer base.

- Political Stances Repelling Customer Demographics: Certain political positions adopted by Musk could negatively impact Tesla's appeal to specific demographics, potentially leading to lost sales opportunities. This is particularly relevant in a highly competitive market with strong rivals.

- Lost Sales Potential: The potential alienation of environmentally conscious consumers who disagree with some of Musk's positions represents a significant risk to Tesla's market share.

- Competitor Gains: Competitors are actively trying to capitalize on any negative publicity surrounding Tesla, potentially gaining market share among consumers who are hesitant about the brand due to Musk's actions. Related keywords: market share, customer demographics, competitor analysis, brand loyalty.

The Economic and Geopolitical Context Affecting Tesla's Performance

Beyond Musk's actions, several macroeconomic and geopolitical factors significantly influence Tesla's profitability.

Global Supply Chain Disruptions

- Specific Disruptions: The ongoing global chip shortage, coupled with logistical bottlenecks and increased shipping costs, has directly impacted Tesla's production capacity and profitability.

- Impact on Production: Reduced access to crucial components has forced production cuts and delivery delays, contributing to lower-than-expected Q1 profits.

- Increased Costs: The increase in raw material prices, particularly lithium and other battery components, further squeezed Tesla's profit margins. Related keywords: supply chain management, global economics, inflation, raw material costs.

Geopolitical Instability and Market Fluctuations

- Geopolitical Events Impacting Tesla: Geopolitical instability, including the ongoing war in Ukraine and related sanctions, has created uncertainty in global markets and directly impacted Tesla's operations in various regions.

- Impact on Sales in Specific Regions: Sales in regions experiencing significant geopolitical upheaval have been negatively affected, further contributing to the overall reduction in Q1 profits.

- Market Analysis: The fluctuating value of different currencies has also impacted Tesla's international revenue streams, creating additional complexity in assessing the overall financial performance. Related keywords: geopolitical risk, international markets, economic sanctions, currency fluctuations.

Analyzing the Correlation (Not Causation) Between Musk's Actions and Tesla's Profits

While there is a clear temporal correlation between Musk's actions and Tesla's reduced Q1 profits, it's crucial to avoid conflating correlation with causation.

Separating Correlation from Causation

- Other Factors Affecting Tesla's Profits: Increased competition, rising production costs, and general economic slowdown are all significant factors contributing to Tesla's reduced profitability. It's essential to consider these alongside Musk's public image.

- Statistical Analysis: A thorough statistical analysis is needed to assess the relative importance of each of these factors and accurately determine the extent to which Musk's actions influenced the company's financial performance. Related keywords: statistical analysis, correlation vs. causation, financial modeling.

Long-Term Implications for Tesla's Brand and Financial Health

The long-term implications of the current situation remain uncertain.

- Possible Scenarios: Tesla could experience continued negative impacts on its brand and stock price, or it could successfully navigate these challenges and return to strong growth.

- Strategies to Mitigate Risks: Tesla may need to implement strategies to improve its brand management, diversify its supply chains, and strengthen its public relations efforts to mitigate future risks. Related keywords: long-term investment, risk management, brand recovery.

Conclusion: Tesla's Reduced Q1 Profits: A Complex Equation

Tesla's reduced Q1 profits represent a complex interplay of factors, including Elon Musk's public actions, global economic headwinds, and geopolitical instability. While Musk's controversial statements and political associations may have negatively impacted investor sentiment and brand perception, it's crucial to acknowledge the influence of external economic and geopolitical factors. Separating correlation from causation requires careful analysis. The long-term impact on Tesla's financial health and brand image will depend on how effectively the company manages these challenges. Follow the unfolding story of Tesla's profits and Musk’s political influence; continue to analyze the impact of Musk’s actions on Tesla’s financial future.

Featured Posts

-

Oblivion Remastered Now Available From Bethesda

Apr 24, 2025

Oblivion Remastered Now Available From Bethesda

Apr 24, 2025 -

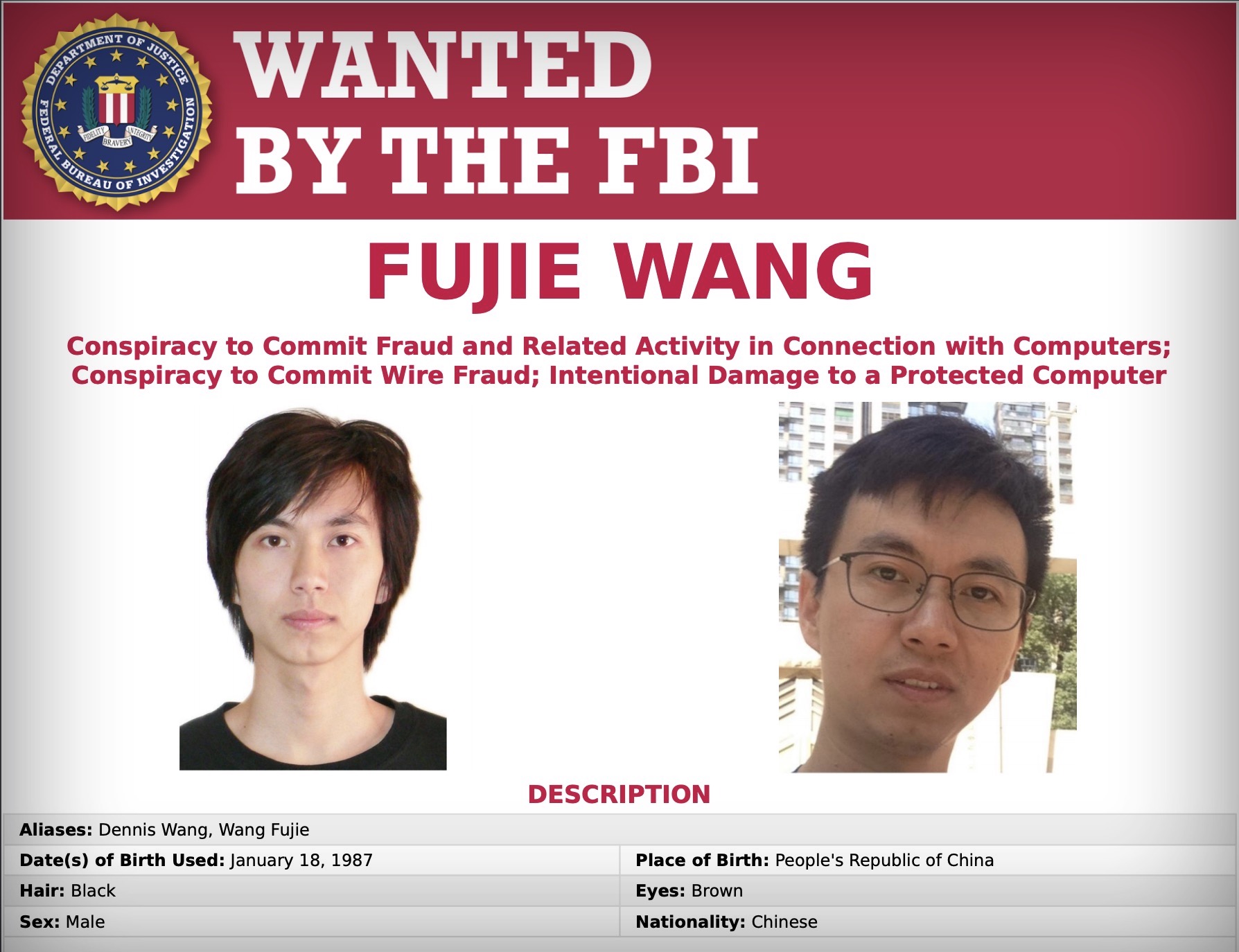

Office365 Data Breach Millions Stolen Hacker Indicted

Apr 24, 2025

Office365 Data Breach Millions Stolen Hacker Indicted

Apr 24, 2025 -

Open Ai And Google Chrome A Potential Merger Based On Chat Gpt Ceos Remarks

Apr 24, 2025

Open Ai And Google Chrome A Potential Merger Based On Chat Gpt Ceos Remarks

Apr 24, 2025 -

Cantor Fitzgerald In Talks For 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025

Cantor Fitzgerald In Talks For 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025 -

Minnesota Attorney General Sues Trump Over Transgender Sports Ban

Apr 24, 2025

Minnesota Attorney General Sues Trump Over Transgender Sports Ban

Apr 24, 2025